SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

Demonstrators march against offshore tax evasion and austerity on April 16, 2016 in London. (Photo: Kristian Buus/In Pictures via Getty Images Images)

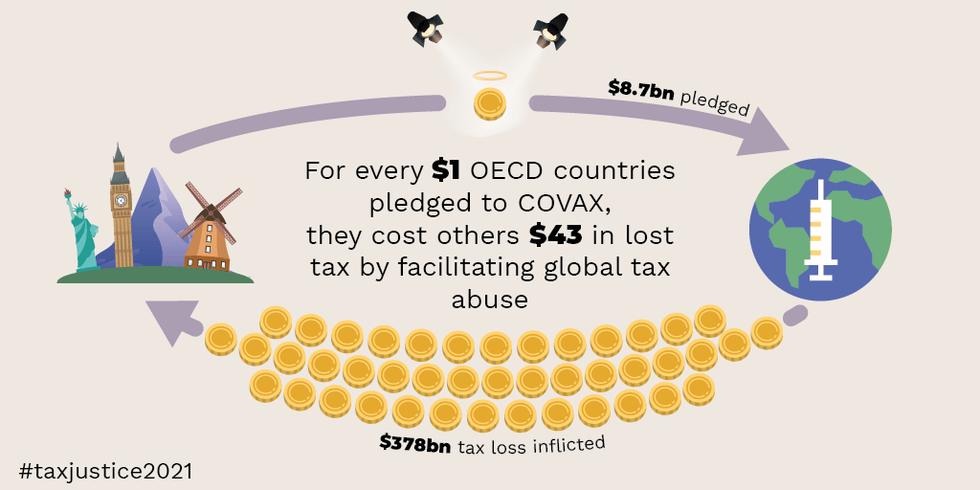

Ending abuses of the global tax system by the super-rich and multinational corporations would allow countries to recoup nearly half a trillion dollars in revenue each year--enough to vaccinate the world's population against Covid-19 three times over.

That estimate is courtesy of The State of Tax Justice 2021, a new report that argues rich countries--not the "palm-fringed islands" on the European Union's tax haven blacklist--are the primary enablers of offshoring by large companies and tax evasion by wealthy individuals.

"To tackle global inequality, we must tackle the inequality in power over global tax rules."

According to the report, members of the Organization for Economic Cooperation and Development (OECD) deserve "the lion's share of blame" for permitting rampant abuses of the global tax system, which has become increasingly leaky in recent decades as countries have altered their laws to better serve the interests of the well-off.

Produced by the Tax Justice Network, the Global Alliance for Tax Justice, and Public Services International, the new report finds that $312 billion annually is "lost to cross-border corporate tax abuse by multinational corporations and $171 billion is lost to offshore tax evasion by wealthy individuals."

"Higher-income countries are responsible for over 99% of all tax lost around the world in a year to offshore wealth tax evasion," the report notes. "Lower-income countries are responsible for less than 1%."

The total $483 billion in tax revenue lost to offshoring and evasion each year is only "the tip of the iceberg," said Tax Justice Network data scientist Miroslav Palansky, who stressed that the estimate is just "what we can see above the surface thanks to some recent progress on tax transparency."

"We know there's a lot more tax abuse below the surface costing magnitudes more in tax losses," he added.

Among OECD members, the United Kingdom and its so-called "spider web" of tax havens--along with the Netherlands, Luxembourg, and Switzerland--are the world's worst enablers of global tax abuses, according to the new analysis, which comes weeks after the Pandora Papers further exposed how world leaders, celebrities, and billionaire business moguls are exploiting tax havens to shield trillions of dollars in assets.

Related Content

While offshoring and evasion cost rich countries more money in absolute terms than poor nations, "their tax losses represent a smaller share of their revenues--9.7% of their collective public health budgets."

"Lower-income countries in comparison lose less tax in absolute terms, $39.7 billion a year, but their losses account for a much higher share of their current tax revenues and spending," the new analysis finds. "Collectively, lower-income countries lose the equivalent of nearly half (48%) of their public health budgets--and unlike OECD members, they have little or no say on the international rules that continue to allow these abuses."

The report estimates that the revenue poor countries lose to tax abuses on a yearly basis "would be enough to vaccinate 60% of their populations, bridging the gap in vaccination rates between lower-income and higher-income countries."

Dr. Dereje Alemayehu, executive coordinator of the Global Alliance for Tax Justice, said in a statement that "the richest countries, much like their colonial forebearers, have appointed themselves as the only ones capable of governing on international tax, draped themselves in the robes of saviors, and set loose the wealthy and powerful to bleed the poorest countries dry."

"To tackle global inequality," said Alemayehu, "we must tackle the inequality in power over global tax rules."

One way to do that, the new report argues, is to shift tax-setting authority away from the OECD--"a small club of rich countries"--to the United Nations.

Advocates say the case for such a move has become even more compelling since October, when OECD members agreed to a new global tax framework that would do little to meaningfully crack down on tax dodging by massive corporations.

Additionally, the new report recommends an excess profits tax on multinational corporations and a wealth tax designed "to fund the Covid-19 response and address the long-term inequalities the pandemic has exacerbated."

"Another year of the pandemic, and another half-trillion dollars snatched by the wealthiest multinational corporations and individuals from public purses around the world," Alex Cobham, chief executive at the Tax Justice Network, said in a statement. "Tax can be our most powerful tool for tackling inequality, but instead it's been made entirely optional for the super-rich."

"We must reprogram the global tax system to protect people's wellbeing and livelihoods over the desires of the wealthiest," Cobham added, "or the cruel inequalities exposed by the pandemic will be locked in for good."

Trump and Musk are on an unconstitutional rampage, aiming for virtually every corner of the federal government. These two right-wing billionaires are targeting nurses, scientists, teachers, daycare providers, judges, veterans, air traffic controllers, and nuclear safety inspectors. No one is safe. The food stamps program, Social Security, Medicare, and Medicaid are next. It’s an unprecedented disaster and a five-alarm fire, but there will be a reckoning. The people did not vote for this. The American people do not want this dystopian hellscape that hides behind claims of “efficiency.” Still, in reality, it is all a giveaway to corporate interests and the libertarian dreams of far-right oligarchs like Musk. Common Dreams is playing a vital role by reporting day and night on this orgy of corruption and greed, as well as what everyday people can do to organize and fight back. As a people-powered nonprofit news outlet, we cover issues the corporate media never will, but we can only continue with our readers’ support. |

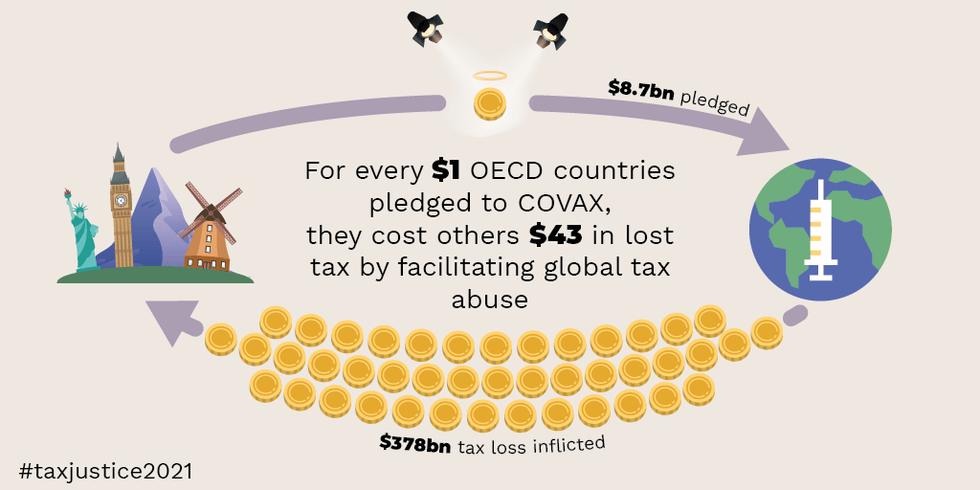

Ending abuses of the global tax system by the super-rich and multinational corporations would allow countries to recoup nearly half a trillion dollars in revenue each year--enough to vaccinate the world's population against Covid-19 three times over.

That estimate is courtesy of The State of Tax Justice 2021, a new report that argues rich countries--not the "palm-fringed islands" on the European Union's tax haven blacklist--are the primary enablers of offshoring by large companies and tax evasion by wealthy individuals.

"To tackle global inequality, we must tackle the inequality in power over global tax rules."

According to the report, members of the Organization for Economic Cooperation and Development (OECD) deserve "the lion's share of blame" for permitting rampant abuses of the global tax system, which has become increasingly leaky in recent decades as countries have altered their laws to better serve the interests of the well-off.

Produced by the Tax Justice Network, the Global Alliance for Tax Justice, and Public Services International, the new report finds that $312 billion annually is "lost to cross-border corporate tax abuse by multinational corporations and $171 billion is lost to offshore tax evasion by wealthy individuals."

"Higher-income countries are responsible for over 99% of all tax lost around the world in a year to offshore wealth tax evasion," the report notes. "Lower-income countries are responsible for less than 1%."

The total $483 billion in tax revenue lost to offshoring and evasion each year is only "the tip of the iceberg," said Tax Justice Network data scientist Miroslav Palansky, who stressed that the estimate is just "what we can see above the surface thanks to some recent progress on tax transparency."

"We know there's a lot more tax abuse below the surface costing magnitudes more in tax losses," he added.

Among OECD members, the United Kingdom and its so-called "spider web" of tax havens--along with the Netherlands, Luxembourg, and Switzerland--are the world's worst enablers of global tax abuses, according to the new analysis, which comes weeks after the Pandora Papers further exposed how world leaders, celebrities, and billionaire business moguls are exploiting tax havens to shield trillions of dollars in assets.

Related Content

While offshoring and evasion cost rich countries more money in absolute terms than poor nations, "their tax losses represent a smaller share of their revenues--9.7% of their collective public health budgets."

"Lower-income countries in comparison lose less tax in absolute terms, $39.7 billion a year, but their losses account for a much higher share of their current tax revenues and spending," the new analysis finds. "Collectively, lower-income countries lose the equivalent of nearly half (48%) of their public health budgets--and unlike OECD members, they have little or no say on the international rules that continue to allow these abuses."

The report estimates that the revenue poor countries lose to tax abuses on a yearly basis "would be enough to vaccinate 60% of their populations, bridging the gap in vaccination rates between lower-income and higher-income countries."

Dr. Dereje Alemayehu, executive coordinator of the Global Alliance for Tax Justice, said in a statement that "the richest countries, much like their colonial forebearers, have appointed themselves as the only ones capable of governing on international tax, draped themselves in the robes of saviors, and set loose the wealthy and powerful to bleed the poorest countries dry."

"To tackle global inequality," said Alemayehu, "we must tackle the inequality in power over global tax rules."

One way to do that, the new report argues, is to shift tax-setting authority away from the OECD--"a small club of rich countries"--to the United Nations.

Advocates say the case for such a move has become even more compelling since October, when OECD members agreed to a new global tax framework that would do little to meaningfully crack down on tax dodging by massive corporations.

Additionally, the new report recommends an excess profits tax on multinational corporations and a wealth tax designed "to fund the Covid-19 response and address the long-term inequalities the pandemic has exacerbated."

"Another year of the pandemic, and another half-trillion dollars snatched by the wealthiest multinational corporations and individuals from public purses around the world," Alex Cobham, chief executive at the Tax Justice Network, said in a statement. "Tax can be our most powerful tool for tackling inequality, but instead it's been made entirely optional for the super-rich."

"We must reprogram the global tax system to protect people's wellbeing and livelihoods over the desires of the wealthiest," Cobham added, "or the cruel inequalities exposed by the pandemic will be locked in for good."

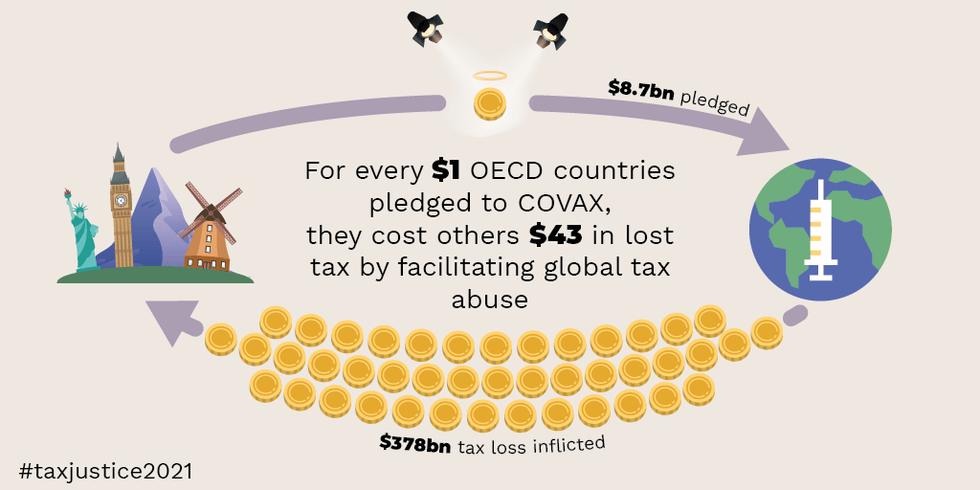

Ending abuses of the global tax system by the super-rich and multinational corporations would allow countries to recoup nearly half a trillion dollars in revenue each year--enough to vaccinate the world's population against Covid-19 three times over.

That estimate is courtesy of The State of Tax Justice 2021, a new report that argues rich countries--not the "palm-fringed islands" on the European Union's tax haven blacklist--are the primary enablers of offshoring by large companies and tax evasion by wealthy individuals.

"To tackle global inequality, we must tackle the inequality in power over global tax rules."

According to the report, members of the Organization for Economic Cooperation and Development (OECD) deserve "the lion's share of blame" for permitting rampant abuses of the global tax system, which has become increasingly leaky in recent decades as countries have altered their laws to better serve the interests of the well-off.

Produced by the Tax Justice Network, the Global Alliance for Tax Justice, and Public Services International, the new report finds that $312 billion annually is "lost to cross-border corporate tax abuse by multinational corporations and $171 billion is lost to offshore tax evasion by wealthy individuals."

"Higher-income countries are responsible for over 99% of all tax lost around the world in a year to offshore wealth tax evasion," the report notes. "Lower-income countries are responsible for less than 1%."

The total $483 billion in tax revenue lost to offshoring and evasion each year is only "the tip of the iceberg," said Tax Justice Network data scientist Miroslav Palansky, who stressed that the estimate is just "what we can see above the surface thanks to some recent progress on tax transparency."

"We know there's a lot more tax abuse below the surface costing magnitudes more in tax losses," he added.

Among OECD members, the United Kingdom and its so-called "spider web" of tax havens--along with the Netherlands, Luxembourg, and Switzerland--are the world's worst enablers of global tax abuses, according to the new analysis, which comes weeks after the Pandora Papers further exposed how world leaders, celebrities, and billionaire business moguls are exploiting tax havens to shield trillions of dollars in assets.

Related Content

While offshoring and evasion cost rich countries more money in absolute terms than poor nations, "their tax losses represent a smaller share of their revenues--9.7% of their collective public health budgets."

"Lower-income countries in comparison lose less tax in absolute terms, $39.7 billion a year, but their losses account for a much higher share of their current tax revenues and spending," the new analysis finds. "Collectively, lower-income countries lose the equivalent of nearly half (48%) of their public health budgets--and unlike OECD members, they have little or no say on the international rules that continue to allow these abuses."

The report estimates that the revenue poor countries lose to tax abuses on a yearly basis "would be enough to vaccinate 60% of their populations, bridging the gap in vaccination rates between lower-income and higher-income countries."

Dr. Dereje Alemayehu, executive coordinator of the Global Alliance for Tax Justice, said in a statement that "the richest countries, much like their colonial forebearers, have appointed themselves as the only ones capable of governing on international tax, draped themselves in the robes of saviors, and set loose the wealthy and powerful to bleed the poorest countries dry."

"To tackle global inequality," said Alemayehu, "we must tackle the inequality in power over global tax rules."

One way to do that, the new report argues, is to shift tax-setting authority away from the OECD--"a small club of rich countries"--to the United Nations.

Advocates say the case for such a move has become even more compelling since October, when OECD members agreed to a new global tax framework that would do little to meaningfully crack down on tax dodging by massive corporations.

Additionally, the new report recommends an excess profits tax on multinational corporations and a wealth tax designed "to fund the Covid-19 response and address the long-term inequalities the pandemic has exacerbated."

"Another year of the pandemic, and another half-trillion dollars snatched by the wealthiest multinational corporations and individuals from public purses around the world," Alex Cobham, chief executive at the Tax Justice Network, said in a statement. "Tax can be our most powerful tool for tackling inequality, but instead it's been made entirely optional for the super-rich."

"We must reprogram the global tax system to protect people's wellbeing and livelihoods over the desires of the wealthiest," Cobham added, "or the cruel inequalities exposed by the pandemic will be locked in for good."