SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

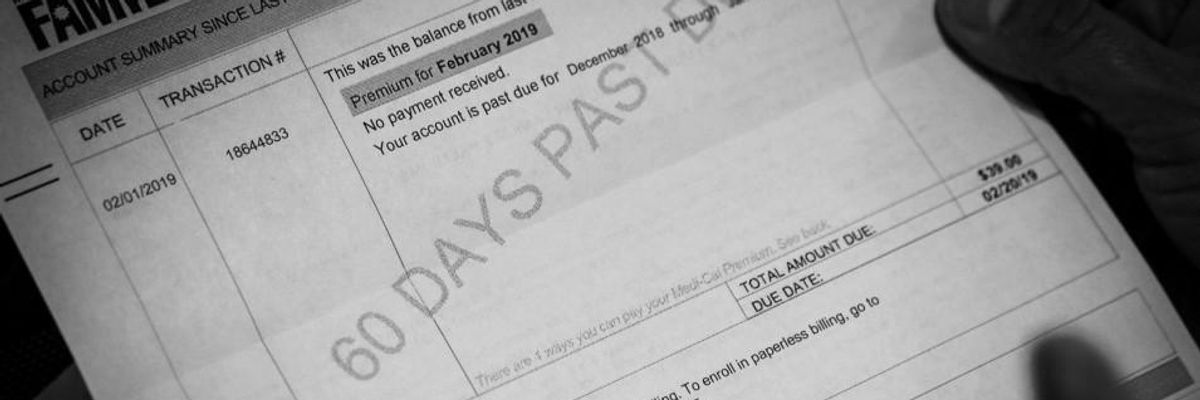

Vicki Ibarra opens a late medical bill for her son at her home on Saturday, February 2, 2019 in Fresno, California. (Photo: Jabin Botsford/The Washington Post via Getty Images)

As millions across the nation lose their employer-tied healthcare coverage amid the Covid-19 pandemic and economic crash, a Gallup poll released Tuesday shows Americans are increasingly concerned a major health event could lead to bankruptcy.

According to the survey of 1,007 people conducted July 1-24, 50% of respondents are concerned or extremely concerned about such a possibility--a five-point increase from the 45% measured last year.

The concern was expressed nearly equally among women (51%) and men (49%). Concern among men jumped 7 percentage points compared to the January-February 2019 survey, while concern among women increased four points.

Among non-whites, concern about a health event-driven bankruptcy spiked 12%, surging from 52% to 64% in the new poll.

A similar uptick was seen in adults aged 29 and younger, increasing from 43% to 55%. For those aged 30-49, concern went up 9 points, going from 46% to 55%.

\u201cDuring a pandemic, this should ring some alarm bells.\n\n50% in U.S. Fear Bankruptcy Due to Major Health Event https://t.co/skCQ7hcdQa\u201d— Dr Andrew Salerno-Garthwaite (@Dr Andrew Salerno-Garthwaite) 1598952085

Gallup's poll also revealed that 15% of adults said someone in their household currently is saddled with medical debt they don't expect to pay off in the next 12 months. And the burden is overwhelmingly likely to be felt by those in lower income brackets. Twenty-eight percent of those in households making less than $40,000 annually said they had that long term medical debt compared to just 6% of those making more than $100,000.

If faced with a $500 medical bill, 26% of those surveyed said they would need to borrow money to pay it. Such a scenario, Gallup noted, "is likely to feed into a cycle of accumulating medical debt that cannot be readily repaid."

The findings come as the coronavirus crisis continues to spotlight the inequities of the U.S. healthcare system. A national analysis out last month from the Economic Policy Institute, for example, estimated that roughly 12 million people have lost access to employer-sponsored healthcare coverage since February.

Those losses have bolstered Medicare for All advocates' demands for a single-payer healthcare system and cancellation of medical debt.

Among those who've called for such a transformation is healthcare activist Ady Barkan. In remarks delivered at the Democratic National Convention last month, Barkan said, "We live in the richest country in history, and yet we do not guarantee this most basic human right."

"Everyone living in America should get the healthcare they need," he said, "regardless of their employment status or ability to pay."

Trump and Musk are on an unconstitutional rampage, aiming for virtually every corner of the federal government. These two right-wing billionaires are targeting nurses, scientists, teachers, daycare providers, judges, veterans, air traffic controllers, and nuclear safety inspectors. No one is safe. The food stamps program, Social Security, Medicare, and Medicaid are next. It’s an unprecedented disaster and a five-alarm fire, but there will be a reckoning. The people did not vote for this. The American people do not want this dystopian hellscape that hides behind claims of “efficiency.” Still, in reality, it is all a giveaway to corporate interests and the libertarian dreams of far-right oligarchs like Musk. Common Dreams is playing a vital role by reporting day and night on this orgy of corruption and greed, as well as what everyday people can do to organize and fight back. As a people-powered nonprofit news outlet, we cover issues the corporate media never will, but we can only continue with our readers’ support. |

As millions across the nation lose their employer-tied healthcare coverage amid the Covid-19 pandemic and economic crash, a Gallup poll released Tuesday shows Americans are increasingly concerned a major health event could lead to bankruptcy.

According to the survey of 1,007 people conducted July 1-24, 50% of respondents are concerned or extremely concerned about such a possibility--a five-point increase from the 45% measured last year.

The concern was expressed nearly equally among women (51%) and men (49%). Concern among men jumped 7 percentage points compared to the January-February 2019 survey, while concern among women increased four points.

Among non-whites, concern about a health event-driven bankruptcy spiked 12%, surging from 52% to 64% in the new poll.

A similar uptick was seen in adults aged 29 and younger, increasing from 43% to 55%. For those aged 30-49, concern went up 9 points, going from 46% to 55%.

\u201cDuring a pandemic, this should ring some alarm bells.\n\n50% in U.S. Fear Bankruptcy Due to Major Health Event https://t.co/skCQ7hcdQa\u201d— Dr Andrew Salerno-Garthwaite (@Dr Andrew Salerno-Garthwaite) 1598952085

Gallup's poll also revealed that 15% of adults said someone in their household currently is saddled with medical debt they don't expect to pay off in the next 12 months. And the burden is overwhelmingly likely to be felt by those in lower income brackets. Twenty-eight percent of those in households making less than $40,000 annually said they had that long term medical debt compared to just 6% of those making more than $100,000.

If faced with a $500 medical bill, 26% of those surveyed said they would need to borrow money to pay it. Such a scenario, Gallup noted, "is likely to feed into a cycle of accumulating medical debt that cannot be readily repaid."

The findings come as the coronavirus crisis continues to spotlight the inequities of the U.S. healthcare system. A national analysis out last month from the Economic Policy Institute, for example, estimated that roughly 12 million people have lost access to employer-sponsored healthcare coverage since February.

Those losses have bolstered Medicare for All advocates' demands for a single-payer healthcare system and cancellation of medical debt.

Among those who've called for such a transformation is healthcare activist Ady Barkan. In remarks delivered at the Democratic National Convention last month, Barkan said, "We live in the richest country in history, and yet we do not guarantee this most basic human right."

"Everyone living in America should get the healthcare they need," he said, "regardless of their employment status or ability to pay."

As millions across the nation lose their employer-tied healthcare coverage amid the Covid-19 pandemic and economic crash, a Gallup poll released Tuesday shows Americans are increasingly concerned a major health event could lead to bankruptcy.

According to the survey of 1,007 people conducted July 1-24, 50% of respondents are concerned or extremely concerned about such a possibility--a five-point increase from the 45% measured last year.

The concern was expressed nearly equally among women (51%) and men (49%). Concern among men jumped 7 percentage points compared to the January-February 2019 survey, while concern among women increased four points.

Among non-whites, concern about a health event-driven bankruptcy spiked 12%, surging from 52% to 64% in the new poll.

A similar uptick was seen in adults aged 29 and younger, increasing from 43% to 55%. For those aged 30-49, concern went up 9 points, going from 46% to 55%.

\u201cDuring a pandemic, this should ring some alarm bells.\n\n50% in U.S. Fear Bankruptcy Due to Major Health Event https://t.co/skCQ7hcdQa\u201d— Dr Andrew Salerno-Garthwaite (@Dr Andrew Salerno-Garthwaite) 1598952085

Gallup's poll also revealed that 15% of adults said someone in their household currently is saddled with medical debt they don't expect to pay off in the next 12 months. And the burden is overwhelmingly likely to be felt by those in lower income brackets. Twenty-eight percent of those in households making less than $40,000 annually said they had that long term medical debt compared to just 6% of those making more than $100,000.

If faced with a $500 medical bill, 26% of those surveyed said they would need to borrow money to pay it. Such a scenario, Gallup noted, "is likely to feed into a cycle of accumulating medical debt that cannot be readily repaid."

The findings come as the coronavirus crisis continues to spotlight the inequities of the U.S. healthcare system. A national analysis out last month from the Economic Policy Institute, for example, estimated that roughly 12 million people have lost access to employer-sponsored healthcare coverage since February.

Those losses have bolstered Medicare for All advocates' demands for a single-payer healthcare system and cancellation of medical debt.

Among those who've called for such a transformation is healthcare activist Ady Barkan. In remarks delivered at the Democratic National Convention last month, Barkan said, "We live in the richest country in history, and yet we do not guarantee this most basic human right."

"Everyone living in America should get the healthcare they need," he said, "regardless of their employment status or ability to pay."