Consumer advocates voiced outrage Friday in response to a finalized rule from the Trump administration's Consumer Financial Protection Bureau, warning the move would allow debt collectors to "aggravate vulnerable consumers with even more harassment and a flood of electronic communication."

The CFPB, directed by President Donald Trump appointee Kathy Kraninger, released the rule Friday, a day after the U.S. saw another record high daily number of coronavirus cases.

"The last thing struggling families need right now is to be harassed by a debt collector."

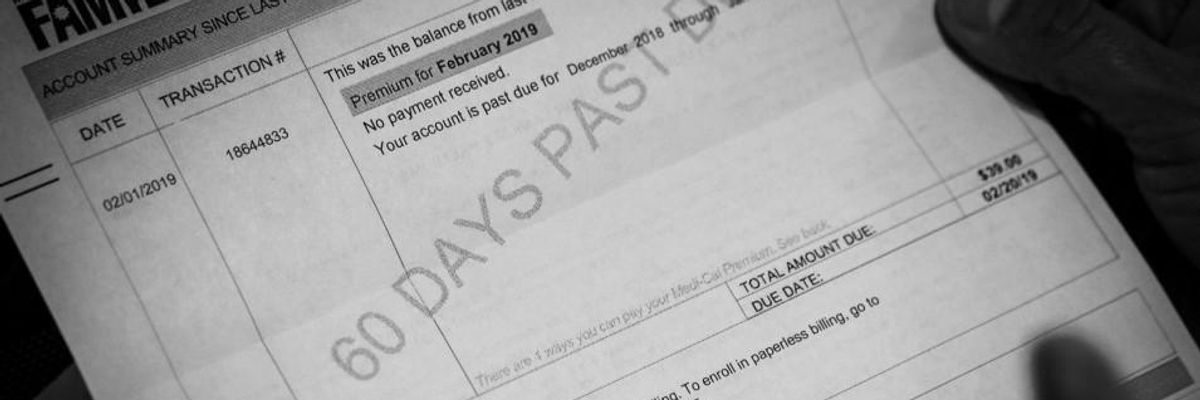

--April Kuehnhoff, National Consumer Law Center"Millions of Americans are out of work and taking on crushing levels of debt no thanks to the recession that followed President Trump's refusal to take the pandemic seriously. And now the Trump administration is adding insult to injury letting debt collectors endlessly harass struggling families who are choosing between food and paying bills," said Allied Progress spokesperson Jeremy Funk in a statement.

The Fair Debt Collection Practices Act affects a significant portion of the country. The Urban Institute said in April that 68 million Americans held debt in collections. Thirty-one percent of communities nationwide hold such debt, compared to 42% of communities of color. The organization said the figures would likley increase in light of the pandemic.

Applauded by House Republicans, the rule will "help clarify" how debt collectors can contact consumers, the CFPB asserted.

That's not the takeaway from a coalition of consumer advocates.

While still parsing through the details outlined in the 653-page rule, the groups--the National Consumer Law Center, Americans for Financial Reform Education Fund, Center for Responsible Lending, Consumer Federation of America, and the National Association of Consumer Advocates--identified as concerning two aspects of the changes.

They warned that debt collectors could be allowed to "harass consumers with a call every day of the week, and several calls a day for consumers who owe multiple debts," and "use emails, text messages, and social media private messages without consumer consent, which could lead to more electronic harassment or to missed communications if sent to old email addresses."

"We appreciate that the CFPB has modified many aspects of the rule in response to our concerns, but with millions of Americans scraping by amid the economic fallout from a global pandemic, the rule still allows debt collectors to make excessive, harassing calls," said National Consumer Law Center attorney April Kuehnhoff.

"The last thing struggling families need right now is to be harassed by a debt collector," she said.

Rachel Gittleman, financial services outreach manager with the Consumer Federation of America, also drew attention to the "unprecedented financial challenges in the wake of the pandemic" many households are facing. Although "the most harmful parts" of the CFPB's initial proposal aren't included, Gittleman says the rule still fails "to protect consumers, especially consumers of color who have a drastically larger share of debt in collections than white communities, from harassing calls and electronic communication."

"Through the guise of modernization," added Christine Hines, legislative director at National Association of Consumer Advocates, "the debt collection rule could open the gate for collectors to aggravate vulnerable consumers with even more harassment and a flood of electronic communications."

The fact that the new rulemaking comes just months after the agency finalized a rule consumer advocates said could set consumers up for predatory "debt traps" amid the pandemic wasn't lost on Allied Progress's Funk, who called "the Trump debt collection spam rule... the administration's latest gift to wealthy donors at the expense of consumers."

An additional part of the CFPB's debt collection rules affecting so-called (pdf) "zombie debt" is expected from the Trump administration in December, capping off a year in which debt collectors have made a killing.