SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

Most Americans believe that the rich already disproportionately benefit from the U.S. tax system, and that Trump's agenda will only make income disparities worse. (Photo: Yuri Keegstra/Flickr/cc)

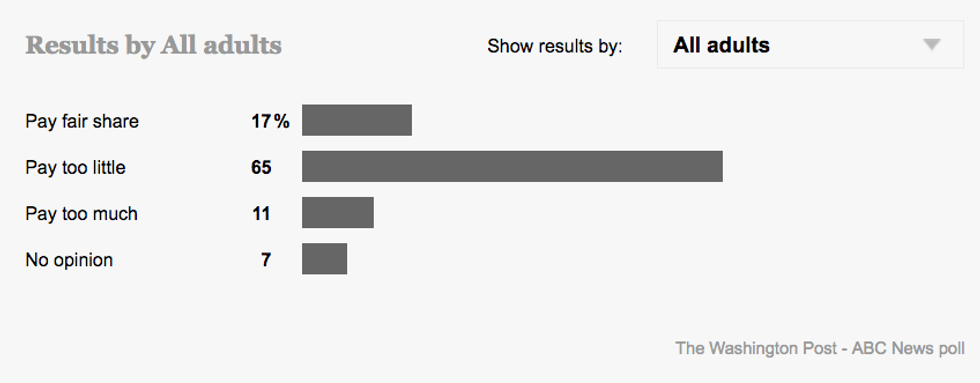

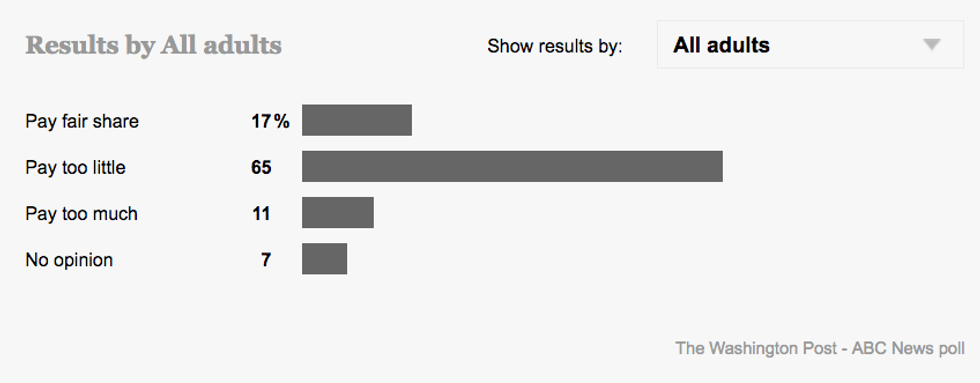

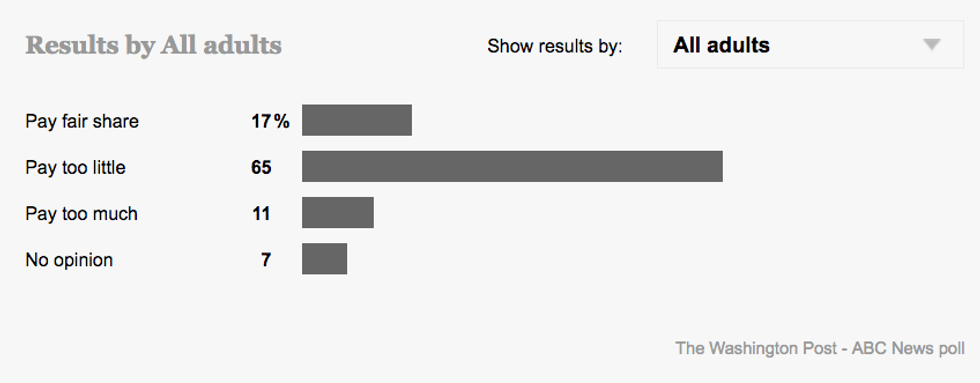

As President Donald Trump looks to pivot from his party's collapsing Obamacare repeal efforts to "tax reform" this week, an ABC News/Washington Post poll (pdf) released Tuesday found that most Americans strongly disapprove of the White House's desire to drastically slash the corporate tax rate: 65 percent of Americans believe that corporations pay too little in taxes, not too much, the survey found.

The poll also revealed what a majority of Americans think of Trump's broad outlines for tax reform so far: not much. Twenty-eight percent expressed support for the president's tax agenda, while 44 percent said they oppose it.

Furthermore, 73 percent of respondents said--consistent with previous surveys--that the U.S. economic system disproportionately favors the wealthy, and that Trump's tax plan will only worsen the gap between the richest and everyone else.

As Axiosreported over the weekend, the so-called "Big Six"--a team of White House officials and Republican lawmakers--is set to unveil the "framework" of their plan on Wednesday as Trump delivers a tax-focused speech in Indiana.

Trump has in the past said he favors reducing the corporate tax rate from 35 percent to 15 percent, arguing that American businesses pay the "highest tax rates in the world." But a recent analysis by the Economic Policy Institute (EPI) found that by utilizing various loopholes and tax avoidance maneuvers, corporations manage to pay far less than the statutory rate of 35 percent.

Despite Trump's insistence that his tax agenda is not designed to benefit the rich, reports indicate that his administration wants to cut the top individual tax rate from 39.6 percent to 35 percent.

Trump and Musk are on an unconstitutional rampage, aiming for virtually every corner of the federal government. These two right-wing billionaires are targeting nurses, scientists, teachers, daycare providers, judges, veterans, air traffic controllers, and nuclear safety inspectors. No one is safe. The food stamps program, Social Security, Medicare, and Medicaid are next. It’s an unprecedented disaster and a five-alarm fire, but there will be a reckoning. The people did not vote for this. The American people do not want this dystopian hellscape that hides behind claims of “efficiency.” Still, in reality, it is all a giveaway to corporate interests and the libertarian dreams of far-right oligarchs like Musk. Common Dreams is playing a vital role by reporting day and night on this orgy of corruption and greed, as well as what everyday people can do to organize and fight back. As a people-powered nonprofit news outlet, we cover issues the corporate media never will, but we can only continue with our readers’ support. |

As President Donald Trump looks to pivot from his party's collapsing Obamacare repeal efforts to "tax reform" this week, an ABC News/Washington Post poll (pdf) released Tuesday found that most Americans strongly disapprove of the White House's desire to drastically slash the corporate tax rate: 65 percent of Americans believe that corporations pay too little in taxes, not too much, the survey found.

The poll also revealed what a majority of Americans think of Trump's broad outlines for tax reform so far: not much. Twenty-eight percent expressed support for the president's tax agenda, while 44 percent said they oppose it.

Furthermore, 73 percent of respondents said--consistent with previous surveys--that the U.S. economic system disproportionately favors the wealthy, and that Trump's tax plan will only worsen the gap between the richest and everyone else.

As Axiosreported over the weekend, the so-called "Big Six"--a team of White House officials and Republican lawmakers--is set to unveil the "framework" of their plan on Wednesday as Trump delivers a tax-focused speech in Indiana.

Trump has in the past said he favors reducing the corporate tax rate from 35 percent to 15 percent, arguing that American businesses pay the "highest tax rates in the world." But a recent analysis by the Economic Policy Institute (EPI) found that by utilizing various loopholes and tax avoidance maneuvers, corporations manage to pay far less than the statutory rate of 35 percent.

Despite Trump's insistence that his tax agenda is not designed to benefit the rich, reports indicate that his administration wants to cut the top individual tax rate from 39.6 percent to 35 percent.

As President Donald Trump looks to pivot from his party's collapsing Obamacare repeal efforts to "tax reform" this week, an ABC News/Washington Post poll (pdf) released Tuesday found that most Americans strongly disapprove of the White House's desire to drastically slash the corporate tax rate: 65 percent of Americans believe that corporations pay too little in taxes, not too much, the survey found.

The poll also revealed what a majority of Americans think of Trump's broad outlines for tax reform so far: not much. Twenty-eight percent expressed support for the president's tax agenda, while 44 percent said they oppose it.

Furthermore, 73 percent of respondents said--consistent with previous surveys--that the U.S. economic system disproportionately favors the wealthy, and that Trump's tax plan will only worsen the gap between the richest and everyone else.

As Axiosreported over the weekend, the so-called "Big Six"--a team of White House officials and Republican lawmakers--is set to unveil the "framework" of their plan on Wednesday as Trump delivers a tax-focused speech in Indiana.

Trump has in the past said he favors reducing the corporate tax rate from 35 percent to 15 percent, arguing that American businesses pay the "highest tax rates in the world." But a recent analysis by the Economic Policy Institute (EPI) found that by utilizing various loopholes and tax avoidance maneuvers, corporations manage to pay far less than the statutory rate of 35 percent.

Despite Trump's insistence that his tax agenda is not designed to benefit the rich, reports indicate that his administration wants to cut the top individual tax rate from 39.6 percent to 35 percent.