Demonstrators against the Republican tax reform bill protest outside the U.S. Capitol in Washington, D.C., on Nov. 30. (Photo: Saul Loeb/AFP/Getty Images)

As Trump Declares 'Americans Are Winning' on Tax Day, Common Good Faces 'Grim Future' Thanks to GOP

"Tax reform should have helped working families get ahead, not tilted the playing field further in favor of the wealthy and well-connected."

While President Donald Trump used Tax Day as an opportunity to declare that ordinary Americans are now "winning" thanks to his deeply unpopular corporate-friendly law, a new report published Tuesday refuted Trump's rosy depiction of the U.S. economy under his leadership and found that--thanks to the Trump-GOP tax cuts for wealthy--healthcare, education, and other necessary public services face a "grim future."

"America's working families are, as usual, getting the short end of the stick from the new Trump-GOP tax law."

--Frank Clemente, Americans for Tax Fairness Conducted by Americans for Tax Fairness (AFT) in partnership with Health Care for America Now (HCAN), the new analysis shows that Trump and the Republican Party are moving to make up for the nearly $2 trillion crater their tax law is expected to blow in the federal deficit by pursuing crippling cuts to programs that millions of Americans rely on for survival.

"The Congressional Budget Office now reports that the tax cuts will add $1.9 trillion to the deficit--nearly one-third more than the $1.5 trillion estimated when the tax law was approved in December," the report notes. "This is close to the $1.7 trillion cut to Medicaid, Medicare, Social Security disability programs, SNAP, and more proposed in Trump's budget."

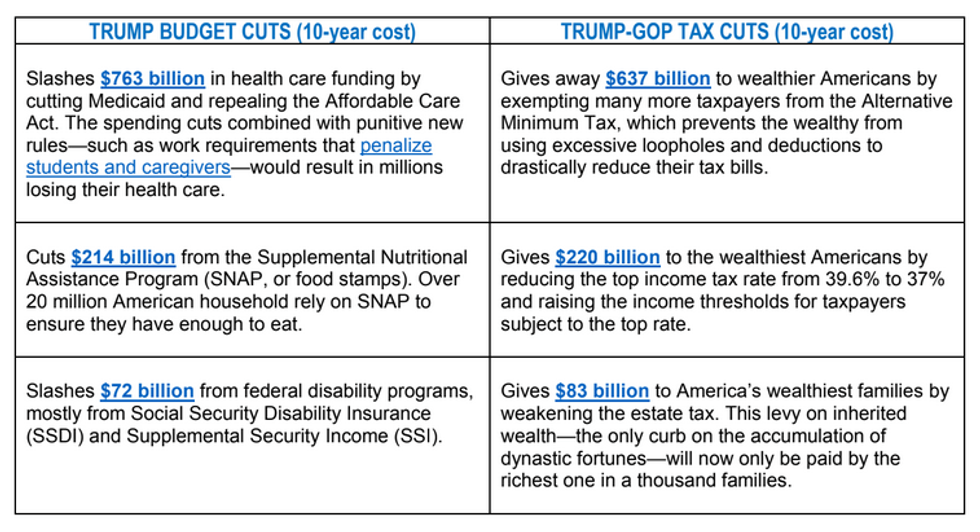

Clearly depicting the Trump administration's priorities, one chart included in the report places the Trump's proposed cuts to safety net programs alongside just a fraction of the GOP tax law's rewards for the wealthiest Americans:

As safety net programs come under attack by Republican legislation, the White House budget, and Trump executive orders, AFT and HCAN note that the overwhelming majority of the tax law's benefits will go straight to the very top of the income distribution.

"When the new tax law is fully phased in, 83 percent of the tax cuts will go to the wealthiest one percent," the analysis notes, laying waste once more to Trump's insistence that the tax law was primarily aimed at helping working- and middle-class Americans. "The richest one percent will get a tax cut of $55,190, on average [in 2019]. The bottom 60 percent will get a tax cut of $440--about a dollar a day."

\u201c\u201cWhat this bill is about, is giving 83% of the tax breaks to the top 1%... and then coming back to the American people to say the debt is so high that we have to cut education, social security, and medicaid.\u201d \u2014\u00a0@SenSanders at our #TaxDay #TaxMarch rally\u201d— Unrig Our Economy (@Unrig Our Economy) 1523982684

"America's working families are, as usual, getting the short end of the stick from the new Trump-GOP tax law," ATF executive director Frank Clemente said in a statement on Tuesday. "Tax reform should have helped working families get ahead, not tilted the playing field further in favor of the wealthy and well-connected."

"It's time to end tax breaks for the Koch brothers, wealthy CEOs and big corporations that shift profits offshore and outsource jobs."

--Rep. Keith Ellison

The new report by ATF and HCAN comes as polling data continues to show that most Americans are not buying the Trump administration's claim that the tax law was crafted with their interests in mind.

According to Gallup, just 39 percent of Americans approve of the tax cuts, despite the best efforts of right-wing big money groups to boost the law's popularity with expensive ad buys.

As Republicans struggle mightily to convince the public that corporate tax cuts are good for them ahead of the 2018 midterms, progressives are looking to use the tax law's unpopularity against the GOP.

In a Tax Day email to supporters on Tuesday, Rep. Keith Ellison (D-Minn.) demanded the repeal of Trump's tax cuts for the rich and suggested that the extra revenue be used to fund infrastructure, education, healthcare, and other public priorities.

"It's time to end tax breaks for the Koch brothers, wealthy CEOs and big corporations that shift profits offshore and outsource jobs. It's time to end tax breaks for Big Pharma and greedy health insurance corporations. It's time to close loopholes that benefit the richest 1 percent and Wall Street," Ellison wrote. "Together, let's demand that our elected leaders put working families, children, and older Americans before wealthy campaign contributors and Wall Street."

An Urgent Message From Our Co-Founder

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

While President Donald Trump used Tax Day as an opportunity to declare that ordinary Americans are now "winning" thanks to his deeply unpopular corporate-friendly law, a new report published Tuesday refuted Trump's rosy depiction of the U.S. economy under his leadership and found that--thanks to the Trump-GOP tax cuts for wealthy--healthcare, education, and other necessary public services face a "grim future."

"America's working families are, as usual, getting the short end of the stick from the new Trump-GOP tax law."

--Frank Clemente, Americans for Tax Fairness Conducted by Americans for Tax Fairness (AFT) in partnership with Health Care for America Now (HCAN), the new analysis shows that Trump and the Republican Party are moving to make up for the nearly $2 trillion crater their tax law is expected to blow in the federal deficit by pursuing crippling cuts to programs that millions of Americans rely on for survival.

"The Congressional Budget Office now reports that the tax cuts will add $1.9 trillion to the deficit--nearly one-third more than the $1.5 trillion estimated when the tax law was approved in December," the report notes. "This is close to the $1.7 trillion cut to Medicaid, Medicare, Social Security disability programs, SNAP, and more proposed in Trump's budget."

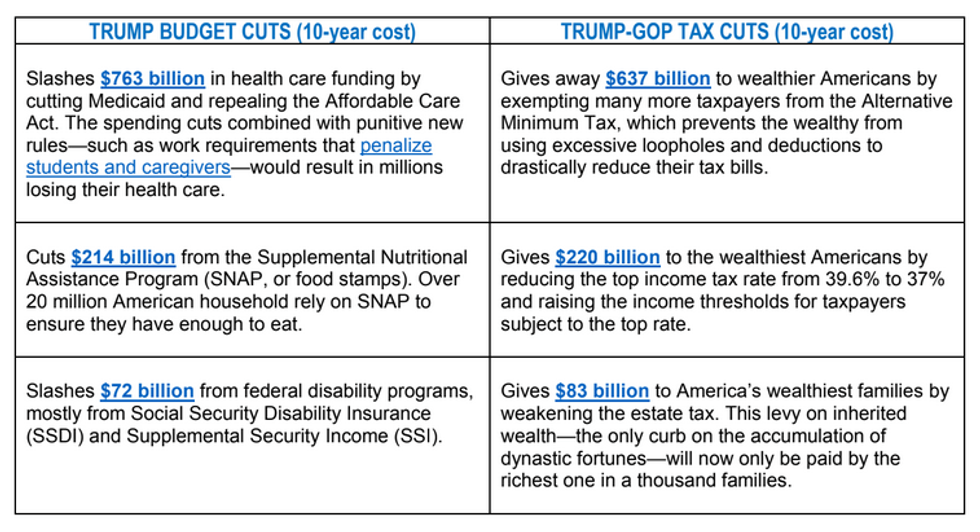

Clearly depicting the Trump administration's priorities, one chart included in the report places the Trump's proposed cuts to safety net programs alongside just a fraction of the GOP tax law's rewards for the wealthiest Americans:

As safety net programs come under attack by Republican legislation, the White House budget, and Trump executive orders, AFT and HCAN note that the overwhelming majority of the tax law's benefits will go straight to the very top of the income distribution.

"When the new tax law is fully phased in, 83 percent of the tax cuts will go to the wealthiest one percent," the analysis notes, laying waste once more to Trump's insistence that the tax law was primarily aimed at helping working- and middle-class Americans. "The richest one percent will get a tax cut of $55,190, on average [in 2019]. The bottom 60 percent will get a tax cut of $440--about a dollar a day."

\u201c\u201cWhat this bill is about, is giving 83% of the tax breaks to the top 1%... and then coming back to the American people to say the debt is so high that we have to cut education, social security, and medicaid.\u201d \u2014\u00a0@SenSanders at our #TaxDay #TaxMarch rally\u201d— Unrig Our Economy (@Unrig Our Economy) 1523982684

"America's working families are, as usual, getting the short end of the stick from the new Trump-GOP tax law," ATF executive director Frank Clemente said in a statement on Tuesday. "Tax reform should have helped working families get ahead, not tilted the playing field further in favor of the wealthy and well-connected."

"It's time to end tax breaks for the Koch brothers, wealthy CEOs and big corporations that shift profits offshore and outsource jobs."

--Rep. Keith Ellison

The new report by ATF and HCAN comes as polling data continues to show that most Americans are not buying the Trump administration's claim that the tax law was crafted with their interests in mind.

According to Gallup, just 39 percent of Americans approve of the tax cuts, despite the best efforts of right-wing big money groups to boost the law's popularity with expensive ad buys.

As Republicans struggle mightily to convince the public that corporate tax cuts are good for them ahead of the 2018 midterms, progressives are looking to use the tax law's unpopularity against the GOP.

In a Tax Day email to supporters on Tuesday, Rep. Keith Ellison (D-Minn.) demanded the repeal of Trump's tax cuts for the rich and suggested that the extra revenue be used to fund infrastructure, education, healthcare, and other public priorities.

"It's time to end tax breaks for the Koch brothers, wealthy CEOs and big corporations that shift profits offshore and outsource jobs. It's time to end tax breaks for Big Pharma and greedy health insurance corporations. It's time to close loopholes that benefit the richest 1 percent and Wall Street," Ellison wrote. "Together, let's demand that our elected leaders put working families, children, and older Americans before wealthy campaign contributors and Wall Street."

While President Donald Trump used Tax Day as an opportunity to declare that ordinary Americans are now "winning" thanks to his deeply unpopular corporate-friendly law, a new report published Tuesday refuted Trump's rosy depiction of the U.S. economy under his leadership and found that--thanks to the Trump-GOP tax cuts for wealthy--healthcare, education, and other necessary public services face a "grim future."

"America's working families are, as usual, getting the short end of the stick from the new Trump-GOP tax law."

--Frank Clemente, Americans for Tax Fairness Conducted by Americans for Tax Fairness (AFT) in partnership with Health Care for America Now (HCAN), the new analysis shows that Trump and the Republican Party are moving to make up for the nearly $2 trillion crater their tax law is expected to blow in the federal deficit by pursuing crippling cuts to programs that millions of Americans rely on for survival.

"The Congressional Budget Office now reports that the tax cuts will add $1.9 trillion to the deficit--nearly one-third more than the $1.5 trillion estimated when the tax law was approved in December," the report notes. "This is close to the $1.7 trillion cut to Medicaid, Medicare, Social Security disability programs, SNAP, and more proposed in Trump's budget."

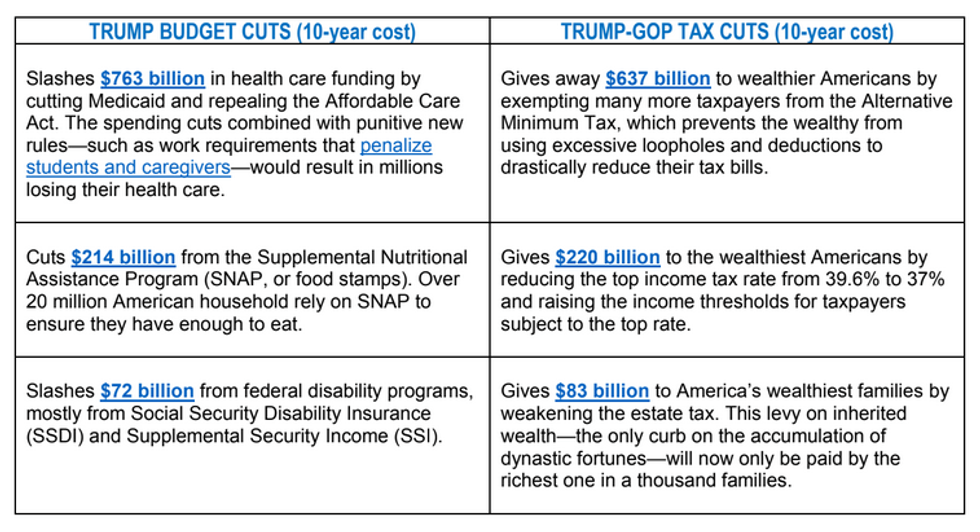

Clearly depicting the Trump administration's priorities, one chart included in the report places the Trump's proposed cuts to safety net programs alongside just a fraction of the GOP tax law's rewards for the wealthiest Americans:

As safety net programs come under attack by Republican legislation, the White House budget, and Trump executive orders, AFT and HCAN note that the overwhelming majority of the tax law's benefits will go straight to the very top of the income distribution.

"When the new tax law is fully phased in, 83 percent of the tax cuts will go to the wealthiest one percent," the analysis notes, laying waste once more to Trump's insistence that the tax law was primarily aimed at helping working- and middle-class Americans. "The richest one percent will get a tax cut of $55,190, on average [in 2019]. The bottom 60 percent will get a tax cut of $440--about a dollar a day."

\u201c\u201cWhat this bill is about, is giving 83% of the tax breaks to the top 1%... and then coming back to the American people to say the debt is so high that we have to cut education, social security, and medicaid.\u201d \u2014\u00a0@SenSanders at our #TaxDay #TaxMarch rally\u201d— Unrig Our Economy (@Unrig Our Economy) 1523982684

"America's working families are, as usual, getting the short end of the stick from the new Trump-GOP tax law," ATF executive director Frank Clemente said in a statement on Tuesday. "Tax reform should have helped working families get ahead, not tilted the playing field further in favor of the wealthy and well-connected."

"It's time to end tax breaks for the Koch brothers, wealthy CEOs and big corporations that shift profits offshore and outsource jobs."

--Rep. Keith Ellison

The new report by ATF and HCAN comes as polling data continues to show that most Americans are not buying the Trump administration's claim that the tax law was crafted with their interests in mind.

According to Gallup, just 39 percent of Americans approve of the tax cuts, despite the best efforts of right-wing big money groups to boost the law's popularity with expensive ad buys.

As Republicans struggle mightily to convince the public that corporate tax cuts are good for them ahead of the 2018 midterms, progressives are looking to use the tax law's unpopularity against the GOP.

In a Tax Day email to supporters on Tuesday, Rep. Keith Ellison (D-Minn.) demanded the repeal of Trump's tax cuts for the rich and suggested that the extra revenue be used to fund infrastructure, education, healthcare, and other public priorities.

"It's time to end tax breaks for the Koch brothers, wealthy CEOs and big corporations that shift profits offshore and outsource jobs. It's time to end tax breaks for Big Pharma and greedy health insurance corporations. It's time to close loopholes that benefit the richest 1 percent and Wall Street," Ellison wrote. "Together, let's demand that our elected leaders put working families, children, and older Americans before wealthy campaign contributors and Wall Street."