SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

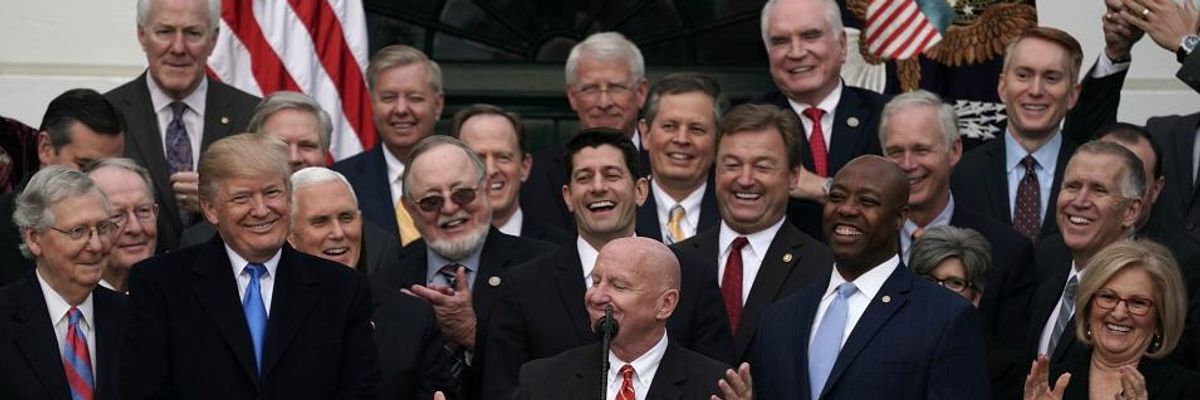

House Ways and Means Committee Chairman Kevin Brady (R-Texas) delivers remarks on the South Lawn of the White House on December 20, 2017 in Washington, D.C. (Photo: Chip Somodevilla/Getty Images)

An investigation into the effects of the 2017 Tax Cuts and Jobs Act found that while the law has not delivered the promised boost in wages or business investment, it has fattened the pockets of the Republican lawmakers who ushered the measure through Congress despite widespread public opposition.

The Center for Public Integrity (CPI) and Vox published a joint article Friday detailing how the tax law--dubbed the "GOP tax scam" by opponents--"likely saved members of Congress hundreds of thousands of dollars in taxes collectively, while the corporate tax cut hiked the value of their holdings."

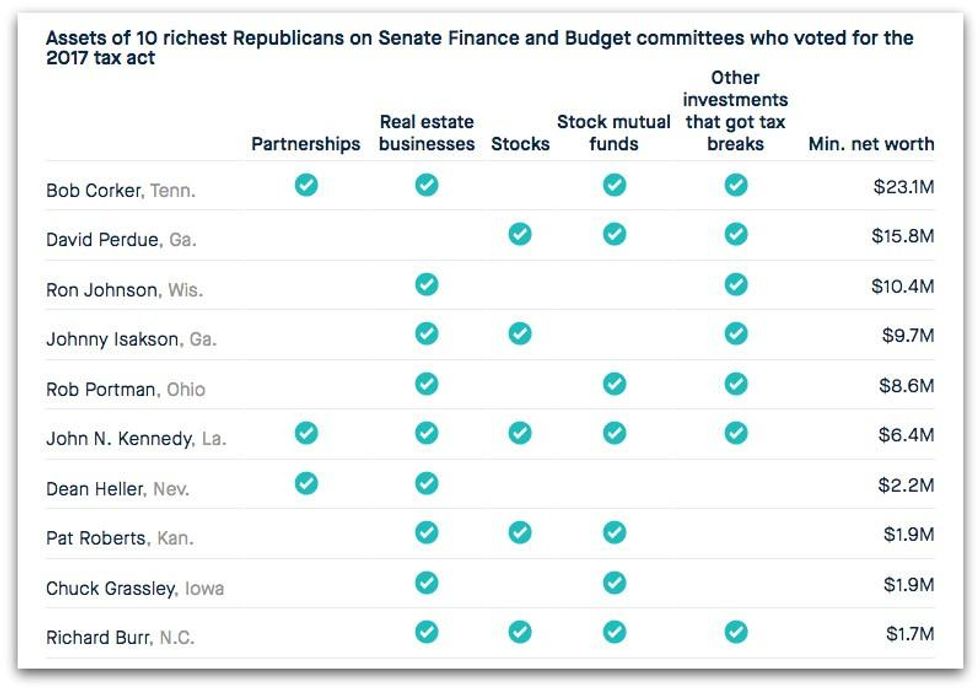

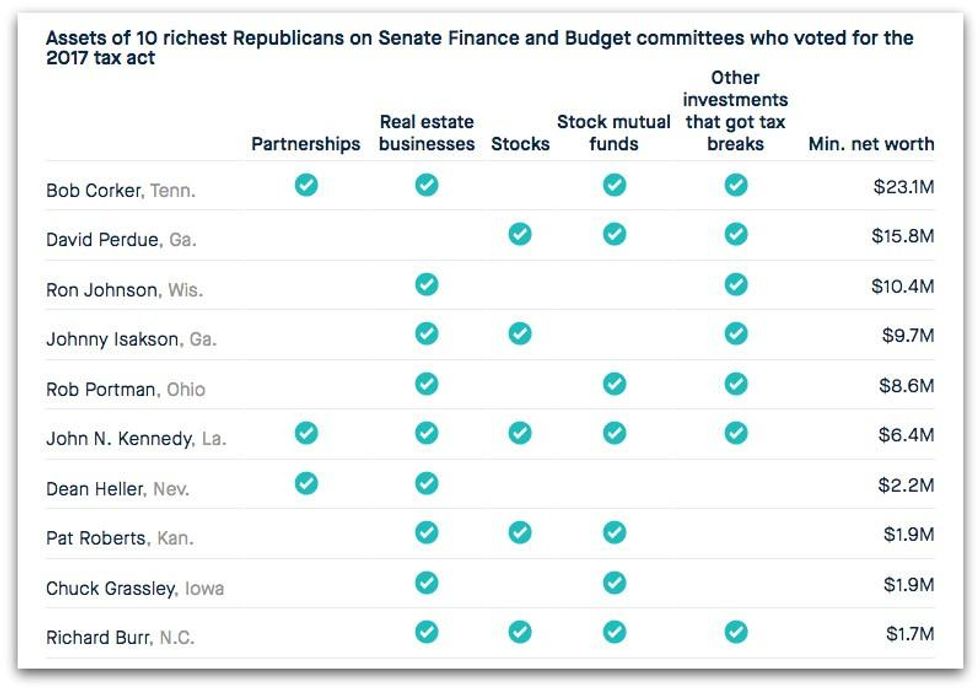

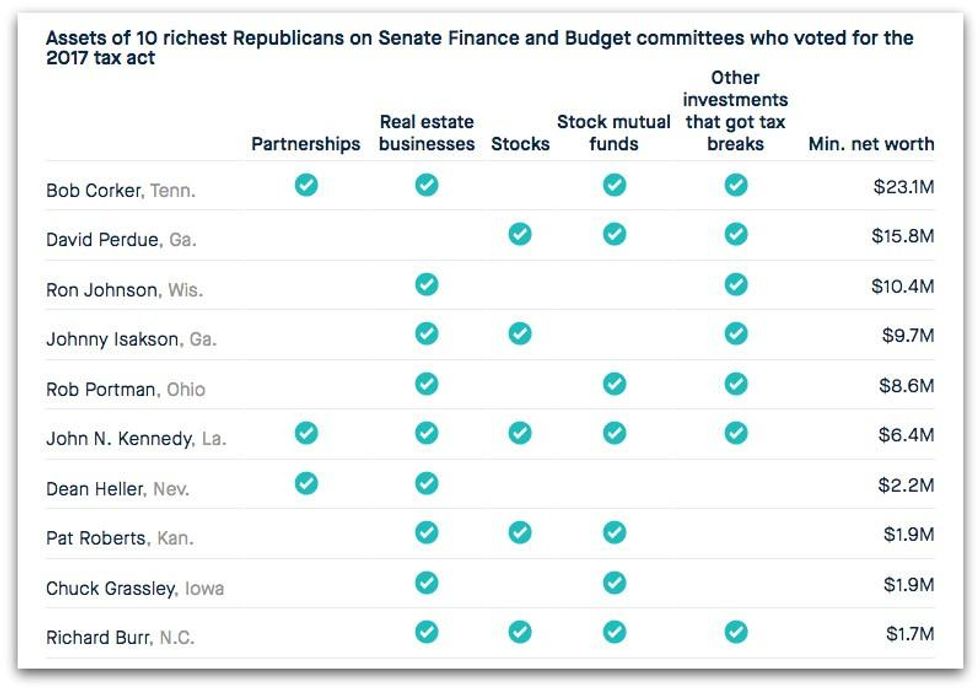

"The 10 richest Republicans in Congress in 2017 who voted for the tax bill held more than $731 million in assets, almost two-thirds of which were in stocks, bonds, mutual funds, and other instruments."

--Peter Cary, Center for Public Integrity

The $1.5 trillion in tax cuts, signed into law by President Donald Trump in December of 2017, slashed the top individual tax rate from 39.6% to 37% and the corporate rate from 35% to 21%.

Peter Cary, reporter for CPI and the lead author of the investigation, noted it is impossible to determine precisely how much money Republican lawmakers saved as a result of the tax law because members of Congress are not required to disclose their tax returns. But the windfall was likely substantial, Cary wrote, given the massive boost in stock prices the law sparked.

"Cutting tax rates for companies like Apple and hundreds of other stocks they own was one of many ways Republican lawmakers enriched themselves after they passed the tax law," Cary wrote. "Democrats also stood to gain from the tax bill, though not one voted for it; all but 12 Republicans voted for the tax bill."

"The 10 richest Republicans in Congress in 2017 who voted for the tax bill held more than $731 million in assets, almost two-thirds of which were in stocks, bonds, mutual funds, and other instruments," Cary added, citing Roll Call's analysis of Congress' wealth.

Jeff Hauser, director of the Revolving Door Project at the Center for Economic and Policy Research, told CPI and Vox that lawmakers profiting off legislation they crafted "feels to me like a kleptocracy."

According to the CPI/Vox analysis, "all but one of the 47 Republicans who sat on the three key committees overseeing the drafting of the tax bill own stocks and stock mutual funds."

The investigation cited a provision in the tax law that rewarded real estate companies and investors as a particularly egregious example of Republican self-dealing.

"One Republican senator who benefited from the last-minute provision was Tennessee's [Republican Sen.] Bob Corker, who at the time owned or was a partner in 18 real estate businesses, LLCs, and partnerships, records show," Cary wrote. "His reported income from them was between $2.1 million and $11.1 million in 2017."

Critics named the provision the "Corker Kickback" after the Tennessee senator, who retired from Congress in 2018.

"It's bad enough that President Trump's and congressional Republicans' GOP tax scam betrayed workers--it's even worse that they're lining their own pockets off it," Sen. Sherrod Brown (D-Ohio), a member of the Senate Finance Committee, tweeted Monday.

Trump and Musk are on an unconstitutional rampage, aiming for virtually every corner of the federal government. These two right-wing billionaires are targeting nurses, scientists, teachers, daycare providers, judges, veterans, air traffic controllers, and nuclear safety inspectors. No one is safe. The food stamps program, Social Security, Medicare, and Medicaid are next. It’s an unprecedented disaster and a five-alarm fire, but there will be a reckoning. The people did not vote for this. The American people do not want this dystopian hellscape that hides behind claims of “efficiency.” Still, in reality, it is all a giveaway to corporate interests and the libertarian dreams of far-right oligarchs like Musk. Common Dreams is playing a vital role by reporting day and night on this orgy of corruption and greed, as well as what everyday people can do to organize and fight back. As a people-powered nonprofit news outlet, we cover issues the corporate media never will, but we can only continue with our readers’ support. |

An investigation into the effects of the 2017 Tax Cuts and Jobs Act found that while the law has not delivered the promised boost in wages or business investment, it has fattened the pockets of the Republican lawmakers who ushered the measure through Congress despite widespread public opposition.

The Center for Public Integrity (CPI) and Vox published a joint article Friday detailing how the tax law--dubbed the "GOP tax scam" by opponents--"likely saved members of Congress hundreds of thousands of dollars in taxes collectively, while the corporate tax cut hiked the value of their holdings."

"The 10 richest Republicans in Congress in 2017 who voted for the tax bill held more than $731 million in assets, almost two-thirds of which were in stocks, bonds, mutual funds, and other instruments."

--Peter Cary, Center for Public Integrity

The $1.5 trillion in tax cuts, signed into law by President Donald Trump in December of 2017, slashed the top individual tax rate from 39.6% to 37% and the corporate rate from 35% to 21%.

Peter Cary, reporter for CPI and the lead author of the investigation, noted it is impossible to determine precisely how much money Republican lawmakers saved as a result of the tax law because members of Congress are not required to disclose their tax returns. But the windfall was likely substantial, Cary wrote, given the massive boost in stock prices the law sparked.

"Cutting tax rates for companies like Apple and hundreds of other stocks they own was one of many ways Republican lawmakers enriched themselves after they passed the tax law," Cary wrote. "Democrats also stood to gain from the tax bill, though not one voted for it; all but 12 Republicans voted for the tax bill."

"The 10 richest Republicans in Congress in 2017 who voted for the tax bill held more than $731 million in assets, almost two-thirds of which were in stocks, bonds, mutual funds, and other instruments," Cary added, citing Roll Call's analysis of Congress' wealth.

Jeff Hauser, director of the Revolving Door Project at the Center for Economic and Policy Research, told CPI and Vox that lawmakers profiting off legislation they crafted "feels to me like a kleptocracy."

According to the CPI/Vox analysis, "all but one of the 47 Republicans who sat on the three key committees overseeing the drafting of the tax bill own stocks and stock mutual funds."

The investigation cited a provision in the tax law that rewarded real estate companies and investors as a particularly egregious example of Republican self-dealing.

"One Republican senator who benefited from the last-minute provision was Tennessee's [Republican Sen.] Bob Corker, who at the time owned or was a partner in 18 real estate businesses, LLCs, and partnerships, records show," Cary wrote. "His reported income from them was between $2.1 million and $11.1 million in 2017."

Critics named the provision the "Corker Kickback" after the Tennessee senator, who retired from Congress in 2018.

"It's bad enough that President Trump's and congressional Republicans' GOP tax scam betrayed workers--it's even worse that they're lining their own pockets off it," Sen. Sherrod Brown (D-Ohio), a member of the Senate Finance Committee, tweeted Monday.

An investigation into the effects of the 2017 Tax Cuts and Jobs Act found that while the law has not delivered the promised boost in wages or business investment, it has fattened the pockets of the Republican lawmakers who ushered the measure through Congress despite widespread public opposition.

The Center for Public Integrity (CPI) and Vox published a joint article Friday detailing how the tax law--dubbed the "GOP tax scam" by opponents--"likely saved members of Congress hundreds of thousands of dollars in taxes collectively, while the corporate tax cut hiked the value of their holdings."

"The 10 richest Republicans in Congress in 2017 who voted for the tax bill held more than $731 million in assets, almost two-thirds of which were in stocks, bonds, mutual funds, and other instruments."

--Peter Cary, Center for Public Integrity

The $1.5 trillion in tax cuts, signed into law by President Donald Trump in December of 2017, slashed the top individual tax rate from 39.6% to 37% and the corporate rate from 35% to 21%.

Peter Cary, reporter for CPI and the lead author of the investigation, noted it is impossible to determine precisely how much money Republican lawmakers saved as a result of the tax law because members of Congress are not required to disclose their tax returns. But the windfall was likely substantial, Cary wrote, given the massive boost in stock prices the law sparked.

"Cutting tax rates for companies like Apple and hundreds of other stocks they own was one of many ways Republican lawmakers enriched themselves after they passed the tax law," Cary wrote. "Democrats also stood to gain from the tax bill, though not one voted for it; all but 12 Republicans voted for the tax bill."

"The 10 richest Republicans in Congress in 2017 who voted for the tax bill held more than $731 million in assets, almost two-thirds of which were in stocks, bonds, mutual funds, and other instruments," Cary added, citing Roll Call's analysis of Congress' wealth.

Jeff Hauser, director of the Revolving Door Project at the Center for Economic and Policy Research, told CPI and Vox that lawmakers profiting off legislation they crafted "feels to me like a kleptocracy."

According to the CPI/Vox analysis, "all but one of the 47 Republicans who sat on the three key committees overseeing the drafting of the tax bill own stocks and stock mutual funds."

The investigation cited a provision in the tax law that rewarded real estate companies and investors as a particularly egregious example of Republican self-dealing.

"One Republican senator who benefited from the last-minute provision was Tennessee's [Republican Sen.] Bob Corker, who at the time owned or was a partner in 18 real estate businesses, LLCs, and partnerships, records show," Cary wrote. "His reported income from them was between $2.1 million and $11.1 million in 2017."

Critics named the provision the "Corker Kickback" after the Tennessee senator, who retired from Congress in 2018.

"It's bad enough that President Trump's and congressional Republicans' GOP tax scam betrayed workers--it's even worse that they're lining their own pockets off it," Sen. Sherrod Brown (D-Ohio), a member of the Senate Finance Committee, tweeted Monday.