Teachers have rallied outside the Kentucky State Capitol for weeks to protest a proposal that would slash their pensions. (Photo: WDRB/screenshot)

To donate by check, phone, or other method, see our More Ways to Give page.

Teachers have rallied outside the Kentucky State Capitol for weeks to protest a proposal that would slash their pensions. (Photo: WDRB/screenshot)

After Kentucky's GOP-controlled legislature passed a bill last week to slash teachers' retirement benefits--a proposal that has provoked a series of massive protests--lawmakers approved legislation that would cut taxes for the state's wealthiest residents while hiking taxes for the remaining 95 percent, moves that critics say clearly demonstrate the misplaced priorities of the Republican Party.

As Democratic National Committee chairman Tom Perez put it:

\u201cThe Kentucky GOP just rammed through a bill that includes $80 million in corporate tax cuts, but taxes Kentuckians for car repairs and trips to the vet. Don't ever tell me again that the GOP is fighting for average Americans. https://t.co/pXCHqiL4pG\u201d— Tom Perez (@Tom Perez) 1522785604

Although both bills still need a signature from Republican Gov. Matt Bevin, he seemed to signal his support for the pension bill on Twitter, and while he has expressed concerns about the tax measure, the legislature could override a veto. If the tax plan takes effect, experts warn that the states' poorest residents will be hardest hit.

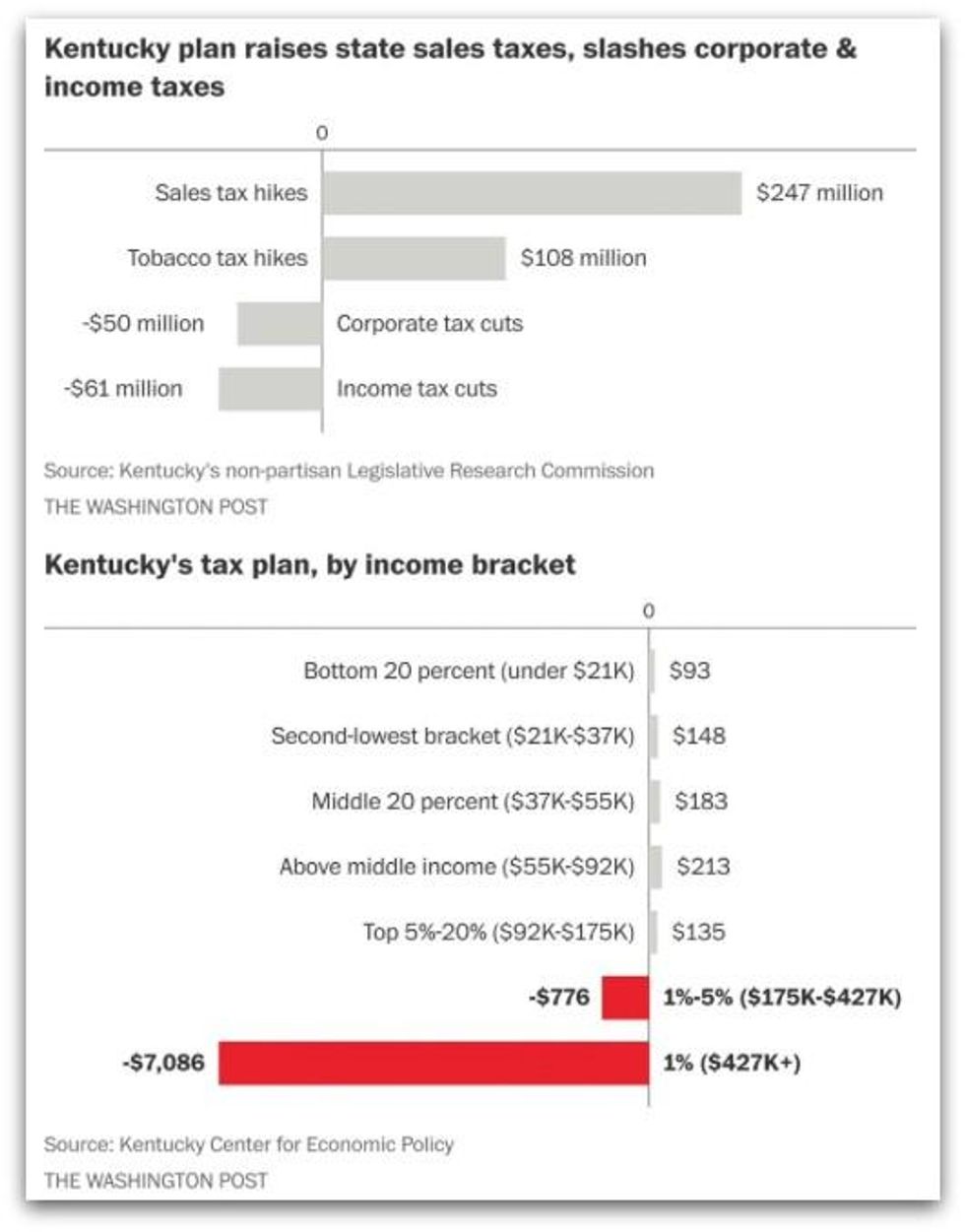

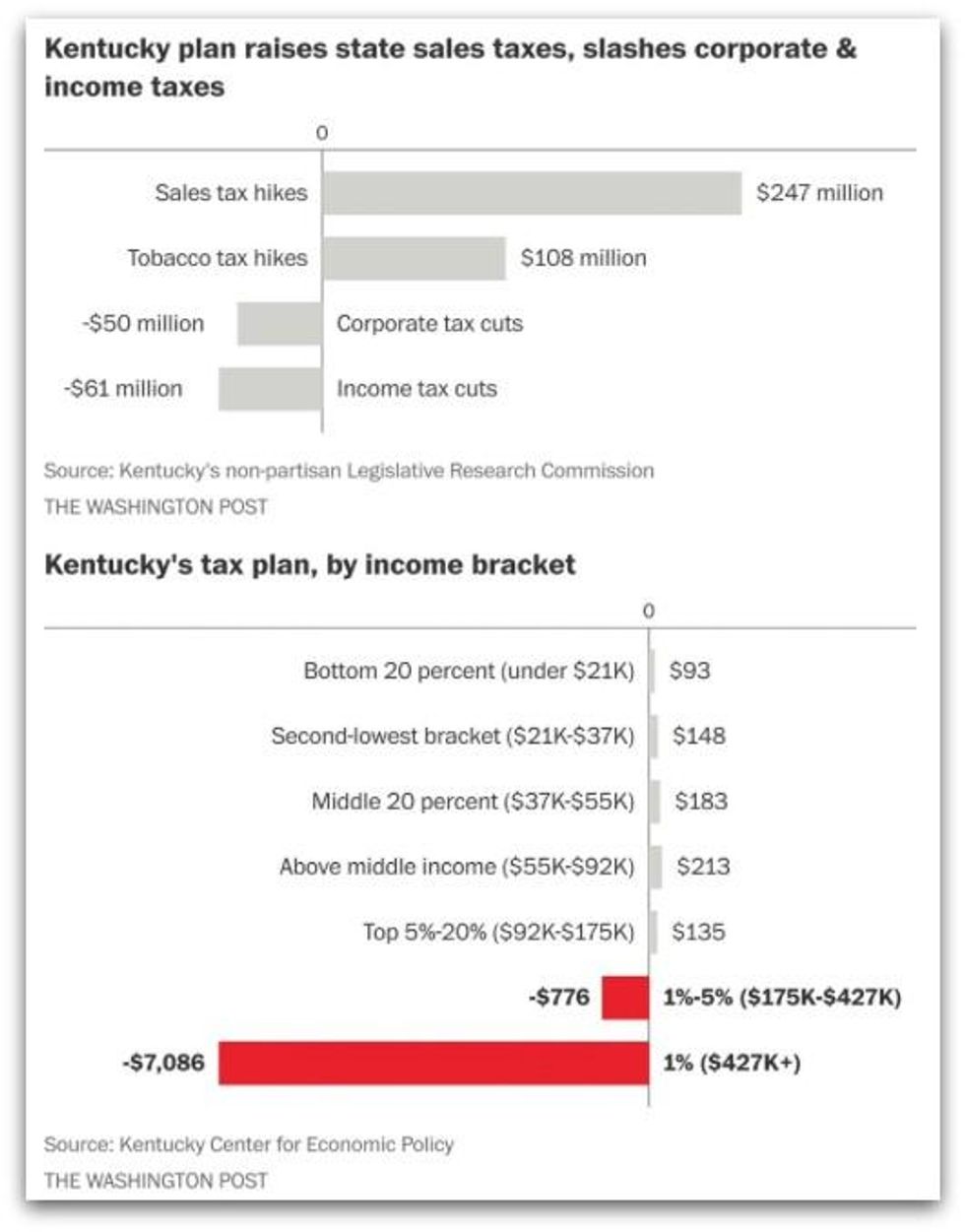

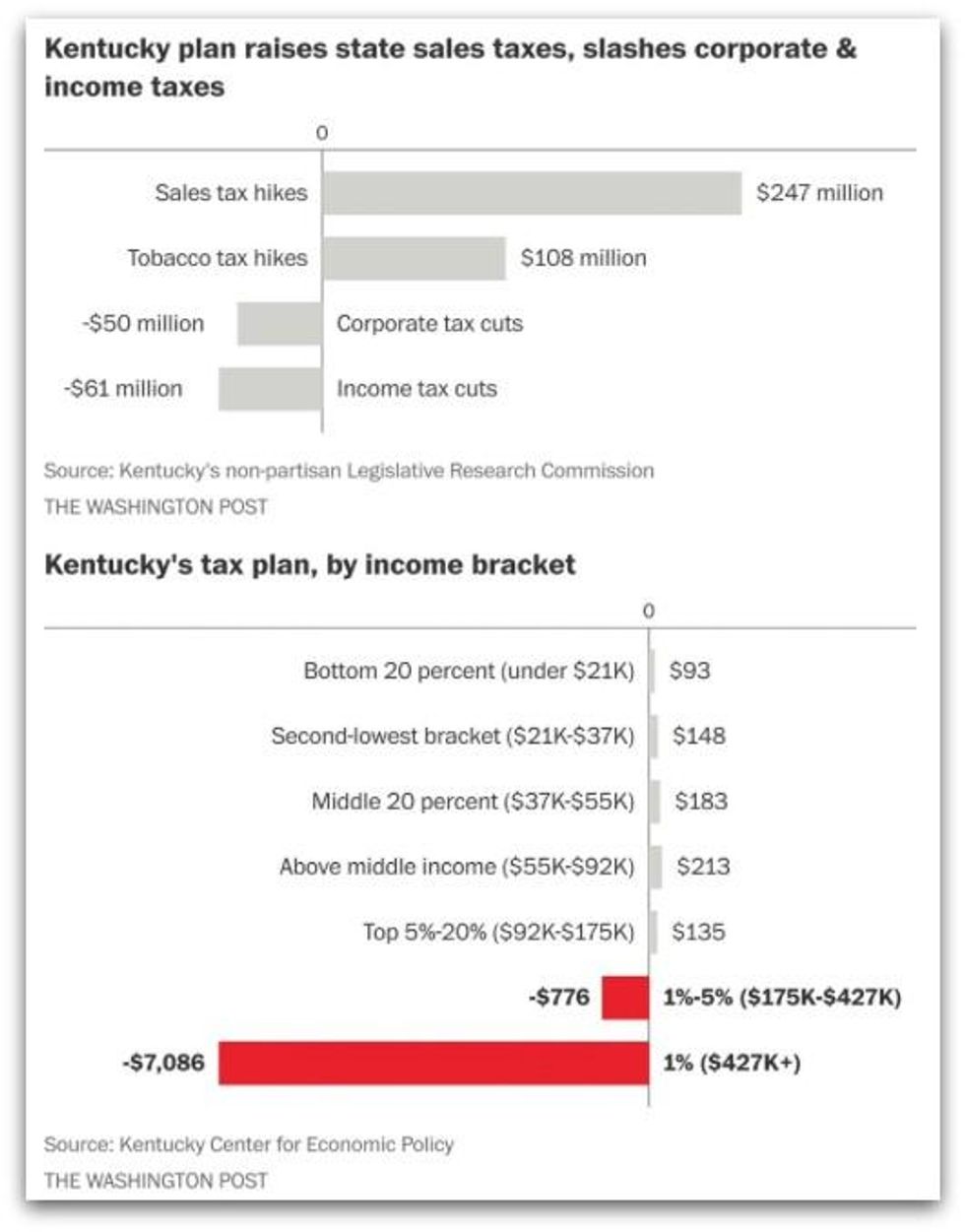

"The whole plan is a big tax shift from the wealthy and corporations to the middle class and poor," Jason Bailey, executive director of the Kentucky Center for Economic Policy (KCEP), told the Lexington Herald-Leader. Bailey highlighted analysis from the Institute for Taxation and Economic Policy (ITEP) that found those in the state's top one percent will save, on average, more than $7,000.

Kentucky's tax overhaul is designed to cut taxes for top earners as well as corporations--like the GOP's federal tax plan pushed through Congress late last year--but unlike the new federal code, as Jeff Stein explained in the Washington Post, "Kentucky Republicans are aiming to avoid dramatically increasing the deficit. That is one reason the Kentucky plan includes an expansion of the sales tax, which is expected to hit most state residents."

Outlining key provisions of the state's plan, Stein continued:

The plan would flatten Kentucky's corporate and personal income-tax rates, setting both at 5 percent. Currently, Kentucky's corporate tax rate runs between 4 and 6 percent, while its income-tax rate ranges from 2 to 6 percent. The new flat rate of 5 percent for everyone means that small companies and Kentuckians with below-average incomes will face tax hikes, and higher earners will get tax cuts.

The bill attempts to make up for those cuts by nearly doubling the cigarette tax and imposing sales taxes on 17 additional services, including landscaping, janitorial work, golf courses and pet grooming.

Pam Thomas, a policy analyst at KCEP, warned, "In the long-run, state funding for education and other services will be undermined by this effort to move away from taxes on corporations and high-income earners, and toward slower-growing, more regressive cigarette taxes and sales taxes instead."

Some critics of Kentucky's pending tax legislation pointed out that the thousands of teachers who have spent weeks fighting for their pensions and demanding greater government investment in public education will be among those negatively impacted by it:

\u201cKentucky is adopting this tax disaster while its teachers are going on strike amidst pension cuts, & other cuts. @alexnpress has a great report: https://t.co/YAPnNKyKsJ\u201d— Taniel (@Taniel) 1522946138

In fact, the state's new tax plan directly contradicts with proposals from Kentucky teachers for saving retirement benefits.

"Kentucky has one of the most poorly funded pension systems in the country, a product of underperforming investments, persistent underfunding, and the use of hedge-fund investment managers by Kentucky Retirement Systems, the agency in charge of the fund," Alex Press wrote for The Outline this week. "Teachers acknowledge the severity of the pension crisis, but disagree with how the legislature wants to close the gap in funding."

Teachers who spoke with Press have proposed "closing corporate tax loopholes, legalizing marijuana, or otherwise taxing luxury services" to raise revenue. However, she concluded, it appears Bevin is ignoring those calls and "demanding further austerity from the public sector" instead.

Trump and Musk are on an unconstitutional rampage, aiming for virtually every corner of the federal government. These two right-wing billionaires are targeting nurses, scientists, teachers, daycare providers, judges, veterans, air traffic controllers, and nuclear safety inspectors. No one is safe. The food stamps program, Social Security, Medicare, and Medicaid are next. It’s an unprecedented disaster and a five-alarm fire, but there will be a reckoning. The people did not vote for this. The American people do not want this dystopian hellscape that hides behind claims of “efficiency.” Still, in reality, it is all a giveaway to corporate interests and the libertarian dreams of far-right oligarchs like Musk. Common Dreams is playing a vital role by reporting day and night on this orgy of corruption and greed, as well as what everyday people can do to organize and fight back. As a people-powered nonprofit news outlet, we cover issues the corporate media never will, but we can only continue with our readers’ support. |

After Kentucky's GOP-controlled legislature passed a bill last week to slash teachers' retirement benefits--a proposal that has provoked a series of massive protests--lawmakers approved legislation that would cut taxes for the state's wealthiest residents while hiking taxes for the remaining 95 percent, moves that critics say clearly demonstrate the misplaced priorities of the Republican Party.

As Democratic National Committee chairman Tom Perez put it:

\u201cThe Kentucky GOP just rammed through a bill that includes $80 million in corporate tax cuts, but taxes Kentuckians for car repairs and trips to the vet. Don't ever tell me again that the GOP is fighting for average Americans. https://t.co/pXCHqiL4pG\u201d— Tom Perez (@Tom Perez) 1522785604

Although both bills still need a signature from Republican Gov. Matt Bevin, he seemed to signal his support for the pension bill on Twitter, and while he has expressed concerns about the tax measure, the legislature could override a veto. If the tax plan takes effect, experts warn that the states' poorest residents will be hardest hit.

"The whole plan is a big tax shift from the wealthy and corporations to the middle class and poor," Jason Bailey, executive director of the Kentucky Center for Economic Policy (KCEP), told the Lexington Herald-Leader. Bailey highlighted analysis from the Institute for Taxation and Economic Policy (ITEP) that found those in the state's top one percent will save, on average, more than $7,000.

Kentucky's tax overhaul is designed to cut taxes for top earners as well as corporations--like the GOP's federal tax plan pushed through Congress late last year--but unlike the new federal code, as Jeff Stein explained in the Washington Post, "Kentucky Republicans are aiming to avoid dramatically increasing the deficit. That is one reason the Kentucky plan includes an expansion of the sales tax, which is expected to hit most state residents."

Outlining key provisions of the state's plan, Stein continued:

The plan would flatten Kentucky's corporate and personal income-tax rates, setting both at 5 percent. Currently, Kentucky's corporate tax rate runs between 4 and 6 percent, while its income-tax rate ranges from 2 to 6 percent. The new flat rate of 5 percent for everyone means that small companies and Kentuckians with below-average incomes will face tax hikes, and higher earners will get tax cuts.

The bill attempts to make up for those cuts by nearly doubling the cigarette tax and imposing sales taxes on 17 additional services, including landscaping, janitorial work, golf courses and pet grooming.

Pam Thomas, a policy analyst at KCEP, warned, "In the long-run, state funding for education and other services will be undermined by this effort to move away from taxes on corporations and high-income earners, and toward slower-growing, more regressive cigarette taxes and sales taxes instead."

Some critics of Kentucky's pending tax legislation pointed out that the thousands of teachers who have spent weeks fighting for their pensions and demanding greater government investment in public education will be among those negatively impacted by it:

\u201cKentucky is adopting this tax disaster while its teachers are going on strike amidst pension cuts, & other cuts. @alexnpress has a great report: https://t.co/YAPnNKyKsJ\u201d— Taniel (@Taniel) 1522946138

In fact, the state's new tax plan directly contradicts with proposals from Kentucky teachers for saving retirement benefits.

"Kentucky has one of the most poorly funded pension systems in the country, a product of underperforming investments, persistent underfunding, and the use of hedge-fund investment managers by Kentucky Retirement Systems, the agency in charge of the fund," Alex Press wrote for The Outline this week. "Teachers acknowledge the severity of the pension crisis, but disagree with how the legislature wants to close the gap in funding."

Teachers who spoke with Press have proposed "closing corporate tax loopholes, legalizing marijuana, or otherwise taxing luxury services" to raise revenue. However, she concluded, it appears Bevin is ignoring those calls and "demanding further austerity from the public sector" instead.

After Kentucky's GOP-controlled legislature passed a bill last week to slash teachers' retirement benefits--a proposal that has provoked a series of massive protests--lawmakers approved legislation that would cut taxes for the state's wealthiest residents while hiking taxes for the remaining 95 percent, moves that critics say clearly demonstrate the misplaced priorities of the Republican Party.

As Democratic National Committee chairman Tom Perez put it:

\u201cThe Kentucky GOP just rammed through a bill that includes $80 million in corporate tax cuts, but taxes Kentuckians for car repairs and trips to the vet. Don't ever tell me again that the GOP is fighting for average Americans. https://t.co/pXCHqiL4pG\u201d— Tom Perez (@Tom Perez) 1522785604

Although both bills still need a signature from Republican Gov. Matt Bevin, he seemed to signal his support for the pension bill on Twitter, and while he has expressed concerns about the tax measure, the legislature could override a veto. If the tax plan takes effect, experts warn that the states' poorest residents will be hardest hit.

"The whole plan is a big tax shift from the wealthy and corporations to the middle class and poor," Jason Bailey, executive director of the Kentucky Center for Economic Policy (KCEP), told the Lexington Herald-Leader. Bailey highlighted analysis from the Institute for Taxation and Economic Policy (ITEP) that found those in the state's top one percent will save, on average, more than $7,000.

Kentucky's tax overhaul is designed to cut taxes for top earners as well as corporations--like the GOP's federal tax plan pushed through Congress late last year--but unlike the new federal code, as Jeff Stein explained in the Washington Post, "Kentucky Republicans are aiming to avoid dramatically increasing the deficit. That is one reason the Kentucky plan includes an expansion of the sales tax, which is expected to hit most state residents."

Outlining key provisions of the state's plan, Stein continued:

The plan would flatten Kentucky's corporate and personal income-tax rates, setting both at 5 percent. Currently, Kentucky's corporate tax rate runs between 4 and 6 percent, while its income-tax rate ranges from 2 to 6 percent. The new flat rate of 5 percent for everyone means that small companies and Kentuckians with below-average incomes will face tax hikes, and higher earners will get tax cuts.

The bill attempts to make up for those cuts by nearly doubling the cigarette tax and imposing sales taxes on 17 additional services, including landscaping, janitorial work, golf courses and pet grooming.

Pam Thomas, a policy analyst at KCEP, warned, "In the long-run, state funding for education and other services will be undermined by this effort to move away from taxes on corporations and high-income earners, and toward slower-growing, more regressive cigarette taxes and sales taxes instead."

Some critics of Kentucky's pending tax legislation pointed out that the thousands of teachers who have spent weeks fighting for their pensions and demanding greater government investment in public education will be among those negatively impacted by it:

\u201cKentucky is adopting this tax disaster while its teachers are going on strike amidst pension cuts, & other cuts. @alexnpress has a great report: https://t.co/YAPnNKyKsJ\u201d— Taniel (@Taniel) 1522946138

In fact, the state's new tax plan directly contradicts with proposals from Kentucky teachers for saving retirement benefits.

"Kentucky has one of the most poorly funded pension systems in the country, a product of underperforming investments, persistent underfunding, and the use of hedge-fund investment managers by Kentucky Retirement Systems, the agency in charge of the fund," Alex Press wrote for The Outline this week. "Teachers acknowledge the severity of the pension crisis, but disagree with how the legislature wants to close the gap in funding."

Teachers who spoke with Press have proposed "closing corporate tax loopholes, legalizing marijuana, or otherwise taxing luxury services" to raise revenue. However, she concluded, it appears Bevin is ignoring those calls and "demanding further austerity from the public sector" instead.