SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

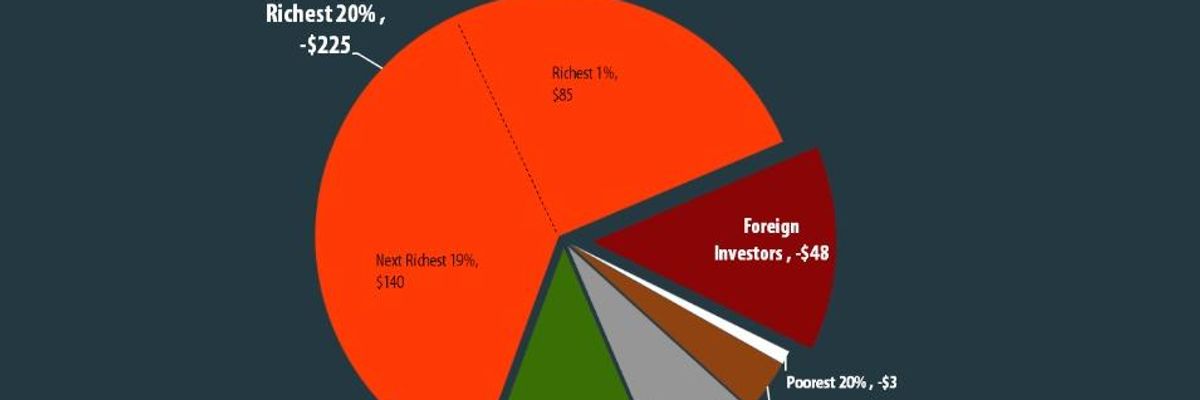

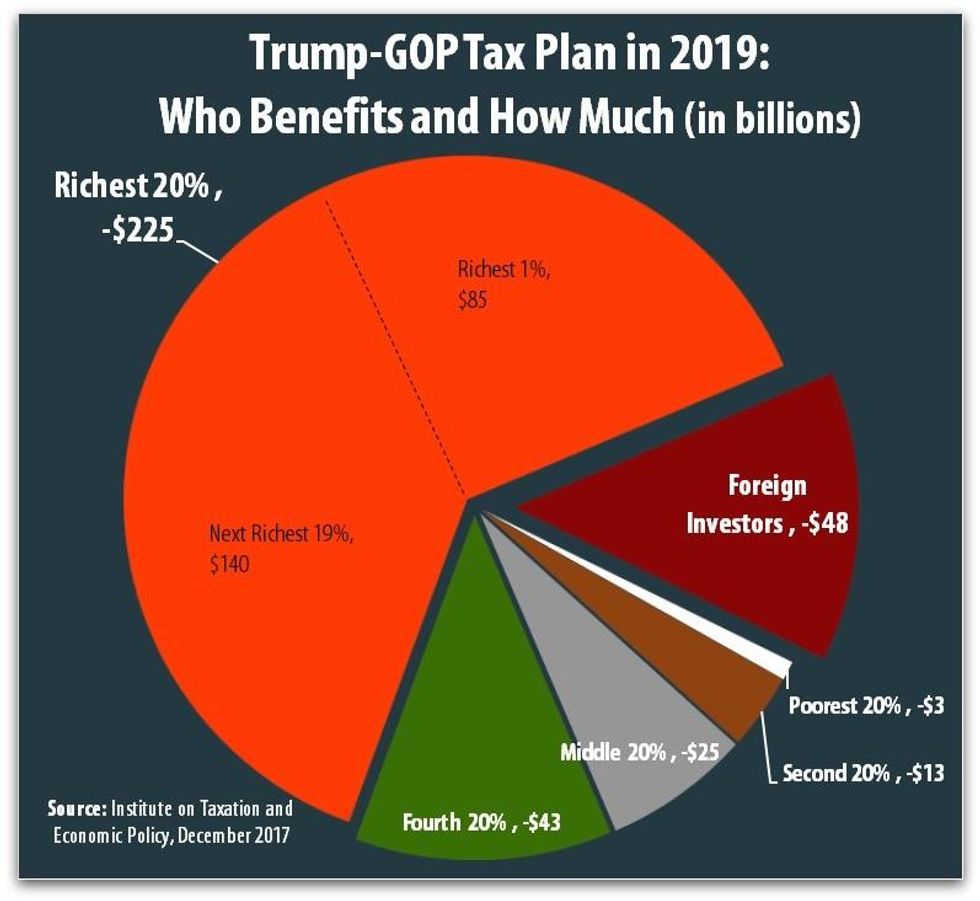

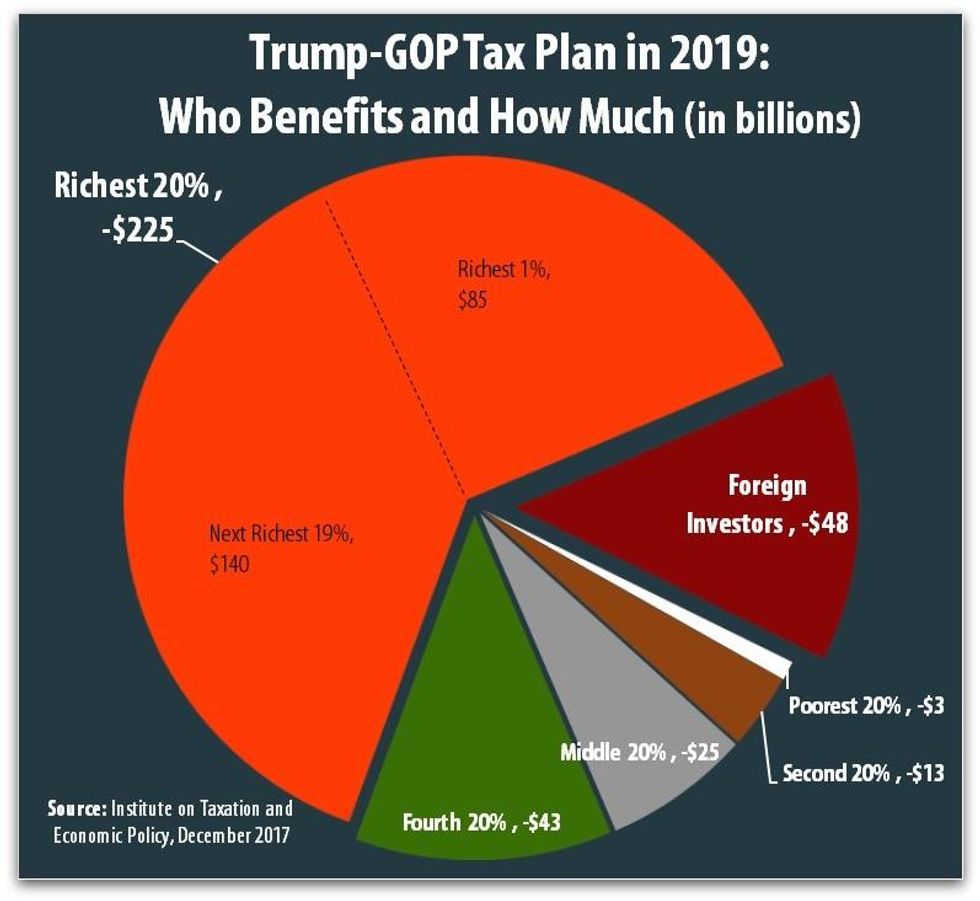

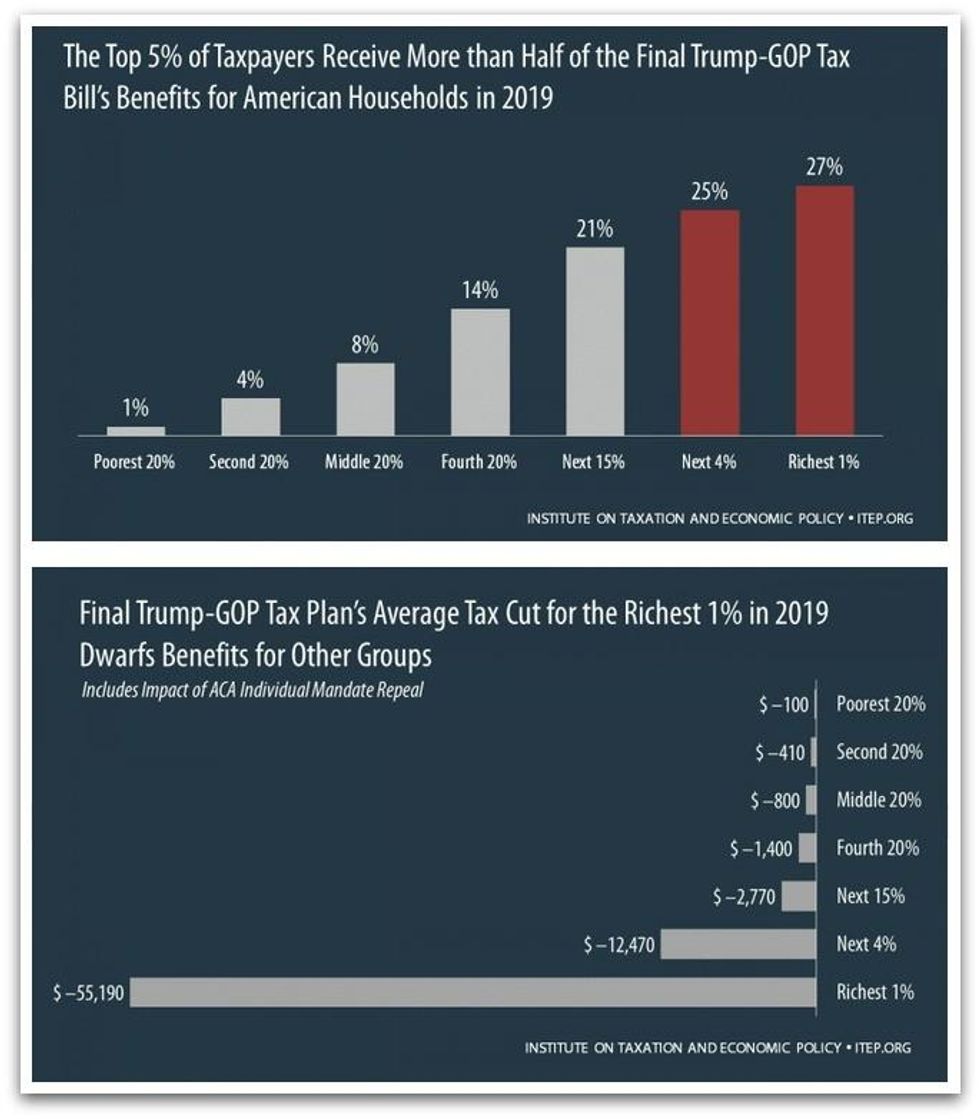

A new analysis released Saturday by the nonpartisan Institute on Taxation and Economic Policy (ITEP) shows how, for individuals, most of the "GOP tax scam" benefits high-income households and foreign investors while raising taxes on many low- and middle-income Americans. (Graph: ITEP)

It's simple. Profit-hungry corporations get a permanent windfall and the rich receive massive cuts. Everyone else--sooner or later, like it or not--gets to help pay for it all.

The jewel of the final "morally and economically obscene" GOP tax plan released by Republicans on Friday--now set for a vote this week in both the House and Senate and a signature by President Donald Trump before the Christmas holiday--is a permanent tax giveaway for corporations who will see their marginal rate slashed from 35 percent down to 21 percent.

But because of budget obligations and legislative rules, in order to pay for that massive gift to foreign investors, the wealthiest, and corporations--already, it should be noted, sitting on record profits and mounds of capital--it will ultimately be low- and middle-income Americans who see their taxes rise.

And it should be no surprise. As a weekend New York Times editorial makes plain, the GOP tax plan isn't only designed to further entrench massive inequality, the bill itself is the direct result of entrenched massive inequality--with the oligarchy that controls most of the nation's wealth also claiming an outsized and unchecked ability to sway political realities and electoral outcomes.

"As a smaller and smaller group of people cornered an ever-larger share of the nation's wealth," the Timesexplains, "so too did they gain an ever-larger share of political power. They became, in effect, kingmakers; the tax bill is a natural consequence of their long effort to bend American politics to serve their interests."

But still, the questions remain: who pays and who exactly--besides Trump and many of the GOP lawmakers who will personally enrich themselves due to this last-minute real estate-related provision they inserted--benefits most from the final bill?

A new analysis--titled "The Final Trump-GOP Tax Plan: National and 50-State Estimates for 2019 & 2027"--released Saturday by the nonpartisan Institute on Taxation and Economic Policy (ITEP) shows that, for individuals, most of the "GOP tax scam" benefits high-income households and foreign investors while raising taxes on many low- and middle-income Americans:

The above graph, ITEP explained in a statement, "divides Americans into five equal groups based on income and illustrates how only one of these groups, the richest fifth of Americans, will receive more benefits from the tax bill than foreign investors. This is because the biggest tax cut in the bill is the reduction in the corporate income tax rate from 35 percent to 21 percent. The corporate tax cut will mainly benefit those who own shares in American corporations. While some middle-income people own shares, most are owned by high-income Americans and foreign investors."

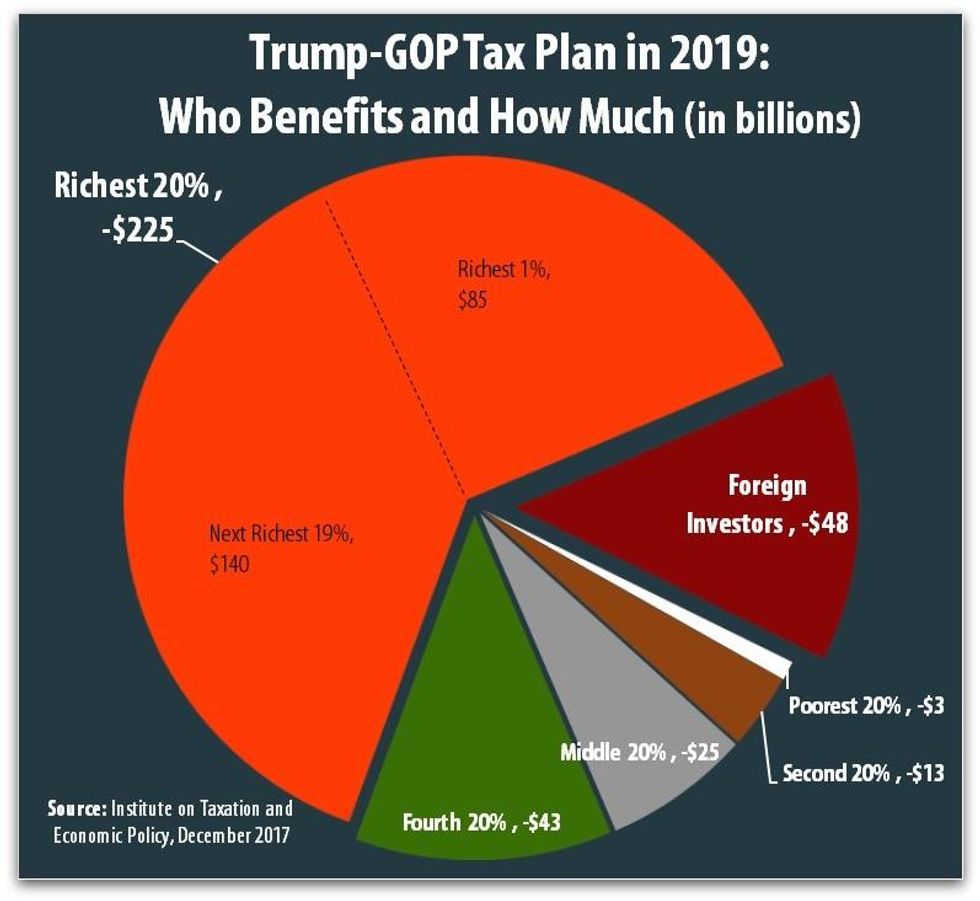

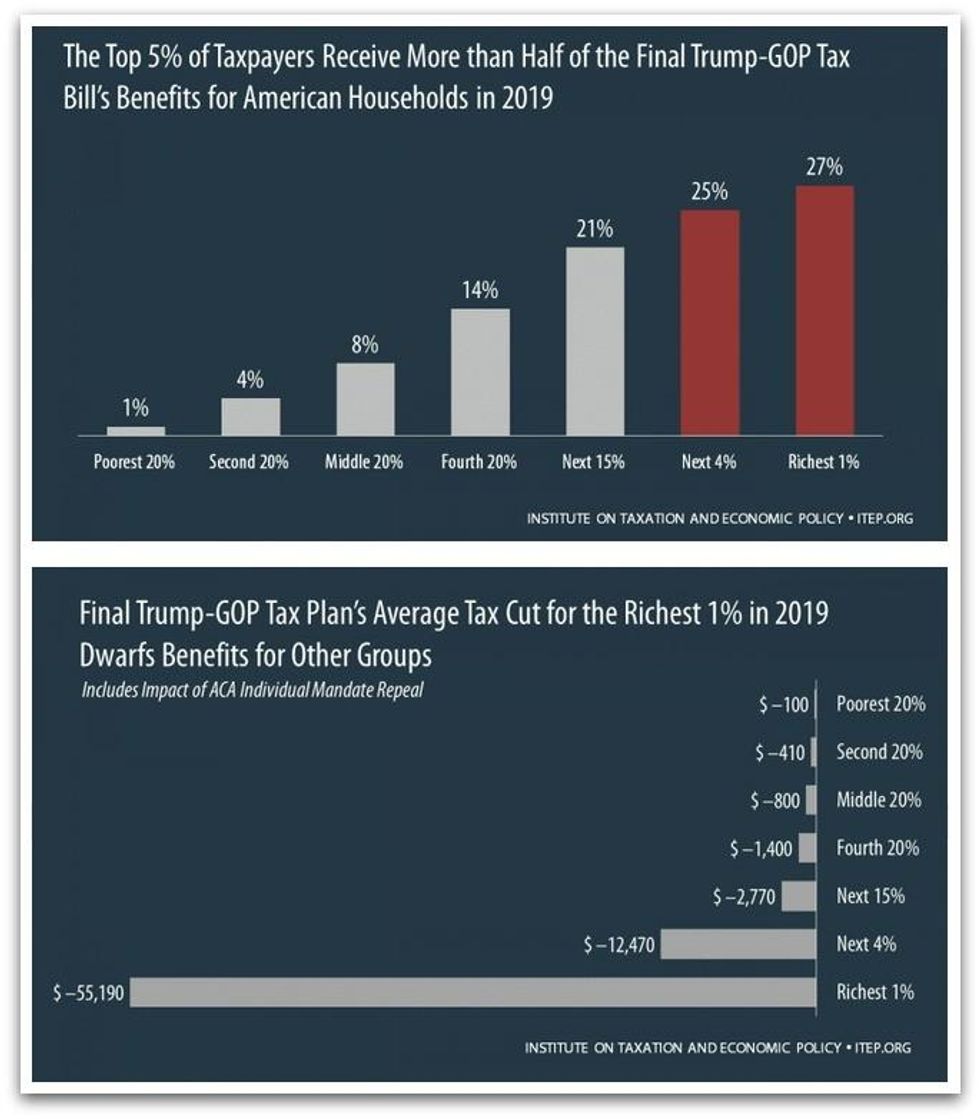

Breaking the numbers down further, ITEP shows that the top 5 percent of taxpayers will receiver more than half of the total benefits from the Trump-GOP tax plan and that in 2019, when the plan is fully in place, the average tax cut for nation's wealthiest individuals will "dwarf" that of lower tax brackets to such an extent that the "average tax cut for richest one percent will be larger than the average income for the middle-fifth of taxpayers, which will be about $53,000 that year."

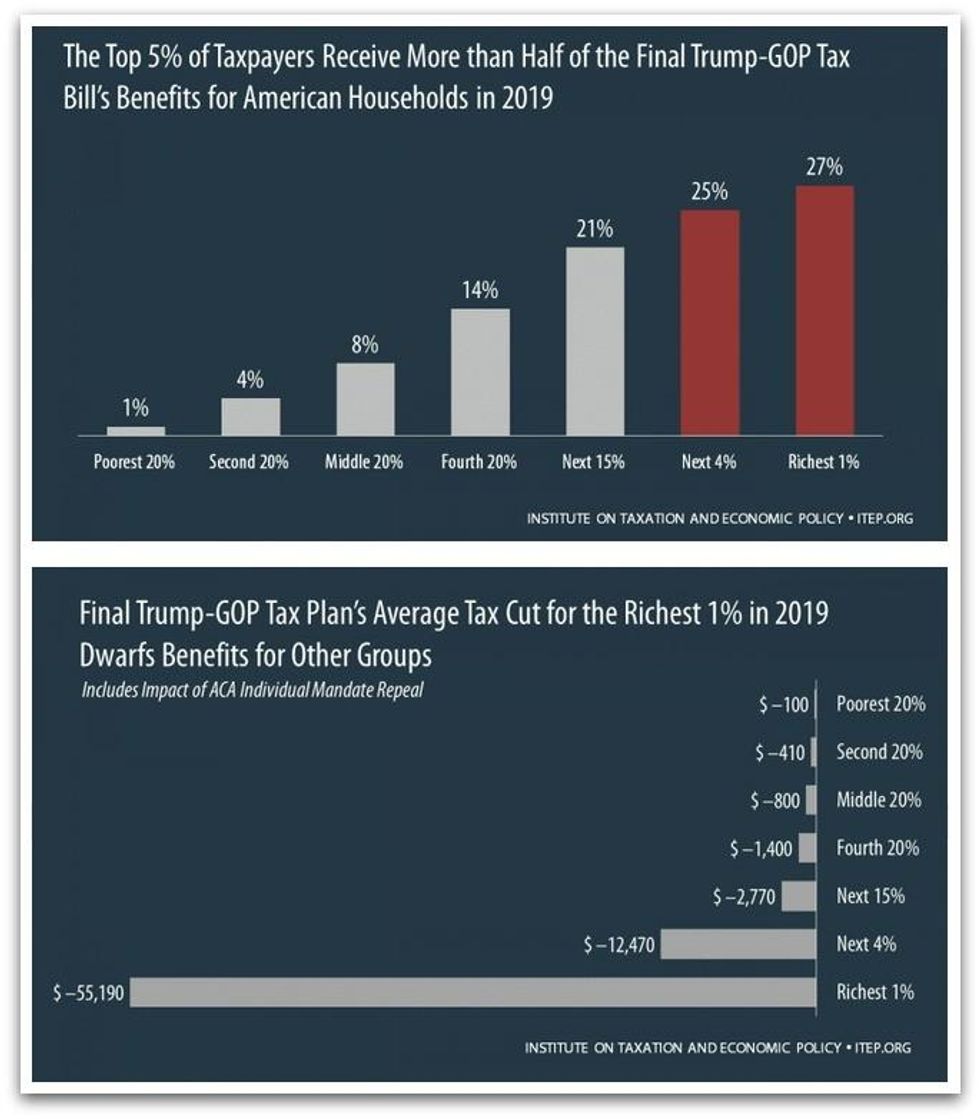

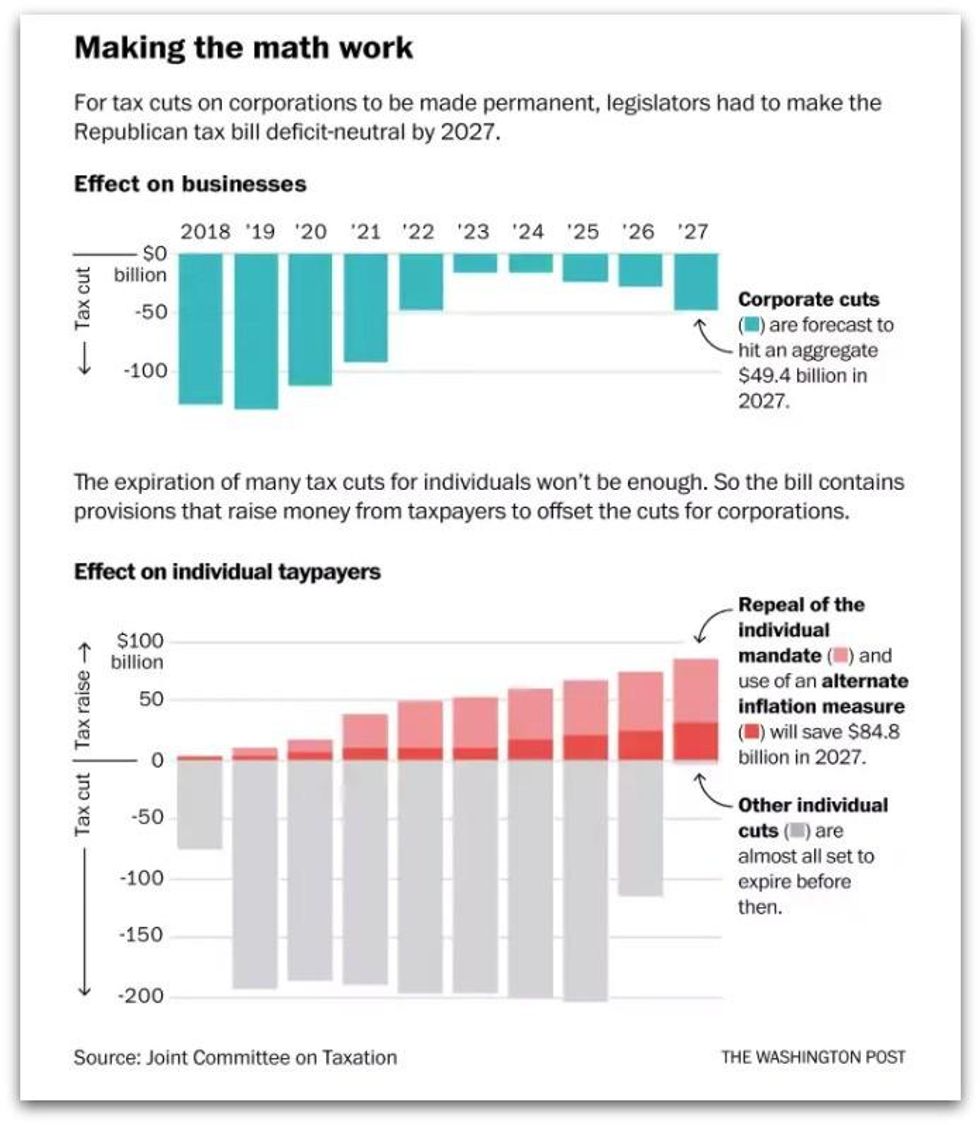

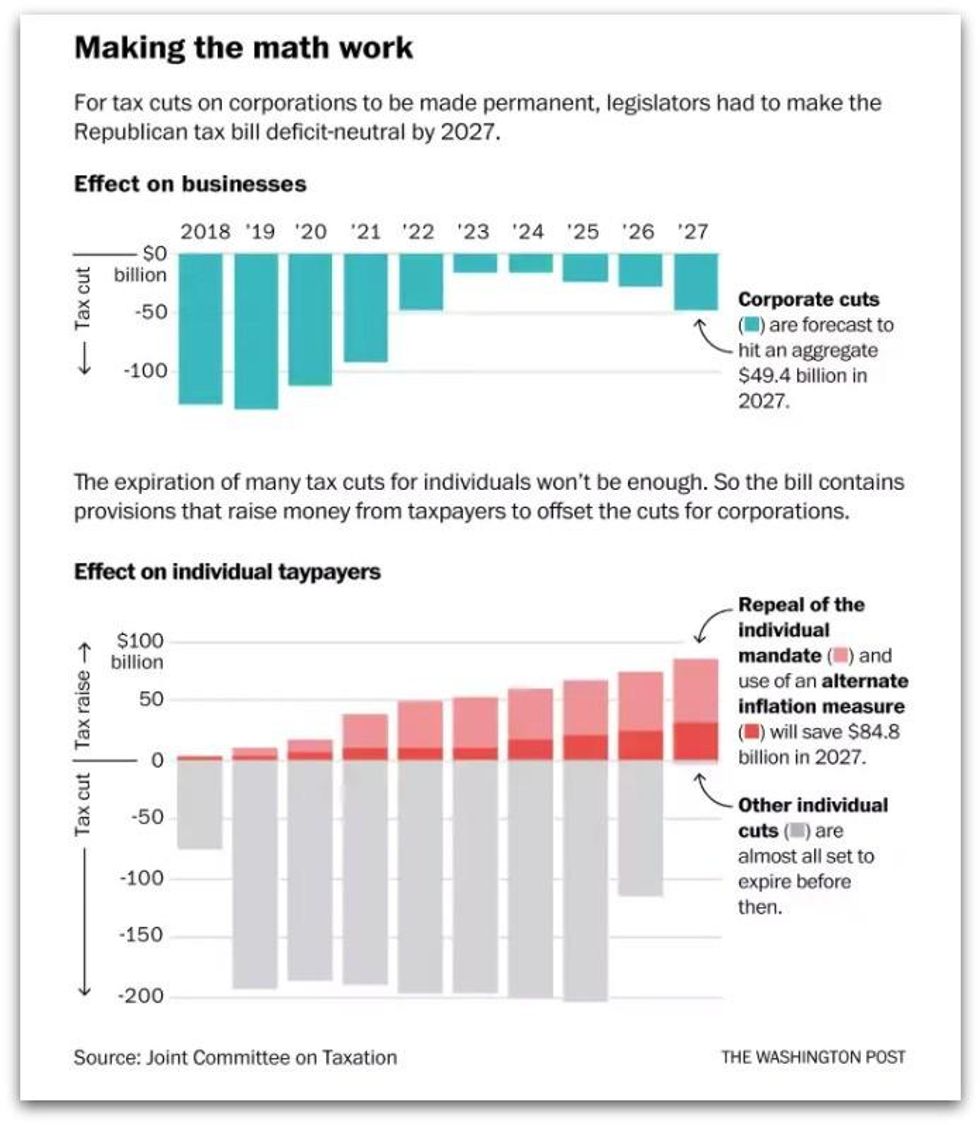

Meanwhile, Andrew Van Dam, writing for the Washington Post, explains how the slashing of the corporate rate is ultimately paid for by individuals:

The bill aims to cut corporate taxes in perpetuity, under the theory that to do anything less would be to create uncertainty for corporations. But to do so and still have the bill not be a money loser after a decade, they need to raise extra funds somewhere.

That's why Republicans can't just let the individual tax cuts expire, as they do at the end of 2025, but they actually need to raise money to offset the permanent corporate tax reduction.

And using data from an estimate put out by the nonpartisan Joint Committee on Taxation alongside Friday's GOP bill, the Post produced these graphs showing how the Republicans "make the math work":

Still, opponents of the bill nationwide say they are not giving up as they plan protests and demonstrations on Capitol Hill and at local congressional offices nationwide on Monday and throughout the week.

Trump and Musk are on an unconstitutional rampage, aiming for virtually every corner of the federal government. These two right-wing billionaires are targeting nurses, scientists, teachers, daycare providers, judges, veterans, air traffic controllers, and nuclear safety inspectors. No one is safe. The food stamps program, Social Security, Medicare, and Medicaid are next. It’s an unprecedented disaster and a five-alarm fire, but there will be a reckoning. The people did not vote for this. The American people do not want this dystopian hellscape that hides behind claims of “efficiency.” Still, in reality, it is all a giveaway to corporate interests and the libertarian dreams of far-right oligarchs like Musk. Common Dreams is playing a vital role by reporting day and night on this orgy of corruption and greed, as well as what everyday people can do to organize and fight back. As a people-powered nonprofit news outlet, we cover issues the corporate media never will, but we can only continue with our readers’ support. |

It's simple. Profit-hungry corporations get a permanent windfall and the rich receive massive cuts. Everyone else--sooner or later, like it or not--gets to help pay for it all.

The jewel of the final "morally and economically obscene" GOP tax plan released by Republicans on Friday--now set for a vote this week in both the House and Senate and a signature by President Donald Trump before the Christmas holiday--is a permanent tax giveaway for corporations who will see their marginal rate slashed from 35 percent down to 21 percent.

But because of budget obligations and legislative rules, in order to pay for that massive gift to foreign investors, the wealthiest, and corporations--already, it should be noted, sitting on record profits and mounds of capital--it will ultimately be low- and middle-income Americans who see their taxes rise.

And it should be no surprise. As a weekend New York Times editorial makes plain, the GOP tax plan isn't only designed to further entrench massive inequality, the bill itself is the direct result of entrenched massive inequality--with the oligarchy that controls most of the nation's wealth also claiming an outsized and unchecked ability to sway political realities and electoral outcomes.

"As a smaller and smaller group of people cornered an ever-larger share of the nation's wealth," the Timesexplains, "so too did they gain an ever-larger share of political power. They became, in effect, kingmakers; the tax bill is a natural consequence of their long effort to bend American politics to serve their interests."

But still, the questions remain: who pays and who exactly--besides Trump and many of the GOP lawmakers who will personally enrich themselves due to this last-minute real estate-related provision they inserted--benefits most from the final bill?

A new analysis--titled "The Final Trump-GOP Tax Plan: National and 50-State Estimates for 2019 & 2027"--released Saturday by the nonpartisan Institute on Taxation and Economic Policy (ITEP) shows that, for individuals, most of the "GOP tax scam" benefits high-income households and foreign investors while raising taxes on many low- and middle-income Americans:

The above graph, ITEP explained in a statement, "divides Americans into five equal groups based on income and illustrates how only one of these groups, the richest fifth of Americans, will receive more benefits from the tax bill than foreign investors. This is because the biggest tax cut in the bill is the reduction in the corporate income tax rate from 35 percent to 21 percent. The corporate tax cut will mainly benefit those who own shares in American corporations. While some middle-income people own shares, most are owned by high-income Americans and foreign investors."

Breaking the numbers down further, ITEP shows that the top 5 percent of taxpayers will receiver more than half of the total benefits from the Trump-GOP tax plan and that in 2019, when the plan is fully in place, the average tax cut for nation's wealthiest individuals will "dwarf" that of lower tax brackets to such an extent that the "average tax cut for richest one percent will be larger than the average income for the middle-fifth of taxpayers, which will be about $53,000 that year."

Meanwhile, Andrew Van Dam, writing for the Washington Post, explains how the slashing of the corporate rate is ultimately paid for by individuals:

The bill aims to cut corporate taxes in perpetuity, under the theory that to do anything less would be to create uncertainty for corporations. But to do so and still have the bill not be a money loser after a decade, they need to raise extra funds somewhere.

That's why Republicans can't just let the individual tax cuts expire, as they do at the end of 2025, but they actually need to raise money to offset the permanent corporate tax reduction.

And using data from an estimate put out by the nonpartisan Joint Committee on Taxation alongside Friday's GOP bill, the Post produced these graphs showing how the Republicans "make the math work":

Still, opponents of the bill nationwide say they are not giving up as they plan protests and demonstrations on Capitol Hill and at local congressional offices nationwide on Monday and throughout the week.

It's simple. Profit-hungry corporations get a permanent windfall and the rich receive massive cuts. Everyone else--sooner or later, like it or not--gets to help pay for it all.

The jewel of the final "morally and economically obscene" GOP tax plan released by Republicans on Friday--now set for a vote this week in both the House and Senate and a signature by President Donald Trump before the Christmas holiday--is a permanent tax giveaway for corporations who will see their marginal rate slashed from 35 percent down to 21 percent.

But because of budget obligations and legislative rules, in order to pay for that massive gift to foreign investors, the wealthiest, and corporations--already, it should be noted, sitting on record profits and mounds of capital--it will ultimately be low- and middle-income Americans who see their taxes rise.

And it should be no surprise. As a weekend New York Times editorial makes plain, the GOP tax plan isn't only designed to further entrench massive inequality, the bill itself is the direct result of entrenched massive inequality--with the oligarchy that controls most of the nation's wealth also claiming an outsized and unchecked ability to sway political realities and electoral outcomes.

"As a smaller and smaller group of people cornered an ever-larger share of the nation's wealth," the Timesexplains, "so too did they gain an ever-larger share of political power. They became, in effect, kingmakers; the tax bill is a natural consequence of their long effort to bend American politics to serve their interests."

But still, the questions remain: who pays and who exactly--besides Trump and many of the GOP lawmakers who will personally enrich themselves due to this last-minute real estate-related provision they inserted--benefits most from the final bill?

A new analysis--titled "The Final Trump-GOP Tax Plan: National and 50-State Estimates for 2019 & 2027"--released Saturday by the nonpartisan Institute on Taxation and Economic Policy (ITEP) shows that, for individuals, most of the "GOP tax scam" benefits high-income households and foreign investors while raising taxes on many low- and middle-income Americans:

The above graph, ITEP explained in a statement, "divides Americans into five equal groups based on income and illustrates how only one of these groups, the richest fifth of Americans, will receive more benefits from the tax bill than foreign investors. This is because the biggest tax cut in the bill is the reduction in the corporate income tax rate from 35 percent to 21 percent. The corporate tax cut will mainly benefit those who own shares in American corporations. While some middle-income people own shares, most are owned by high-income Americans and foreign investors."

Breaking the numbers down further, ITEP shows that the top 5 percent of taxpayers will receiver more than half of the total benefits from the Trump-GOP tax plan and that in 2019, when the plan is fully in place, the average tax cut for nation's wealthiest individuals will "dwarf" that of lower tax brackets to such an extent that the "average tax cut for richest one percent will be larger than the average income for the middle-fifth of taxpayers, which will be about $53,000 that year."

Meanwhile, Andrew Van Dam, writing for the Washington Post, explains how the slashing of the corporate rate is ultimately paid for by individuals:

The bill aims to cut corporate taxes in perpetuity, under the theory that to do anything less would be to create uncertainty for corporations. But to do so and still have the bill not be a money loser after a decade, they need to raise extra funds somewhere.

That's why Republicans can't just let the individual tax cuts expire, as they do at the end of 2025, but they actually need to raise money to offset the permanent corporate tax reduction.

And using data from an estimate put out by the nonpartisan Joint Committee on Taxation alongside Friday's GOP bill, the Post produced these graphs showing how the Republicans "make the math work":

Still, opponents of the bill nationwide say they are not giving up as they plan protests and demonstrations on Capitol Hill and at local congressional offices nationwide on Monday and throughout the week.