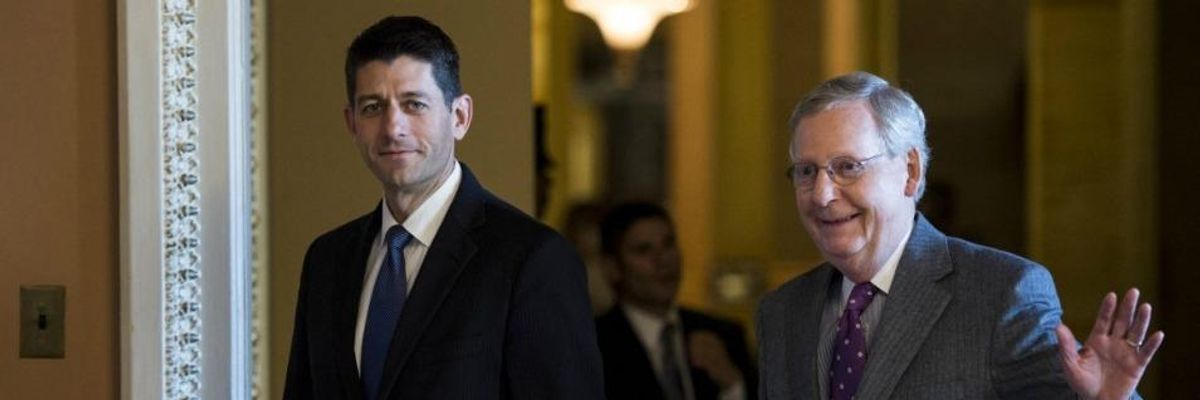

As the deficit-exploding GOP tax plan hurtles toward a final vote in the Senate this week, Sen. Bernie Sanders (I-Vt.) delivered a letter to Senate Majority Leader Mitch McConnell (R-Ky.) and House Speaker Paul Ryan (R-Wis.) on Monday demanding to know how much they are planning to cut from Medicare, Medicaid, Social Security, and other key programs in order to offset the costs of tax cuts for the ultra-wealthy.

"Will you attempt to end Medicare as we know it by giving seniors vouchers to purchase private health insurance, something long supported by Speaker Ryan? How much will you cut Social Security? Will you try to increase the retirement age to 70?"

--Sen. Bernie Sanders"I am very concerned that if you succeed in passing tax legislation that significantly adds to our national debt, you will then move aggressively to balance the budget on the backs of working families, the elderly, the children, the sick, and the poor," Sanders wrote. "In other words, in order to pay for tax breaks for the rich and large corporations, you will make massive cuts to Social Security, Medicare, Medicaid, nutrition, environmental protection, and every other program designed to protect the needs of the middle class and working families of our country."

Highlighting nonpartisan analyses predicting that the Republican tax plan would increase the federal deficit by $1.4 trillion over the next decade, Sanders implored McConnell and Ryan to provide the American public with a "specific and detailed explanation as to how the Republican Congress will achieve its commitment of balancing the budget."

"Will you attempt to end Medicare as we know it by giving seniors vouchers to purchase private health insurance, something long supported by Speaker Ryan?" Sanders asked. "How much will you cut Social Security? Will you try to increase the retirement age to 70?"

Sanders' questions come as the Senate Budget Committee is expected to vote on the GOP's deeply unpopular tax bill on Tuesday, setting the stage for a final vote as early as Thursday.

As Common Dreams reported on Monday, progressive groups have been urgently mobilizing across the country in a last-ditch effort to block a bill that would overwhelmingly favor the top one percent of earners while hiking taxes on millions of middle class and low-income families.

While Republicans have repeatedly attempted to justify their budget-busting tax cuts by claiming that federal revenue losses will be offset by economic growth, even conservative analysts have characterized this selling point as a way to mask their plan to enact deep cuts to the social safety net.

In an op-ed for the Washington Post earlier this month, former Reagan adviser Bruce Bartlett called the idea that tax cuts for the rich drive economic growth a "fantasy."

Echoing Sanders' concerns, Bartlett argued that Republicans really "want to force a major overall spending cut that would be a political non-starter without first passing a tax cut that creates a deficit so large, something must be done about it. Spending cuts must be enacted, then, as they would be presented as the only way to pay for the already passed tax cut's lost revenue."

"Republicans have played this game before--luring Americans toward government downsizing with the promise of tax cuts," Bartlett concludes. "The best way to avoid getting played again is not to play the game."

Read Sanders' full letter:

Dear Majority Leader McConnell and Speaker Ryan:

It is no secret that I am vigorously opposed to the disastrous "tax reform" bills that you are pushing in the U.S. House and U.S. Senate.

At a time of massive income and wealth inequality, both of these bills would provide huge tax breaks to the very rich and large corporations. Meanwhile, they would raise taxes for millions of middle class families.

Further, and the point of this letter, is that both of these bills would increase the federal deficit by more than $1.4 trillion, according to the Joint Committee on Taxation.

I am very concerned that if you succeed in passing tax legislation that significantly adds to our national debt, you will then move aggressively to balance the budget on the backs of working families, the elderly, the children, the sick, and the poor. In other words, in order to pay for tax breaks for the rich and large corporations, you will make massive cuts to Social Security, Medicare, Medicaid, nutrition, environmental protection, and every other program designed to protect the needs of the middle class and working families of our country.

Before the Senate votes on tax legislation that adds over $1.4 trillion to the deficit, you owe the American people a specific and detailed explanation as to how the Republican Congress will achieve its commitment of balancing the budget over the next decade.

Will you schedule a vote to raise the eligibility of Medicare from 65 to 67 as called for in the House Budget Resolution? Will you attempt to end Medicare as we know it by giving seniors vouchers to purchase private health insurance, something long supported by Speaker Ryan?

How much will you cut Social Security? Will you try to increase the retirement age to 70, cut cost-of-living adjustments for senior citizens and disabled veterans, and/or privatize Social Security?

Will you support legislation to cut Medicaid by $1 trillion over the next decade, kicking 15 million Americans off of health insurance? As you know, this was a provision included in the Republican Budget Resolution that was passed earlier this year.

How much do you plan on cutting affordable housing, Pell Grants, WIC, and Head Start to pay for a permanent tax break for profitable corporations?

The bottom line is that the American people have a right to know exactly how you plan to pay for a $1.4 trillion increase in the deficit before, not after, tax legislation is signed into law. In your response, please be as specific as you can.