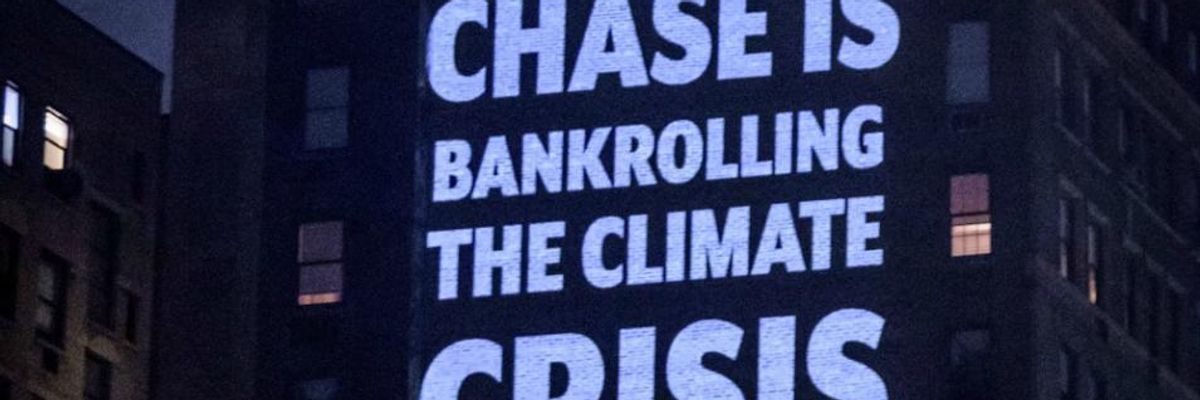

Activist and shareholder frustrations with JPMorgan Chase's funding of global climate catastrophe were on full display Tuesday during the multinational investment bank's virtual Annual General Meeting.

"The pressure Chase faced on climate at today's meeting and the votes showing unprecedented support for climate accountability are proof that the movement to push Chase and other big banks to clean up their act on climate is only gaining momentum and power."

--Ben Cushing, Sierra Club

In a clear signal of support for reforming the lending practices of the world's largest private bank to ensure a habitable future planet, 49.6% of shareholders voted in favor of a resolution that asked JPMorgan to craft a plan to better align its operations with the Paris climate agreement's goal of limiting global temperature rise to 1.5degC.

Welcoming that vote in a statement Tuesday, Sierra Club campaigner Ben Cushing declared that "the days when Chase could quietly funnel money into the fossil fuel industry without the public taking notice are over."

"The pressure Chase faced on climate at today's meeting and the votes showing unprecedented support for climate accountability are proof that the movement to push Chase and other big banks to clean up their act on climate is only gaining momentum and power," Cushing said. "This is only the beginning, and we'll continue to demand meaningful changes to align Chase's investments with a climate-safe future."

The development was also celebrated by Danielle Fugere, president of the nonprofit shareholder advocacy group As You Sow. "Shareholders today sent the message that it is past time for Chase to catch up with its peers, implement a strategy to decarbonize and de-risk its lending portfolio, and help build a more secure future for all," she said.

Since the landmark Paris accord was adopted in late 2015, JPMorgan has provided over a quarter of a trillion dollars in fossil fuel financing. That has made the bank a top target of climate activists--including Stop the Money Pipeline, a campaign launched in January by a coalition of advocacy groups to pressure banks, insurers, and asset managers to cut ties with planet-wrecking companies.

"As the world's largest funder of fossil fuels, JPMorgan Chase has a decision to make--either recognize growing global climate risk and dramatically reduce its fossil fuel funding or continue irresponsibly driving global temperature rise to greater and more devastating impacts," said Fugere. She noted that As You Sow withdrew similar proposals at Wells Fargo, Morgan Stanley, Bank of America, and Goldman Sachs after the banks made climate commitments.

"It is critical that financial heavyweight JPMorgan Chase accelerate ambition to clean up its fossil fuel financing," Fugere added. "JPMorgan's inaction in the face of the staggering risks of climate change is noteworthy and unacceptable. Investors can no longer tolerate business as usual in these unprecedented times."

JPMorgan announced in February that it would stop financing extraction projects in the Arctic and phase out loans for coal by 2024 but continue funding oil and gas developments. At the time, activists called the moves "small concessions" but also evidence that "citizen power can work."

Eli Kasargod-Staub, executive director of nonprofit shareholder advocacy group Majority Action, said Tuesday that "instead of vague professions of support of the Paris agreement, JPMorgan must commit to the goal of achieving net-zero CO2 financed emissions by 2050 and disclose their plans for how they will realign their lending and underwriting strategies to achieve this goal."

During the annual meeting, JP Morgan also faced pressure to oust from its board of directors Lee Raymond, an ex-CEO of oil giant ExxonMobil who was quietly demoted from his longtime leadership role at the bank earlier this month due to activist and investor demands. Additionally, 41.96% of shareholder voted to split the roles of board chair and CEO, which activists lauded as a rebuke to Jamie Dimon, who holds both positions.

"This shareholders' revolt against Jamie Dimon's failed record on climate change shows that JPMorgan Chase's days of acting as the house bank of the fossil fuel industry will have to end," Patrick McCully, Climate & Energy Program director at Rainforest Action Network, said in a statement.

"The unprecedented share of the votes against management," he said, "and the fact that JPMorgan had to demote climate denier Lee Raymond from his board leadership role, shows that investors agree with activists that business as usual in financing fossil fuels is no longer acceptable."

Although Raymond's demotion pleased activists, 350.org senior strategist Richard Brooks urged the bank to go further. As he put it: "While demoting climate-denying Lee Raymond as lead independent director after 19 years is a start, this is just the tip of the melting iceberg of what needs to happen at JPMorgan Chase."

"The future is not in financing risky, bankrupt prone fossil fuel companies wrecking our climate," Brooks added. "It is in investing in community driven climate solutions. The climate related shareholder votes signal it's time for an overhaul at JPMorgan and we aren't going to stop until we achieve that."

Brooks also took to Twitter Tuesday to share a Daily News op-ed called for Raymond's removal:

The op-ed was co-authored by Boston University fellow Neva Goodwin, Rockefeller Family Fund president Miranda Kaiser, and New York City Comptroller Scott Stringer; Goodwin and Kaiser are the daughter and granddaughter of former Chase chairman David Rockefeller. In the article, they also took aim at the bank's lending practices.

"In contrast, a coalition of 130 banks and competitors to JPMorgan, including Citigroup and Barclays, have committed to aligning their investment actions with the goals of the Paris climate agreement," the trio wrote. "Rather than trying to capitalize on a global energy transition, JPMorgan's financing of fossil fuels today locks in emissions for decades to come. This places JPMorgan at the back of the pack and drastically behind the curve."