Chief executive officers at the largest companies in the United States saw their compensation surge by 1,085% from 1978 to 2023, compared with only a 24% increase for typical worker pay, according to an annual report published Thursday.

The Economic Policy Insitute (EPI) analysis focuses on the 350 largest publicly owned U.S. firms by revenue.

"Since CEO pay is mostly stock-based—and the value of stocks changes frequently—calculating it is not entirely straightforward," the report explains, so EPI uses "a backward-looking measure—realized compensation—and a forward-looking measure—granted compensation."

CEOs' annual realized compensation in 1978 was $1,874,000 in 1978, but rose to $22,207,000 last year—the 1,085% increase. Meanwhile, private-sector workers were making $57,000 a year nearly half a century ago, and have only seen that rise to $71,000. The figures were adjusted for inflation.

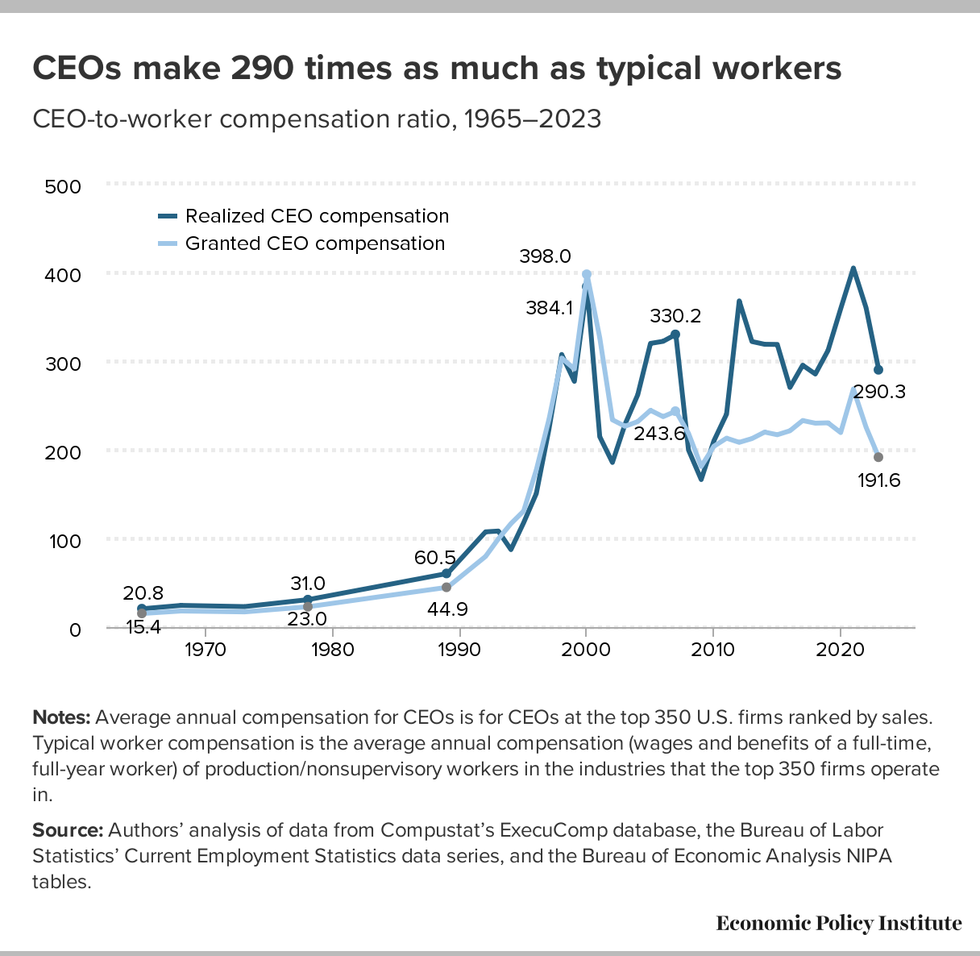

"The realized CEO-to-worker compensation ratio was 290-to-1 in 2023, in stark contrast to the 21-to-1 ratio in 1965," the report says. "Over the last two decades, the ratio has been far higher than at any point from the 1960s to the early 1990s."

The report notes some limited progress. Last year's analysis—released amid the United Auto Workers strike at the "Big Three"—found that CEOs made 344 times as much as typical workers. There was a 19% decrease in CEOs' realized compensation from 2022 to 2023. The report also points out positive trends regarding how they are compensated.

"The composition of CEO compensation is shifting away from the use of stock options and toward stock awards—a promising move to align CEO pay to longer-term incentives," the report details. "In 2006, stock options accounted for just over 70% of stock-related pay in realized CEO compensation. But in 2023, stock options made up only 22%, with vested stock awards accounting for the rest. Stock-related pay (exercised stock options and vested stock awards) averaged $16.7 million in 2023 and accounted for 77.6% of average realized CEO compensation."

However, economic justice advocates argue that far more must be done to improve U.S. worker pay and job conditions.

The report highlights "how distorted CEO pay is, even compared with the most privileged workers in the U.S. economy."

EPI researchers found that "CEOs made over 9 times as much in salary as even the most privileged 0.1% of workers in the economy. This 9.4 ratio in 2022 was 6.8 points higher than the historical average of 2.6 over the 1965–1978 period."

"This is a large change, meaning that the relative pay of CEOs increased by an amount equal to the total annual wages of nearly seven of these very high-wage earners," the report states.

As EPI chief economist and report co-author Josh Bivens emphasized, "CEOs are paid so much more because of their extraordinary leverage over corporate boards, not because of an extraordinary skill or contribution they make to their firms."

"Exorbitant CEO pay has contributed to rising inequality in recent decades—concentrating earnings at the top and leaving fewer gains for ordinary workers," he said. "The silver lining in this otherwise unfortunate trend is that CEO pay can be curtailed without damaging economywide growth."

EPI's policy recommendations include implementing higher marginal income tax rates at the very top and hiking corporate tax rates for firms that have higher ratios of CEO-to-worker compensation.

Americans for Tax Fairness and the Institute for Policy Studies earlier this year identified 35 major U.S. corporations—including Ford, Netflix, and Tesla—that paid their top executives more than they paid in federal taxes between 2018 and 2022.

The new EPI report stresses that "ideally, tax reforms would be paired with changes in corporate governance."

EPI senior economist and report co-author Elise Gould said that "policies that limit CEOs' ability to collude with corporate boards to extract excessive compensation are needed to prevent the U.S. from becoming a winner-take-all society."

This post has been updated to note that annual compensation figures were adjusted for inflation.