The Longview Power Plant, a coal-fired plant, stands on August 21, 2018 in Maidsville, West Virginia. (Photo: Spencer Platt/Getty Images)

To donate by check, phone, or other method, see our More Ways to Give page.

The Longview Power Plant, a coal-fired plant, stands on August 21, 2018 in Maidsville, West Virginia. (Photo: Spencer Platt/Getty Images)

Underscoring expert warnings about the inadequacy of current global pledges to cut planet-heating emissions, the world's largest climate-focused investor initiative released an analysis Monday detailing how the biggest corporate polluters are falling short in terms transitioning to net-zero businesses by 2050 or sooner.

"While the oil and gas industry claims to care about the climate, it is failing utterly to put its money where its mouth is."

--Kelly Trout, OCI

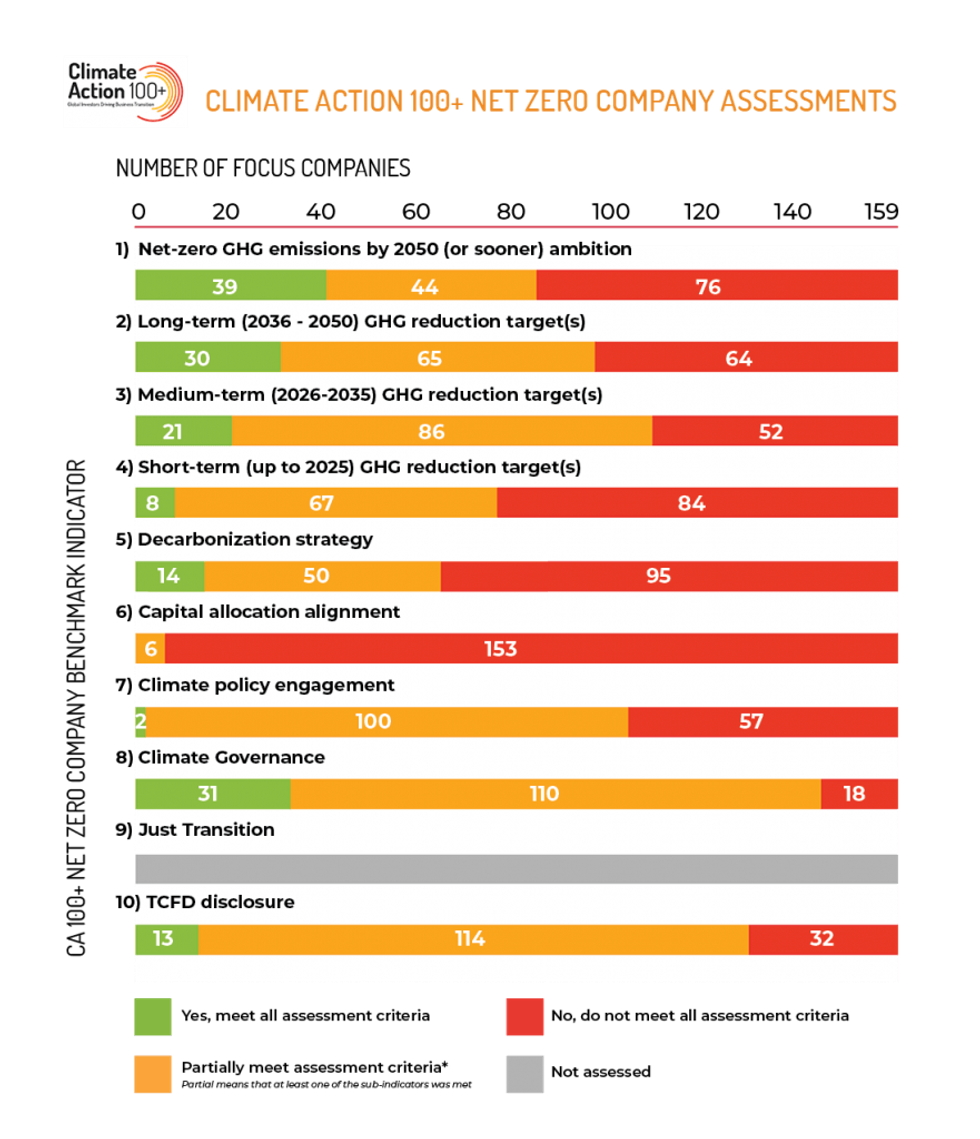

After sending letters last September to companies responsible for the most greenhouse gas (GHG) emissions and calling on them to urgently pursue net-zero goals, Climate Action 100+ (CA100+) released its Net-Zero Company Benchmark, rating 159 "focus list" firms from multiple industries on their plans and action to reduce emissions, improve governance, and strengthen climate-related financial disclosures.

Lila Holzman, senior energy program manager of As You Sow, called the new assessments "the latest example of a clear signal from investors on the actions they expect companies to take on climate change" and said that her shareholder advocacy group, which is a member of CA100+, looks forward to "seeing this tool evolve and provide a baseline bar that all companies must meet."

\u201cNew #ClimateAction100+ Net-Zero Company Benchmark reveals that 87% of focus companies have either board-level oversight or board/CEO responsibility for #climatechange, but only a third tie CEO and/or senior executive remuneration to emission reduction targets.\u201d— Climate Action 100+ (@Climate Action 100+) 1616419276

Rather than scoring or ranking various companies, or doling out numeric or alphabetic ratings, the benchmark addresses short-, medium-, and long-term GHG reduction targets; decarbonization strategies; capital allocation alignment; climate policy engagement; climate governance; and disclosures in terms of a net-zero emissions future and the Paris climate agreement's 1.5degC temperature goal.

CA100+ found that 83 of the companies--or 52%--have set "an ambition to achieve net-zero by 2050 or sooner. However, roughly half of these commitments (44) do not cover the full scope of the companies' most material emissions."

The benchmark also reveals that:

"The Climate Action 100+ Net-Zero Company Benchmark moves us from 'why' to 'how' companies make the net-zero transition," said Anne Simpson, a CA100+ Steering Committee member and managing investment director of board governance and sustainability at CalPERS. "It sets out the indicators that matter to investors."

"We cannot manage what we cannot measure," she added. "The benchmark gives us the tool needed for engagement and to inform our proxy voting. The first assessments show the scale of ambition, where we are, and where we need to get to, with measures along the way. We're in the foothills of a long climb. This is tough, but necessary."

Launched in December 2017, CA100+ now involves more than 570 investors responsible for over $54 trillion in assets under management. The initiative's work is coordinated by the Asia Investor Group on Climate Change (AIGCC), Ceres, Investor Group on Climate Change (IGCC), Institutional Investors Group on Climate Change (IIGCC), and Principles for Responsible Investment (PRI).

The benchmark's development was aided by climate research and data groups including Carbon Tracker Initiative, 2deg Investing Initiative, InfluenceMap (IM), and Transition Pathway Initiative (TPI), which conducted the company disclosure analysis with support from the Grantham Research Institute on Climate Change and the Environment at the London School of Economics and FTSE Russell.

Maarten Vleeschhouwer of 2deg Investing Initiative called the benchmark "a wake-up call to investors and companies worldwide, showing that far more specific, concrete, and ambitious action plans are needed in order to make the promise of a net-zero future a reality."

Vleeschhouwer, whose group provided insights on the power and automotive sectors, added that the analysis shows "the vast majority of companies in these carbon-critical sectors are still not aligned with the Paris agreement goals, underscoring the need for these firms to improve their climate action and transparency efforts."

\u201c\u201cThe world\u2019s largest corporate emitters have an opportunity to act quickly to distinguish themselves from their peers, and move forward with plans to become net-zero businesses.\u201d via\n\u2066@Climate @CeresNews @MindyLubber https://t.co/OHgvJ2XiQ0\u201d— Climate Action 100+ (@Climate Action 100+) 1616434907

Although the focus companies cover a range of sectors, Kelly Trout, senior research analyst at Oil Change International (OCI), specifically took aim at the fossil fuel industry in a statement Monday.

"This analysis reconfirms the obvious. No Big Oil and Gas company has a serious plan to wind down its fossil fuel operations at a pace that comes anywhere close to aligning with the critical 1.5degC limit," said Trout, referencing a recent report from her group outlining oil majors' failed climate commitments.

"While the oil and gas industry claims to care about the climate, it is failing utterly to put its money where its mouth is," she said, arguing that the new findings should serve as a call to action. "The reality is that disclosure and superficial target-setting is not enough."

"Oil and gas companies can prove they are serious about the climate crisis by immediately ceasing to develop new oil and gas extraction and putting their production into a rapid decline," Trout concluded. "Short of that, there is no time left for investors to dillydally. Either they use their voting power to pass resolutions that force companies like Shell, Total, and Exxon to begin immediately phasing out oil and gas extraction, or they ditch these dirty investments once and for all."

Trump and Musk are on an unconstitutional rampage, aiming for virtually every corner of the federal government. These two right-wing billionaires are targeting nurses, scientists, teachers, daycare providers, judges, veterans, air traffic controllers, and nuclear safety inspectors. No one is safe. The food stamps program, Social Security, Medicare, and Medicaid are next. It’s an unprecedented disaster and a five-alarm fire, but there will be a reckoning. The people did not vote for this. The American people do not want this dystopian hellscape that hides behind claims of “efficiency.” Still, in reality, it is all a giveaway to corporate interests and the libertarian dreams of far-right oligarchs like Musk. Common Dreams is playing a vital role by reporting day and night on this orgy of corruption and greed, as well as what everyday people can do to organize and fight back. As a people-powered nonprofit news outlet, we cover issues the corporate media never will, but we can only continue with our readers’ support. |

Underscoring expert warnings about the inadequacy of current global pledges to cut planet-heating emissions, the world's largest climate-focused investor initiative released an analysis Monday detailing how the biggest corporate polluters are falling short in terms transitioning to net-zero businesses by 2050 or sooner.

"While the oil and gas industry claims to care about the climate, it is failing utterly to put its money where its mouth is."

--Kelly Trout, OCI

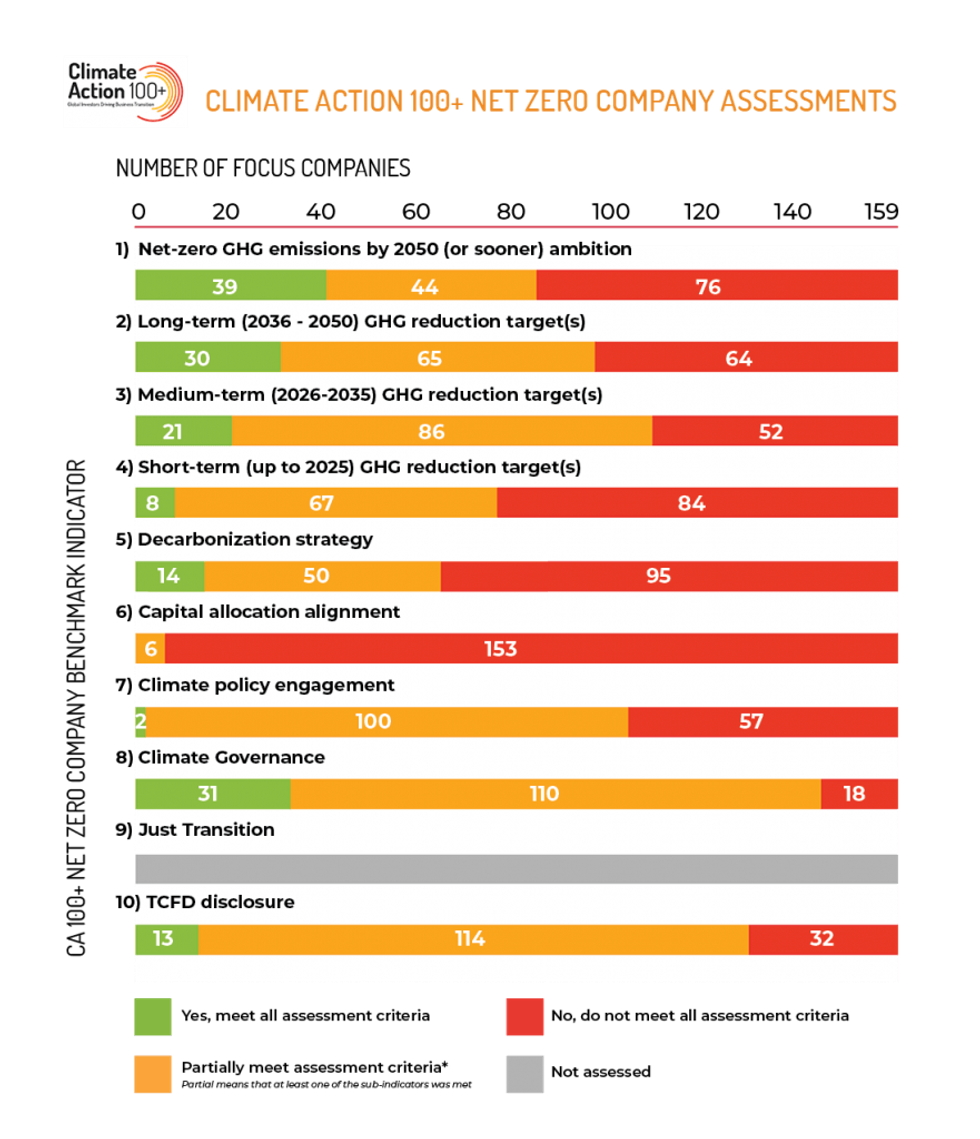

After sending letters last September to companies responsible for the most greenhouse gas (GHG) emissions and calling on them to urgently pursue net-zero goals, Climate Action 100+ (CA100+) released its Net-Zero Company Benchmark, rating 159 "focus list" firms from multiple industries on their plans and action to reduce emissions, improve governance, and strengthen climate-related financial disclosures.

Lila Holzman, senior energy program manager of As You Sow, called the new assessments "the latest example of a clear signal from investors on the actions they expect companies to take on climate change" and said that her shareholder advocacy group, which is a member of CA100+, looks forward to "seeing this tool evolve and provide a baseline bar that all companies must meet."

\u201cNew #ClimateAction100+ Net-Zero Company Benchmark reveals that 87% of focus companies have either board-level oversight or board/CEO responsibility for #climatechange, but only a third tie CEO and/or senior executive remuneration to emission reduction targets.\u201d— Climate Action 100+ (@Climate Action 100+) 1616419276

Rather than scoring or ranking various companies, or doling out numeric or alphabetic ratings, the benchmark addresses short-, medium-, and long-term GHG reduction targets; decarbonization strategies; capital allocation alignment; climate policy engagement; climate governance; and disclosures in terms of a net-zero emissions future and the Paris climate agreement's 1.5degC temperature goal.

CA100+ found that 83 of the companies--or 52%--have set "an ambition to achieve net-zero by 2050 or sooner. However, roughly half of these commitments (44) do not cover the full scope of the companies' most material emissions."

The benchmark also reveals that:

"The Climate Action 100+ Net-Zero Company Benchmark moves us from 'why' to 'how' companies make the net-zero transition," said Anne Simpson, a CA100+ Steering Committee member and managing investment director of board governance and sustainability at CalPERS. "It sets out the indicators that matter to investors."

"We cannot manage what we cannot measure," she added. "The benchmark gives us the tool needed for engagement and to inform our proxy voting. The first assessments show the scale of ambition, where we are, and where we need to get to, with measures along the way. We're in the foothills of a long climb. This is tough, but necessary."

Launched in December 2017, CA100+ now involves more than 570 investors responsible for over $54 trillion in assets under management. The initiative's work is coordinated by the Asia Investor Group on Climate Change (AIGCC), Ceres, Investor Group on Climate Change (IGCC), Institutional Investors Group on Climate Change (IIGCC), and Principles for Responsible Investment (PRI).

The benchmark's development was aided by climate research and data groups including Carbon Tracker Initiative, 2deg Investing Initiative, InfluenceMap (IM), and Transition Pathway Initiative (TPI), which conducted the company disclosure analysis with support from the Grantham Research Institute on Climate Change and the Environment at the London School of Economics and FTSE Russell.

Maarten Vleeschhouwer of 2deg Investing Initiative called the benchmark "a wake-up call to investors and companies worldwide, showing that far more specific, concrete, and ambitious action plans are needed in order to make the promise of a net-zero future a reality."

Vleeschhouwer, whose group provided insights on the power and automotive sectors, added that the analysis shows "the vast majority of companies in these carbon-critical sectors are still not aligned with the Paris agreement goals, underscoring the need for these firms to improve their climate action and transparency efforts."

\u201c\u201cThe world\u2019s largest corporate emitters have an opportunity to act quickly to distinguish themselves from their peers, and move forward with plans to become net-zero businesses.\u201d via\n\u2066@Climate @CeresNews @MindyLubber https://t.co/OHgvJ2XiQ0\u201d— Climate Action 100+ (@Climate Action 100+) 1616434907

Although the focus companies cover a range of sectors, Kelly Trout, senior research analyst at Oil Change International (OCI), specifically took aim at the fossil fuel industry in a statement Monday.

"This analysis reconfirms the obvious. No Big Oil and Gas company has a serious plan to wind down its fossil fuel operations at a pace that comes anywhere close to aligning with the critical 1.5degC limit," said Trout, referencing a recent report from her group outlining oil majors' failed climate commitments.

"While the oil and gas industry claims to care about the climate, it is failing utterly to put its money where its mouth is," she said, arguing that the new findings should serve as a call to action. "The reality is that disclosure and superficial target-setting is not enough."

"Oil and gas companies can prove they are serious about the climate crisis by immediately ceasing to develop new oil and gas extraction and putting their production into a rapid decline," Trout concluded. "Short of that, there is no time left for investors to dillydally. Either they use their voting power to pass resolutions that force companies like Shell, Total, and Exxon to begin immediately phasing out oil and gas extraction, or they ditch these dirty investments once and for all."

Underscoring expert warnings about the inadequacy of current global pledges to cut planet-heating emissions, the world's largest climate-focused investor initiative released an analysis Monday detailing how the biggest corporate polluters are falling short in terms transitioning to net-zero businesses by 2050 or sooner.

"While the oil and gas industry claims to care about the climate, it is failing utterly to put its money where its mouth is."

--Kelly Trout, OCI

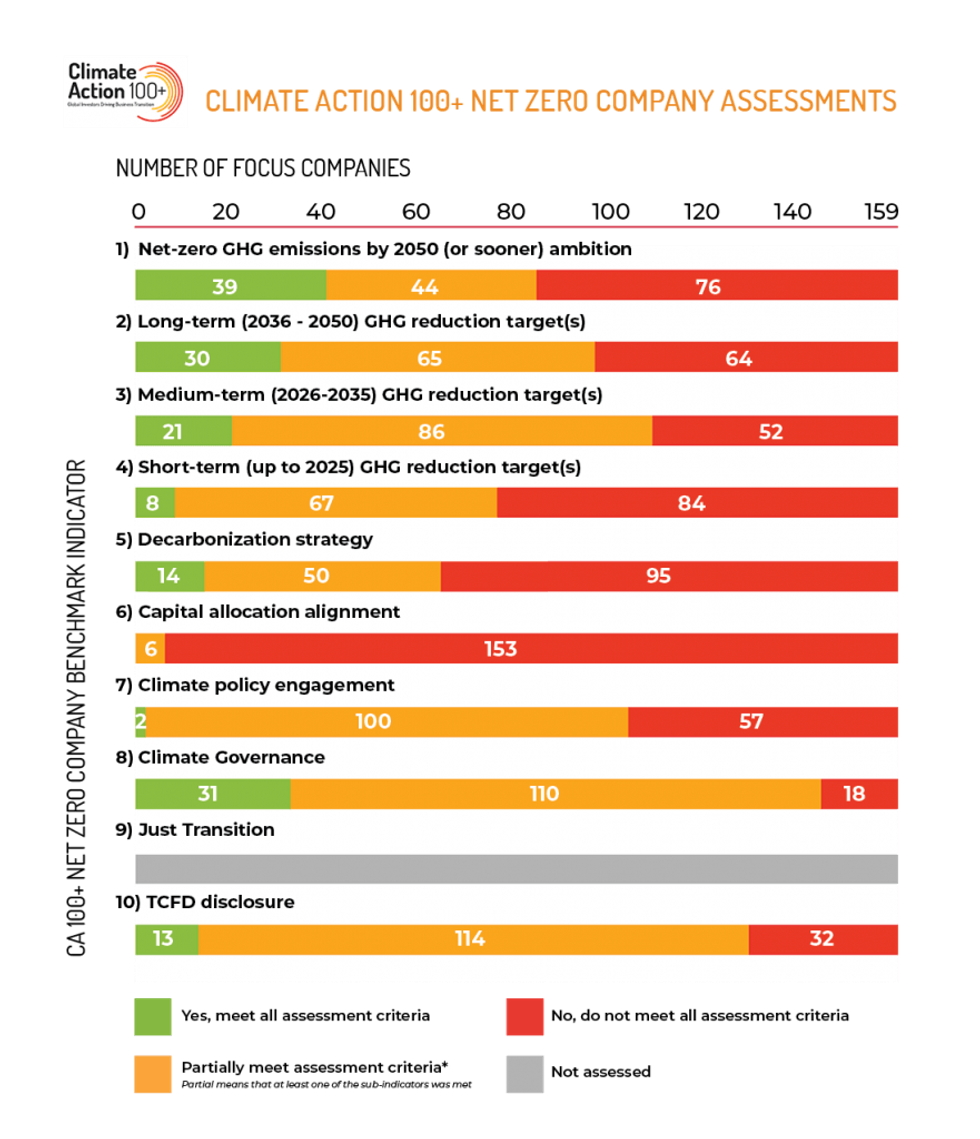

After sending letters last September to companies responsible for the most greenhouse gas (GHG) emissions and calling on them to urgently pursue net-zero goals, Climate Action 100+ (CA100+) released its Net-Zero Company Benchmark, rating 159 "focus list" firms from multiple industries on their plans and action to reduce emissions, improve governance, and strengthen climate-related financial disclosures.

Lila Holzman, senior energy program manager of As You Sow, called the new assessments "the latest example of a clear signal from investors on the actions they expect companies to take on climate change" and said that her shareholder advocacy group, which is a member of CA100+, looks forward to "seeing this tool evolve and provide a baseline bar that all companies must meet."

\u201cNew #ClimateAction100+ Net-Zero Company Benchmark reveals that 87% of focus companies have either board-level oversight or board/CEO responsibility for #climatechange, but only a third tie CEO and/or senior executive remuneration to emission reduction targets.\u201d— Climate Action 100+ (@Climate Action 100+) 1616419276

Rather than scoring or ranking various companies, or doling out numeric or alphabetic ratings, the benchmark addresses short-, medium-, and long-term GHG reduction targets; decarbonization strategies; capital allocation alignment; climate policy engagement; climate governance; and disclosures in terms of a net-zero emissions future and the Paris climate agreement's 1.5degC temperature goal.

CA100+ found that 83 of the companies--or 52%--have set "an ambition to achieve net-zero by 2050 or sooner. However, roughly half of these commitments (44) do not cover the full scope of the companies' most material emissions."

The benchmark also reveals that:

"The Climate Action 100+ Net-Zero Company Benchmark moves us from 'why' to 'how' companies make the net-zero transition," said Anne Simpson, a CA100+ Steering Committee member and managing investment director of board governance and sustainability at CalPERS. "It sets out the indicators that matter to investors."

"We cannot manage what we cannot measure," she added. "The benchmark gives us the tool needed for engagement and to inform our proxy voting. The first assessments show the scale of ambition, where we are, and where we need to get to, with measures along the way. We're in the foothills of a long climb. This is tough, but necessary."

Launched in December 2017, CA100+ now involves more than 570 investors responsible for over $54 trillion in assets under management. The initiative's work is coordinated by the Asia Investor Group on Climate Change (AIGCC), Ceres, Investor Group on Climate Change (IGCC), Institutional Investors Group on Climate Change (IIGCC), and Principles for Responsible Investment (PRI).

The benchmark's development was aided by climate research and data groups including Carbon Tracker Initiative, 2deg Investing Initiative, InfluenceMap (IM), and Transition Pathway Initiative (TPI), which conducted the company disclosure analysis with support from the Grantham Research Institute on Climate Change and the Environment at the London School of Economics and FTSE Russell.

Maarten Vleeschhouwer of 2deg Investing Initiative called the benchmark "a wake-up call to investors and companies worldwide, showing that far more specific, concrete, and ambitious action plans are needed in order to make the promise of a net-zero future a reality."

Vleeschhouwer, whose group provided insights on the power and automotive sectors, added that the analysis shows "the vast majority of companies in these carbon-critical sectors are still not aligned with the Paris agreement goals, underscoring the need for these firms to improve their climate action and transparency efforts."

\u201c\u201cThe world\u2019s largest corporate emitters have an opportunity to act quickly to distinguish themselves from their peers, and move forward with plans to become net-zero businesses.\u201d via\n\u2066@Climate @CeresNews @MindyLubber https://t.co/OHgvJ2XiQ0\u201d— Climate Action 100+ (@Climate Action 100+) 1616434907

Although the focus companies cover a range of sectors, Kelly Trout, senior research analyst at Oil Change International (OCI), specifically took aim at the fossil fuel industry in a statement Monday.

"This analysis reconfirms the obvious. No Big Oil and Gas company has a serious plan to wind down its fossil fuel operations at a pace that comes anywhere close to aligning with the critical 1.5degC limit," said Trout, referencing a recent report from her group outlining oil majors' failed climate commitments.

"While the oil and gas industry claims to care about the climate, it is failing utterly to put its money where its mouth is," she said, arguing that the new findings should serve as a call to action. "The reality is that disclosure and superficial target-setting is not enough."

"Oil and gas companies can prove they are serious about the climate crisis by immediately ceasing to develop new oil and gas extraction and putting their production into a rapid decline," Trout concluded. "Short of that, there is no time left for investors to dillydally. Either they use their voting power to pass resolutions that force companies like Shell, Total, and Exxon to begin immediately phasing out oil and gas extraction, or they ditch these dirty investments once and for all."