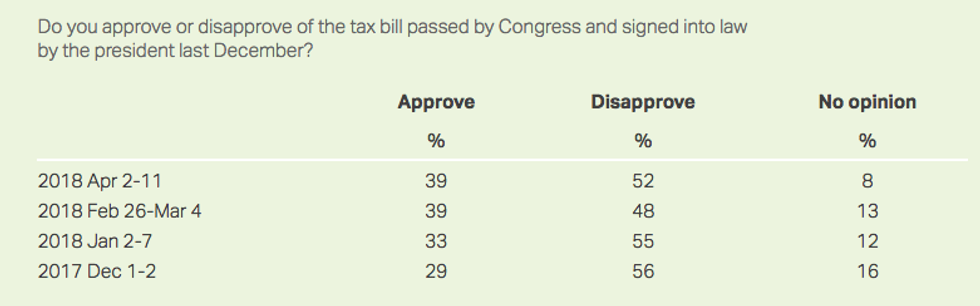

As right-wing advocacy groups embark on yet another campaign to sell the American public on the GOP's corporate-friendly tax law that President Donald Trump insisted would sell itself, a new Gallup poll published Monday found that the tax cuts remain "very unpopular," with just 39 percent approving and 52 percent disapproving.

"Who knew that giving massive tax cuts to the wealthy, rich CEOs, and big corporations at the expense of working families wouldn't resonate with voters?"

--Americans for Tax Fairness

While the law--which is already fattening the pockets of wealthy executives and massive corporations--appeared to gain in popularity at the beginning of the year, Gallup's polling indicates that Republicans are going to have a difficult time marketing their signature achievement ahead of the 2018 midterms, as its disapproval rating is up significantly from last month.

"Who knew that giving massive tax cuts to the wealthy, rich CEOs, and big corporations at the expense of working families wouldn't resonate with voters?" Americans for Tax Fairness (ATF) wrote in a sardonic tweet on Monday.

"Some GOP lawmakers who hoped the law would save them from defeat may have to start dusting off their resumes," Bloomberg's Sahil Kapur noted in an article on Monday, detailing the GOP's struggle to promote their $1.5 trillion tax cuts that independent analysts have concluded will largely benefit the wealthiest Americans and explode the federal deficit.

Additionally, as Common Dreams reported, a CNBC poll published last month found that less than a third of Americans reported taking home more pay as a result of the massive tax cuts.

In an effort to boost the Republican tax law's popularity, the American Action Network--a right-wing group aligned with retiring House Speaker Paul Ryan (R-Wis.)--is launching a brand new million-dollar ad campaign ahead of Tax Day on Tuesday in districts Hillary Clinton won in 2016, Axios reported on Monday.

But Splinter's Clio Chang argued on Monday that pricey ad-buys are unlikely to persuade most Americans that enormous tax cuts for the rich are good for them.

"Republicans are going to throw more money and air time to try to make their tax bill popular," Chang noted. "But so far, at least, voters have somehow figured out that a giveaway to wealthy corporations is not in their best interests."