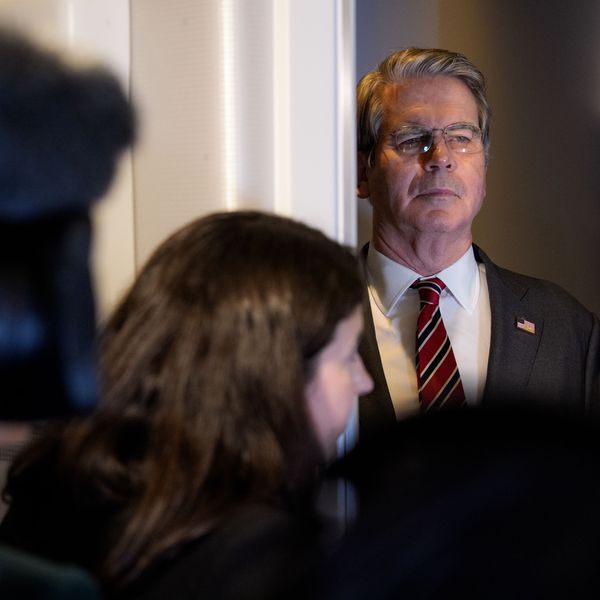

Sen. Marco Rubio (R-Fla.) takes questions from reporters about the relief effort in Puerto Rico following Hurricane Maria, September 26, 2017 at the U.S. Capitol in Washington, D.C. (Photo: Drew Angerer/Getty Images)

With Tax Plan Safely Across Finish Line, Marco Rubio Admits GOP 'Probably Went Too Far' in Rewarding Corporations

The Florida senator also conceded that corporate tax cuts will not create "dramatic economic growth," as his colleagues have claimed

Now that the GOP's $1.5 trillion tax bill has passed both houses of Congress and been signed into law, Sen. Marco Rubio (R-Fla.)--whose vote helped ensure the legislation's passage--conceded in an interview with the Florida-based outlet News-Press that his party's deeply unpopular plan "probably" goes "too far" in rewarding some of America's most profitable corporations.

"If I were king for a day, this tax bill would have looked different," Rubio said, while insisting that the GOP plan is still "better" than the current tax code. "I thought we probably went too far on [helping] corporations. By and large, you're going to see a lot of these multinationals buy back shares to drive up the price. Some of them will be forced, because they're sitting on historic levels of cash, to pay out dividends to shareholders. That isn't going to create dramatic economic growth."

Rubio's remarks sparked immediate outcry, largely because the fact that the GOP bill overwhelmingly favors big business was known to nearly everyone--including President Donald Trump's closest advisers and corporate CEOs themselves--from the very beginning.

\u201cProfiles in Convenient Courage: The Marco Rubio Story. https://t.co/FFJNs4P9if\u201d— Jared Yates Sexton (@Jared Yates Sexton) 1514576409

\u201cWouldn't it be nice if @marcorubio were in the majority party of a legislative body and thus able to push for improvements to the legislation rather than hastily passing it? Wouldn't that be something... https://t.co/Sr5dXmKeLN\u201d— Miranda Yaver, PhD (@Miranda Yaver, PhD) 1514576678

As Common Dreams reported, Rubio briefly threatened to vote against the Republican plan earlier this month unless it included a larger expansion of the child tax credit, but quickly caved once he was granted a relatively minor concession.

The bill--which reduces the corporate tax rate from 35 percent to 21 percent--ultimately flew through Congress earlier this month, and was signed into law by President Donald Trump last Friday.

Rubio's concession that the GOP tax bill is a major gift to corporate America--an observation supported by countless analyses--comes just days after Trump exclaimed that "corporations are literally going wild" over the plan's passage.

While dining at Mar-a-Lago later that night, Trump reportedly told a group of his wealthy friends, "You all just got a lot richer."

An Urgent Message From Our Co-Founder

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

Now that the GOP's $1.5 trillion tax bill has passed both houses of Congress and been signed into law, Sen. Marco Rubio (R-Fla.)--whose vote helped ensure the legislation's passage--conceded in an interview with the Florida-based outlet News-Press that his party's deeply unpopular plan "probably" goes "too far" in rewarding some of America's most profitable corporations.

"If I were king for a day, this tax bill would have looked different," Rubio said, while insisting that the GOP plan is still "better" than the current tax code. "I thought we probably went too far on [helping] corporations. By and large, you're going to see a lot of these multinationals buy back shares to drive up the price. Some of them will be forced, because they're sitting on historic levels of cash, to pay out dividends to shareholders. That isn't going to create dramatic economic growth."

Rubio's remarks sparked immediate outcry, largely because the fact that the GOP bill overwhelmingly favors big business was known to nearly everyone--including President Donald Trump's closest advisers and corporate CEOs themselves--from the very beginning.

\u201cProfiles in Convenient Courage: The Marco Rubio Story. https://t.co/FFJNs4P9if\u201d— Jared Yates Sexton (@Jared Yates Sexton) 1514576409

\u201cWouldn't it be nice if @marcorubio were in the majority party of a legislative body and thus able to push for improvements to the legislation rather than hastily passing it? Wouldn't that be something... https://t.co/Sr5dXmKeLN\u201d— Miranda Yaver, PhD (@Miranda Yaver, PhD) 1514576678

As Common Dreams reported, Rubio briefly threatened to vote against the Republican plan earlier this month unless it included a larger expansion of the child tax credit, but quickly caved once he was granted a relatively minor concession.

The bill--which reduces the corporate tax rate from 35 percent to 21 percent--ultimately flew through Congress earlier this month, and was signed into law by President Donald Trump last Friday.

Rubio's concession that the GOP tax bill is a major gift to corporate America--an observation supported by countless analyses--comes just days after Trump exclaimed that "corporations are literally going wild" over the plan's passage.

While dining at Mar-a-Lago later that night, Trump reportedly told a group of his wealthy friends, "You all just got a lot richer."

Now that the GOP's $1.5 trillion tax bill has passed both houses of Congress and been signed into law, Sen. Marco Rubio (R-Fla.)--whose vote helped ensure the legislation's passage--conceded in an interview with the Florida-based outlet News-Press that his party's deeply unpopular plan "probably" goes "too far" in rewarding some of America's most profitable corporations.

"If I were king for a day, this tax bill would have looked different," Rubio said, while insisting that the GOP plan is still "better" than the current tax code. "I thought we probably went too far on [helping] corporations. By and large, you're going to see a lot of these multinationals buy back shares to drive up the price. Some of them will be forced, because they're sitting on historic levels of cash, to pay out dividends to shareholders. That isn't going to create dramatic economic growth."

Rubio's remarks sparked immediate outcry, largely because the fact that the GOP bill overwhelmingly favors big business was known to nearly everyone--including President Donald Trump's closest advisers and corporate CEOs themselves--from the very beginning.

\u201cProfiles in Convenient Courage: The Marco Rubio Story. https://t.co/FFJNs4P9if\u201d— Jared Yates Sexton (@Jared Yates Sexton) 1514576409

\u201cWouldn't it be nice if @marcorubio were in the majority party of a legislative body and thus able to push for improvements to the legislation rather than hastily passing it? Wouldn't that be something... https://t.co/Sr5dXmKeLN\u201d— Miranda Yaver, PhD (@Miranda Yaver, PhD) 1514576678

As Common Dreams reported, Rubio briefly threatened to vote against the Republican plan earlier this month unless it included a larger expansion of the child tax credit, but quickly caved once he was granted a relatively minor concession.

The bill--which reduces the corporate tax rate from 35 percent to 21 percent--ultimately flew through Congress earlier this month, and was signed into law by President Donald Trump last Friday.

Rubio's concession that the GOP tax bill is a major gift to corporate America--an observation supported by countless analyses--comes just days after Trump exclaimed that "corporations are literally going wild" over the plan's passage.

While dining at Mar-a-Lago later that night, Trump reportedly told a group of his wealthy friends, "You all just got a lot richer."