The nonpartisan Congressional Budget Office projected Wednesday that extending provisions of the 2017 Trump-GOP tax law that are set to expire at the end of next year would shrink the U.S. economy over the long run, a finding that came as Republicans planned to move ahead with another round of regressive tax cuts within the first 100 days of the new Congress.

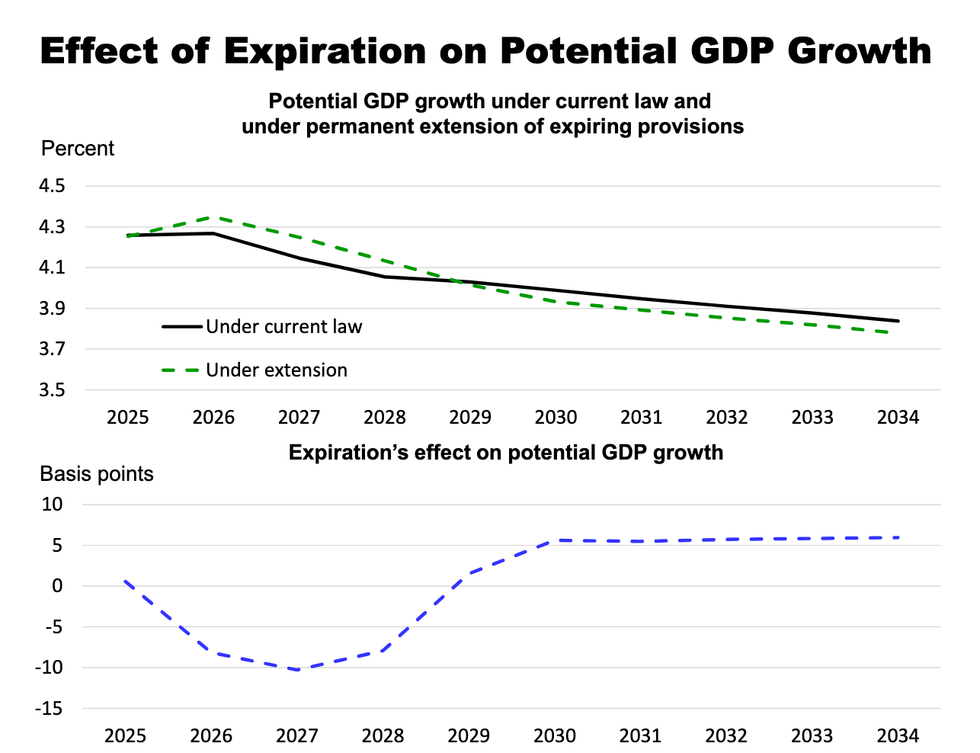

In its new analysis, the CBO found that allowing provisions of the 2017 Tax Cuts and Jobs Act to expire as scheduled in 2025 would have a positive long-term effect on Gross Domestic Product (GDP) growth compared to permanently extending the provisions.

"Expiration increases the long-term growth of potential GDP by about 6 basis points," the CBO said.

Sen. Sheldon Whitehouse (D-R.I.), chairman of the Senate Budget Committee, said in response to the CBO's findings that "the looting has begun."

"Far from unleashing record-breaking growth, the next Trump tax scam will make hardworking families worse off, shrink our economy, and blow a $4.6 trillion hole in the deficit," said Whitehouse. "What a racket, to push for trillions in tax cuts so billionaires keep paying lower rates than nurses and plumbers, and then cite deficit concerns to rob families needing things like home heating or childcare."

"Looting the treasury for megadonors is a rotten trick," the senator added, "and no amount of budgetary smoke and mirrors will hide it."

The CBO report was published as congressional Republicans continued to map out their legislative agenda before taking control of both chambers in January. The Associated Pressreported earlier this week that "in preparation for Trump's return, Republicans in Congress have been meeting privately for months and with the president-elect to go over proposals to extend and enhance those tax breaks, some of which would otherwise expire in 2025."

"It's always been about further enriching political and economic elites even at the cost of our economic future."

During the 2024 campaign, Trump pledged to sustain individual tax breaks enacted by the 2017 law—which disproportionately benefited the rich—and further reduce the statutory tax rate for U.S. corporations.

"The last time Republicans spent this much money for no apparent gain was the war in Iraq," Sen. Ron Wyden (D-Ore.), chairman of the Senate Finance Committee, said Wednesday. "Trump's political donors want a return on their investment, and Republicans are going to give it to them, even at the cost of shrinking our economy and destroying jobs."

To offset the massive projected cost of extending the 2017 law and enacting new corporate tax cuts, Republicans are planning to pursue deep cuts to Medicaid, federal nutrition assistance, and other programs that help low-income Americans meet basic needs.

"President-elect Trump campaigned as a champion of the working class but his first act will be tanking the economy and throwing workers under the bus to line the pockets of his wealthy friends," said Lindsay Owens, executive director of the Groundwork Collaborative. "The Trump tax scam is back for its second act, and Americans should brace for impact."

David Kass, executive director of Americans for Tax Fairness, called the latest CBO analysis of the Republican Party's tax policies "even more damning than previous iterations."

"Using the country's credit card to give away trillions of dollars to the wealthiest Americans and big corporations would be disastrous for our economy and the average American," Kass said Wednesday. "The Trump Tax Scam bill has never been about economic growth or improving the lives of working and middle-class Americans. It's always been about further enriching political and economic elites even at the cost of our economic future."

"Moving forward," Kass added, "the incoming administration and congressional Republicans must answer why they plan to make hardworking Americans worse off, shrink our economy, and increase the deficit by $4.6 trillion."