SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

As the Washington Post's Jeff Stein noted in a breakdown of TPC's analysis on Friday, the tax break for the wealthiest is even larger--$51,140--when the corporate tax cuts and the reduction of the estate tax are factored in. (Photo: Stop the GOP Tax Scam)

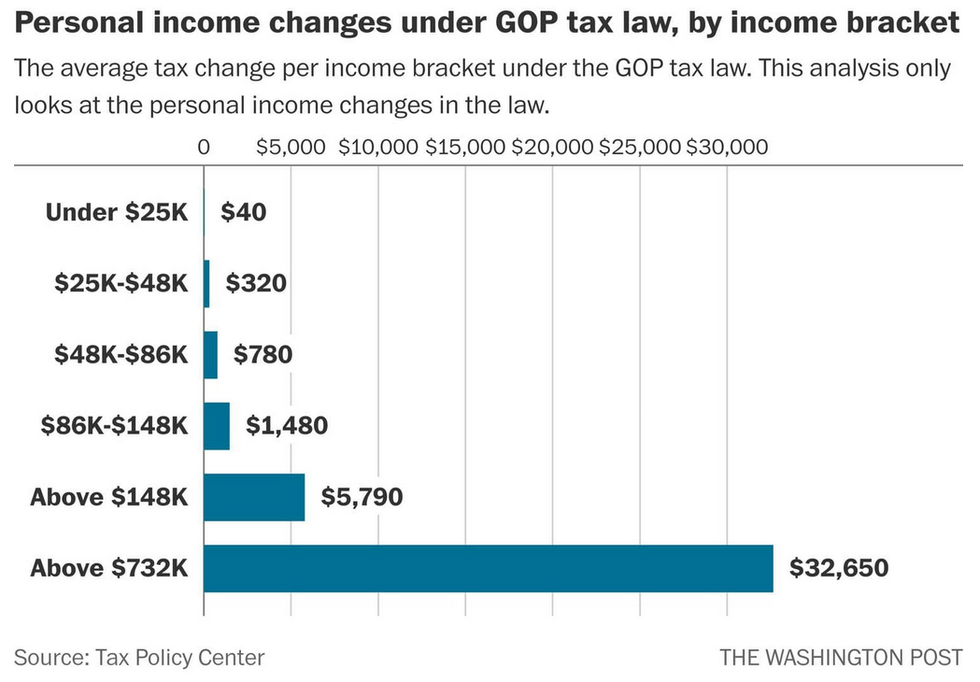

In its first analysis of how the GOP tax plan will affect Americans' personal income taxes alone, the nonpartisan Tax Policy Center (TPC) this week underscored what experts and most of the public already knew: that the Republican tax law will pour tens of thousands of extra dollars into pockets of the wealthy few while providing mere crumbs for the poor.

Specifically, according to TPC's new report, the top one percent of earners will receive an average annual tax cut of around $33,000 just from individual tax changes under the GOP law. The poorest Americans, by contrast, will see an average break of about $40 per year.

"While most of the corporate tax cuts flow to the top of the income distribution, what this shows is that even in the direct changes to the individual-side of the tax code, most of those changes are still being allocated to the top," Kim Rueben, a senior fellow at TPC, told the Washington Post.

The Post published a visual of the disproportionate gains seen by those at the very top:

As the Post's Jeff Stein noted in a breakdown of TPC's analysis on Friday, the tax break for the wealthiest is even larger--$51,140--when the corporate tax cuts and the reduction of the estate tax are factored in.

TPC's analysis of the Republican tax plan--which President Donald Trump signed into law last December--comes as profitable companies continue their stock buyback binge while most Americans report seeing very few if any changes in their paychecks.

Despite Treasury Secretary Steve Mnuchin's promise that Americans would start seeing a positive bump in their checks no later than February 15, the majority of the public said they have yet to see any boost from the GOP tax law, according to a CNBC poll published on Tuesday.

Trump and Musk are on an unconstitutional rampage, aiming for virtually every corner of the federal government. These two right-wing billionaires are targeting nurses, scientists, teachers, daycare providers, judges, veterans, air traffic controllers, and nuclear safety inspectors. No one is safe. The food stamps program, Social Security, Medicare, and Medicaid are next. It’s an unprecedented disaster and a five-alarm fire, but there will be a reckoning. The people did not vote for this. The American people do not want this dystopian hellscape that hides behind claims of “efficiency.” Still, in reality, it is all a giveaway to corporate interests and the libertarian dreams of far-right oligarchs like Musk. Common Dreams is playing a vital role by reporting day and night on this orgy of corruption and greed, as well as what everyday people can do to organize and fight back. As a people-powered nonprofit news outlet, we cover issues the corporate media never will, but we can only continue with our readers’ support. |

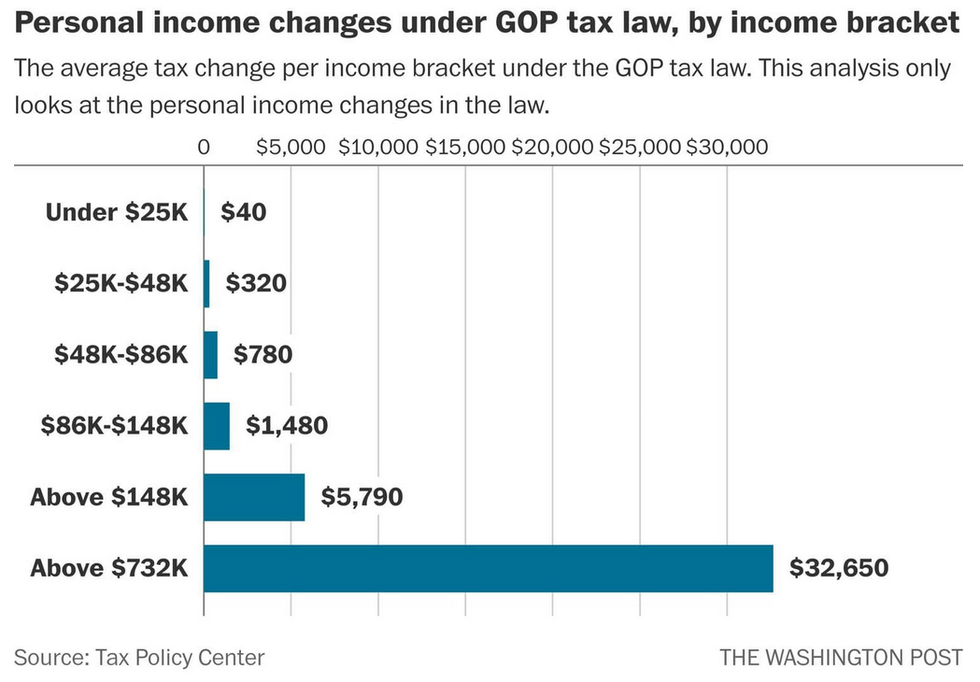

In its first analysis of how the GOP tax plan will affect Americans' personal income taxes alone, the nonpartisan Tax Policy Center (TPC) this week underscored what experts and most of the public already knew: that the Republican tax law will pour tens of thousands of extra dollars into pockets of the wealthy few while providing mere crumbs for the poor.

Specifically, according to TPC's new report, the top one percent of earners will receive an average annual tax cut of around $33,000 just from individual tax changes under the GOP law. The poorest Americans, by contrast, will see an average break of about $40 per year.

"While most of the corporate tax cuts flow to the top of the income distribution, what this shows is that even in the direct changes to the individual-side of the tax code, most of those changes are still being allocated to the top," Kim Rueben, a senior fellow at TPC, told the Washington Post.

The Post published a visual of the disproportionate gains seen by those at the very top:

As the Post's Jeff Stein noted in a breakdown of TPC's analysis on Friday, the tax break for the wealthiest is even larger--$51,140--when the corporate tax cuts and the reduction of the estate tax are factored in.

TPC's analysis of the Republican tax plan--which President Donald Trump signed into law last December--comes as profitable companies continue their stock buyback binge while most Americans report seeing very few if any changes in their paychecks.

Despite Treasury Secretary Steve Mnuchin's promise that Americans would start seeing a positive bump in their checks no later than February 15, the majority of the public said they have yet to see any boost from the GOP tax law, according to a CNBC poll published on Tuesday.

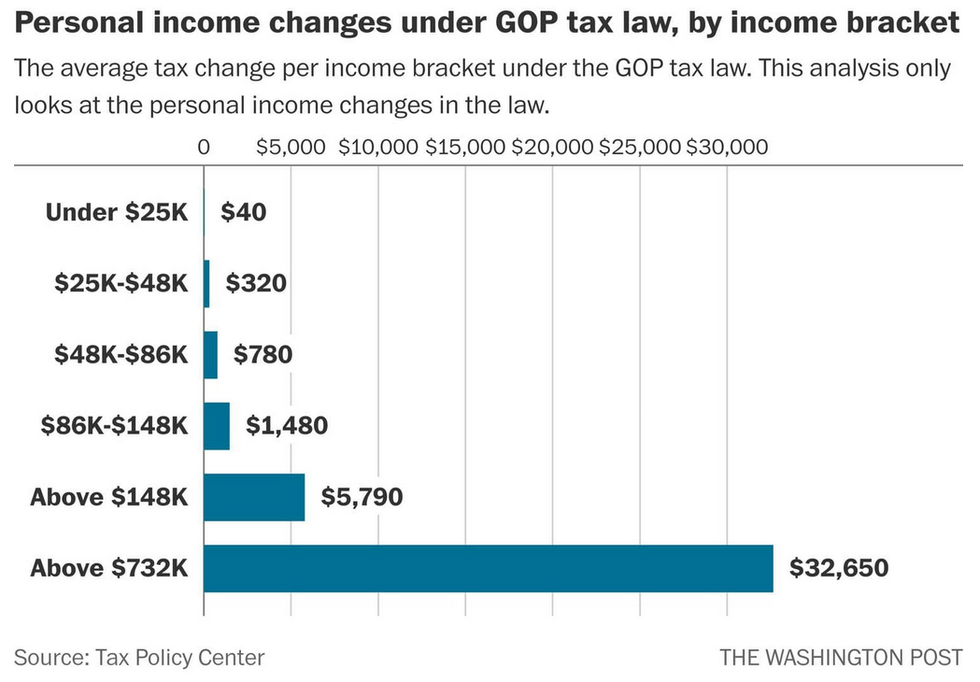

In its first analysis of how the GOP tax plan will affect Americans' personal income taxes alone, the nonpartisan Tax Policy Center (TPC) this week underscored what experts and most of the public already knew: that the Republican tax law will pour tens of thousands of extra dollars into pockets of the wealthy few while providing mere crumbs for the poor.

Specifically, according to TPC's new report, the top one percent of earners will receive an average annual tax cut of around $33,000 just from individual tax changes under the GOP law. The poorest Americans, by contrast, will see an average break of about $40 per year.

"While most of the corporate tax cuts flow to the top of the income distribution, what this shows is that even in the direct changes to the individual-side of the tax code, most of those changes are still being allocated to the top," Kim Rueben, a senior fellow at TPC, told the Washington Post.

The Post published a visual of the disproportionate gains seen by those at the very top:

As the Post's Jeff Stein noted in a breakdown of TPC's analysis on Friday, the tax break for the wealthiest is even larger--$51,140--when the corporate tax cuts and the reduction of the estate tax are factored in.

TPC's analysis of the Republican tax plan--which President Donald Trump signed into law last December--comes as profitable companies continue their stock buyback binge while most Americans report seeing very few if any changes in their paychecks.

Despite Treasury Secretary Steve Mnuchin's promise that Americans would start seeing a positive bump in their checks no later than February 15, the majority of the public said they have yet to see any boost from the GOP tax law, according to a CNBC poll published on Tuesday.