SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

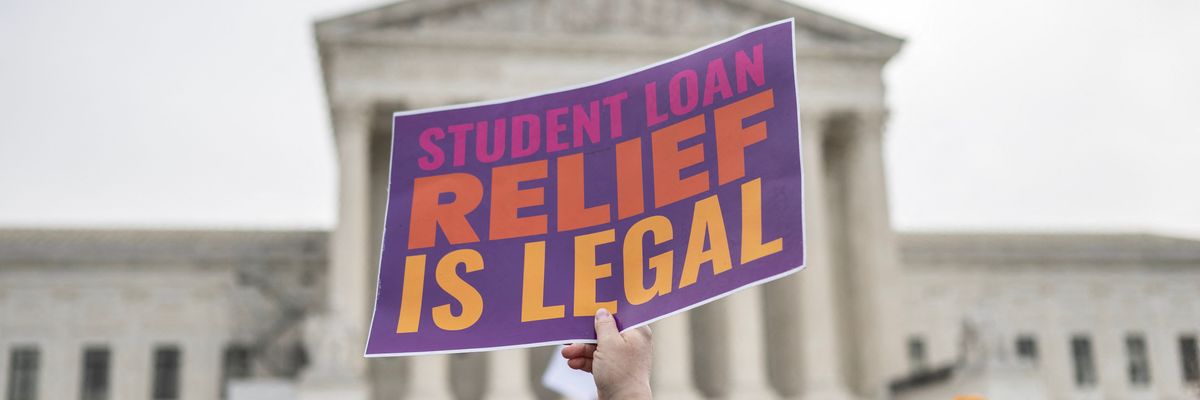

Activists and students protest in front of the Supreme Court during a rally for student debt cancellation in Washington, D.C. on February 28, 2023.

"Biden has options and inaction cannot be one of them," wrote one campaigner with the Debt Collective.

As another week passed without a Supreme Court ruling on President Joe Biden's student debt cancellation plan, campaigners implored the White House to recognize that an unfavorable decision from the deeply corrupt, conservative-dominated judicial body does not have to spell an end to debt relief efforts.

In an op-ed for Teen Vogue on Thursday, Debt Collective organizer Frederick Bell Jr. wrote that "the president still has the power to cancel student debt" even if the Supreme Court strikes down his pending plan, which invokes emergency authority under the 2003 emergency authority under the Higher Education Relief Opportunities for Students (HEROES) Act.

"Biden has options, and inaction cannot be one of them," Bell added, echoing a message that progressive lawmakers have sent to administration officials publicly and behind closed doors.

Bell noted that the two cases currently before the Supreme Court "are not about the legality of student debt relief in general, but rather the specific legal authority Biden used."

"Fortunately, there are other legal tools available," Bell wrote. "For example, since 2020, student lending experts and activists have consistently communicated to White House officials that using the 'Compromise and Settlement' power in the Higher Education Act of 1965 is a robust and viable option for broad-based student loan cancellation. That legislation states that the Department of Education can 'enforce, pay, compromise, waive, or release any right, title, claim, lien, or demand' related to federal student debt.'"

"Forty-three million debtors are waiting for the relief they were promised by this administration."

Bell also pointed to the looming end of the student loan repayment moratorium. Under the debt ceiling agreement negotiated by the Biden White House and congressional Republicans, the freeze is supposed to end 60 days after June 30, 2023.

In practice, the Biden Education Department has said student loan interest accumulation—which has also been paused since early in the coronavirus pandemic—will resume on September 1 and repayments will begin the following month. While the debt ceiling law states that the education secretary is barred from using "any authority to implement an extension," Biden administration officials insisted that they still have the ability to implement another pause in the future.

If the Supreme Court blocks Biden's debt relief plan, "more than 40 million borrowers who were eligible for relief—and 16 million people who were told by the government their applications were approved—will be in the horrible position of having loans reinstated that the administration promised to erase," Bell warned Thursday.

"This will, predictably, disproportionately harm working-class, young, Black, and Latinx borrowers. Alternatively, Biden can decisively implement a Plan B, pursuing another legal avenue to deliver promised relief," he wrote. "Forty-three million debtors are waiting for the relief they were promised by this administration."

"Biden doing nothing if his program is blocked would be as if star NBA player Nikola Jokic and the Denver Nuggets threw in the towel after the Miami Heat tied up the series in game two of the best-of-seven finals," Bell wrote. "You still have five games left. Let's play to win and finish the job."

The Supreme Court is expected to rule on Biden's debt cancellation plan by next week as the end of its term approaches.

A key dispute in the student debt cases is whether the challengers have legal standing to sue. In order to have standing under Article III of the Constitution, the plaintiffs must demonstrate that they have suffered or will suffer concrete harm from the debt relief program.

One of the cases, brought by a coalition of Republican-led states, contends that MOHELA—Missouri's state-created higher education loan authority—would face financial harms from the plan, a claim contradicted by MOHELA's internal impact analysis. (MOHELA itself is not a plaintiff in the case.)

The other case, brought by two individuals named Myra Brown and Alexander Taylor with the help of the right-wing Job Creators Network, contends that the plaintiffs would be harmed because they wouldn't be eligible for relief under the Biden administration's plan, an argument that critics have dismissed as absurd.

While the Supreme Court's right-wing justices expressed skepticism over the Biden administration's debt cancellation plan during oral arguments in February, two high court rulings in different cases over the past week could offer hope for those who want to see the fundamentally flawed legal challenges to student debt relief tossed.

Student loan law attorney Adam Minsky wrote in a column for Forbes that the high court's 8-1 ruling on Friday in United States v. Texas, a case involving Biden immigration rules, "concluded that the states do not have Article III standing."

Justice Samuel Alito, who has been urged to recuse from the student debt cases given his newly revealed ties to a billionaire with financial connections to the plaintiffs, was the lone dissent.

Justice Brett Kavanaugh, who wrote the majority opinion in the immigration case, "seemed to be drawing a line in the sand that the justices do not have an appetite for dramatically reworking Supreme Court precedent on Article III standing to give states more flexibility to challenge the federal government," Minsky argued Friday.

"This is notable, as the Biden administration argued that to conclude that Missouri and Nebraska have standing to sue over the student loan forgiveness plan, the court would have to abandon key precedent on standing," Minsky continued. "In Haaland v. Brackeen, a ruling delivered last week over a dispute regarding the Indian Child Welfare Act, a solid majority on the court concluded that the states... do not have standing. In that decision, the court reaffirmed its precedent regarding third-party standing, noting that as a general rule, states do not usually have standing to challenge the federal government on behalf of its citizens, outside of some relatively narrow exceptions."

Braxton Brewington, press secretary for the Debt Collective, tweeted Friday that "on two cases this session, SCOTUS has ruled that states don't have standing to sue Biden, especially on behalf of third parties."

"That's exactly what's happening in the student debt case with Nebraska," Brewington wrote. "If they strike down relief, it will be political—and a deviation from recent rulings."

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

As another week passed without a Supreme Court ruling on President Joe Biden's student debt cancellation plan, campaigners implored the White House to recognize that an unfavorable decision from the deeply corrupt, conservative-dominated judicial body does not have to spell an end to debt relief efforts.

In an op-ed for Teen Vogue on Thursday, Debt Collective organizer Frederick Bell Jr. wrote that "the president still has the power to cancel student debt" even if the Supreme Court strikes down his pending plan, which invokes emergency authority under the 2003 emergency authority under the Higher Education Relief Opportunities for Students (HEROES) Act.

"Biden has options, and inaction cannot be one of them," Bell added, echoing a message that progressive lawmakers have sent to administration officials publicly and behind closed doors.

Bell noted that the two cases currently before the Supreme Court "are not about the legality of student debt relief in general, but rather the specific legal authority Biden used."

"Fortunately, there are other legal tools available," Bell wrote. "For example, since 2020, student lending experts and activists have consistently communicated to White House officials that using the 'Compromise and Settlement' power in the Higher Education Act of 1965 is a robust and viable option for broad-based student loan cancellation. That legislation states that the Department of Education can 'enforce, pay, compromise, waive, or release any right, title, claim, lien, or demand' related to federal student debt.'"

"Forty-three million debtors are waiting for the relief they were promised by this administration."

Bell also pointed to the looming end of the student loan repayment moratorium. Under the debt ceiling agreement negotiated by the Biden White House and congressional Republicans, the freeze is supposed to end 60 days after June 30, 2023.

In practice, the Biden Education Department has said student loan interest accumulation—which has also been paused since early in the coronavirus pandemic—will resume on September 1 and repayments will begin the following month. While the debt ceiling law states that the education secretary is barred from using "any authority to implement an extension," Biden administration officials insisted that they still have the ability to implement another pause in the future.

If the Supreme Court blocks Biden's debt relief plan, "more than 40 million borrowers who were eligible for relief—and 16 million people who were told by the government their applications were approved—will be in the horrible position of having loans reinstated that the administration promised to erase," Bell warned Thursday.

"This will, predictably, disproportionately harm working-class, young, Black, and Latinx borrowers. Alternatively, Biden can decisively implement a Plan B, pursuing another legal avenue to deliver promised relief," he wrote. "Forty-three million debtors are waiting for the relief they were promised by this administration."

"Biden doing nothing if his program is blocked would be as if star NBA player Nikola Jokic and the Denver Nuggets threw in the towel after the Miami Heat tied up the series in game two of the best-of-seven finals," Bell wrote. "You still have five games left. Let's play to win and finish the job."

The Supreme Court is expected to rule on Biden's debt cancellation plan by next week as the end of its term approaches.

A key dispute in the student debt cases is whether the challengers have legal standing to sue. In order to have standing under Article III of the Constitution, the plaintiffs must demonstrate that they have suffered or will suffer concrete harm from the debt relief program.

One of the cases, brought by a coalition of Republican-led states, contends that MOHELA—Missouri's state-created higher education loan authority—would face financial harms from the plan, a claim contradicted by MOHELA's internal impact analysis. (MOHELA itself is not a plaintiff in the case.)

The other case, brought by two individuals named Myra Brown and Alexander Taylor with the help of the right-wing Job Creators Network, contends that the plaintiffs would be harmed because they wouldn't be eligible for relief under the Biden administration's plan, an argument that critics have dismissed as absurd.

While the Supreme Court's right-wing justices expressed skepticism over the Biden administration's debt cancellation plan during oral arguments in February, two high court rulings in different cases over the past week could offer hope for those who want to see the fundamentally flawed legal challenges to student debt relief tossed.

Student loan law attorney Adam Minsky wrote in a column for Forbes that the high court's 8-1 ruling on Friday in United States v. Texas, a case involving Biden immigration rules, "concluded that the states do not have Article III standing."

Justice Samuel Alito, who has been urged to recuse from the student debt cases given his newly revealed ties to a billionaire with financial connections to the plaintiffs, was the lone dissent.

Justice Brett Kavanaugh, who wrote the majority opinion in the immigration case, "seemed to be drawing a line in the sand that the justices do not have an appetite for dramatically reworking Supreme Court precedent on Article III standing to give states more flexibility to challenge the federal government," Minsky argued Friday.

"This is notable, as the Biden administration argued that to conclude that Missouri and Nebraska have standing to sue over the student loan forgiveness plan, the court would have to abandon key precedent on standing," Minsky continued. "In Haaland v. Brackeen, a ruling delivered last week over a dispute regarding the Indian Child Welfare Act, a solid majority on the court concluded that the states... do not have standing. In that decision, the court reaffirmed its precedent regarding third-party standing, noting that as a general rule, states do not usually have standing to challenge the federal government on behalf of its citizens, outside of some relatively narrow exceptions."

Braxton Brewington, press secretary for the Debt Collective, tweeted Friday that "on two cases this session, SCOTUS has ruled that states don't have standing to sue Biden, especially on behalf of third parties."

"That's exactly what's happening in the student debt case with Nebraska," Brewington wrote. "If they strike down relief, it will be political—and a deviation from recent rulings."

As another week passed without a Supreme Court ruling on President Joe Biden's student debt cancellation plan, campaigners implored the White House to recognize that an unfavorable decision from the deeply corrupt, conservative-dominated judicial body does not have to spell an end to debt relief efforts.

In an op-ed for Teen Vogue on Thursday, Debt Collective organizer Frederick Bell Jr. wrote that "the president still has the power to cancel student debt" even if the Supreme Court strikes down his pending plan, which invokes emergency authority under the 2003 emergency authority under the Higher Education Relief Opportunities for Students (HEROES) Act.

"Biden has options, and inaction cannot be one of them," Bell added, echoing a message that progressive lawmakers have sent to administration officials publicly and behind closed doors.

Bell noted that the two cases currently before the Supreme Court "are not about the legality of student debt relief in general, but rather the specific legal authority Biden used."

"Fortunately, there are other legal tools available," Bell wrote. "For example, since 2020, student lending experts and activists have consistently communicated to White House officials that using the 'Compromise and Settlement' power in the Higher Education Act of 1965 is a robust and viable option for broad-based student loan cancellation. That legislation states that the Department of Education can 'enforce, pay, compromise, waive, or release any right, title, claim, lien, or demand' related to federal student debt.'"

"Forty-three million debtors are waiting for the relief they were promised by this administration."

Bell also pointed to the looming end of the student loan repayment moratorium. Under the debt ceiling agreement negotiated by the Biden White House and congressional Republicans, the freeze is supposed to end 60 days after June 30, 2023.

In practice, the Biden Education Department has said student loan interest accumulation—which has also been paused since early in the coronavirus pandemic—will resume on September 1 and repayments will begin the following month. While the debt ceiling law states that the education secretary is barred from using "any authority to implement an extension," Biden administration officials insisted that they still have the ability to implement another pause in the future.

If the Supreme Court blocks Biden's debt relief plan, "more than 40 million borrowers who were eligible for relief—and 16 million people who were told by the government their applications were approved—will be in the horrible position of having loans reinstated that the administration promised to erase," Bell warned Thursday.

"This will, predictably, disproportionately harm working-class, young, Black, and Latinx borrowers. Alternatively, Biden can decisively implement a Plan B, pursuing another legal avenue to deliver promised relief," he wrote. "Forty-three million debtors are waiting for the relief they were promised by this administration."

"Biden doing nothing if his program is blocked would be as if star NBA player Nikola Jokic and the Denver Nuggets threw in the towel after the Miami Heat tied up the series in game two of the best-of-seven finals," Bell wrote. "You still have five games left. Let's play to win and finish the job."

The Supreme Court is expected to rule on Biden's debt cancellation plan by next week as the end of its term approaches.

A key dispute in the student debt cases is whether the challengers have legal standing to sue. In order to have standing under Article III of the Constitution, the plaintiffs must demonstrate that they have suffered or will suffer concrete harm from the debt relief program.

One of the cases, brought by a coalition of Republican-led states, contends that MOHELA—Missouri's state-created higher education loan authority—would face financial harms from the plan, a claim contradicted by MOHELA's internal impact analysis. (MOHELA itself is not a plaintiff in the case.)

The other case, brought by two individuals named Myra Brown and Alexander Taylor with the help of the right-wing Job Creators Network, contends that the plaintiffs would be harmed because they wouldn't be eligible for relief under the Biden administration's plan, an argument that critics have dismissed as absurd.

While the Supreme Court's right-wing justices expressed skepticism over the Biden administration's debt cancellation plan during oral arguments in February, two high court rulings in different cases over the past week could offer hope for those who want to see the fundamentally flawed legal challenges to student debt relief tossed.

Student loan law attorney Adam Minsky wrote in a column for Forbes that the high court's 8-1 ruling on Friday in United States v. Texas, a case involving Biden immigration rules, "concluded that the states do not have Article III standing."

Justice Samuel Alito, who has been urged to recuse from the student debt cases given his newly revealed ties to a billionaire with financial connections to the plaintiffs, was the lone dissent.

Justice Brett Kavanaugh, who wrote the majority opinion in the immigration case, "seemed to be drawing a line in the sand that the justices do not have an appetite for dramatically reworking Supreme Court precedent on Article III standing to give states more flexibility to challenge the federal government," Minsky argued Friday.

"This is notable, as the Biden administration argued that to conclude that Missouri and Nebraska have standing to sue over the student loan forgiveness plan, the court would have to abandon key precedent on standing," Minsky continued. "In Haaland v. Brackeen, a ruling delivered last week over a dispute regarding the Indian Child Welfare Act, a solid majority on the court concluded that the states... do not have standing. In that decision, the court reaffirmed its precedent regarding third-party standing, noting that as a general rule, states do not usually have standing to challenge the federal government on behalf of its citizens, outside of some relatively narrow exceptions."

Braxton Brewington, press secretary for the Debt Collective, tweeted Friday that "on two cases this session, SCOTUS has ruled that states don't have standing to sue Biden, especially on behalf of third parties."

"That's exactly what's happening in the student debt case with Nebraska," Brewington wrote. "If they strike down relief, it will be political—and a deviation from recent rulings."