SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

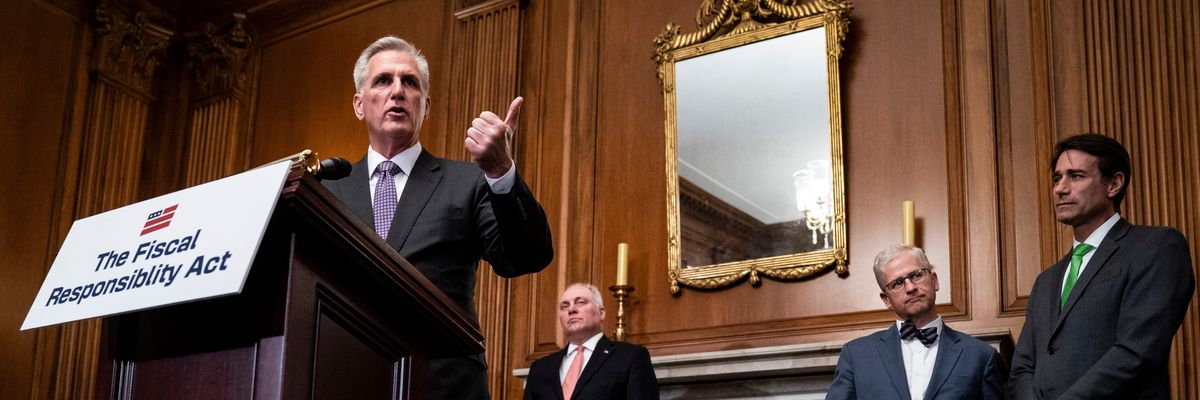

House Speaker Kevin McCarthy (R-Calif.) talks at a press conference on May 31, 2023 in Washington, D.C.

The poorest fifth, meanwhile, would get just $1.4 billion in tax cuts under the Republican legislation, according to a new analysis.

Tax cut legislation that House Republicans are set to consider this week after pushing the global economy to the brink of disaster would deliver more than $28 billion to the richest 1% of Americans next year—and just $1.4 billion to the poorest fifth of the country.

That's according to a new analysis of the legislation by the Institute on Taxation and Economic Policy (ITEP), which estimated Sunday that the poorest fifth of Americans would receive an average tax break of just $40 next year under the three new Republican bills, one of which is titled the Tax Cuts for Working Families Act.

By contrast, ITEP showed, people in the top 1% of the income distribution would see an average tax cut of $16,550 under the legislation.

The wealthiest 20% of Americans would receive a total of $60.8 billion in tax cuts next year under the new bills, which are unlikely to pass the divided Congress.

The three measures, which the House Ways and Means Committee is set to mark up on Tuesday, would also reward foreign investors to the tune of $23.8 billion next year by slashing business taxes, the ITEP analysis found, pointing to research showing that "foreign investors own 40% of stocks in American corporations and would therefore receive a significant share of the benefits from corporate tax cuts."

Steve Wamhoff, ITEP's director of federal policy and the author of the new analysis, said House Republicans' legislative package "looks like a terrible deal for ordinary Americans and a windfall for foreign investors and the richest 1% of Americans."

Wamhoff noted that while the legislation "includes an increase in the standard deduction that would help some middle-income taxpayers," the change "would do little for those who most need help."

The bills, which House Republicans outlined late last week, came shortly after the House GOP used a looming debt default as leverage to impose damaging new caps on federal spending and add more harsh work requirements to federal safety net programs, including nutrition assistance—potentially stripping food aid from hundreds of thousands of older adults.

Republicans justified their push for spending restrictions by pointing to the exploding federal debt—not mentioning that tax cuts under GOP Presidents George W. Bush and Donald Trump, which starve the government of vital revenue year after year, are primarily responsible.

Wamhoff wrote Sunday that the new Republican legislation would further "increase the deficit by expanding the Trump tax cuts for corporations and other businesses."

"Officially the cost of the new tax cuts would be offset, mostly by provisions that would roll back certain parts of President Biden's Inflation Reduction Act addressing climate change, but the true costs are hidden by budget gimmicks," Wamhoff observed. "The most important budget gimmick is that the legislation enacts the biggest tax cuts for only two years even though its proponents plan to extend them in the future, making them, in effect, permanent."

In a statement summarizing the major provisions of the tax bills, House Ways and Means Chairman Jason Smith (R-Mo.) touted the supposed savings that would come from repealing the Inflation Reduction Act's clean energy tax credits, which are aimed at accelerating the nation's lagging transition to renewable energy.

But as Wamhoff wrote Sunday, the costs of repealing those tax credits "would ultimately fall on everyone in the form of greater climate damage."

Trump and Musk are on an unconstitutional rampage, aiming for virtually every corner of the federal government. These two right-wing billionaires are targeting nurses, scientists, teachers, daycare providers, judges, veterans, air traffic controllers, and nuclear safety inspectors. No one is safe. The food stamps program, Social Security, Medicare, and Medicaid are next. It’s an unprecedented disaster and a five-alarm fire, but there will be a reckoning. The people did not vote for this. The American people do not want this dystopian hellscape that hides behind claims of “efficiency.” Still, in reality, it is all a giveaway to corporate interests and the libertarian dreams of far-right oligarchs like Musk. Common Dreams is playing a vital role by reporting day and night on this orgy of corruption and greed, as well as what everyday people can do to organize and fight back. As a people-powered nonprofit news outlet, we cover issues the corporate media never will, but we can only continue with our readers’ support. |

Tax cut legislation that House Republicans are set to consider this week after pushing the global economy to the brink of disaster would deliver more than $28 billion to the richest 1% of Americans next year—and just $1.4 billion to the poorest fifth of the country.

That's according to a new analysis of the legislation by the Institute on Taxation and Economic Policy (ITEP), which estimated Sunday that the poorest fifth of Americans would receive an average tax break of just $40 next year under the three new Republican bills, one of which is titled the Tax Cuts for Working Families Act.

By contrast, ITEP showed, people in the top 1% of the income distribution would see an average tax cut of $16,550 under the legislation.

The wealthiest 20% of Americans would receive a total of $60.8 billion in tax cuts next year under the new bills, which are unlikely to pass the divided Congress.

The three measures, which the House Ways and Means Committee is set to mark up on Tuesday, would also reward foreign investors to the tune of $23.8 billion next year by slashing business taxes, the ITEP analysis found, pointing to research showing that "foreign investors own 40% of stocks in American corporations and would therefore receive a significant share of the benefits from corporate tax cuts."

Steve Wamhoff, ITEP's director of federal policy and the author of the new analysis, said House Republicans' legislative package "looks like a terrible deal for ordinary Americans and a windfall for foreign investors and the richest 1% of Americans."

Wamhoff noted that while the legislation "includes an increase in the standard deduction that would help some middle-income taxpayers," the change "would do little for those who most need help."

The bills, which House Republicans outlined late last week, came shortly after the House GOP used a looming debt default as leverage to impose damaging new caps on federal spending and add more harsh work requirements to federal safety net programs, including nutrition assistance—potentially stripping food aid from hundreds of thousands of older adults.

Republicans justified their push for spending restrictions by pointing to the exploding federal debt—not mentioning that tax cuts under GOP Presidents George W. Bush and Donald Trump, which starve the government of vital revenue year after year, are primarily responsible.

Wamhoff wrote Sunday that the new Republican legislation would further "increase the deficit by expanding the Trump tax cuts for corporations and other businesses."

"Officially the cost of the new tax cuts would be offset, mostly by provisions that would roll back certain parts of President Biden's Inflation Reduction Act addressing climate change, but the true costs are hidden by budget gimmicks," Wamhoff observed. "The most important budget gimmick is that the legislation enacts the biggest tax cuts for only two years even though its proponents plan to extend them in the future, making them, in effect, permanent."

In a statement summarizing the major provisions of the tax bills, House Ways and Means Chairman Jason Smith (R-Mo.) touted the supposed savings that would come from repealing the Inflation Reduction Act's clean energy tax credits, which are aimed at accelerating the nation's lagging transition to renewable energy.

But as Wamhoff wrote Sunday, the costs of repealing those tax credits "would ultimately fall on everyone in the form of greater climate damage."

Tax cut legislation that House Republicans are set to consider this week after pushing the global economy to the brink of disaster would deliver more than $28 billion to the richest 1% of Americans next year—and just $1.4 billion to the poorest fifth of the country.

That's according to a new analysis of the legislation by the Institute on Taxation and Economic Policy (ITEP), which estimated Sunday that the poorest fifth of Americans would receive an average tax break of just $40 next year under the three new Republican bills, one of which is titled the Tax Cuts for Working Families Act.

By contrast, ITEP showed, people in the top 1% of the income distribution would see an average tax cut of $16,550 under the legislation.

The wealthiest 20% of Americans would receive a total of $60.8 billion in tax cuts next year under the new bills, which are unlikely to pass the divided Congress.

The three measures, which the House Ways and Means Committee is set to mark up on Tuesday, would also reward foreign investors to the tune of $23.8 billion next year by slashing business taxes, the ITEP analysis found, pointing to research showing that "foreign investors own 40% of stocks in American corporations and would therefore receive a significant share of the benefits from corporate tax cuts."

Steve Wamhoff, ITEP's director of federal policy and the author of the new analysis, said House Republicans' legislative package "looks like a terrible deal for ordinary Americans and a windfall for foreign investors and the richest 1% of Americans."

Wamhoff noted that while the legislation "includes an increase in the standard deduction that would help some middle-income taxpayers," the change "would do little for those who most need help."

The bills, which House Republicans outlined late last week, came shortly after the House GOP used a looming debt default as leverage to impose damaging new caps on federal spending and add more harsh work requirements to federal safety net programs, including nutrition assistance—potentially stripping food aid from hundreds of thousands of older adults.

Republicans justified their push for spending restrictions by pointing to the exploding federal debt—not mentioning that tax cuts under GOP Presidents George W. Bush and Donald Trump, which starve the government of vital revenue year after year, are primarily responsible.

Wamhoff wrote Sunday that the new Republican legislation would further "increase the deficit by expanding the Trump tax cuts for corporations and other businesses."

"Officially the cost of the new tax cuts would be offset, mostly by provisions that would roll back certain parts of President Biden's Inflation Reduction Act addressing climate change, but the true costs are hidden by budget gimmicks," Wamhoff observed. "The most important budget gimmick is that the legislation enacts the biggest tax cuts for only two years even though its proponents plan to extend them in the future, making them, in effect, permanent."

In a statement summarizing the major provisions of the tax bills, House Ways and Means Chairman Jason Smith (R-Mo.) touted the supposed savings that would come from repealing the Inflation Reduction Act's clean energy tax credits, which are aimed at accelerating the nation's lagging transition to renewable energy.

But as Wamhoff wrote Sunday, the costs of repealing those tax credits "would ultimately fall on everyone in the form of greater climate damage."