"Student debt is at a crisis level in this country," said Sen. Kirsten Gillibrand (D.N.Y.). (Photo: thisisbossi/Flickr/cc)

To donate by check, phone, or other method, see our More Ways to Give page.

"Student debt is at a crisis level in this country," said Sen. Kirsten Gillibrand (D.N.Y.). (Photo: thisisbossi/Flickr/cc)

Underscoring the need for progressive proposals like tuition-free college and debt relief, new data shows young Americans are being crushed by debt.

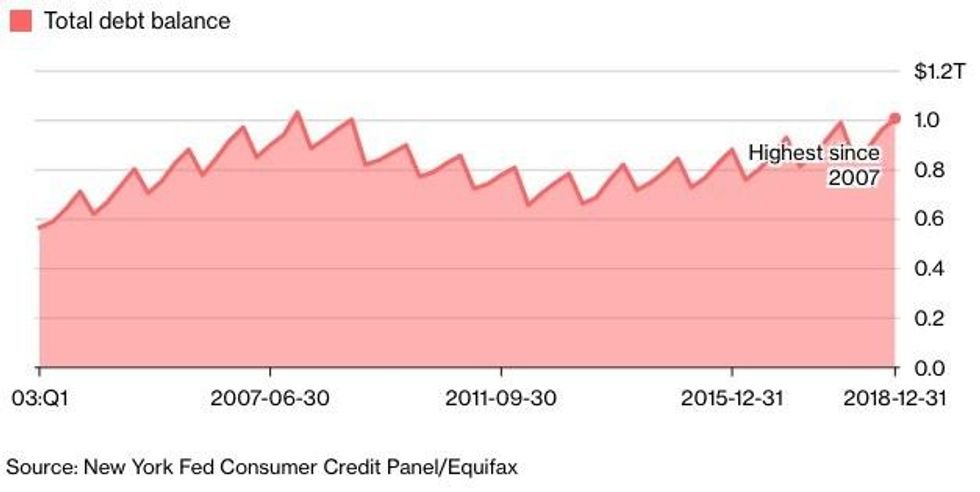

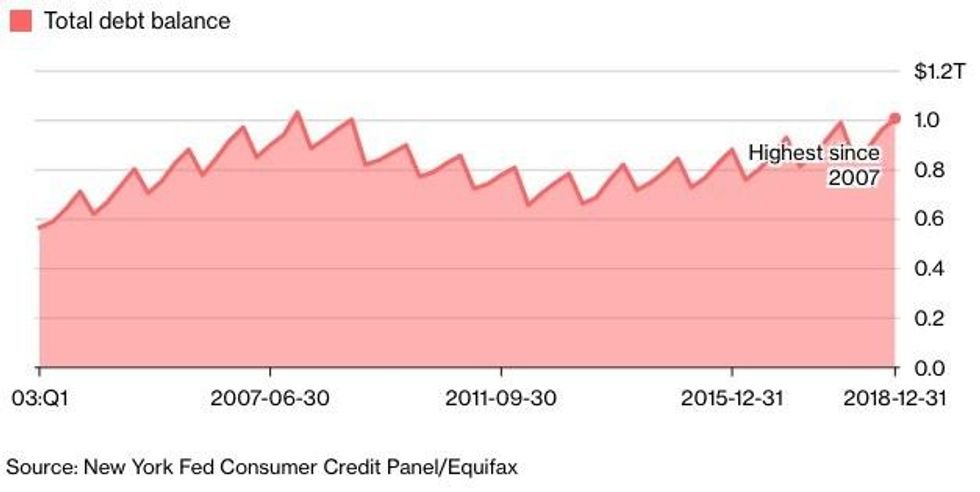

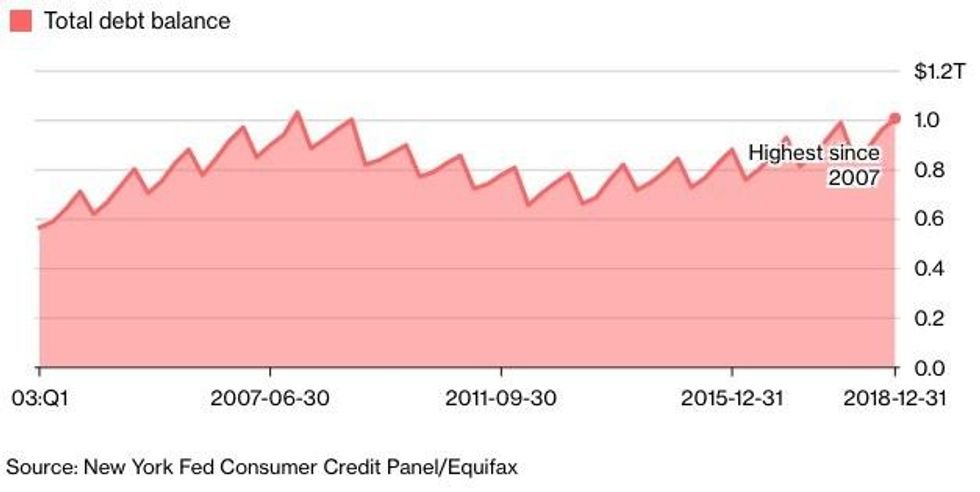

In the last quarter of 2018, outstanding student loan debt went up $15 billion to $1.46 trillion. Credit card balances shot up as well, raising $26 billion to $870 billion, according to (pdf) the most recent quarterly housefold debt report from the Federal Reserve Bank of New York's Center for Microeconomic Data.

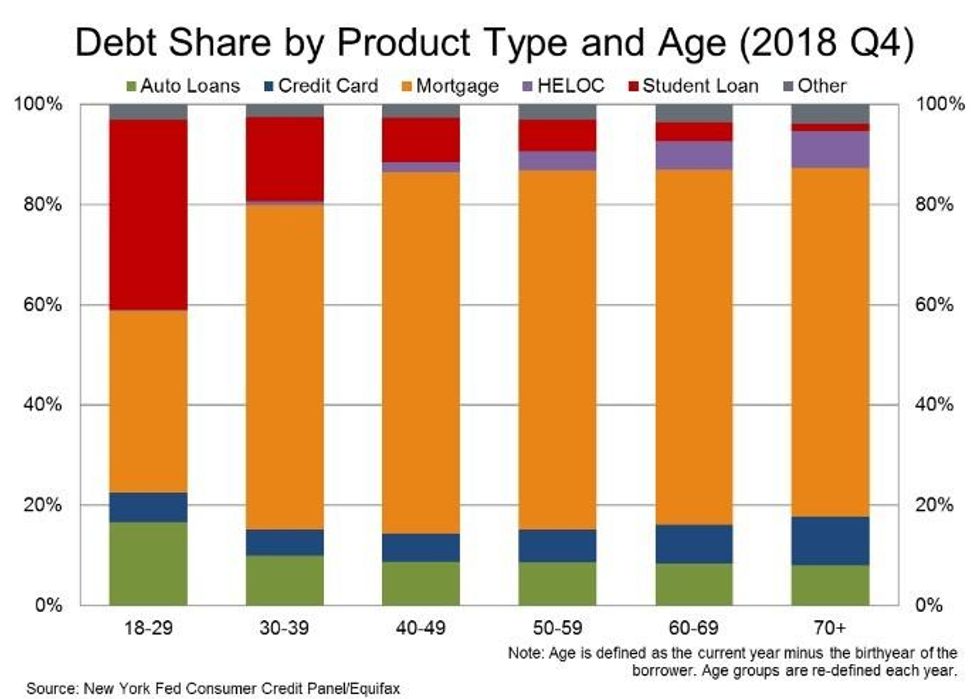

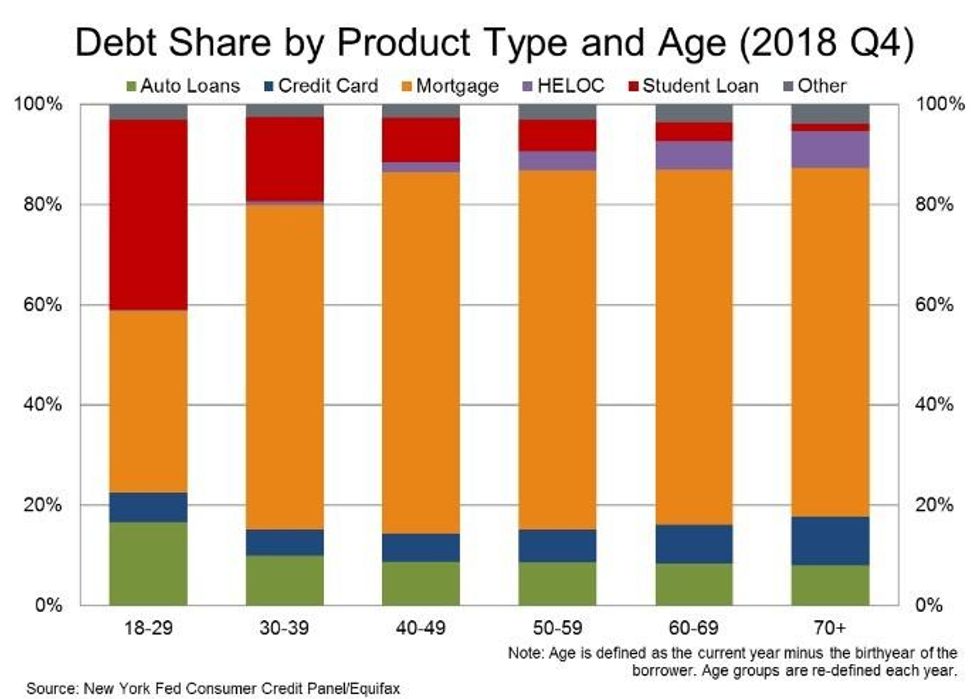

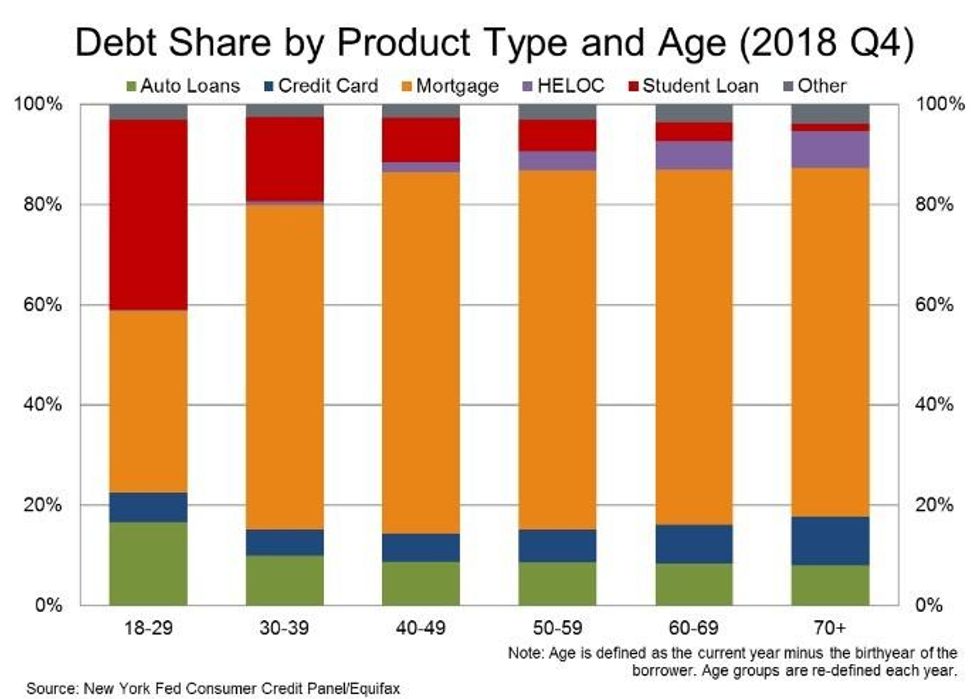

The youngest age bracket in the report, those aged 19-29, had over $1 trillion in debt in 2018. "That's the highest debt exposure for the youngest adult group since late 2007," Bloomberg reported. Moreover, "Student loans make up the majority of the $1,005,000,000,000 owed by this cohort, followed by mortgage debt," the reporting adds.

"We are crushing the next generation with debt," tweeted Democratic presidential hopeful and Universal Basic Income proponent Andrew Yang in response to the findings.

In a tweet last week, another Democratic 2020 contender, Sen. Kirsten Gillibrand (D.N.Y.), said, "Student debt is at a crisis level in this country, and it holds our whole economy down."

Among the roughly one in four Americans facing that crisis--a problem a bipartisan majority of Americans want Congress to do something about--is Melissa Haggerty, a Loyola University Chicago alumna.

Being "strapped with student loan debt," she recently wrote that she's "barely getting by, and looking for solutions from lawmakers." She added:

In cities across Illinois, borrowers are putting 10 percent or more of their paychecks towards paying down student loan debt. The consequences of this means financial stability will continue to be out of reach for young people like me unless bold policies are implemented that make college more affordable for future students, and provide meaningful relief to borrowers like me. In Illinois, borrowers now have a Student Loan Bill of Rights, which provides basic consumer protections to defend them against bad practices by student loan companies. But we need to go further. Incoming policymakers should hold greedy student loan lenders accountable for their deceptive practices, and consider debt forgiveness programs for current borrowers. Borrowers should also be allowed to file for bankruptcy. Saddled with tens of thousands of student loans, filing for bankruptcy would be a welcome relief.

"It's time our policymakers take these challenges seriously, and offer meaningful solutions to help borrowers get ahead," she concluded.

Trump and Musk are on an unconstitutional rampage, aiming for virtually every corner of the federal government. These two right-wing billionaires are targeting nurses, scientists, teachers, daycare providers, judges, veterans, air traffic controllers, and nuclear safety inspectors. No one is safe. The food stamps program, Social Security, Medicare, and Medicaid are next. It’s an unprecedented disaster and a five-alarm fire, but there will be a reckoning. The people did not vote for this. The American people do not want this dystopian hellscape that hides behind claims of “efficiency.” Still, in reality, it is all a giveaway to corporate interests and the libertarian dreams of far-right oligarchs like Musk. Common Dreams is playing a vital role by reporting day and night on this orgy of corruption and greed, as well as what everyday people can do to organize and fight back. As a people-powered nonprofit news outlet, we cover issues the corporate media never will, but we can only continue with our readers’ support. |

Underscoring the need for progressive proposals like tuition-free college and debt relief, new data shows young Americans are being crushed by debt.

In the last quarter of 2018, outstanding student loan debt went up $15 billion to $1.46 trillion. Credit card balances shot up as well, raising $26 billion to $870 billion, according to (pdf) the most recent quarterly housefold debt report from the Federal Reserve Bank of New York's Center for Microeconomic Data.

The youngest age bracket in the report, those aged 19-29, had over $1 trillion in debt in 2018. "That's the highest debt exposure for the youngest adult group since late 2007," Bloomberg reported. Moreover, "Student loans make up the majority of the $1,005,000,000,000 owed by this cohort, followed by mortgage debt," the reporting adds.

"We are crushing the next generation with debt," tweeted Democratic presidential hopeful and Universal Basic Income proponent Andrew Yang in response to the findings.

In a tweet last week, another Democratic 2020 contender, Sen. Kirsten Gillibrand (D.N.Y.), said, "Student debt is at a crisis level in this country, and it holds our whole economy down."

Among the roughly one in four Americans facing that crisis--a problem a bipartisan majority of Americans want Congress to do something about--is Melissa Haggerty, a Loyola University Chicago alumna.

Being "strapped with student loan debt," she recently wrote that she's "barely getting by, and looking for solutions from lawmakers." She added:

In cities across Illinois, borrowers are putting 10 percent or more of their paychecks towards paying down student loan debt. The consequences of this means financial stability will continue to be out of reach for young people like me unless bold policies are implemented that make college more affordable for future students, and provide meaningful relief to borrowers like me. In Illinois, borrowers now have a Student Loan Bill of Rights, which provides basic consumer protections to defend them against bad practices by student loan companies. But we need to go further. Incoming policymakers should hold greedy student loan lenders accountable for their deceptive practices, and consider debt forgiveness programs for current borrowers. Borrowers should also be allowed to file for bankruptcy. Saddled with tens of thousands of student loans, filing for bankruptcy would be a welcome relief.

"It's time our policymakers take these challenges seriously, and offer meaningful solutions to help borrowers get ahead," she concluded.

Underscoring the need for progressive proposals like tuition-free college and debt relief, new data shows young Americans are being crushed by debt.

In the last quarter of 2018, outstanding student loan debt went up $15 billion to $1.46 trillion. Credit card balances shot up as well, raising $26 billion to $870 billion, according to (pdf) the most recent quarterly housefold debt report from the Federal Reserve Bank of New York's Center for Microeconomic Data.

The youngest age bracket in the report, those aged 19-29, had over $1 trillion in debt in 2018. "That's the highest debt exposure for the youngest adult group since late 2007," Bloomberg reported. Moreover, "Student loans make up the majority of the $1,005,000,000,000 owed by this cohort, followed by mortgage debt," the reporting adds.

"We are crushing the next generation with debt," tweeted Democratic presidential hopeful and Universal Basic Income proponent Andrew Yang in response to the findings.

In a tweet last week, another Democratic 2020 contender, Sen. Kirsten Gillibrand (D.N.Y.), said, "Student debt is at a crisis level in this country, and it holds our whole economy down."

Among the roughly one in four Americans facing that crisis--a problem a bipartisan majority of Americans want Congress to do something about--is Melissa Haggerty, a Loyola University Chicago alumna.

Being "strapped with student loan debt," she recently wrote that she's "barely getting by, and looking for solutions from lawmakers." She added:

In cities across Illinois, borrowers are putting 10 percent or more of their paychecks towards paying down student loan debt. The consequences of this means financial stability will continue to be out of reach for young people like me unless bold policies are implemented that make college more affordable for future students, and provide meaningful relief to borrowers like me. In Illinois, borrowers now have a Student Loan Bill of Rights, which provides basic consumer protections to defend them against bad practices by student loan companies. But we need to go further. Incoming policymakers should hold greedy student loan lenders accountable for their deceptive practices, and consider debt forgiveness programs for current borrowers. Borrowers should also be allowed to file for bankruptcy. Saddled with tens of thousands of student loans, filing for bankruptcy would be a welcome relief.

"It's time our policymakers take these challenges seriously, and offer meaningful solutions to help borrowers get ahead," she concluded.