JPMorgan Chase CEO Jamie Dimon attends a policy forum with U.S. President Donald Trump in the State Dining Room at the White House February 3, 2017 in Washington, D.C. (Photo: Chip Somodevilla/Getty Images)

As Workers' Wages Continue to Fall Under Trump, Analysis Shows CEO Pay Is Way Higher Than Typically Reported

"The data is out: CEOs are cashing in their huge benefits from the [Trump tax cuts], meanwhile workers' wages are declining and Americans are struggling to afford rising healthcare premiums."

As wages for most American workers continue to steadily decline following the passage of President Donald Trump's massive corporate tax cuts at the end of last year, a new analysis of federal data by Axios found that the pay of some of America's top CEOs is often even higher than the astronomical numbers that typically appear in the headlines.

"The CEOs running S&P 500 companies cumulatively took home $10 billion in 2017, an amount that is 44 percent higher than what is usually reported," notes Axios's Bob Herman. "The big reason: CEOs cashing in their stock."

Annual Securities and Exchange Commission (SEC) filings, adds Herman, "bury the fact that many of America's top executives are sometimes paid even more than what headlines suggest, due almost entirely to the huge gains they reap from the stock market. Meanwhile, worker wages are stagnant, the average household is living on $59,000 a year, and income inequality has become one of the most visible political rallying cries."

\u201cNew analysis: Corporate executives make a lot more than you think. Dive in and explore what we found for the S&P 500 CEOs. https://t.co/icEC2zg6qn\u201d— Bob Herman (@Bob Herman) 1532614128

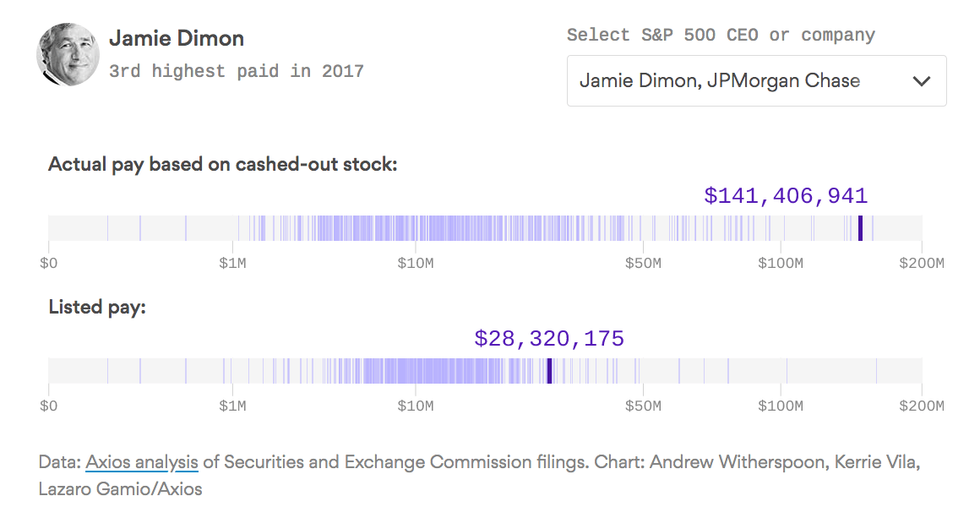

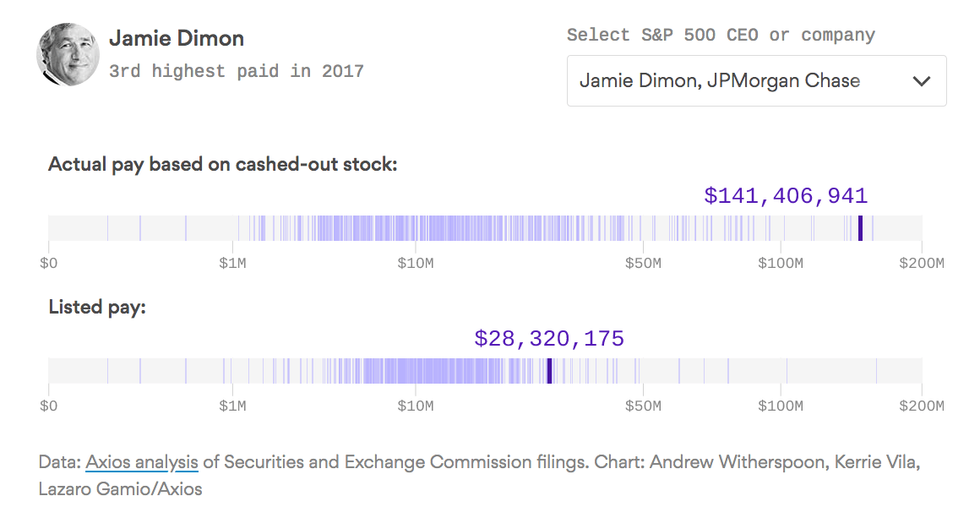

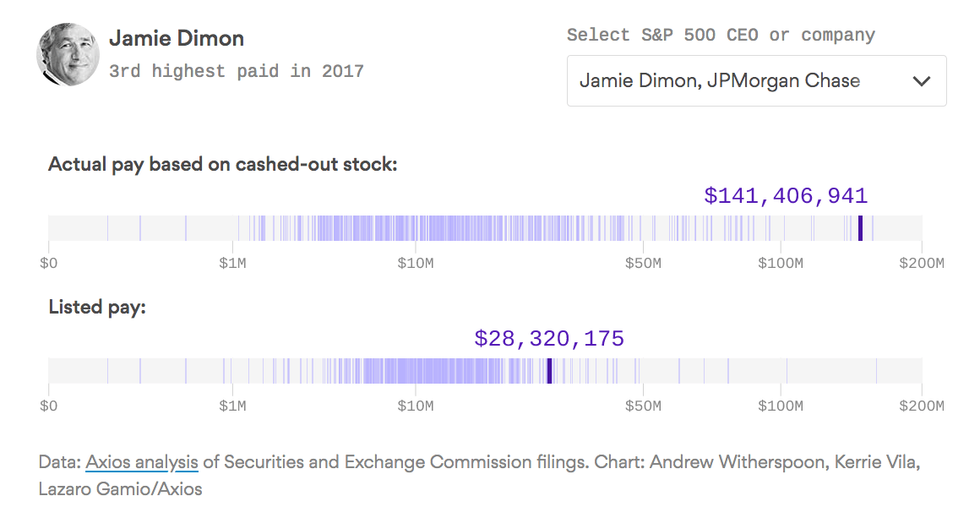

One striking example of a CEO who took home a lot more money in 2017 than news stories suggested was Jamie Dimon, chief executive at the Wall Street mega-bank JPMorgan Chase.

In total, "nine CEOs made more than $100 million last year under our calculations, compared with just two CEOs under standard rules," Axios notes. "CEOs in the tech, finance, and healthcare industries often made a lot more in real dollars than what was normally reported."

"The data is out: CEOs are cashing in their huge benefits from the [Trump tax cuts], meanwhile workers' wages are declining and Americans are struggling to afford rising healthcare premiums," wrote the advocacy group Tax March in response to the new analysis.

Between the first and second quarters of 2018--as executives and major corporations cashed in with record stock buybucks--real wages declined by 1.8 percent, as Bloomberg showed in a chart that quickly went viral.

\u201cWages were supposed to rise after Trump's tax cuts. Instead, they\u2019ve fallen https://t.co/LactYzTE7a via @bopinion\u201d— Bloomberg (@Bloomberg) 1532175742

An Urgent Message From Our Co-Founder

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

As wages for most American workers continue to steadily decline following the passage of President Donald Trump's massive corporate tax cuts at the end of last year, a new analysis of federal data by Axios found that the pay of some of America's top CEOs is often even higher than the astronomical numbers that typically appear in the headlines.

"The CEOs running S&P 500 companies cumulatively took home $10 billion in 2017, an amount that is 44 percent higher than what is usually reported," notes Axios's Bob Herman. "The big reason: CEOs cashing in their stock."

Annual Securities and Exchange Commission (SEC) filings, adds Herman, "bury the fact that many of America's top executives are sometimes paid even more than what headlines suggest, due almost entirely to the huge gains they reap from the stock market. Meanwhile, worker wages are stagnant, the average household is living on $59,000 a year, and income inequality has become one of the most visible political rallying cries."

\u201cNew analysis: Corporate executives make a lot more than you think. Dive in and explore what we found for the S&P 500 CEOs. https://t.co/icEC2zg6qn\u201d— Bob Herman (@Bob Herman) 1532614128

One striking example of a CEO who took home a lot more money in 2017 than news stories suggested was Jamie Dimon, chief executive at the Wall Street mega-bank JPMorgan Chase.

In total, "nine CEOs made more than $100 million last year under our calculations, compared with just two CEOs under standard rules," Axios notes. "CEOs in the tech, finance, and healthcare industries often made a lot more in real dollars than what was normally reported."

"The data is out: CEOs are cashing in their huge benefits from the [Trump tax cuts], meanwhile workers' wages are declining and Americans are struggling to afford rising healthcare premiums," wrote the advocacy group Tax March in response to the new analysis.

Between the first and second quarters of 2018--as executives and major corporations cashed in with record stock buybucks--real wages declined by 1.8 percent, as Bloomberg showed in a chart that quickly went viral.

\u201cWages were supposed to rise after Trump's tax cuts. Instead, they\u2019ve fallen https://t.co/LactYzTE7a via @bopinion\u201d— Bloomberg (@Bloomberg) 1532175742

As wages for most American workers continue to steadily decline following the passage of President Donald Trump's massive corporate tax cuts at the end of last year, a new analysis of federal data by Axios found that the pay of some of America's top CEOs is often even higher than the astronomical numbers that typically appear in the headlines.

"The CEOs running S&P 500 companies cumulatively took home $10 billion in 2017, an amount that is 44 percent higher than what is usually reported," notes Axios's Bob Herman. "The big reason: CEOs cashing in their stock."

Annual Securities and Exchange Commission (SEC) filings, adds Herman, "bury the fact that many of America's top executives are sometimes paid even more than what headlines suggest, due almost entirely to the huge gains they reap from the stock market. Meanwhile, worker wages are stagnant, the average household is living on $59,000 a year, and income inequality has become one of the most visible political rallying cries."

\u201cNew analysis: Corporate executives make a lot more than you think. Dive in and explore what we found for the S&P 500 CEOs. https://t.co/icEC2zg6qn\u201d— Bob Herman (@Bob Herman) 1532614128

One striking example of a CEO who took home a lot more money in 2017 than news stories suggested was Jamie Dimon, chief executive at the Wall Street mega-bank JPMorgan Chase.

In total, "nine CEOs made more than $100 million last year under our calculations, compared with just two CEOs under standard rules," Axios notes. "CEOs in the tech, finance, and healthcare industries often made a lot more in real dollars than what was normally reported."

"The data is out: CEOs are cashing in their huge benefits from the [Trump tax cuts], meanwhile workers' wages are declining and Americans are struggling to afford rising healthcare premiums," wrote the advocacy group Tax March in response to the new analysis.

Between the first and second quarters of 2018--as executives and major corporations cashed in with record stock buybucks--real wages declined by 1.8 percent, as Bloomberg showed in a chart that quickly went viral.

\u201cWages were supposed to rise after Trump's tax cuts. Instead, they\u2019ve fallen https://t.co/LactYzTE7a via @bopinion\u201d— Bloomberg (@Bloomberg) 1532175742