SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

Treasury Secretary Steven Mnuchin and his wife, Louise Linton, hold up a sheet of new $1 bills, the first currency notes bearing his and U.S. Treasurer Jovita Carranza's signatures on Nov. 15 at the Bureau of Engraving and Printing in Washington. (Photo: Jacquelyn Martin/AP)

With $5.1 trillion, the U.S. government could provide healthcare for all Americans and make public colleges tuition free with cash to spare, but a report released on Wednesday by the Institute on Taxation and Economic Policy (ITEP) shows that the past three presidents have instead opted to send this vast sum of money to the richest Americans through massive tax cuts.

"These policies have transferred trillions in wealth to those who were already rich."

--Alan Essig, Institute on Taxation and Economic Policy

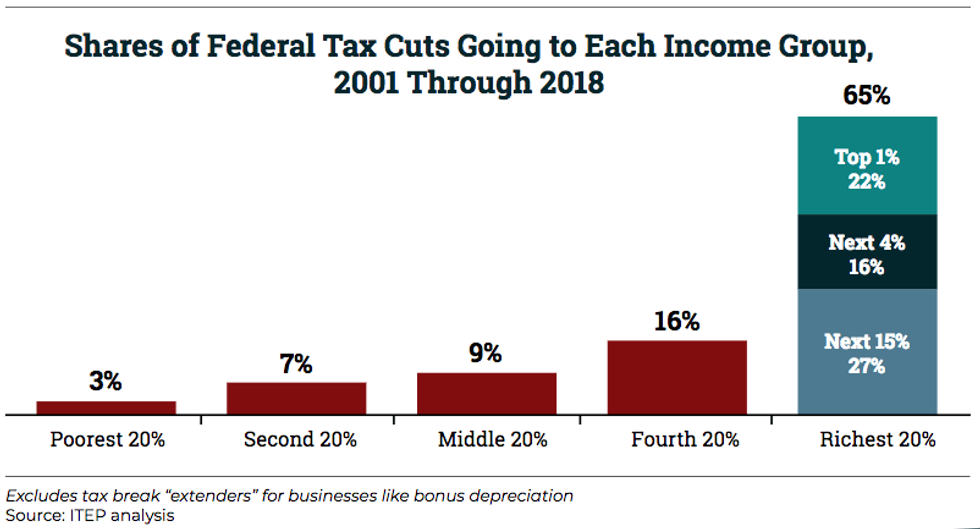

Titled "Federal Tax Changes in the Bush, Obama, and Trump Years," the new analysis (pdf) finds that tax cuts enacted since 2000 have cost the U.S. government $5.1 trillion in revenue, "with nearly two-thirds of that flowing to the richest fifth of Americans."

Thanks in large part to President Donald Trump's $1.5 trillion tax cut package that was signed into law last December--which will send 83 percent of its benefits to the top one percent--"the tally of tax cuts will grow to $10.6 trillion" by 2025 and "nearly $2 trillion of this amount will have gone to the richest one percent," the report estimates.

\u201cGreat report here from ITEP. When people demand specifics on how to pay for expansions to social insurance, income supports, and public investments, seems like part of the answer is just 'we could stop doing this'\nhttps://t.co/vvwH2Wfaos\u201d— Josh Bivens (@Josh Bivens) 1531324880

At a time when tens of millions of Americans are suffering from "massive levels of deprivation" and "appalling rates" of poverty, the tax cuts rammed through by George W. Bush, extended in part by Barack Obama, and built upon by Trump "have mostly benefited those who are least in need of help," Steve Wamhoff, director of federal policy at ITEP and the lead author of the new analysis, argued in a statement on Wednesday.

"For example, the richest one percent received more benefits than the bottom 60 percent," Wamhoff added. "It's worth asking whether this is the result most Americans wanted from their lawmakers."

Polling data suggests that it is not. As Common Dreams reported, a poll published last month found that just 37 percent of registered voters support Trump's massive tax cuts, which America's largest corporations are using to buy back their own stock rather than boost worker pay.

While Trump's tax cuts are the latest and most egregious example of tax policy that rewards the rich at the expense of everyone else, ITEP executive director Alan Essig notes that this upward redistribution of wealth is part of a broad trend of soaring inequality that consecutive administrations have fueled.

"These policies have transferred trillions in wealth to those who were already rich," Essig said of tax changes under Bush, Obama, and Trump. "Annual income for the top 20 percent of households has grown since 2000. But it essentially has remained stagnant for families in the middle-income quintile and declined for poor and low-income households."

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

With $5.1 trillion, the U.S. government could provide healthcare for all Americans and make public colleges tuition free with cash to spare, but a report released on Wednesday by the Institute on Taxation and Economic Policy (ITEP) shows that the past three presidents have instead opted to send this vast sum of money to the richest Americans through massive tax cuts.

"These policies have transferred trillions in wealth to those who were already rich."

--Alan Essig, Institute on Taxation and Economic Policy

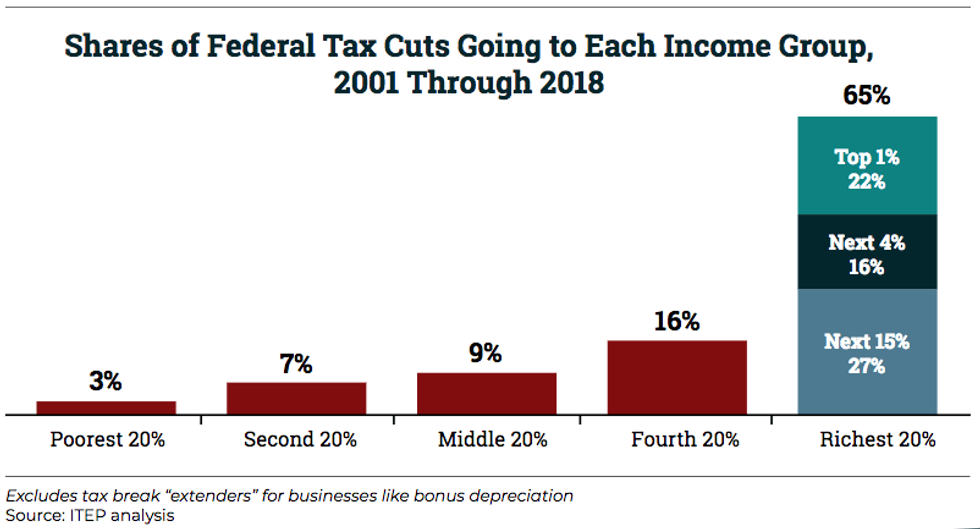

Titled "Federal Tax Changes in the Bush, Obama, and Trump Years," the new analysis (pdf) finds that tax cuts enacted since 2000 have cost the U.S. government $5.1 trillion in revenue, "with nearly two-thirds of that flowing to the richest fifth of Americans."

Thanks in large part to President Donald Trump's $1.5 trillion tax cut package that was signed into law last December--which will send 83 percent of its benefits to the top one percent--"the tally of tax cuts will grow to $10.6 trillion" by 2025 and "nearly $2 trillion of this amount will have gone to the richest one percent," the report estimates.

\u201cGreat report here from ITEP. When people demand specifics on how to pay for expansions to social insurance, income supports, and public investments, seems like part of the answer is just 'we could stop doing this'\nhttps://t.co/vvwH2Wfaos\u201d— Josh Bivens (@Josh Bivens) 1531324880

At a time when tens of millions of Americans are suffering from "massive levels of deprivation" and "appalling rates" of poverty, the tax cuts rammed through by George W. Bush, extended in part by Barack Obama, and built upon by Trump "have mostly benefited those who are least in need of help," Steve Wamhoff, director of federal policy at ITEP and the lead author of the new analysis, argued in a statement on Wednesday.

"For example, the richest one percent received more benefits than the bottom 60 percent," Wamhoff added. "It's worth asking whether this is the result most Americans wanted from their lawmakers."

Polling data suggests that it is not. As Common Dreams reported, a poll published last month found that just 37 percent of registered voters support Trump's massive tax cuts, which America's largest corporations are using to buy back their own stock rather than boost worker pay.

While Trump's tax cuts are the latest and most egregious example of tax policy that rewards the rich at the expense of everyone else, ITEP executive director Alan Essig notes that this upward redistribution of wealth is part of a broad trend of soaring inequality that consecutive administrations have fueled.

"These policies have transferred trillions in wealth to those who were already rich," Essig said of tax changes under Bush, Obama, and Trump. "Annual income for the top 20 percent of households has grown since 2000. But it essentially has remained stagnant for families in the middle-income quintile and declined for poor and low-income households."

With $5.1 trillion, the U.S. government could provide healthcare for all Americans and make public colleges tuition free with cash to spare, but a report released on Wednesday by the Institute on Taxation and Economic Policy (ITEP) shows that the past three presidents have instead opted to send this vast sum of money to the richest Americans through massive tax cuts.

"These policies have transferred trillions in wealth to those who were already rich."

--Alan Essig, Institute on Taxation and Economic Policy

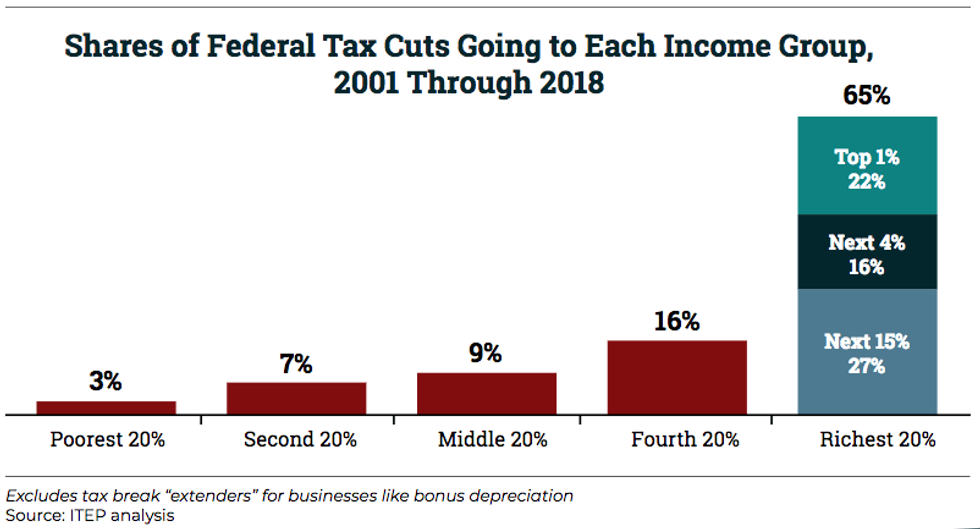

Titled "Federal Tax Changes in the Bush, Obama, and Trump Years," the new analysis (pdf) finds that tax cuts enacted since 2000 have cost the U.S. government $5.1 trillion in revenue, "with nearly two-thirds of that flowing to the richest fifth of Americans."

Thanks in large part to President Donald Trump's $1.5 trillion tax cut package that was signed into law last December--which will send 83 percent of its benefits to the top one percent--"the tally of tax cuts will grow to $10.6 trillion" by 2025 and "nearly $2 trillion of this amount will have gone to the richest one percent," the report estimates.

\u201cGreat report here from ITEP. When people demand specifics on how to pay for expansions to social insurance, income supports, and public investments, seems like part of the answer is just 'we could stop doing this'\nhttps://t.co/vvwH2Wfaos\u201d— Josh Bivens (@Josh Bivens) 1531324880

At a time when tens of millions of Americans are suffering from "massive levels of deprivation" and "appalling rates" of poverty, the tax cuts rammed through by George W. Bush, extended in part by Barack Obama, and built upon by Trump "have mostly benefited those who are least in need of help," Steve Wamhoff, director of federal policy at ITEP and the lead author of the new analysis, argued in a statement on Wednesday.

"For example, the richest one percent received more benefits than the bottom 60 percent," Wamhoff added. "It's worth asking whether this is the result most Americans wanted from their lawmakers."

Polling data suggests that it is not. As Common Dreams reported, a poll published last month found that just 37 percent of registered voters support Trump's massive tax cuts, which America's largest corporations are using to buy back their own stock rather than boost worker pay.

While Trump's tax cuts are the latest and most egregious example of tax policy that rewards the rich at the expense of everyone else, ITEP executive director Alan Essig notes that this upward redistribution of wealth is part of a broad trend of soaring inequality that consecutive administrations have fueled.

"These policies have transferred trillions in wealth to those who were already rich," Essig said of tax changes under Bush, Obama, and Trump. "Annual income for the top 20 percent of households has grown since 2000. But it essentially has remained stagnant for families in the middle-income quintile and declined for poor and low-income households."