SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

"Rising executive pay is not connected to overall growth in the economic pie," notes Economic Policy Institute president Lawrence Mishel. (Photo: Fibonacci Blue/Flickr/cc)

Wages for most American workers have remained basically stagnant for decades, but a new report published on Thursday by the Economic Policy Institute (EPI) shows that the CEOs of America's largest firms have seen their pay soar at a consistent and "outrageous" clip.

"Simply put, money that goes to the executive class is money that does not go to other people."

--Lawrence Mishel, Economic Policy Institute

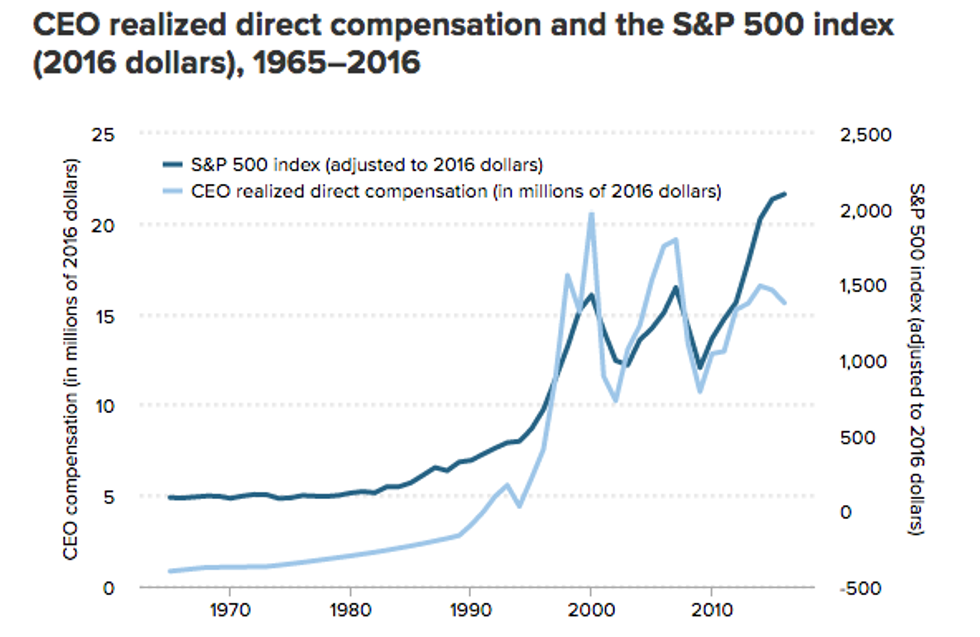

Between 1978 and 2016, CEO pay rose by 937 percent, EPI's Lawrence Mishel and Jessica Schieder found. By contrast, the typical worker saw "painfully slow" compensation growth--11.2 percent over the same period.

Mishel and Schieder also note that CEOs of "America's largest firms made an average of $15.6 million in compensation, or 271 times the annual average pay of the typical worker."

"While the 2016 CEO-to-worker compensation ratio of 271-to-1 is down from 299-to-1 in 2014 and 286-to-1 in 2015, it is still light years beyond the 20-to-1 ratio in 1965 and the 59-to-1 ratio in 1989," the report observes. "The average CEO in a large firm now earns 5.33 times the annual earnings of the average very-high-wage earner (earner in the top 0.1 percent)."

EPI's report is just the latest on an ever-expanding list of analyses documenting America's staggering income inequality, which is the worst in the industrialized world. In March, the economists Thomas Piketty, Emmanuel Saez, and Gabriel Zucman labeled the U.S. inequality crisis--the massive gap between the wealthiest and everyone else--"a tale of two countries."

"For the 117 million US adults in the bottom half of the income distribution, growth has been non-existent for a generation, while at the top of the ladder it has been extraordinarily strong," Piketty, Saez, and Zucman wrote.

Mishel points out that the vast disparity between CEO pay and average worker compensation, which EPI documents annually, "is a major driver of inequality."

"Simply put, money that goes to the executive class is money that does not go to other people. Rising executive pay is not connected to overall growth in the economic pie," Mishel argues. "We could curtail the explosive growth in CEO pay without doing any harm to the economy."

EPI proposes several policies that would curtail executive pay and potentially put more money into the pockets of workers, including "higher marginal income tax rates at the very top" and higher taxes for companies with high CEO-to-worker pay ratios.

The Trump administration, however, has indicated that it intends to do precisely the opposite. President Donald Trump's proposed tax policies, a recent analysis found, would provide massive cuts for the rich while hiking taxes for many middle class families.

For this reason--and simply because of "history and greed"--Mishel toldThe Guardian he "fully expect[s] CEO compensation to escalate in the near future."

Trump and Musk are on an unconstitutional rampage, aiming for virtually every corner of the federal government. These two right-wing billionaires are targeting nurses, scientists, teachers, daycare providers, judges, veterans, air traffic controllers, and nuclear safety inspectors. No one is safe. The food stamps program, Social Security, Medicare, and Medicaid are next. It’s an unprecedented disaster and a five-alarm fire, but there will be a reckoning. The people did not vote for this. The American people do not want this dystopian hellscape that hides behind claims of “efficiency.” Still, in reality, it is all a giveaway to corporate interests and the libertarian dreams of far-right oligarchs like Musk. Common Dreams is playing a vital role by reporting day and night on this orgy of corruption and greed, as well as what everyday people can do to organize and fight back. As a people-powered nonprofit news outlet, we cover issues the corporate media never will, but we can only continue with our readers’ support. |

Wages for most American workers have remained basically stagnant for decades, but a new report published on Thursday by the Economic Policy Institute (EPI) shows that the CEOs of America's largest firms have seen their pay soar at a consistent and "outrageous" clip.

"Simply put, money that goes to the executive class is money that does not go to other people."

--Lawrence Mishel, Economic Policy Institute

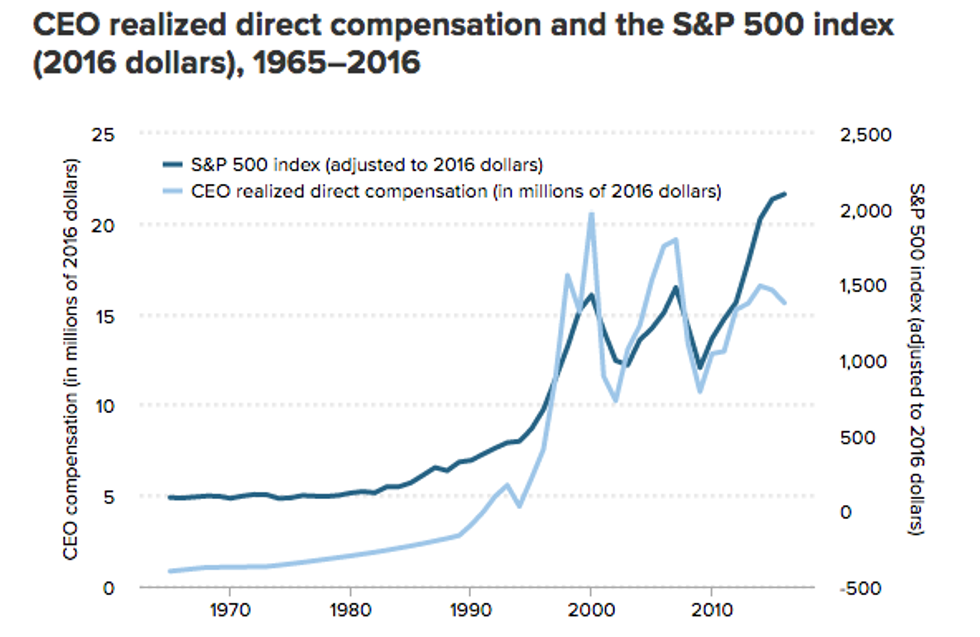

Between 1978 and 2016, CEO pay rose by 937 percent, EPI's Lawrence Mishel and Jessica Schieder found. By contrast, the typical worker saw "painfully slow" compensation growth--11.2 percent over the same period.

Mishel and Schieder also note that CEOs of "America's largest firms made an average of $15.6 million in compensation, or 271 times the annual average pay of the typical worker."

"While the 2016 CEO-to-worker compensation ratio of 271-to-1 is down from 299-to-1 in 2014 and 286-to-1 in 2015, it is still light years beyond the 20-to-1 ratio in 1965 and the 59-to-1 ratio in 1989," the report observes. "The average CEO in a large firm now earns 5.33 times the annual earnings of the average very-high-wage earner (earner in the top 0.1 percent)."

EPI's report is just the latest on an ever-expanding list of analyses documenting America's staggering income inequality, which is the worst in the industrialized world. In March, the economists Thomas Piketty, Emmanuel Saez, and Gabriel Zucman labeled the U.S. inequality crisis--the massive gap between the wealthiest and everyone else--"a tale of two countries."

"For the 117 million US adults in the bottom half of the income distribution, growth has been non-existent for a generation, while at the top of the ladder it has been extraordinarily strong," Piketty, Saez, and Zucman wrote.

Mishel points out that the vast disparity between CEO pay and average worker compensation, which EPI documents annually, "is a major driver of inequality."

"Simply put, money that goes to the executive class is money that does not go to other people. Rising executive pay is not connected to overall growth in the economic pie," Mishel argues. "We could curtail the explosive growth in CEO pay without doing any harm to the economy."

EPI proposes several policies that would curtail executive pay and potentially put more money into the pockets of workers, including "higher marginal income tax rates at the very top" and higher taxes for companies with high CEO-to-worker pay ratios.

The Trump administration, however, has indicated that it intends to do precisely the opposite. President Donald Trump's proposed tax policies, a recent analysis found, would provide massive cuts for the rich while hiking taxes for many middle class families.

For this reason--and simply because of "history and greed"--Mishel toldThe Guardian he "fully expect[s] CEO compensation to escalate in the near future."

Wages for most American workers have remained basically stagnant for decades, but a new report published on Thursday by the Economic Policy Institute (EPI) shows that the CEOs of America's largest firms have seen their pay soar at a consistent and "outrageous" clip.

"Simply put, money that goes to the executive class is money that does not go to other people."

--Lawrence Mishel, Economic Policy Institute

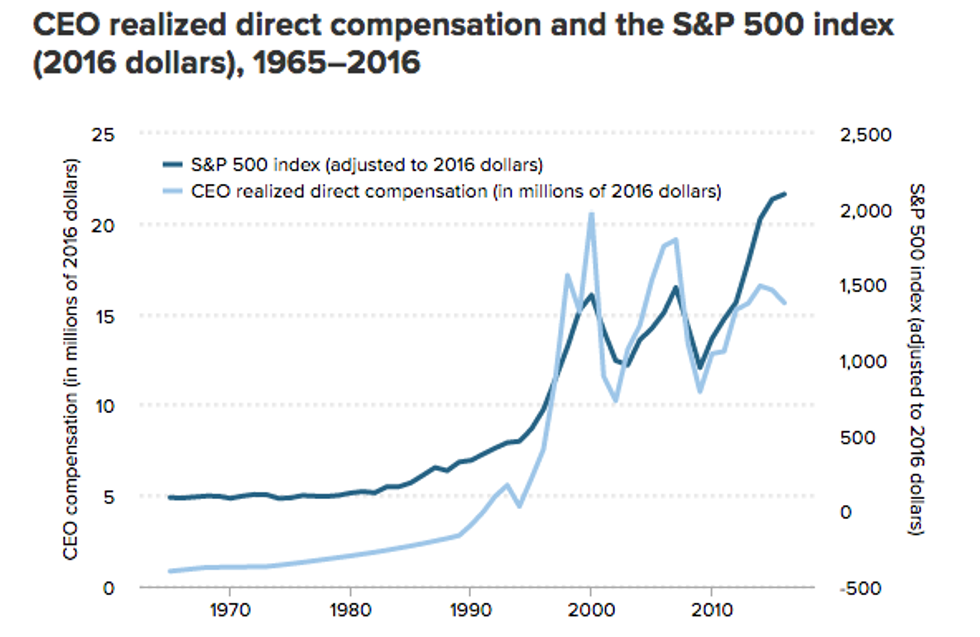

Between 1978 and 2016, CEO pay rose by 937 percent, EPI's Lawrence Mishel and Jessica Schieder found. By contrast, the typical worker saw "painfully slow" compensation growth--11.2 percent over the same period.

Mishel and Schieder also note that CEOs of "America's largest firms made an average of $15.6 million in compensation, or 271 times the annual average pay of the typical worker."

"While the 2016 CEO-to-worker compensation ratio of 271-to-1 is down from 299-to-1 in 2014 and 286-to-1 in 2015, it is still light years beyond the 20-to-1 ratio in 1965 and the 59-to-1 ratio in 1989," the report observes. "The average CEO in a large firm now earns 5.33 times the annual earnings of the average very-high-wage earner (earner in the top 0.1 percent)."

EPI's report is just the latest on an ever-expanding list of analyses documenting America's staggering income inequality, which is the worst in the industrialized world. In March, the economists Thomas Piketty, Emmanuel Saez, and Gabriel Zucman labeled the U.S. inequality crisis--the massive gap between the wealthiest and everyone else--"a tale of two countries."

"For the 117 million US adults in the bottom half of the income distribution, growth has been non-existent for a generation, while at the top of the ladder it has been extraordinarily strong," Piketty, Saez, and Zucman wrote.

Mishel points out that the vast disparity between CEO pay and average worker compensation, which EPI documents annually, "is a major driver of inequality."

"Simply put, money that goes to the executive class is money that does not go to other people. Rising executive pay is not connected to overall growth in the economic pie," Mishel argues. "We could curtail the explosive growth in CEO pay without doing any harm to the economy."

EPI proposes several policies that would curtail executive pay and potentially put more money into the pockets of workers, including "higher marginal income tax rates at the very top" and higher taxes for companies with high CEO-to-worker pay ratios.

The Trump administration, however, has indicated that it intends to do precisely the opposite. President Donald Trump's proposed tax policies, a recent analysis found, would provide massive cuts for the rich while hiking taxes for many middle class families.

For this reason--and simply because of "history and greed"--Mishel toldThe Guardian he "fully expect[s] CEO compensation to escalate in the near future."