A coalition of environmental groups called out 33 global banks for collectively giving at least $1.9 trillion to fossil fuel companies since world leaders adopted the Paris climate agreement in December of 2015.

"If banks don't rapidly phase out their support for dirty energy, planetary collapse from man-made climate change is not just probable--it is imminent."

-- Alison Kirsch, RAN

The call-out came in Banking on Climate Change(pdf), published Wednesday as the tenth annual fossil fuel report card from the Rainforest Action Network (RAN), BankTrack, Indigenous Environmental Network, Oil Change International, Sierra Club, and Honor the Earth.

"This report is a red alert," declared RAN climate and energy researcher Alison Kirsch. "The massive scale at which global banks continue to pump billions of dollars into fossil fuels is flatly incompatible with a livable future."

"If banks don't rapidly phase out their support for dirty energy, planetary collapse from man-made climate change is not just probable," Kirsch warned. "It is imminent."

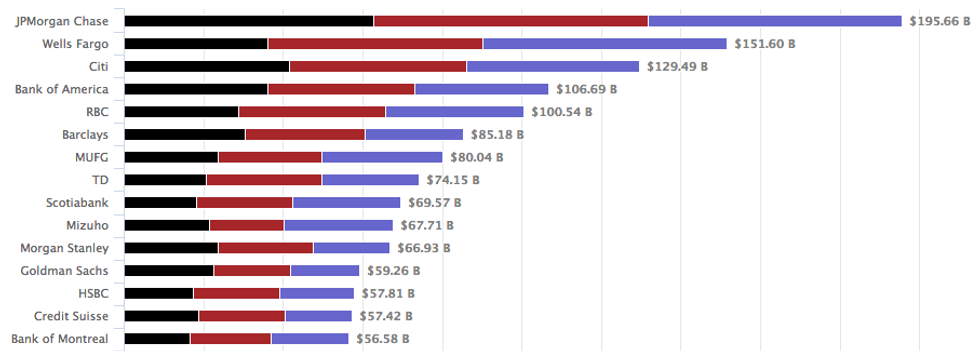

According to the report, the top four funders of coal, oil, and gas companies from 2016 to 2018 were all U.S. banks: JPMorgan Chase ($195.66 billion), Wells Fargo ($151.6 billion), Citi ($129.49 billion), and Bank of America ($106.69 billion).

Other major offenders included RBC ($100.54 billion), TD ($74.15 billion), and Scotiabank ($69.57 billion) of Canada; Barclays ($85.18 billion) of the United Kingdom; and Mitsubishi UFJ Financial Group ($80.04 billion) and Mizuho ($67.71 billion) of Japan.

The report doles out grades to the banks for fossil fuel expansion generally as well as projects across the sectors of the industry: tar sands oil, Arctic oil and gas, ultra-deepwater oil and gas, fracked oil and gas, liquefied natural gas (LNG), coal mining, and coal power.

In addition to identifying the global banks financing major fossil fuel projects, the report expanded on past analyses to identify companies "whose investments in new fossil fuel extraction, infrastructure, and power most fly in the face of the clear and urgent need to start a managed decline in the use of fossil fuels."

"These companies--and the banks that finance them--bear a powerful moral responsibility to stop building new coal mines and plants, and oil and gas fields and pipelines," the report states. "This new infrastructure risks extending by decades the lifespan of a sector whose growth is a cancer upon our planet."

The report highlights the "nightmarish tale" detailed in the United Nations Intergovernmental Panel on Climate Change's (IPCC) October 2018 special report on the consequences of global temperatures rising to an average of 1.5degC above pre-industrial levels, the Paris agreement's end-of-century target. The IPCC warned that without rapid systemic reforms--particularly, an urgent phaseout of fossil fuels--the world could hit that target decades early.

"The latest IPCC report provides a stark 2030 deadline for the deep cuts in global CO2 emissions needed to avoid full climate breakdown," noted BankTrack director Johan Frijns. "Yet banks continue to throw their billions at the fossil fuel industry, while announcing minor policy tweaks here and endorsements of the latest toothless 'responsible finance' initiative there."

Rather than incremental reforms, the backers of the new banking report want an immediate end to fossil fuel funding. As Oil Change International executive director Stephen Kretzmann put it, "Financing the expansion of any part of the oil, gas, or coal industry is now clearly climate denial, and we demand that it stop."

"We need change, we need it now," added Honor The Earth campaigns director Tara Houska. "It is a question of our shared survival that banks must respond to. We cannot drink money."