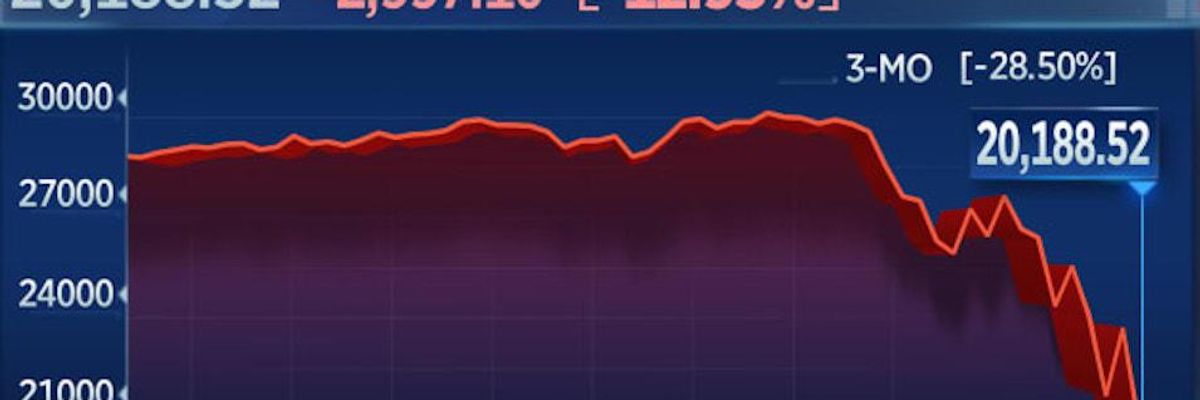

The Dow Jones Industrial Average fell nearly 3,000 points by the end of trading Monday as part of the stock market's 12.9% drop--its second worst one-day decline ever, after the "Black Monday" crash in 1987--on fears of continuing economic stoppage due to the coronavirus outbreak which has covered the planet.

"Who needs Disneyland when the stock market is currently the wildest ride on the planet," tweetedMedia Matters researcher Nikki McCann Ramirez.

Monday's drop followed an attempt by the Federal Reserve to stabilize markets with an interest rate cut.

"The market will take care of itself," President Donald Trump said at a White House press conference Monday afternoon as the bell rang in New York.

At the beginning of trading Monday stocks fell so fast that they tripped the "circuit breaker," which suspends trading for 15 minutes to give markets a chance to recover from losses of 7%. The circuit breaker kicks on again at 13%.

"While the news continues to worsen and with the price action doing things we've only seen a handful of other times in the last century, it's nearly impossible to keep things in perspective," Instinet executive director Frank Cappelleri toldCNBC.

The economic slowdown spurred by the coronavirus outbreak has already done major damage to the economies of China, South Korea, Japan, and the European Union. Investors fear the U.S. is next and told CNBC they were unlikely to jump back into the market until the disease had passed its peak.

"The market is at the mercy of the virus and at the mercy of whether the containment policies work," said Quincy Krosby, a Prudential Financial chief market strategist.