Dec 15, 2017

President Donald Trump lies a lot--especially about the Republican tax plan--but during a Friday morning scrum with reporters on the White House lawn, Trump accidentally told the truth.

Asked about the GOP tax bill, which is expected to hit the floor of the House and Senate for a final vote early next week, Trump said: "I think we're doing very well, it's something that's going to be monumental. It will be the biggest tax increase--or tax cut--in the history of our country."

@marcorubio

-- Patriot Power (@Kakistocracy15) December 15, 2017

Oops BIGLY Freudian slip Trump:

"It will be the biggest tax increase...in the history of our country"#GOPTaxScam pic.twitter.com/L7PGo0VIuH

\u201cTrump slips, just now, says that his tax bill is the biggest tax INCREASE...\u201d— Jeffrey Evan Gold \ud83c\uddfa\ud83c\udde6\ud83c\uddfa\ud83c\uddf2 (@Jeffrey Evan Gold \ud83c\uddfa\ud83c\udde6\ud83c\uddfa\ud83c\uddf2) 1513348849

Even if it was just a slip of the tongue, Trump's characterization of the GOP tax bill as the "biggest tax increase" in American history is accurate, according to some analysts.

As The Intercept's Ryan Grim noted in an analysis earlier this month, the GOP tax bill is "routinely referred to as a $1.5 trillion tax cut. And, in some ways, that's true: On net, it would reduce the amount of taxes collected by the Treasury by about $1.5 trillion over 10 years."

However, "that figure masks the eye-popping scale and audacity of the GOP's rushed restructuring of the economy," Grim adds. "[The bill,] properly described, is two things: the largest tax cut--and also the biggest tax increase--in American history."

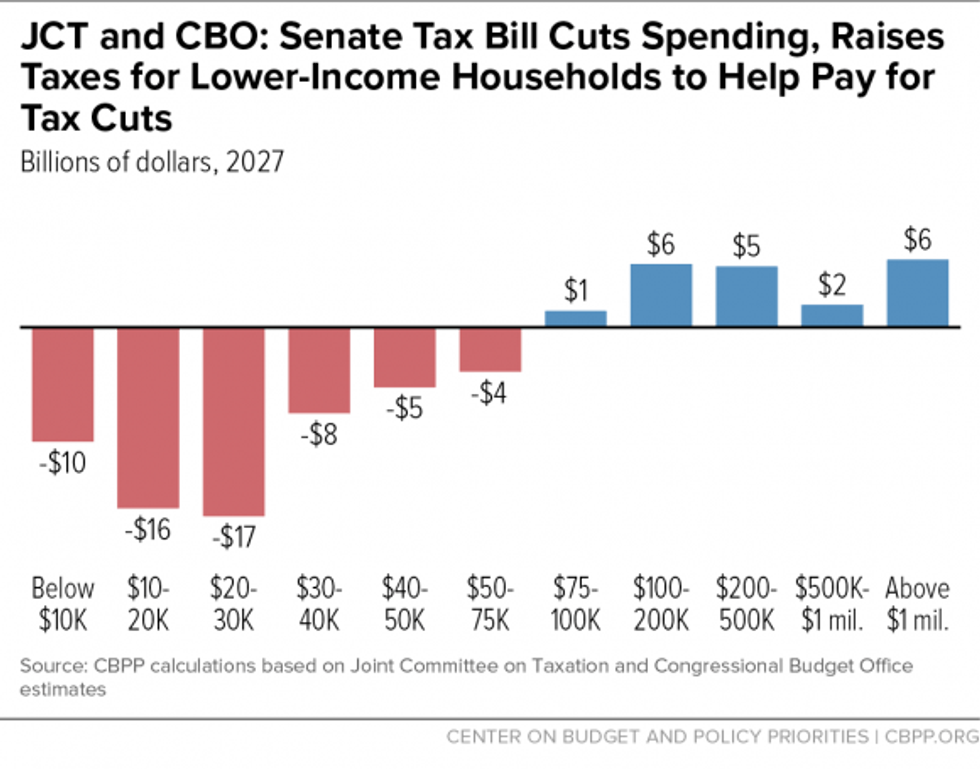

This tax increase, as research by the Center on Budget and Policy Priorities (CBPP) has found, would primarily be shouldered by low-income and middle class Americans. Additionally, while the GOP bill would give corporations permanent tax cuts, many of the cuts for middle class and low-income Americans would expire after a decade.

As Common Dreams reported on Wednesday, House and Senate Republicans reached a backroom "deal" that tilts the benefits of their bill even further toward the wealthiest Americans by reducing the top marginal tax rate from from 39.6 percent to 37 percent.

"Overall, in 2027--when only the corporate tax cuts, slower inflation measure, and individual mandate repeal would remain in place--the Senate bill would, on average, raise taxes or reduce federal expenditures for households with incomes below $75,000 by about $60 billion--while still giving large tax reductions (through its corporate tax cuts) to those at the top," noted CBPP's Chuck Marr.

An Unconstitutional Rampage

Trump and Musk are on an unconstitutional rampage, aiming for virtually every corner of the federal government. These two right-wing billionaires are targeting nurses, scientists, teachers, daycare providers, judges, veterans, air traffic controllers, and nuclear safety inspectors. No one is safe. The food stamps program, Social Security, Medicare, and Medicaid are next. It’s an unprecedented disaster and a five-alarm fire, but there will be a reckoning. The people did not vote for this. The American people do not want this dystopian hellscape that hides behind claims of “efficiency.” Still, in reality, it is all a giveaway to corporate interests and the libertarian dreams of far-right oligarchs like Musk. Common Dreams is playing a vital role by reporting day and night on this orgy of corruption and greed, as well as what everyday people can do to organize and fight back. As a people-powered nonprofit news outlet, we cover issues the corporate media never will, but we can only continue with our readers’ support. |

Our work is licensed under Creative Commons (CC BY-NC-ND 3.0). Feel free to republish and share widely.

President Donald Trump lies a lot--especially about the Republican tax plan--but during a Friday morning scrum with reporters on the White House lawn, Trump accidentally told the truth.

Asked about the GOP tax bill, which is expected to hit the floor of the House and Senate for a final vote early next week, Trump said: "I think we're doing very well, it's something that's going to be monumental. It will be the biggest tax increase--or tax cut--in the history of our country."

@marcorubio

-- Patriot Power (@Kakistocracy15) December 15, 2017

Oops BIGLY Freudian slip Trump:

"It will be the biggest tax increase...in the history of our country"#GOPTaxScam pic.twitter.com/L7PGo0VIuH

\u201cTrump slips, just now, says that his tax bill is the biggest tax INCREASE...\u201d— Jeffrey Evan Gold \ud83c\uddfa\ud83c\udde6\ud83c\uddfa\ud83c\uddf2 (@Jeffrey Evan Gold \ud83c\uddfa\ud83c\udde6\ud83c\uddfa\ud83c\uddf2) 1513348849

Even if it was just a slip of the tongue, Trump's characterization of the GOP tax bill as the "biggest tax increase" in American history is accurate, according to some analysts.

As The Intercept's Ryan Grim noted in an analysis earlier this month, the GOP tax bill is "routinely referred to as a $1.5 trillion tax cut. And, in some ways, that's true: On net, it would reduce the amount of taxes collected by the Treasury by about $1.5 trillion over 10 years."

However, "that figure masks the eye-popping scale and audacity of the GOP's rushed restructuring of the economy," Grim adds. "[The bill,] properly described, is two things: the largest tax cut--and also the biggest tax increase--in American history."

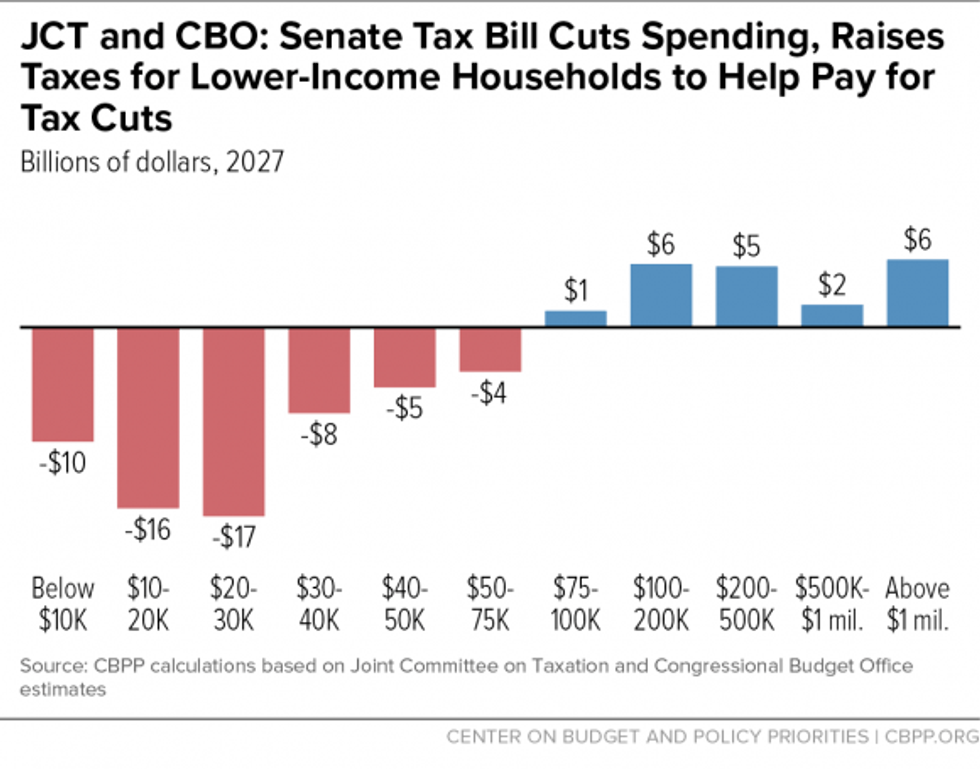

This tax increase, as research by the Center on Budget and Policy Priorities (CBPP) has found, would primarily be shouldered by low-income and middle class Americans. Additionally, while the GOP bill would give corporations permanent tax cuts, many of the cuts for middle class and low-income Americans would expire after a decade.

As Common Dreams reported on Wednesday, House and Senate Republicans reached a backroom "deal" that tilts the benefits of their bill even further toward the wealthiest Americans by reducing the top marginal tax rate from from 39.6 percent to 37 percent.

"Overall, in 2027--when only the corporate tax cuts, slower inflation measure, and individual mandate repeal would remain in place--the Senate bill would, on average, raise taxes or reduce federal expenditures for households with incomes below $75,000 by about $60 billion--while still giving large tax reductions (through its corporate tax cuts) to those at the top," noted CBPP's Chuck Marr.

President Donald Trump lies a lot--especially about the Republican tax plan--but during a Friday morning scrum with reporters on the White House lawn, Trump accidentally told the truth.

Asked about the GOP tax bill, which is expected to hit the floor of the House and Senate for a final vote early next week, Trump said: "I think we're doing very well, it's something that's going to be monumental. It will be the biggest tax increase--or tax cut--in the history of our country."

@marcorubio

-- Patriot Power (@Kakistocracy15) December 15, 2017

Oops BIGLY Freudian slip Trump:

"It will be the biggest tax increase...in the history of our country"#GOPTaxScam pic.twitter.com/L7PGo0VIuH

\u201cTrump slips, just now, says that his tax bill is the biggest tax INCREASE...\u201d— Jeffrey Evan Gold \ud83c\uddfa\ud83c\udde6\ud83c\uddfa\ud83c\uddf2 (@Jeffrey Evan Gold \ud83c\uddfa\ud83c\udde6\ud83c\uddfa\ud83c\uddf2) 1513348849

Even if it was just a slip of the tongue, Trump's characterization of the GOP tax bill as the "biggest tax increase" in American history is accurate, according to some analysts.

As The Intercept's Ryan Grim noted in an analysis earlier this month, the GOP tax bill is "routinely referred to as a $1.5 trillion tax cut. And, in some ways, that's true: On net, it would reduce the amount of taxes collected by the Treasury by about $1.5 trillion over 10 years."

However, "that figure masks the eye-popping scale and audacity of the GOP's rushed restructuring of the economy," Grim adds. "[The bill,] properly described, is two things: the largest tax cut--and also the biggest tax increase--in American history."

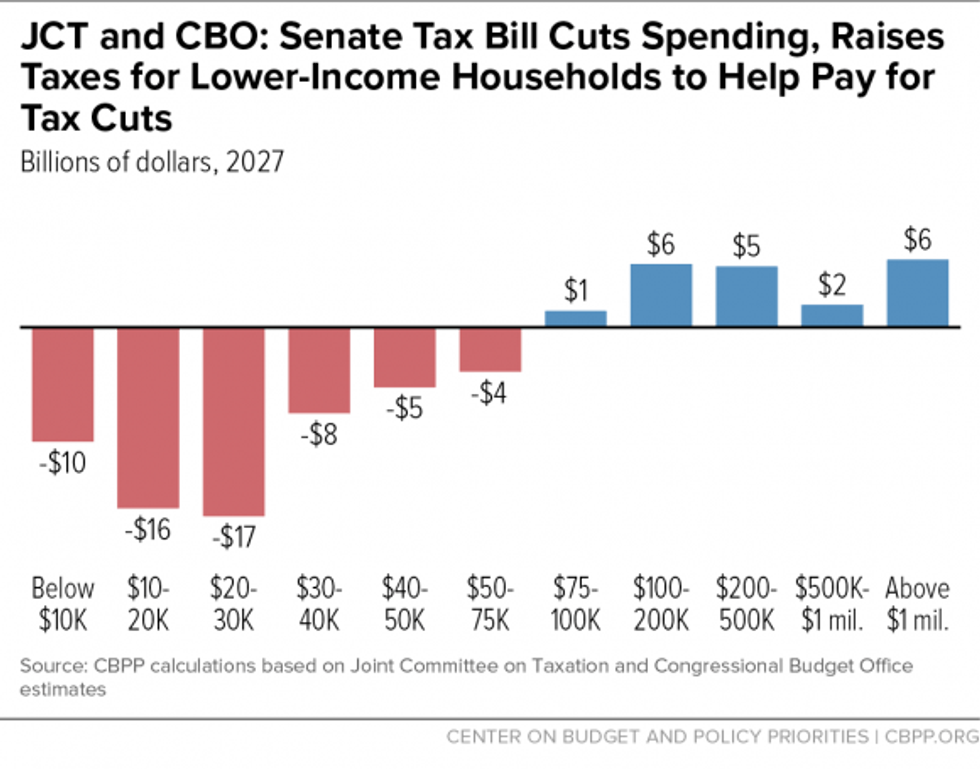

This tax increase, as research by the Center on Budget and Policy Priorities (CBPP) has found, would primarily be shouldered by low-income and middle class Americans. Additionally, while the GOP bill would give corporations permanent tax cuts, many of the cuts for middle class and low-income Americans would expire after a decade.

As Common Dreams reported on Wednesday, House and Senate Republicans reached a backroom "deal" that tilts the benefits of their bill even further toward the wealthiest Americans by reducing the top marginal tax rate from from 39.6 percent to 37 percent.

"Overall, in 2027--when only the corporate tax cuts, slower inflation measure, and individual mandate repeal would remain in place--the Senate bill would, on average, raise taxes or reduce federal expenditures for households with incomes below $75,000 by about $60 billion--while still giving large tax reductions (through its corporate tax cuts) to those at the top," noted CBPP's Chuck Marr.

We've had enough. The 1% own and operate the corporate media. They are doing everything they can to defend the status quo, squash dissent and protect the wealthy and the powerful. The Common Dreams media model is different. We cover the news that matters to the 99%. Our mission? To inform. To inspire. To ignite change for the common good. How? Nonprofit. Independent. Reader-supported. Free to read. Free to republish. Free to share. With no advertising. No paywalls. No selling of your data. Thousands of small donations fund our newsroom and allow us to continue publishing. Can you chip in? We can't do it without you. Thank you.