SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

Protesters took to the streets ahead of Congress's passage of the Republican tax plan, noting the legislation was designed to benefit rich Americans including President Donald Trump. (Photo: @zacjanderson/Twitter)

Bolstering poll results and expert analysis indicating that the tax plan Republicans forced through Congress last year is primarily benefiting big businesses and wealthy Americans, a new report finds very few corporations are raising workers' wages or giving them bonuses, despite receiving billions of dollars in tax cuts.

As President Donald Trump signed the tax plan into law just before the New Year, he proclaimed, "Corporations are literally going wild over this, I think even beyond my expectations," just moments after touting the legislation as "a bill for the middle class."

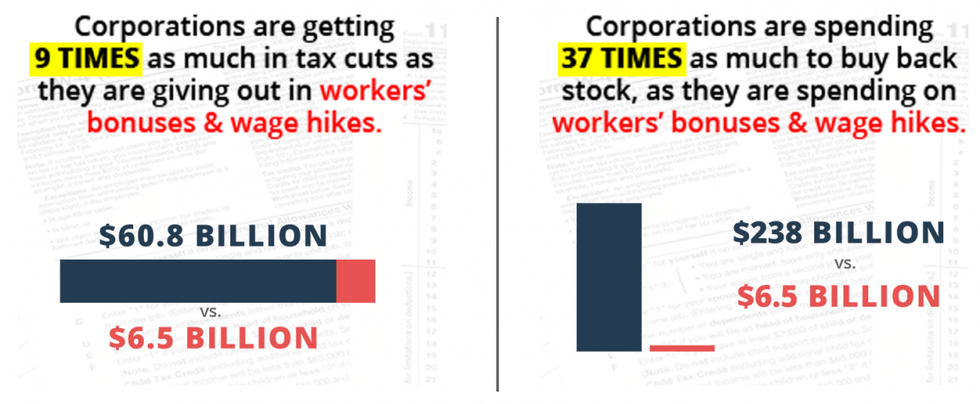

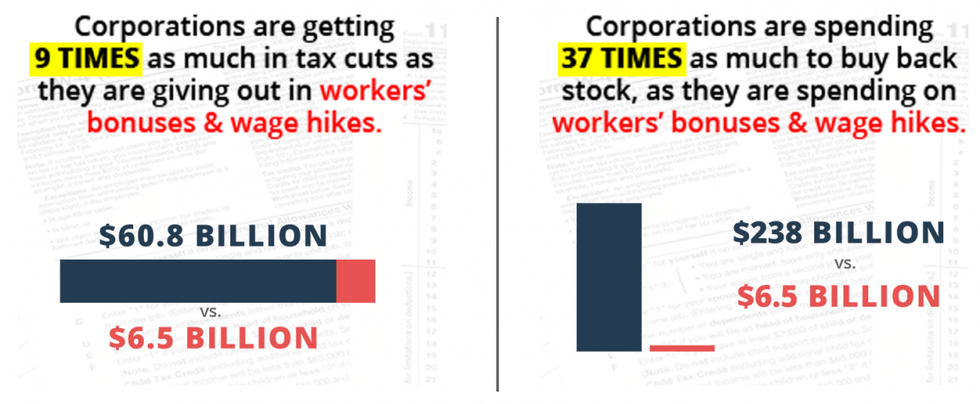

But while corporations are getting about $60.8 billion in tax cuts, a study (pdf) by Americans for Tax Fairness (ATF) reveals that they are passing on only a fraction of that to their workers. A mere four percent of workers have received one-time bonuses or wage increases thanks to Republicans' changes to the tax code, according to available data.

ATF--a campaign of more than 425 national, state, and local organizations that advocate for progressive tax reform--has launched the "Trump Tax Cut Truths" website, which details the report's findings and features a searchable database outlining corporations' tax cuts, stock buybacks, benefits to workers, job cuts, and new investments tied to the GOP's tax legislation.

"There are too many disingenuous claims that the Trump and Republican tax cuts for corporations will trickle down to the middle class."

--Frank Clemente, ATF

"This website exposes the truths, that President Trump and Republicans gave huge tax cuts to big drug companies, big oil, and other corporations, but corporations are giving back little--if anything--to working families," ATF executive director Frank Clemente explained. "There are too many disingenuous claims that the Trump and Republican tax cuts for corporations will trickle down to the middle class."

The website lists among the report's key findings the fact that 433 "corporate cheapskates," or 87 percent of all Fortune 500 companies, have not publicly disclosed any wage hikes or worker bonuses tied to the tax overhaul. This list includes major players across several industries such as ExxonMobil, General Motors, Amazon, Boeing, Microsoft, and Citigroup. By contrast, just 65 of the richest American companies are raising wages or issuing bonuses.

Across all 26 million of the nation's businesses, only 383 are granting workers wage increases or bonuses. Meanwhile, the site notes, "a total of 94,296 private-sector job cuts have been announced at 183 companies since the tax law was passed by Congress. The actual job-loss total is higher, but some big companies, including Amazon and Wells Fargo, have not offered precise figures in their layoff announcements."

\u201cOnly 383 corporations out of 26 MILLION in the country have announced bonuses or wage hikes from the #TrumpTax. It's a drop in the bucket of the billions in tax cuts corporations are getting!\n\nLearn more about the TRUTH of Trump's tax cuts: https://t.co/Ok8YUqt7Gx\u201d— Unrig Our Economy (@Unrig Our Economy) 1523307629

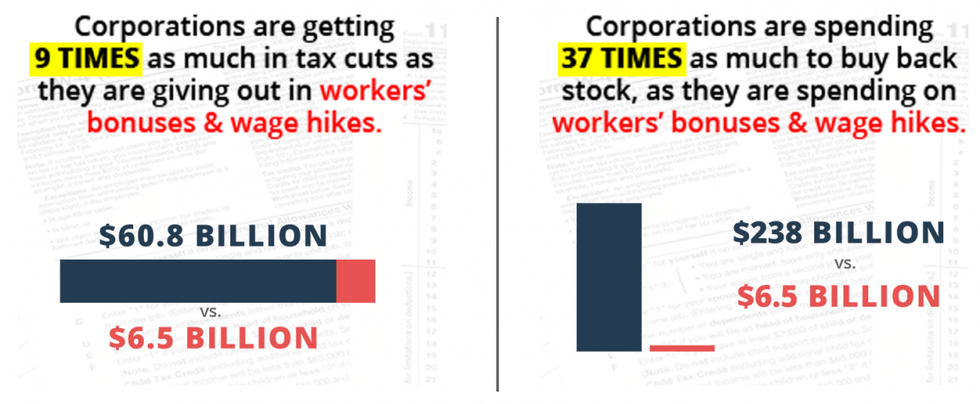

"It's a great story: corporation shares its Trump tax cut with workers and communities," the ATF report reads. "But dig a little deeper and you'll often find those big announcements of employee bonuses are dwarfed by even bigger payouts to wealthy shareholders; loudly publicized hikes in company minimum wages are followed by quieter layoff notices; and investments ascribed to the new tax law closely resemble investment patterns in place before corporate taxes were slashed."

Trump and Musk are on an unconstitutional rampage, aiming for virtually every corner of the federal government. These two right-wing billionaires are targeting nurses, scientists, teachers, daycare providers, judges, veterans, air traffic controllers, and nuclear safety inspectors. No one is safe. The food stamps program, Social Security, Medicare, and Medicaid are next. It’s an unprecedented disaster and a five-alarm fire, but there will be a reckoning. The people did not vote for this. The American people do not want this dystopian hellscape that hides behind claims of “efficiency.” Still, in reality, it is all a giveaway to corporate interests and the libertarian dreams of far-right oligarchs like Musk. Common Dreams is playing a vital role by reporting day and night on this orgy of corruption and greed, as well as what everyday people can do to organize and fight back. As a people-powered nonprofit news outlet, we cover issues the corporate media never will, but we can only continue with our readers’ support. |

Bolstering poll results and expert analysis indicating that the tax plan Republicans forced through Congress last year is primarily benefiting big businesses and wealthy Americans, a new report finds very few corporations are raising workers' wages or giving them bonuses, despite receiving billions of dollars in tax cuts.

As President Donald Trump signed the tax plan into law just before the New Year, he proclaimed, "Corporations are literally going wild over this, I think even beyond my expectations," just moments after touting the legislation as "a bill for the middle class."

But while corporations are getting about $60.8 billion in tax cuts, a study (pdf) by Americans for Tax Fairness (ATF) reveals that they are passing on only a fraction of that to their workers. A mere four percent of workers have received one-time bonuses or wage increases thanks to Republicans' changes to the tax code, according to available data.

ATF--a campaign of more than 425 national, state, and local organizations that advocate for progressive tax reform--has launched the "Trump Tax Cut Truths" website, which details the report's findings and features a searchable database outlining corporations' tax cuts, stock buybacks, benefits to workers, job cuts, and new investments tied to the GOP's tax legislation.

"There are too many disingenuous claims that the Trump and Republican tax cuts for corporations will trickle down to the middle class."

--Frank Clemente, ATF

"This website exposes the truths, that President Trump and Republicans gave huge tax cuts to big drug companies, big oil, and other corporations, but corporations are giving back little--if anything--to working families," ATF executive director Frank Clemente explained. "There are too many disingenuous claims that the Trump and Republican tax cuts for corporations will trickle down to the middle class."

The website lists among the report's key findings the fact that 433 "corporate cheapskates," or 87 percent of all Fortune 500 companies, have not publicly disclosed any wage hikes or worker bonuses tied to the tax overhaul. This list includes major players across several industries such as ExxonMobil, General Motors, Amazon, Boeing, Microsoft, and Citigroup. By contrast, just 65 of the richest American companies are raising wages or issuing bonuses.

Across all 26 million of the nation's businesses, only 383 are granting workers wage increases or bonuses. Meanwhile, the site notes, "a total of 94,296 private-sector job cuts have been announced at 183 companies since the tax law was passed by Congress. The actual job-loss total is higher, but some big companies, including Amazon and Wells Fargo, have not offered precise figures in their layoff announcements."

\u201cOnly 383 corporations out of 26 MILLION in the country have announced bonuses or wage hikes from the #TrumpTax. It's a drop in the bucket of the billions in tax cuts corporations are getting!\n\nLearn more about the TRUTH of Trump's tax cuts: https://t.co/Ok8YUqt7Gx\u201d— Unrig Our Economy (@Unrig Our Economy) 1523307629

"It's a great story: corporation shares its Trump tax cut with workers and communities," the ATF report reads. "But dig a little deeper and you'll often find those big announcements of employee bonuses are dwarfed by even bigger payouts to wealthy shareholders; loudly publicized hikes in company minimum wages are followed by quieter layoff notices; and investments ascribed to the new tax law closely resemble investment patterns in place before corporate taxes were slashed."

Bolstering poll results and expert analysis indicating that the tax plan Republicans forced through Congress last year is primarily benefiting big businesses and wealthy Americans, a new report finds very few corporations are raising workers' wages or giving them bonuses, despite receiving billions of dollars in tax cuts.

As President Donald Trump signed the tax plan into law just before the New Year, he proclaimed, "Corporations are literally going wild over this, I think even beyond my expectations," just moments after touting the legislation as "a bill for the middle class."

But while corporations are getting about $60.8 billion in tax cuts, a study (pdf) by Americans for Tax Fairness (ATF) reveals that they are passing on only a fraction of that to their workers. A mere four percent of workers have received one-time bonuses or wage increases thanks to Republicans' changes to the tax code, according to available data.

ATF--a campaign of more than 425 national, state, and local organizations that advocate for progressive tax reform--has launched the "Trump Tax Cut Truths" website, which details the report's findings and features a searchable database outlining corporations' tax cuts, stock buybacks, benefits to workers, job cuts, and new investments tied to the GOP's tax legislation.

"There are too many disingenuous claims that the Trump and Republican tax cuts for corporations will trickle down to the middle class."

--Frank Clemente, ATF

"This website exposes the truths, that President Trump and Republicans gave huge tax cuts to big drug companies, big oil, and other corporations, but corporations are giving back little--if anything--to working families," ATF executive director Frank Clemente explained. "There are too many disingenuous claims that the Trump and Republican tax cuts for corporations will trickle down to the middle class."

The website lists among the report's key findings the fact that 433 "corporate cheapskates," or 87 percent of all Fortune 500 companies, have not publicly disclosed any wage hikes or worker bonuses tied to the tax overhaul. This list includes major players across several industries such as ExxonMobil, General Motors, Amazon, Boeing, Microsoft, and Citigroup. By contrast, just 65 of the richest American companies are raising wages or issuing bonuses.

Across all 26 million of the nation's businesses, only 383 are granting workers wage increases or bonuses. Meanwhile, the site notes, "a total of 94,296 private-sector job cuts have been announced at 183 companies since the tax law was passed by Congress. The actual job-loss total is higher, but some big companies, including Amazon and Wells Fargo, have not offered precise figures in their layoff announcements."

\u201cOnly 383 corporations out of 26 MILLION in the country have announced bonuses or wage hikes from the #TrumpTax. It's a drop in the bucket of the billions in tax cuts corporations are getting!\n\nLearn more about the TRUTH of Trump's tax cuts: https://t.co/Ok8YUqt7Gx\u201d— Unrig Our Economy (@Unrig Our Economy) 1523307629

"It's a great story: corporation shares its Trump tax cut with workers and communities," the ATF report reads. "But dig a little deeper and you'll often find those big announcements of employee bonuses are dwarfed by even bigger payouts to wealthy shareholders; loudly publicized hikes in company minimum wages are followed by quieter layoff notices; and investments ascribed to the new tax law closely resemble investment patterns in place before corporate taxes were slashed."