Democratic congressional leaders expressed optimism Tuesday after the White House agreed in closed-door negotiations to allow independent "oversight" of a $500 billion corporate bailout program proposed by Senate Republicans in their $2 trillion coronavirus stimulus bill.

But progressive critics warned the oversight mechanisms that the White House reportedly agreed to--an independent inspector general and an oversight board--would not be nearly enough to prevent the Trump administration from abusing a massive program that Democratic lawmakers earlier this week characterized as a corporate "slush fund."

"Oversight isn't a substitute for real rules. You need concrete prohibitions against abusive activity. Without them, the best oversight panel in the world is basically a PR team for decency."

--Zach Carter, HuffPost

"You're absolutely dreaming if you think a nasty inspector general report... is gonna stop Donald Trump from misusing this $500 billion loan program," tweeted Farhad Manjoo, opinion columnist at the New York Times. "Are you kidding?"

Joe Cirincione, president of the Ploughshares Fund, called the oversight proposals "much too weak."

"Now it's a slush fund with reporting requirements," tweeted Cirincione. "Trump will blow right through any 'oversight.'"

While the details of the stimulus plan are still being hashed out behind the scenes, Senate Minority Leader Chuck Schumer (D-N.Y.) said in a speech on the Senate floor Tuesday that Democratic negotiators have "been pushing hard" for adequate transparency for any corporate bailout funds in order to ensure "these things are on the level."

"We would like very much, and believe we should have, a congressional oversight board," said Schumer, who said a final deal on the sprawling stimulus package could come as early as Tuesday afternoon.

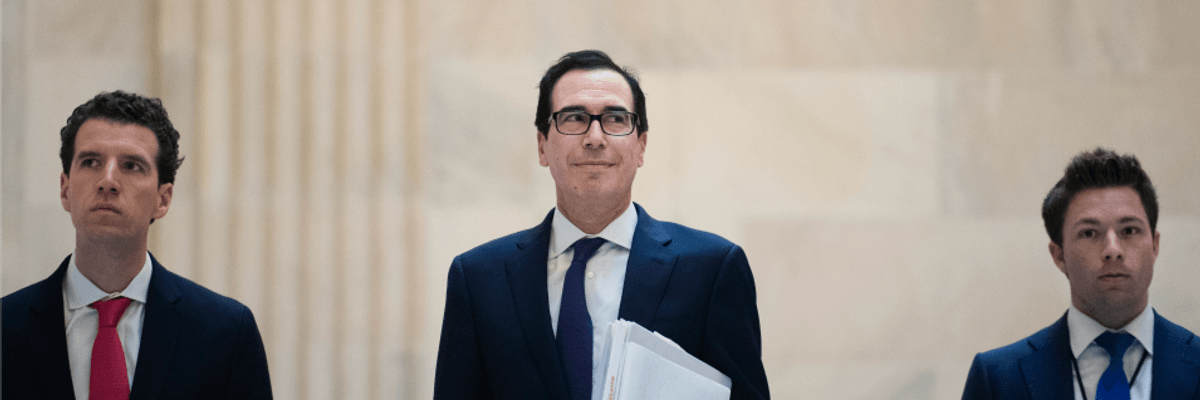

House Speaker Nancy Pelosi (D-Calif.), who on Monday unveiled a $2.5 trillion stimulus proposal in the House, threw her support behind negotiations between Schumer and Treasury Secretary Steve Mnuchin on Tuesday.

The Washington Postreported Tuesday morning that Trump administration officials "agreed to allow an independent inspector general and an oversight board to scrutinize the lending decisions."

"The most recent precedent for this is the $700 billion Troubled Asset Relief Program that was created during the 2008 financial crisis," the Post noted. "To oversee TARP, Congress created an independent inspector general, a regulatory oversight board and a congressional oversight panel. Over the course of several years, investigations uncovered numerous cases of fraud at large and small companies as firms sought to obtain taxpayer money through various programs."

HuffPost senior reporter Zach Carter noted in a series of tweets Tuesday that while TARP oversight teams did great work exposing misuse of taxpayer funds during the financial crisis, "the abuse continued" nonetheless.

"You can't do a big bailout without oversight," Carter wrote. "Somebody has to enforce the rules. But oversight isn't a substitute for real rules. You need concrete prohibitions against abusive activity. Without them, the best oversight panel in the world is basically a PR team for decency."

Zephyr Teachout, a professor at the Fordham University School of Law and anti-corruption expert, cautioned Democrats against accepting toothless oversight requirements that do nothing to prevent corporate or government malfeasance.

The $500 billion program--officially called the "Exchange Stabilization Fund"--has been one of the key sticking points in negotiations over Senate Republicans' stimulus measure, which failed two consecutive procedural votes Sunday and Monday as Democrats held the line to stop the bill from advancing.

The original legislation would have handed Mnuchin--a former Goldman Sachs executive--sweeping authority over the program with little to no oversight. The language of the bill would have allowed Mnuchin to withhold from Congress the names of companies that receive federal bailout money and how much they receive for up to six months.

Asked about the lack of oversight for the proposed fund during a press briefing Monday evening, President Donald Trump said, "I'll be the oversight."

"We're going to make good deals," said Trump, who has refused to vow that his own companies will not benefit from the corporate bailout funds.

Jeff Hauser, director of the Revolving Door Project, asked in a tweet Tuesday why congressional Democrats would give the Trump White House any control over such an enormous bailout fund.

"If Trump's superpower is shamelessness," Hauser wrote, "why is there a bailout with any executive branch discretion?"

"Trump's team violates lawful requests for information constantly, including Mnuchin on Trump's tax returns," Hauser added. "Trusting Mnuchin to share information with oversight suggests Democratic leadership never heard the story of the boy who cried wolf."