Exxon CEO Darren Woods speaks at a conference on May 6, 2024 in Beverly Hills, California.

AFL-CIO Warns of 'CEO Payflation' Crisis Fueled by Stock Buybacks, Trump Tax Cuts

The union federation's new analysis provides a "snapshot of the extreme economic inequity that will only worsen under Donald Trump's Project 2025 Agenda."

The largest federation of labor unions in the U.S. published a report Thursday warning that the country is facing a crisis of "CEO payflation" as executive compensation at leading companies surges, a trend fueled by former President Donald Trump's regressive tax cuts and record stock buybacks.

The AFL-CIO's annual report on executive pay shows that the CEO-to-median-worker-pay ratio at S&P 500 companies was 268 to 1 last year, meaning that "it would take more than five career lifetimes for workers to earn what CEOs receive in just one year."

"On average, the median employee of an S&P 500 company would have had to start working in 1762 (prior to the American Revolution) to earn what the average CEO received in 2023," says the report, which points to a number of specific companies as the poster children of out-of-control executive compensation.

From 2021 to 2023, ExxonMobil CEO Darren Woods' total compensation rose from $23.6 million to $36.9 million as the company reaped massive windfall profits from energy market chaos sparked by Russia's invasion of Ukraine. Starbucks CEO Laxman Narasimhan saw his compensation jump 66%—from $8.8 million in 2022 to $14.6 million in 2023—as the company aggressively fought unionization efforts.

Overall, CEO pay at leading U.S. corporations rose 6% in 2023 compared to the previous year as companies continued to pass costs onto consumers—even as business expenses declined. Last year, the AFL-CIO's new report notes, "commodity prices that companies pay fell by 3% while consumer prices rose 3%, boosting corporate profits and CEO pay."

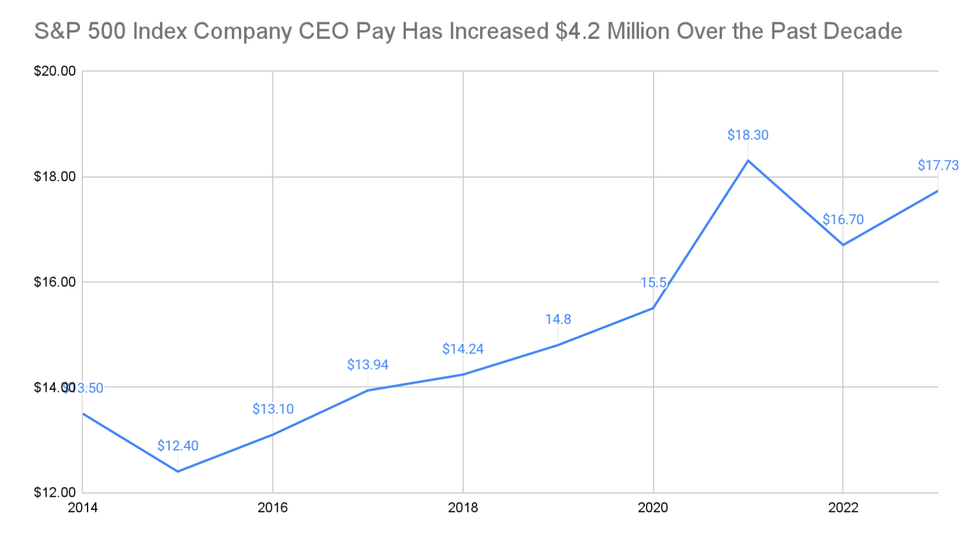

Over the past decade, the average S&P 500 CEO has seen a pay increase of roughly $4.2 million.

The executive compensation surge has been fueled in part by stock buybacks, which the AFL-CIO describes as "a financial

engineering practice that increases earnings per share that is used in many CEOs' incentive pay plans." Stock-based awards made up about 70% of total executive compensation in 2023, a separate study found.

Top U.S. companies bought back $795.1 billion worth of their shares last year, the AFL-CIO noted Thursday. One estimate from Goldman Sachs indicates share repurchases by S&P 500 companies could surpass $1 trillion next year for the first time in U.S. history.

In May, Apple—whose CEO received $63.2 million in total compensation last year—announced a $110 billion stock buyback authorization, the largest share repurchase program by a single company in the nation's history, beating its own record set in 2018.

"We are deeply concerned about pro-corporate policies that would drive up costs, put people out of work, endanger people's lives, and make it harder for working people to get ahead."

The massive tax cuts for corporations and the rich that the Republican-controlled Congress passed in 2017 and former President Donald Trump signed into law have also contributed to rising executive pay, the AFL-CIO said in its new report.

The law, which sparked a massive stock buyback spree, "permanently reduced the top corporate income tax rate from 35% to 21%," reads the new report. "Economists estimate that 51% of the income gains from the corporate tax cuts went to firm owners, 10% went to the top five highest-paid senior executives, 38% went to the top 10%, and 0% of the wage gains went to the bottom 90% of workers."

The AFL-CIO, which has been tracking executive pay since 1997, said its new findings present a mere "snapshot of the extreme economic inequity that will only worsen under Donald Trump's Project 2025 Agenda."

"This level of inequality is not sustainable," Fred Redmond, the AFL-CIO's secretary-treasurer, said during a press call on Thursday. "Working people are sick and tired of politicians like Donald Trump pushing massive tax breaks for CEOs."

Trump, the Republican presidential nominee, has proposed extending elements of his tax law that are set to expire at the end of next year while slashing the corporate tax rate even further.

The Trump campaign and Project 2025—a far-right agenda crafted by at least 140 former Trump administration officials—have both called for a reduction in corporate taxes, even as profits surge to all-time highs.

Last month, the AFL-CIO launched an online tool aimed at educating U.S. voters on "how a second Trump term would decimate workers' ability to organize; gut health and safety protections; attack civil, labor, and consumer rights; eviscerate retirement security; and undermine our ability to hold the wealthy and corporations accountable."

"We are deeply concerned about pro-corporate policies that would drive up costs, put people out of work, endanger people's lives, and make it harder for working people to get ahead," said the labor organization, which has endorsed Democratic nominee Kamala Harris. "For unions, this agenda would make it tougher for members to win gains in our next contracts and stack the deck in favor of CEOs."

An Urgent Message From Our Co-Founder

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

The largest federation of labor unions in the U.S. published a report Thursday warning that the country is facing a crisis of "CEO payflation" as executive compensation at leading companies surges, a trend fueled by former President Donald Trump's regressive tax cuts and record stock buybacks.

The AFL-CIO's annual report on executive pay shows that the CEO-to-median-worker-pay ratio at S&P 500 companies was 268 to 1 last year, meaning that "it would take more than five career lifetimes for workers to earn what CEOs receive in just one year."

"On average, the median employee of an S&P 500 company would have had to start working in 1762 (prior to the American Revolution) to earn what the average CEO received in 2023," says the report, which points to a number of specific companies as the poster children of out-of-control executive compensation.

From 2021 to 2023, ExxonMobil CEO Darren Woods' total compensation rose from $23.6 million to $36.9 million as the company reaped massive windfall profits from energy market chaos sparked by Russia's invasion of Ukraine. Starbucks CEO Laxman Narasimhan saw his compensation jump 66%—from $8.8 million in 2022 to $14.6 million in 2023—as the company aggressively fought unionization efforts.

Overall, CEO pay at leading U.S. corporations rose 6% in 2023 compared to the previous year as companies continued to pass costs onto consumers—even as business expenses declined. Last year, the AFL-CIO's new report notes, "commodity prices that companies pay fell by 3% while consumer prices rose 3%, boosting corporate profits and CEO pay."

Over the past decade, the average S&P 500 CEO has seen a pay increase of roughly $4.2 million.

The executive compensation surge has been fueled in part by stock buybacks, which the AFL-CIO describes as "a financial

engineering practice that increases earnings per share that is used in many CEOs' incentive pay plans." Stock-based awards made up about 70% of total executive compensation in 2023, a separate study found.

Top U.S. companies bought back $795.1 billion worth of their shares last year, the AFL-CIO noted Thursday. One estimate from Goldman Sachs indicates share repurchases by S&P 500 companies could surpass $1 trillion next year for the first time in U.S. history.

In May, Apple—whose CEO received $63.2 million in total compensation last year—announced a $110 billion stock buyback authorization, the largest share repurchase program by a single company in the nation's history, beating its own record set in 2018.

"We are deeply concerned about pro-corporate policies that would drive up costs, put people out of work, endanger people's lives, and make it harder for working people to get ahead."

The massive tax cuts for corporations and the rich that the Republican-controlled Congress passed in 2017 and former President Donald Trump signed into law have also contributed to rising executive pay, the AFL-CIO said in its new report.

The law, which sparked a massive stock buyback spree, "permanently reduced the top corporate income tax rate from 35% to 21%," reads the new report. "Economists estimate that 51% of the income gains from the corporate tax cuts went to firm owners, 10% went to the top five highest-paid senior executives, 38% went to the top 10%, and 0% of the wage gains went to the bottom 90% of workers."

The AFL-CIO, which has been tracking executive pay since 1997, said its new findings present a mere "snapshot of the extreme economic inequity that will only worsen under Donald Trump's Project 2025 Agenda."

"This level of inequality is not sustainable," Fred Redmond, the AFL-CIO's secretary-treasurer, said during a press call on Thursday. "Working people are sick and tired of politicians like Donald Trump pushing massive tax breaks for CEOs."

Trump, the Republican presidential nominee, has proposed extending elements of his tax law that are set to expire at the end of next year while slashing the corporate tax rate even further.

The Trump campaign and Project 2025—a far-right agenda crafted by at least 140 former Trump administration officials—have both called for a reduction in corporate taxes, even as profits surge to all-time highs.

Last month, the AFL-CIO launched an online tool aimed at educating U.S. voters on "how a second Trump term would decimate workers' ability to organize; gut health and safety protections; attack civil, labor, and consumer rights; eviscerate retirement security; and undermine our ability to hold the wealthy and corporations accountable."

"We are deeply concerned about pro-corporate policies that would drive up costs, put people out of work, endanger people's lives, and make it harder for working people to get ahead," said the labor organization, which has endorsed Democratic nominee Kamala Harris. "For unions, this agenda would make it tougher for members to win gains in our next contracts and stack the deck in favor of CEOs."

- Progressive Lawmakers Unveil Bill to Attack 'Disease' of Corporate Greed ›

- Top US CEOs Make More in Seven Hours Than Average Workers Earn in an Entire Year: Analysis ›

- 'CEOs, Not Working People, Are Causing Inflation': Report Shows Soaring Executive Pay ›

- Dems in Congress Vows to Fight 'Inflationary Policies' of Trump | Common Dreams ›

- Opinion | ‘I Couldn’t Care Less’: Trump Reveals His True Stance on Inflation | Common Dreams ›

The largest federation of labor unions in the U.S. published a report Thursday warning that the country is facing a crisis of "CEO payflation" as executive compensation at leading companies surges, a trend fueled by former President Donald Trump's regressive tax cuts and record stock buybacks.

The AFL-CIO's annual report on executive pay shows that the CEO-to-median-worker-pay ratio at S&P 500 companies was 268 to 1 last year, meaning that "it would take more than five career lifetimes for workers to earn what CEOs receive in just one year."

"On average, the median employee of an S&P 500 company would have had to start working in 1762 (prior to the American Revolution) to earn what the average CEO received in 2023," says the report, which points to a number of specific companies as the poster children of out-of-control executive compensation.

From 2021 to 2023, ExxonMobil CEO Darren Woods' total compensation rose from $23.6 million to $36.9 million as the company reaped massive windfall profits from energy market chaos sparked by Russia's invasion of Ukraine. Starbucks CEO Laxman Narasimhan saw his compensation jump 66%—from $8.8 million in 2022 to $14.6 million in 2023—as the company aggressively fought unionization efforts.

Overall, CEO pay at leading U.S. corporations rose 6% in 2023 compared to the previous year as companies continued to pass costs onto consumers—even as business expenses declined. Last year, the AFL-CIO's new report notes, "commodity prices that companies pay fell by 3% while consumer prices rose 3%, boosting corporate profits and CEO pay."

Over the past decade, the average S&P 500 CEO has seen a pay increase of roughly $4.2 million.

The executive compensation surge has been fueled in part by stock buybacks, which the AFL-CIO describes as "a financial

engineering practice that increases earnings per share that is used in many CEOs' incentive pay plans." Stock-based awards made up about 70% of total executive compensation in 2023, a separate study found.

Top U.S. companies bought back $795.1 billion worth of their shares last year, the AFL-CIO noted Thursday. One estimate from Goldman Sachs indicates share repurchases by S&P 500 companies could surpass $1 trillion next year for the first time in U.S. history.

In May, Apple—whose CEO received $63.2 million in total compensation last year—announced a $110 billion stock buyback authorization, the largest share repurchase program by a single company in the nation's history, beating its own record set in 2018.

"We are deeply concerned about pro-corporate policies that would drive up costs, put people out of work, endanger people's lives, and make it harder for working people to get ahead."

The massive tax cuts for corporations and the rich that the Republican-controlled Congress passed in 2017 and former President Donald Trump signed into law have also contributed to rising executive pay, the AFL-CIO said in its new report.

The law, which sparked a massive stock buyback spree, "permanently reduced the top corporate income tax rate from 35% to 21%," reads the new report. "Economists estimate that 51% of the income gains from the corporate tax cuts went to firm owners, 10% went to the top five highest-paid senior executives, 38% went to the top 10%, and 0% of the wage gains went to the bottom 90% of workers."

The AFL-CIO, which has been tracking executive pay since 1997, said its new findings present a mere "snapshot of the extreme economic inequity that will only worsen under Donald Trump's Project 2025 Agenda."

"This level of inequality is not sustainable," Fred Redmond, the AFL-CIO's secretary-treasurer, said during a press call on Thursday. "Working people are sick and tired of politicians like Donald Trump pushing massive tax breaks for CEOs."

Trump, the Republican presidential nominee, has proposed extending elements of his tax law that are set to expire at the end of next year while slashing the corporate tax rate even further.

The Trump campaign and Project 2025—a far-right agenda crafted by at least 140 former Trump administration officials—have both called for a reduction in corporate taxes, even as profits surge to all-time highs.

Last month, the AFL-CIO launched an online tool aimed at educating U.S. voters on "how a second Trump term would decimate workers' ability to organize; gut health and safety protections; attack civil, labor, and consumer rights; eviscerate retirement security; and undermine our ability to hold the wealthy and corporations accountable."

"We are deeply concerned about pro-corporate policies that would drive up costs, put people out of work, endanger people's lives, and make it harder for working people to get ahead," said the labor organization, which has endorsed Democratic nominee Kamala Harris. "For unions, this agenda would make it tougher for members to win gains in our next contracts and stack the deck in favor of CEOs."

- Progressive Lawmakers Unveil Bill to Attack 'Disease' of Corporate Greed ›

- Top US CEOs Make More in Seven Hours Than Average Workers Earn in an Entire Year: Analysis ›

- 'CEOs, Not Working People, Are Causing Inflation': Report Shows Soaring Executive Pay ›

- Dems in Congress Vows to Fight 'Inflationary Policies' of Trump | Common Dreams ›

- Opinion | ‘I Couldn’t Care Less’: Trump Reveals His True Stance on Inflation | Common Dreams ›