Why Your Support Matters Now

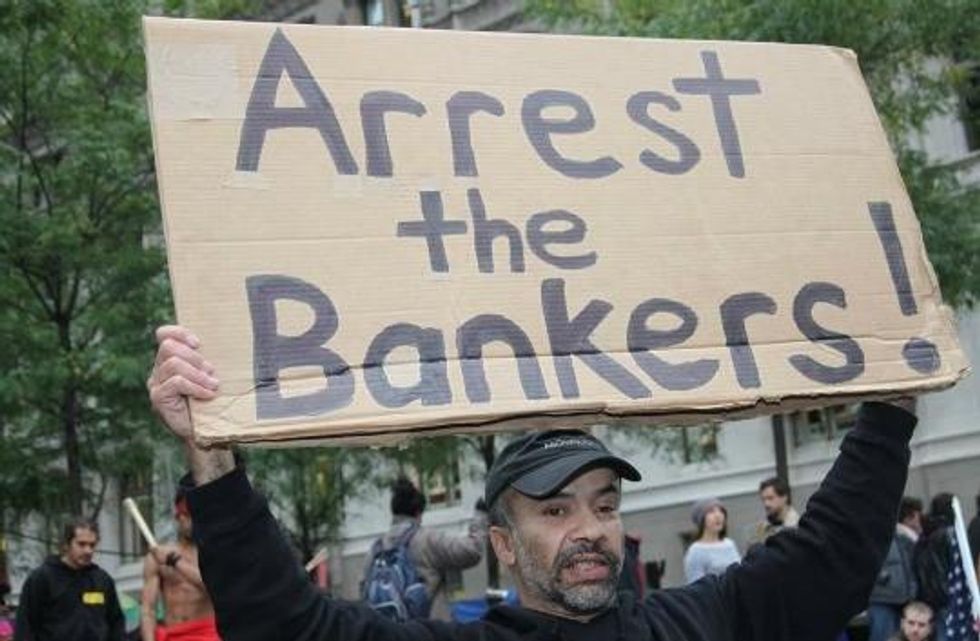

We’re witnessing a full-scale collapse in the journalism industry at the very moment accountability is needed most. Common Dreams remains one of the few nonprofit news outlets still willing and able to confront fascists and corporate criminals. If independent outlets like ours can’t survive, neither can democracy.

For over 25 years, our model of reader-funded journalism has survived for one reason only: people like you. Please help us get our Winter Campaign off to a strong start. A gift of $8, $13, $27, $75, or whatever amount you can afford will help keep Common Dreams strong now and into the future.

We are fighting like hell. Please join us today.