SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

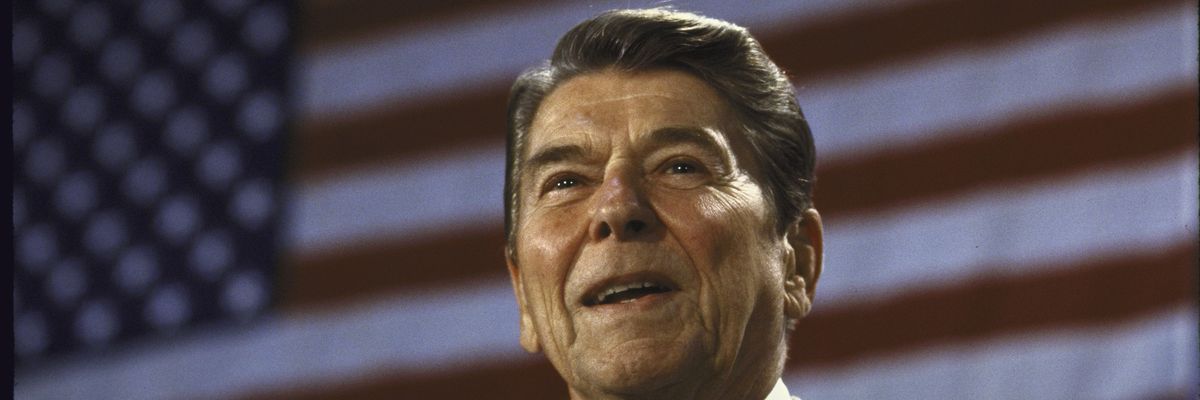

Then-U.S. President Ronald Reagan was pictured speaking at a fundraiser.

"Failing to reimagine a more ambitious and comprehensive use of corporate tax policy prevents us from achieving a more equitable, sustainable, and democratic economy."

Two new reports published Tuesday by the Roosevelt Institute argue that robust corporate taxation is key to creating a strong economy and improving the well-being of families and children—objectives that have been undermined in the decades since the Reagan era by regressive tax cuts enacted on the false premise that benefits would "trickle down" to the rest of society.

The first report, A Mapping of the Full Potential of U.S. Corporate Taxation to Enhance Child and Family Well-Being, examines what the authors describe as the understudied notion that "increasing corporate taxation will necessarily help children and families by providing additional revenue for essential public services."

That perspective runs counter to what the Roosevelt Institute's second report calls "a 'cut-to-grow' mentality" that rose to prominence in the 1970s and was enthusiastically embraced by the administration of President Ronald Reagan.

"Under this view, the thinking went, it was necessary to reduce the corporate tax rate to grow the economy—and that this growth would allow gains to eventually 'trickle down' from the rich shareholders to the middle class," the report states. "During this time, the corporate tax rate was gradually reduced to 35% before it was dramatically cut to 21% in 2017. These cuts resulted in corporate tax revenues falling to less than 10% of total federal revenues."

"Perhaps more than any other, President Ronald Reagan leveraged mounting backlash to taxation and government spending to dramatically reduce both, regardless of the consequences to American families," the report observes.

"Corporate tax policy since Reagan has been driven by the trickle-down economics narrative that cutting the taxes on 'job creators' will benefit less wealthy U.S. taxpayers."

The decades-long decline in corporate tax rates has severely undermined the federal government's ability to finance critical public goods, from education to childcare.

"Since regressive corporate tax cuts don't significantly increase earnings for working families (through either wage or employment increases), but they do reduce the government's ability to fund family income and care supports, childcare costs—which are already rising—can become a relatively more expensive line item in working parents' household budgets," reads the Roosevelt Institute's first report, authored by Emily DiVito and Niko Lusiani.

"When they can't afford childcare," they added, "parents face the difficult choice of having to cut costs in other places—often on the basic necessities that allow children to thrive, like food, clothing, and enrichment activities—or taking on additional caregiving duties themselves."

At the state and local levels, DiVito and Lusiani noted, "corporations' successful efforts to avoid their full property tax liability devastate public school budgets."

DiVito, deputy director for the corporate power program at the Roosevelt Institute, said Tuesday that "we have a false idea in the U.S. that corporate tax policy is unrelated to equitable social reforms."

"However, strong corporate tax policy is vital to all aspects of a thriving economy," she argued. "And the failing to reimagine a more ambitious and comprehensive use of corporate tax policy prevents us from achieving a more equitable, sustainable, and democratic economy and society for all families."

The new reports come a week after a bipartisan pair of House and Senate negotiators announced a deal to expand the child tax credit (CTC) for three years in exchange for a series of corporate tax cuts. The American Prospect's David Dayen estimated that "in the time period when all the tax credits are actually in place, the business tax changes are five times more costly than the CTC changes."

"Who knows if this deal can pass in time to take effect in the upcoming 2023 tax season, if ever. Sen. Mike Crapo (R-Idaho), the ranking Republican on the Senate Finance Committee, is already asking for changes to make it even more generous to businesses. That's in part a function of the dissembling that there is 'parity' in the deal. The truth is that this is not an equal trade. And it may extend that inequity well into the future."

That warning is in line with the Roosevelt Institute's new research, which argues that a corporate tax code generous to big business fuels inequality by "benefiting capital interests (i.e., business owners, partners, and shareholders) at the expense of workers and their families."

"When corporations enjoy low taxes on their profits, they face a trade-off for how to otherwise disperse them: make investments in the workforce and productive capacity (e.g., raise wages, hire more workers, and/or upgrade buildings, equipment, or technology) or distribute them to shareholders (i.e., pay out dividends and buy back stock to inflate prices). Data shows that executives typically choose the latter."

Reuven S. Avi-Yonah, a professor of law at the University of Michigan and the lead author of the new report on "cut to grow" ideology, said in a statement that "corporate tax policy since Reagan has been driven by the trickle-down economics narrative that cutting the taxes on 'job creators' will benefit less wealthy U.S. taxpayers."

"Such an idea is often offered in tandem with the notion that this is the only way tax policy can help American families," said Avi-Yonah. "But this just isn't true. In fact, this false 'cut-to-grow' narrative has made it very difficult to argue for a more expansive, progressive vision of corporate tax reform—contributing to a decades-long stalemate in efforts toward real comprehensive corporate tax reform."

"Now is the time," he added, "to reverse this trend with a more historically grounded support of the corporate tax."

Trump and Musk are on an unconstitutional rampage, aiming for virtually every corner of the federal government. These two right-wing billionaires are targeting nurses, scientists, teachers, daycare providers, judges, veterans, air traffic controllers, and nuclear safety inspectors. No one is safe. The food stamps program, Social Security, Medicare, and Medicaid are next. It’s an unprecedented disaster and a five-alarm fire, but there will be a reckoning. The people did not vote for this. The American people do not want this dystopian hellscape that hides behind claims of “efficiency.” Still, in reality, it is all a giveaway to corporate interests and the libertarian dreams of far-right oligarchs like Musk. Common Dreams is playing a vital role by reporting day and night on this orgy of corruption and greed, as well as what everyday people can do to organize and fight back. As a people-powered nonprofit news outlet, we cover issues the corporate media never will, but we can only continue with our readers’ support. |

Two new reports published Tuesday by the Roosevelt Institute argue that robust corporate taxation is key to creating a strong economy and improving the well-being of families and children—objectives that have been undermined in the decades since the Reagan era by regressive tax cuts enacted on the false premise that benefits would "trickle down" to the rest of society.

The first report, A Mapping of the Full Potential of U.S. Corporate Taxation to Enhance Child and Family Well-Being, examines what the authors describe as the understudied notion that "increasing corporate taxation will necessarily help children and families by providing additional revenue for essential public services."

That perspective runs counter to what the Roosevelt Institute's second report calls "a 'cut-to-grow' mentality" that rose to prominence in the 1970s and was enthusiastically embraced by the administration of President Ronald Reagan.

"Under this view, the thinking went, it was necessary to reduce the corporate tax rate to grow the economy—and that this growth would allow gains to eventually 'trickle down' from the rich shareholders to the middle class," the report states. "During this time, the corporate tax rate was gradually reduced to 35% before it was dramatically cut to 21% in 2017. These cuts resulted in corporate tax revenues falling to less than 10% of total federal revenues."

"Perhaps more than any other, President Ronald Reagan leveraged mounting backlash to taxation and government spending to dramatically reduce both, regardless of the consequences to American families," the report observes.

"Corporate tax policy since Reagan has been driven by the trickle-down economics narrative that cutting the taxes on 'job creators' will benefit less wealthy U.S. taxpayers."

The decades-long decline in corporate tax rates has severely undermined the federal government's ability to finance critical public goods, from education to childcare.

"Since regressive corporate tax cuts don't significantly increase earnings for working families (through either wage or employment increases), but they do reduce the government's ability to fund family income and care supports, childcare costs—which are already rising—can become a relatively more expensive line item in working parents' household budgets," reads the Roosevelt Institute's first report, authored by Emily DiVito and Niko Lusiani.

"When they can't afford childcare," they added, "parents face the difficult choice of having to cut costs in other places—often on the basic necessities that allow children to thrive, like food, clothing, and enrichment activities—or taking on additional caregiving duties themselves."

At the state and local levels, DiVito and Lusiani noted, "corporations' successful efforts to avoid their full property tax liability devastate public school budgets."

DiVito, deputy director for the corporate power program at the Roosevelt Institute, said Tuesday that "we have a false idea in the U.S. that corporate tax policy is unrelated to equitable social reforms."

"However, strong corporate tax policy is vital to all aspects of a thriving economy," she argued. "And the failing to reimagine a more ambitious and comprehensive use of corporate tax policy prevents us from achieving a more equitable, sustainable, and democratic economy and society for all families."

The new reports come a week after a bipartisan pair of House and Senate negotiators announced a deal to expand the child tax credit (CTC) for three years in exchange for a series of corporate tax cuts. The American Prospect's David Dayen estimated that "in the time period when all the tax credits are actually in place, the business tax changes are five times more costly than the CTC changes."

"Who knows if this deal can pass in time to take effect in the upcoming 2023 tax season, if ever. Sen. Mike Crapo (R-Idaho), the ranking Republican on the Senate Finance Committee, is already asking for changes to make it even more generous to businesses. That's in part a function of the dissembling that there is 'parity' in the deal. The truth is that this is not an equal trade. And it may extend that inequity well into the future."

That warning is in line with the Roosevelt Institute's new research, which argues that a corporate tax code generous to big business fuels inequality by "benefiting capital interests (i.e., business owners, partners, and shareholders) at the expense of workers and their families."

"When corporations enjoy low taxes on their profits, they face a trade-off for how to otherwise disperse them: make investments in the workforce and productive capacity (e.g., raise wages, hire more workers, and/or upgrade buildings, equipment, or technology) or distribute them to shareholders (i.e., pay out dividends and buy back stock to inflate prices). Data shows that executives typically choose the latter."

Reuven S. Avi-Yonah, a professor of law at the University of Michigan and the lead author of the new report on "cut to grow" ideology, said in a statement that "corporate tax policy since Reagan has been driven by the trickle-down economics narrative that cutting the taxes on 'job creators' will benefit less wealthy U.S. taxpayers."

"Such an idea is often offered in tandem with the notion that this is the only way tax policy can help American families," said Avi-Yonah. "But this just isn't true. In fact, this false 'cut-to-grow' narrative has made it very difficult to argue for a more expansive, progressive vision of corporate tax reform—contributing to a decades-long stalemate in efforts toward real comprehensive corporate tax reform."

"Now is the time," he added, "to reverse this trend with a more historically grounded support of the corporate tax."

Two new reports published Tuesday by the Roosevelt Institute argue that robust corporate taxation is key to creating a strong economy and improving the well-being of families and children—objectives that have been undermined in the decades since the Reagan era by regressive tax cuts enacted on the false premise that benefits would "trickle down" to the rest of society.

The first report, A Mapping of the Full Potential of U.S. Corporate Taxation to Enhance Child and Family Well-Being, examines what the authors describe as the understudied notion that "increasing corporate taxation will necessarily help children and families by providing additional revenue for essential public services."

That perspective runs counter to what the Roosevelt Institute's second report calls "a 'cut-to-grow' mentality" that rose to prominence in the 1970s and was enthusiastically embraced by the administration of President Ronald Reagan.

"Under this view, the thinking went, it was necessary to reduce the corporate tax rate to grow the economy—and that this growth would allow gains to eventually 'trickle down' from the rich shareholders to the middle class," the report states. "During this time, the corporate tax rate was gradually reduced to 35% before it was dramatically cut to 21% in 2017. These cuts resulted in corporate tax revenues falling to less than 10% of total federal revenues."

"Perhaps more than any other, President Ronald Reagan leveraged mounting backlash to taxation and government spending to dramatically reduce both, regardless of the consequences to American families," the report observes.

"Corporate tax policy since Reagan has been driven by the trickle-down economics narrative that cutting the taxes on 'job creators' will benefit less wealthy U.S. taxpayers."

The decades-long decline in corporate tax rates has severely undermined the federal government's ability to finance critical public goods, from education to childcare.

"Since regressive corporate tax cuts don't significantly increase earnings for working families (through either wage or employment increases), but they do reduce the government's ability to fund family income and care supports, childcare costs—which are already rising—can become a relatively more expensive line item in working parents' household budgets," reads the Roosevelt Institute's first report, authored by Emily DiVito and Niko Lusiani.

"When they can't afford childcare," they added, "parents face the difficult choice of having to cut costs in other places—often on the basic necessities that allow children to thrive, like food, clothing, and enrichment activities—or taking on additional caregiving duties themselves."

At the state and local levels, DiVito and Lusiani noted, "corporations' successful efforts to avoid their full property tax liability devastate public school budgets."

DiVito, deputy director for the corporate power program at the Roosevelt Institute, said Tuesday that "we have a false idea in the U.S. that corporate tax policy is unrelated to equitable social reforms."

"However, strong corporate tax policy is vital to all aspects of a thriving economy," she argued. "And the failing to reimagine a more ambitious and comprehensive use of corporate tax policy prevents us from achieving a more equitable, sustainable, and democratic economy and society for all families."

The new reports come a week after a bipartisan pair of House and Senate negotiators announced a deal to expand the child tax credit (CTC) for three years in exchange for a series of corporate tax cuts. The American Prospect's David Dayen estimated that "in the time period when all the tax credits are actually in place, the business tax changes are five times more costly than the CTC changes."

"Who knows if this deal can pass in time to take effect in the upcoming 2023 tax season, if ever. Sen. Mike Crapo (R-Idaho), the ranking Republican on the Senate Finance Committee, is already asking for changes to make it even more generous to businesses. That's in part a function of the dissembling that there is 'parity' in the deal. The truth is that this is not an equal trade. And it may extend that inequity well into the future."

That warning is in line with the Roosevelt Institute's new research, which argues that a corporate tax code generous to big business fuels inequality by "benefiting capital interests (i.e., business owners, partners, and shareholders) at the expense of workers and their families."

"When corporations enjoy low taxes on their profits, they face a trade-off for how to otherwise disperse them: make investments in the workforce and productive capacity (e.g., raise wages, hire more workers, and/or upgrade buildings, equipment, or technology) or distribute them to shareholders (i.e., pay out dividends and buy back stock to inflate prices). Data shows that executives typically choose the latter."

Reuven S. Avi-Yonah, a professor of law at the University of Michigan and the lead author of the new report on "cut to grow" ideology, said in a statement that "corporate tax policy since Reagan has been driven by the trickle-down economics narrative that cutting the taxes on 'job creators' will benefit less wealthy U.S. taxpayers."

"Such an idea is often offered in tandem with the notion that this is the only way tax policy can help American families," said Avi-Yonah. "But this just isn't true. In fact, this false 'cut-to-grow' narrative has made it very difficult to argue for a more expansive, progressive vision of corporate tax reform—contributing to a decades-long stalemate in efforts toward real comprehensive corporate tax reform."

"Now is the time," he added, "to reverse this trend with a more historically grounded support of the corporate tax."