The August recess isn't over yet, but progressive organizations are using the time to mobilize against looming Republican plans--spearheaded by the Trump administration in the White House and by Speaker of the House Paul Ryan (R-Wis.) in Congress--to give corporations and the nation's wealthiest individuals massive tax cuts while putting services and social programs on the chopping block.

"We can't afford tax cuts for the wealthy and corporations that are paid for by cuts to Social Security, Medicare, Medicaid, public education, and other services that working families rely on," warns Frank Clemente, executive director of Americans for Tax Fairness (ATF). "Side-by-side, there's no denying it: Trump's draconian cuts to services that will harm working families are intended to pay for his massive tax giveaways to big corporations and the wealthy. Helping the American people understand what's at stake is how we will win the tax fight."

"Side-by-side, there's no denying it: Trump's draconian cuts to services that will harm working families are intended to pay for his massive tax giveaways to big corporations and the wealthy. Helping the American people understand what's at stake is how we will win the tax fight."

--Frank Clemente, Americans for Tax Fairness

ATF is leading a huge coalition in a new campaign that aims to raise public awareness about what the GOP wants to do and mobilize grassroots energy to defeat the plan.

"Republicans think they can trick the American people into supporting their massive tax cuts for the wealthy and corporations by calling it 'tax reform' and using the vaguest terms possible to talk about what they're doing," said Angel Padilla, policy director for the Indivisible Project, part of the coalition. "We know their game: this is nothing but a plan to cut taxes for the wealthy and corporations paid for by taking away Medicaid, Medicare, and other basic services. The American people didn't support tax cuts for the rich when they were in the Republican healthcare bill and they don't support them through this 'tax reform' charade either."

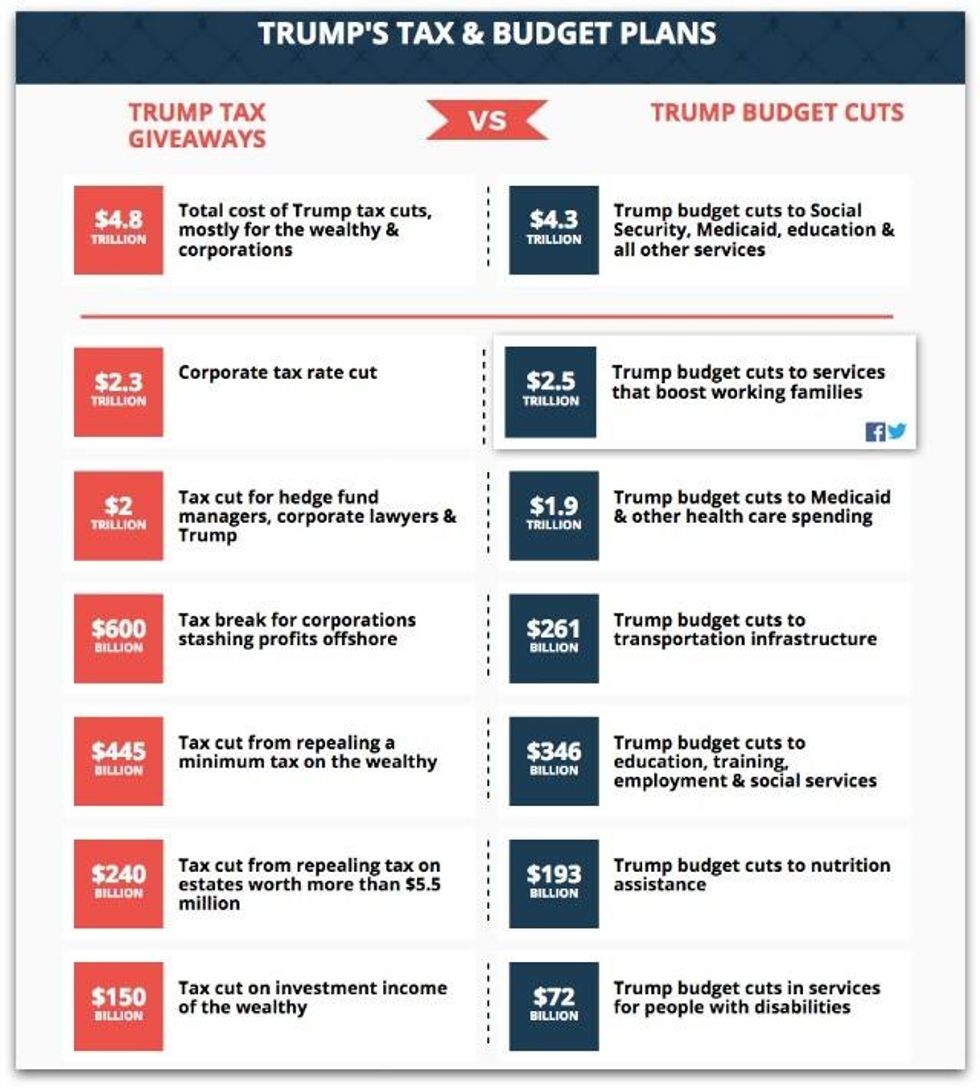

As the coalition points out, $4.3 trillion--the overall size of Trump's proposed budget cuts--is remarkably similar to the cost of the tax cuts that Trump is proposing, estimated to be between $3.5 trillion and $4.8 trillion.

The campaign has built a new website, StopTrumpTaxCuts.org, where visitors can see how the tax cuts proposed by Trump and his congressional allies would reward the wealthy and corporations while their budget cuts would gut programs and services for working families.

For example:

- The $1.9 trillion in proposed cuts to Medicaid and other healthcare services in Trump's budget is similar in size to the $1.4 trillion to $2 trillion business tax cut Trump is proposing, which would benefit hedge fund managers and real estate developers like Trump.

- The $193 billion in cuts to nutrition assistance in the Trump budget is similar to the revenue lost from Trump's elimination of the tax on estates worth more than $5.5 million, which would cost $240 billion.

- A $72 billion cut in services for people with disabilities will pay for half of Trump's $150 billion tax cut on investment income for the wealthy.

Last week, a new analysis by the Tax Policy Center (TPC) showed that if Trump's proposed tax cuts are paid for "through the types of spending cuts in his budget proposal, the vast majority of Americans--including more than 90 percent of households in the middle fifth of the income spectrum--would be net losers." In addition to being a plan that overwhelmingly benefits those at the top of the economic income and wealth ladders, the plan has enormous hidden costs for workers, the social safety net, and the broader economy.

As the StopTrumpTaxCuts coalition hopes to expose these realities in order to galvanize opposition to Republican efforts, grassroots organizers with the "Not One Penny" campaign, as Politicoreported Sunday, are also "gearing up to hit any Democrat who strays from the fold on tax cuts for the wealthy."

According to Politico, the groups behind Not One Penny--which includes MoveOn.org, Working Families Party, CREDO Action, and many others--are "expecting Democrats to stand together against any legislation that cuts taxes for the rich, even if it also trims tax bills for others. And they're prepared to unleash their energized grass roots on any lawmaker who doesn't get on board."

Ben Wikler, MoveOn.org's Washington director, said the mission of the campaign is clear. "The goal is to defeat any attempt to cut taxes for the wealthy," he told Politico in an interview. "That means any Democrat or Republican who signs on for such a proposal should expect to incur the wrath of a public that thinks the economy is already rigged in favor of the rich and shouldn't get any worse."