The cost of solar energy technology is expected to fall within the next decade, giving a boost to the industry. (Photo: Oregon Department of Transportation/flickr/cc)

To donate by check, phone, or other method, see our More Ways to Give page.

The cost of solar energy technology is expected to fall within the next decade, giving a boost to the industry. (Photo: Oregon Department of Transportation/flickr/cc)

As an increasing number of nations make plans for banning gas and diesel vehicles within the coming decades, and drivers gain an awareness of the benefits associated with electric vehicles, researchers are prediciting notable consequences for dirty energy sources as the public shifts toward favoring renewable alternatives.

"Post-2025, that's where electric car sales take off. The further you go into the future, the more it's electric cars," Alan Gelder, a senior analyst for the research group Wood Mackenzie, told the Guardian. "If cities began banning cars with a combustion engine, that would rapidly accelerate the switch to electric vehicles."

Drivers transitioning to electric vehicles out of necessity, because of such bans--which multiple European nations plan to implement in the next 15-25 years--and efforts by governments to increase fuel efficiency regluations, is only part of what is fueling the blossoming electric vehicle market.

Auto manufacturers are also taking cues from the increased demand due to bans and enhanced regulations as well as consumer desire for more environmentally friendly vehicles, as Business Insider detailed in May.

These efforts by governments to limit emissions and by automakers to meet the rising demand for electic vehicles are expected to substanitally impact the oil and gas industry in the coming years.

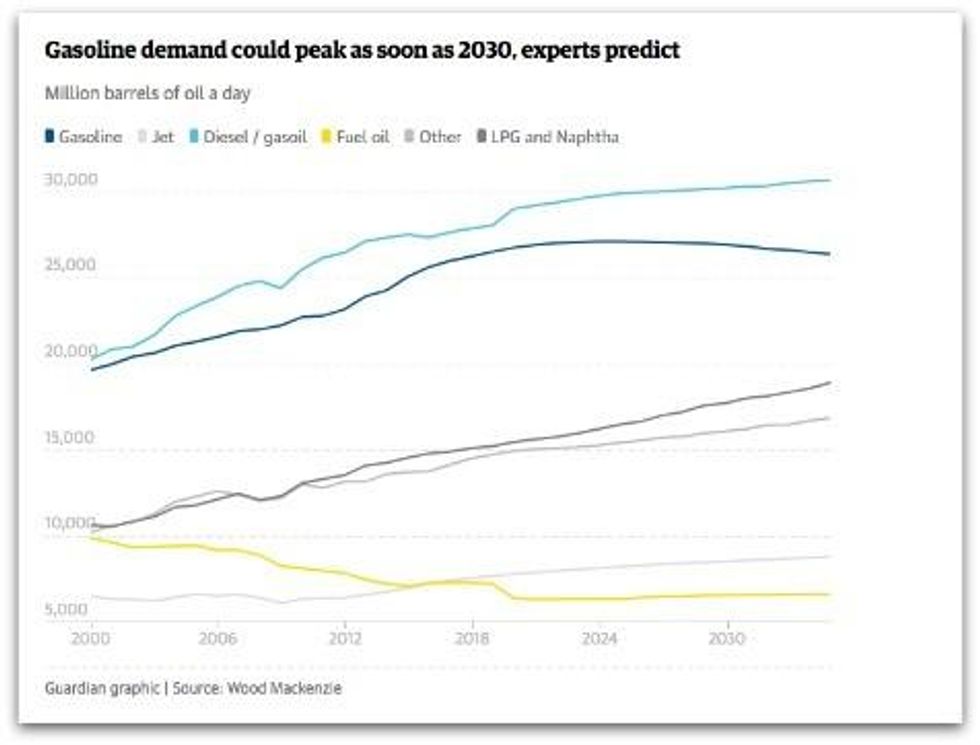

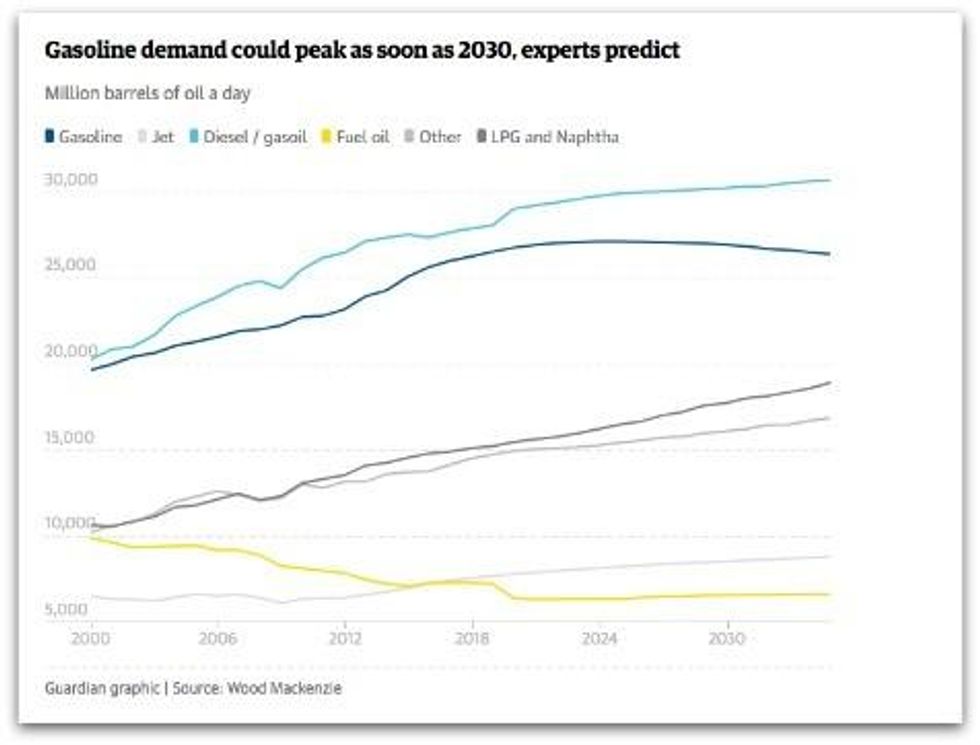

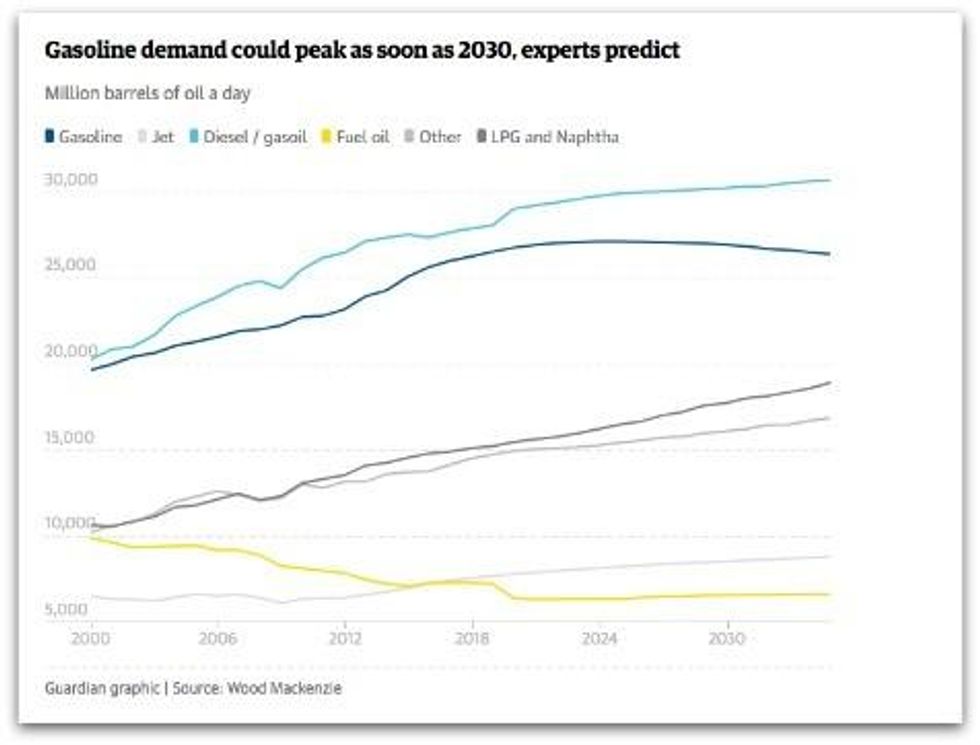

Wood Mackenzie estimates global gasoline prices will peak then start to fall by 2030, though Gelder posits "the ripples of gasoline's plateau would be felt much earlier," as fossil fuel companies take fewer investment risks once demand for gas ebbs.

"While gasoline will peak first," the newspaper notes, "the analysts expect total oil demand to plateau about 2035, as growth is hit by climate change policies and developing world economies maturing."

Meanwhile, the oil and gas industry is also taking a hit from the solar energy market--which is booming in the U.S. and elsewhere, and is expected to continue doing well over the next decade. The head of the International Renewable Energy Agency (IRENA) toldReuters the industry expects the costs of solar power to fall a notable amount over the next 10 year.

"In the next decade, the cost of (utility scale) solar could fall by 60 percent or more," IRENA director general Adnan Amin said.

The Trump administration is currently weighing whether to increase taxes on imported solar materials, after the U.S. International Trade Commission determined in September that cheap imports had been harmful to U.S.-based solar companies.

Amin criticized the possible increased taxation as short-sighted, considering the growing global demand for solar products and renewable alternatives to oil and gas.

"It's not always the best strategy to try to protect your industry and have high prices," Amin said, "because in the long-term what you want to do is drive down the cost of energy."

Trump and Musk are on an unconstitutional rampage, aiming for virtually every corner of the federal government. These two right-wing billionaires are targeting nurses, scientists, teachers, daycare providers, judges, veterans, air traffic controllers, and nuclear safety inspectors. No one is safe. The food stamps program, Social Security, Medicare, and Medicaid are next. It’s an unprecedented disaster and a five-alarm fire, but there will be a reckoning. The people did not vote for this. The American people do not want this dystopian hellscape that hides behind claims of “efficiency.” Still, in reality, it is all a giveaway to corporate interests and the libertarian dreams of far-right oligarchs like Musk. Common Dreams is playing a vital role by reporting day and night on this orgy of corruption and greed, as well as what everyday people can do to organize and fight back. As a people-powered nonprofit news outlet, we cover issues the corporate media never will, but we can only continue with our readers’ support. |

As an increasing number of nations make plans for banning gas and diesel vehicles within the coming decades, and drivers gain an awareness of the benefits associated with electric vehicles, researchers are prediciting notable consequences for dirty energy sources as the public shifts toward favoring renewable alternatives.

"Post-2025, that's where electric car sales take off. The further you go into the future, the more it's electric cars," Alan Gelder, a senior analyst for the research group Wood Mackenzie, told the Guardian. "If cities began banning cars with a combustion engine, that would rapidly accelerate the switch to electric vehicles."

Drivers transitioning to electric vehicles out of necessity, because of such bans--which multiple European nations plan to implement in the next 15-25 years--and efforts by governments to increase fuel efficiency regluations, is only part of what is fueling the blossoming electric vehicle market.

Auto manufacturers are also taking cues from the increased demand due to bans and enhanced regulations as well as consumer desire for more environmentally friendly vehicles, as Business Insider detailed in May.

These efforts by governments to limit emissions and by automakers to meet the rising demand for electic vehicles are expected to substanitally impact the oil and gas industry in the coming years.

Wood Mackenzie estimates global gasoline prices will peak then start to fall by 2030, though Gelder posits "the ripples of gasoline's plateau would be felt much earlier," as fossil fuel companies take fewer investment risks once demand for gas ebbs.

"While gasoline will peak first," the newspaper notes, "the analysts expect total oil demand to plateau about 2035, as growth is hit by climate change policies and developing world economies maturing."

Meanwhile, the oil and gas industry is also taking a hit from the solar energy market--which is booming in the U.S. and elsewhere, and is expected to continue doing well over the next decade. The head of the International Renewable Energy Agency (IRENA) toldReuters the industry expects the costs of solar power to fall a notable amount over the next 10 year.

"In the next decade, the cost of (utility scale) solar could fall by 60 percent or more," IRENA director general Adnan Amin said.

The Trump administration is currently weighing whether to increase taxes on imported solar materials, after the U.S. International Trade Commission determined in September that cheap imports had been harmful to U.S.-based solar companies.

Amin criticized the possible increased taxation as short-sighted, considering the growing global demand for solar products and renewable alternatives to oil and gas.

"It's not always the best strategy to try to protect your industry and have high prices," Amin said, "because in the long-term what you want to do is drive down the cost of energy."

As an increasing number of nations make plans for banning gas and diesel vehicles within the coming decades, and drivers gain an awareness of the benefits associated with electric vehicles, researchers are prediciting notable consequences for dirty energy sources as the public shifts toward favoring renewable alternatives.

"Post-2025, that's where electric car sales take off. The further you go into the future, the more it's electric cars," Alan Gelder, a senior analyst for the research group Wood Mackenzie, told the Guardian. "If cities began banning cars with a combustion engine, that would rapidly accelerate the switch to electric vehicles."

Drivers transitioning to electric vehicles out of necessity, because of such bans--which multiple European nations plan to implement in the next 15-25 years--and efforts by governments to increase fuel efficiency regluations, is only part of what is fueling the blossoming electric vehicle market.

Auto manufacturers are also taking cues from the increased demand due to bans and enhanced regulations as well as consumer desire for more environmentally friendly vehicles, as Business Insider detailed in May.

These efforts by governments to limit emissions and by automakers to meet the rising demand for electic vehicles are expected to substanitally impact the oil and gas industry in the coming years.

Wood Mackenzie estimates global gasoline prices will peak then start to fall by 2030, though Gelder posits "the ripples of gasoline's plateau would be felt much earlier," as fossil fuel companies take fewer investment risks once demand for gas ebbs.

"While gasoline will peak first," the newspaper notes, "the analysts expect total oil demand to plateau about 2035, as growth is hit by climate change policies and developing world economies maturing."

Meanwhile, the oil and gas industry is also taking a hit from the solar energy market--which is booming in the U.S. and elsewhere, and is expected to continue doing well over the next decade. The head of the International Renewable Energy Agency (IRENA) toldReuters the industry expects the costs of solar power to fall a notable amount over the next 10 year.

"In the next decade, the cost of (utility scale) solar could fall by 60 percent or more," IRENA director general Adnan Amin said.

The Trump administration is currently weighing whether to increase taxes on imported solar materials, after the U.S. International Trade Commission determined in September that cheap imports had been harmful to U.S.-based solar companies.

Amin criticized the possible increased taxation as short-sighted, considering the growing global demand for solar products and renewable alternatives to oil and gas.

"It's not always the best strategy to try to protect your industry and have high prices," Amin said, "because in the long-term what you want to do is drive down the cost of energy."