SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

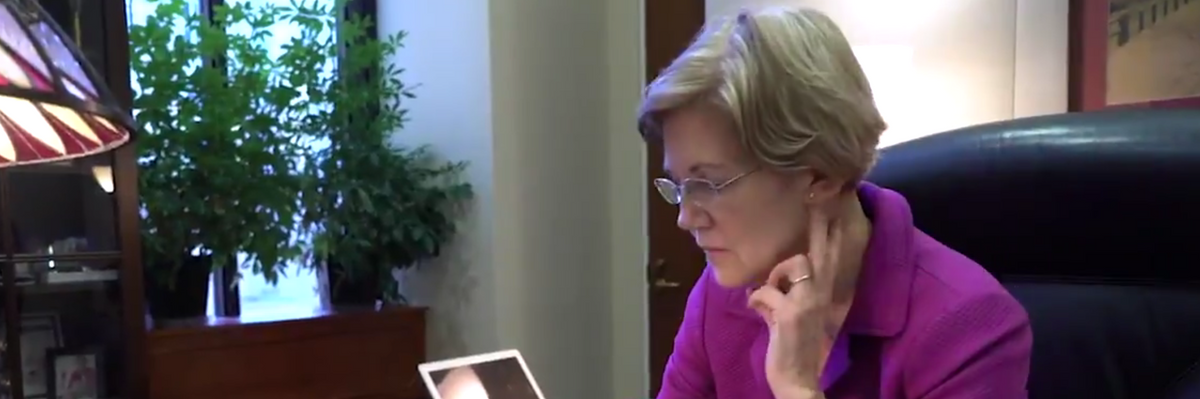

Have you ever tried to call a rating agency to deal with an error or have your credit temporarily frozen? Did it look anything like this? (Photo: Screeenshot/Twitter/@SenWarren)

If credit agencies use your personal financial records to make their assessment of your credit-worthiness, why is it so hard to get them to freeze or adjust your credit rating when you are the victim of fraud or when some hacker manages to steal that sensitive information?

Good question.

And one that Sen.Elizabeth Warren (D-Mass.)--who has proposed legislation making it possible for individual consumers to put a hold on their credit without charge--was left asking in desperation after having this experience of trying to call the credit service giant Equifax on Monday:

\u201cWarning: calling @Equifax to freeze your credit takes forever and may not even work. We need the FREE Act so freezes are fast and free.\u201d— Elizabeth Warren (@Elizabeth Warren) 1508773172

"Warning," wrote Warren in a Facebook post, "from a painfully boring experience: calling Equifax to freeze your credit takes forever and may not even work. Freezing your credit file should be quick and free - that's why we need to pass the FREE Act."

Trump and Musk are on an unconstitutional rampage, aiming for virtually every corner of the federal government. These two right-wing billionaires are targeting nurses, scientists, teachers, daycare providers, judges, veterans, air traffic controllers, and nuclear safety inspectors. No one is safe. The food stamps program, Social Security, Medicare, and Medicaid are next. It’s an unprecedented disaster and a five-alarm fire, but there will be a reckoning. The people did not vote for this. The American people do not want this dystopian hellscape that hides behind claims of “efficiency.” Still, in reality, it is all a giveaway to corporate interests and the libertarian dreams of far-right oligarchs like Musk. Common Dreams is playing a vital role by reporting day and night on this orgy of corruption and greed, as well as what everyday people can do to organize and fight back. As a people-powered nonprofit news outlet, we cover issues the corporate media never will, but we can only continue with our readers’ support. |

If credit agencies use your personal financial records to make their assessment of your credit-worthiness, why is it so hard to get them to freeze or adjust your credit rating when you are the victim of fraud or when some hacker manages to steal that sensitive information?

Good question.

And one that Sen.Elizabeth Warren (D-Mass.)--who has proposed legislation making it possible for individual consumers to put a hold on their credit without charge--was left asking in desperation after having this experience of trying to call the credit service giant Equifax on Monday:

\u201cWarning: calling @Equifax to freeze your credit takes forever and may not even work. We need the FREE Act so freezes are fast and free.\u201d— Elizabeth Warren (@Elizabeth Warren) 1508773172

"Warning," wrote Warren in a Facebook post, "from a painfully boring experience: calling Equifax to freeze your credit takes forever and may not even work. Freezing your credit file should be quick and free - that's why we need to pass the FREE Act."

If credit agencies use your personal financial records to make their assessment of your credit-worthiness, why is it so hard to get them to freeze or adjust your credit rating when you are the victim of fraud or when some hacker manages to steal that sensitive information?

Good question.

And one that Sen.Elizabeth Warren (D-Mass.)--who has proposed legislation making it possible for individual consumers to put a hold on their credit without charge--was left asking in desperation after having this experience of trying to call the credit service giant Equifax on Monday:

\u201cWarning: calling @Equifax to freeze your credit takes forever and may not even work. We need the FREE Act so freezes are fast and free.\u201d— Elizabeth Warren (@Elizabeth Warren) 1508773172

"Warning," wrote Warren in a Facebook post, "from a painfully boring experience: calling Equifax to freeze your credit takes forever and may not even work. Freezing your credit file should be quick and free - that's why we need to pass the FREE Act."