Reps. Judy Chu (D-Calif.), Pramila Jayapal (D-Wash.), and Keith Ellison (D-Minn.) join a rally against the proposed Republican tax reform legislation on the east side of the U.S. Capitol November 15, 2017 in Washington, DC. (Photo: Chip Somodevilla/Getty Images)

Detailing CEO-Worker Pay Gaps as High as 5,000 to 1, It's Clear Why Corporate Execs Didn't Want This Report Released

"I knew inequality was a great problem in our society but I didn’t understand quite how extreme it was," says Rep. Keith Ellison

Major American corporations have spent a lot of time, energy, and cash "scheming" to hide the enormous pay disparities between their workers and CEOs, and a new report published Wednesday by Rep. Keith Ellison (D-Minn.) makes it abundantly clear why.

"This immense inequality is a crisis for our economy and our democracy, and we need legislative action at the local, state and federal level to address it."

--Rep. Keith Ellison (D-Minn.)

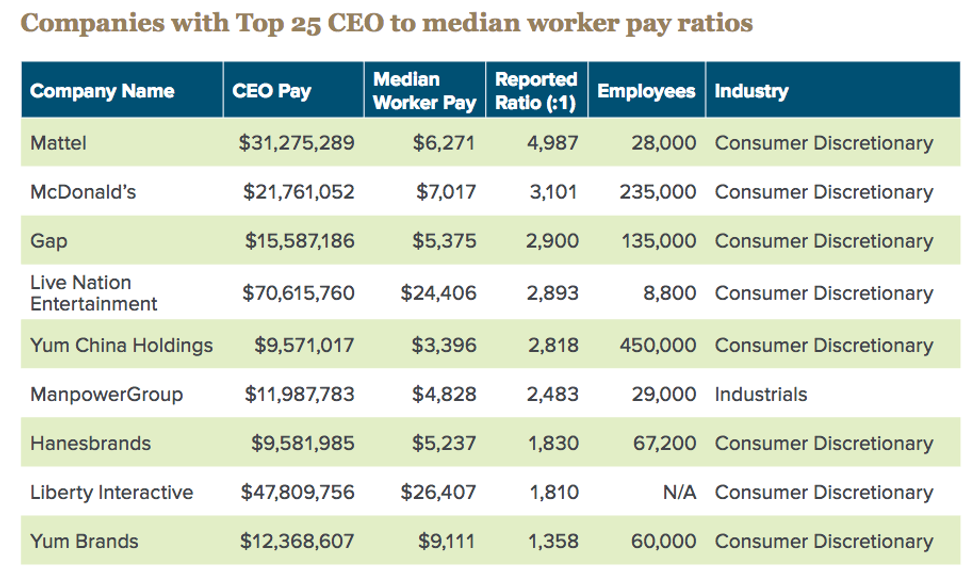

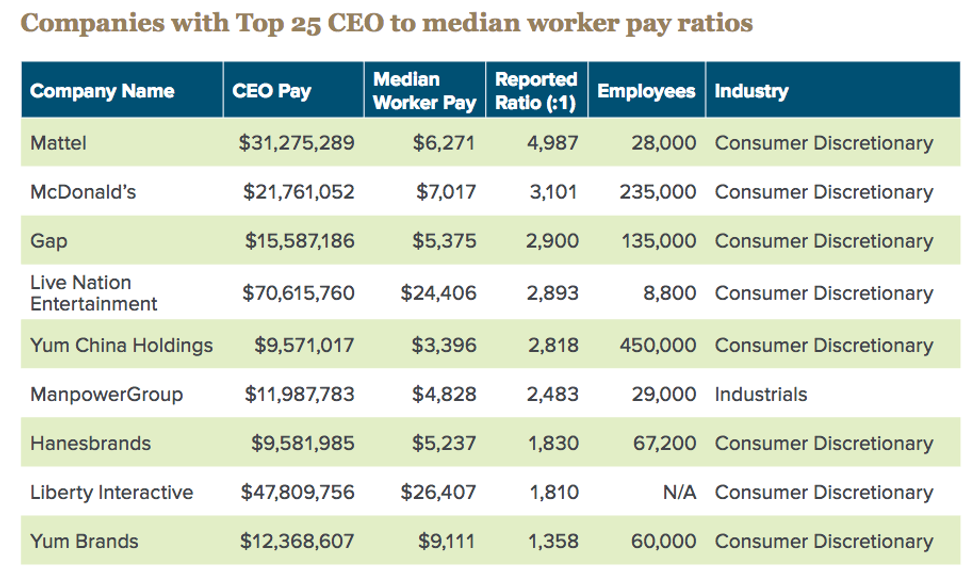

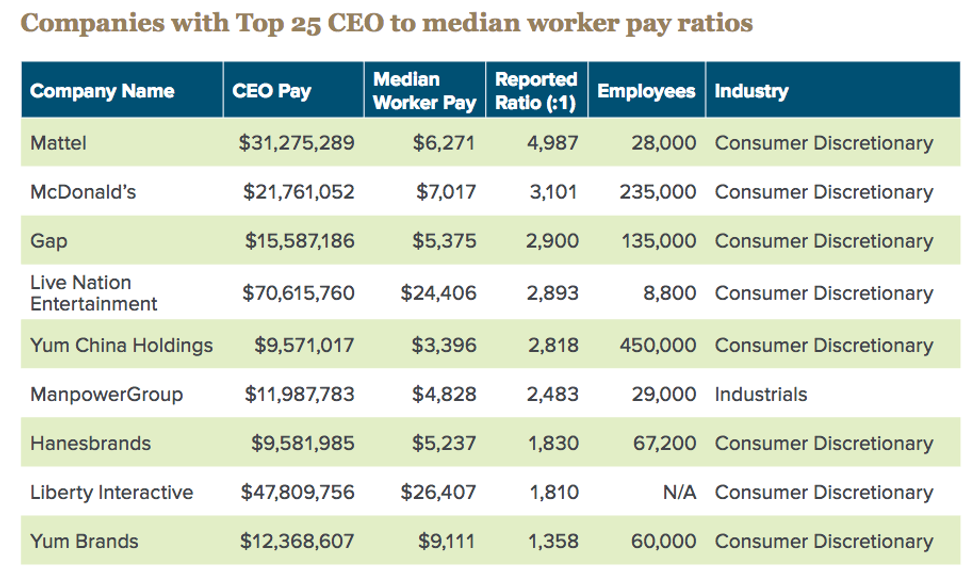

Titled "Rewarding or Hoarding" (pdf), Ellison's study--described as "the first comprehensive analysis of CEO pay ratios of large, publicly traded companies"--draws upon Securities and Exchange Commission (SEC) data and finds that the average CEO-to-median worker pay ratio of the 225 companies examined was 339 to 1, while the largest ratio was nearly 5,000 to 1.

"The median worker at the vast majority of these companies wouldn't make in an entire 45-year career--and in many cases, multiple careers--what their CEO makes in a single year," Ellison said in a statement. "This immense inequality is a crisis for our economy and our democracy, and we need legislative action at the local, state and federal level to address it."

"It is important to remember that many CEOs and top executives didn't want to release this data," Ellison added.

The only reason these staggering numbers are publicly available in the first place is because of a pay transparency rule inserted in the 2010 Dodd-Frank Act, against the will of corporate executives and their allies in Congress.

For years, companies dragged their feet and put off complying with the rule, arguing that it is too vague or overly burdensome. Last year, the Trump administration moved to kill the rule entirely.

But, as Sarah Anderson noted in an op-ed for Inequality.org on Wednesday, "Ellison and other Democrats, along with responsible investors and economic justice advocates, mobilized...to defend the rule--and won."

With the pay-ratio data now trickling in, Ellison told the Guardian that even he was surprised by the sheer size of the gulf between deep-pocketed executives and average workers.

"I knew inequality was a great problem in our society but I didn't understand quite how extreme it was," Eliison said.

To address these vast inequities, Ellison proposes a number of solutions, including banning stock buy-backs--which have increased dramatically since the GOP's $1.5 trillion tax cuts went into effect--and hiking the top marginal tax rate.

"But we also need to increase the voice of workers," Ellison concluded. "It's not like this concentration and hoarding of wealth has no consequence. Everytime [CEOs] acquire more, it means someone else gets less."

An Urgent Message From Our Co-Founder

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

Major American corporations have spent a lot of time, energy, and cash "scheming" to hide the enormous pay disparities between their workers and CEOs, and a new report published Wednesday by Rep. Keith Ellison (D-Minn.) makes it abundantly clear why.

"This immense inequality is a crisis for our economy and our democracy, and we need legislative action at the local, state and federal level to address it."

--Rep. Keith Ellison (D-Minn.)

Titled "Rewarding or Hoarding" (pdf), Ellison's study--described as "the first comprehensive analysis of CEO pay ratios of large, publicly traded companies"--draws upon Securities and Exchange Commission (SEC) data and finds that the average CEO-to-median worker pay ratio of the 225 companies examined was 339 to 1, while the largest ratio was nearly 5,000 to 1.

"The median worker at the vast majority of these companies wouldn't make in an entire 45-year career--and in many cases, multiple careers--what their CEO makes in a single year," Ellison said in a statement. "This immense inequality is a crisis for our economy and our democracy, and we need legislative action at the local, state and federal level to address it."

"It is important to remember that many CEOs and top executives didn't want to release this data," Ellison added.

The only reason these staggering numbers are publicly available in the first place is because of a pay transparency rule inserted in the 2010 Dodd-Frank Act, against the will of corporate executives and their allies in Congress.

For years, companies dragged their feet and put off complying with the rule, arguing that it is too vague or overly burdensome. Last year, the Trump administration moved to kill the rule entirely.

But, as Sarah Anderson noted in an op-ed for Inequality.org on Wednesday, "Ellison and other Democrats, along with responsible investors and economic justice advocates, mobilized...to defend the rule--and won."

With the pay-ratio data now trickling in, Ellison told the Guardian that even he was surprised by the sheer size of the gulf between deep-pocketed executives and average workers.

"I knew inequality was a great problem in our society but I didn't understand quite how extreme it was," Eliison said.

To address these vast inequities, Ellison proposes a number of solutions, including banning stock buy-backs--which have increased dramatically since the GOP's $1.5 trillion tax cuts went into effect--and hiking the top marginal tax rate.

"But we also need to increase the voice of workers," Ellison concluded. "It's not like this concentration and hoarding of wealth has no consequence. Everytime [CEOs] acquire more, it means someone else gets less."

Major American corporations have spent a lot of time, energy, and cash "scheming" to hide the enormous pay disparities between their workers and CEOs, and a new report published Wednesday by Rep. Keith Ellison (D-Minn.) makes it abundantly clear why.

"This immense inequality is a crisis for our economy and our democracy, and we need legislative action at the local, state and federal level to address it."

--Rep. Keith Ellison (D-Minn.)

Titled "Rewarding or Hoarding" (pdf), Ellison's study--described as "the first comprehensive analysis of CEO pay ratios of large, publicly traded companies"--draws upon Securities and Exchange Commission (SEC) data and finds that the average CEO-to-median worker pay ratio of the 225 companies examined was 339 to 1, while the largest ratio was nearly 5,000 to 1.

"The median worker at the vast majority of these companies wouldn't make in an entire 45-year career--and in many cases, multiple careers--what their CEO makes in a single year," Ellison said in a statement. "This immense inequality is a crisis for our economy and our democracy, and we need legislative action at the local, state and federal level to address it."

"It is important to remember that many CEOs and top executives didn't want to release this data," Ellison added.

The only reason these staggering numbers are publicly available in the first place is because of a pay transparency rule inserted in the 2010 Dodd-Frank Act, against the will of corporate executives and their allies in Congress.

For years, companies dragged their feet and put off complying with the rule, arguing that it is too vague or overly burdensome. Last year, the Trump administration moved to kill the rule entirely.

But, as Sarah Anderson noted in an op-ed for Inequality.org on Wednesday, "Ellison and other Democrats, along with responsible investors and economic justice advocates, mobilized...to defend the rule--and won."

With the pay-ratio data now trickling in, Ellison told the Guardian that even he was surprised by the sheer size of the gulf between deep-pocketed executives and average workers.

"I knew inequality was a great problem in our society but I didn't understand quite how extreme it was," Eliison said.

To address these vast inequities, Ellison proposes a number of solutions, including banning stock buy-backs--which have increased dramatically since the GOP's $1.5 trillion tax cuts went into effect--and hiking the top marginal tax rate.

"But we also need to increase the voice of workers," Ellison concluded. "It's not like this concentration and hoarding of wealth has no consequence. Everytime [CEOs] acquire more, it means someone else gets less."