SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

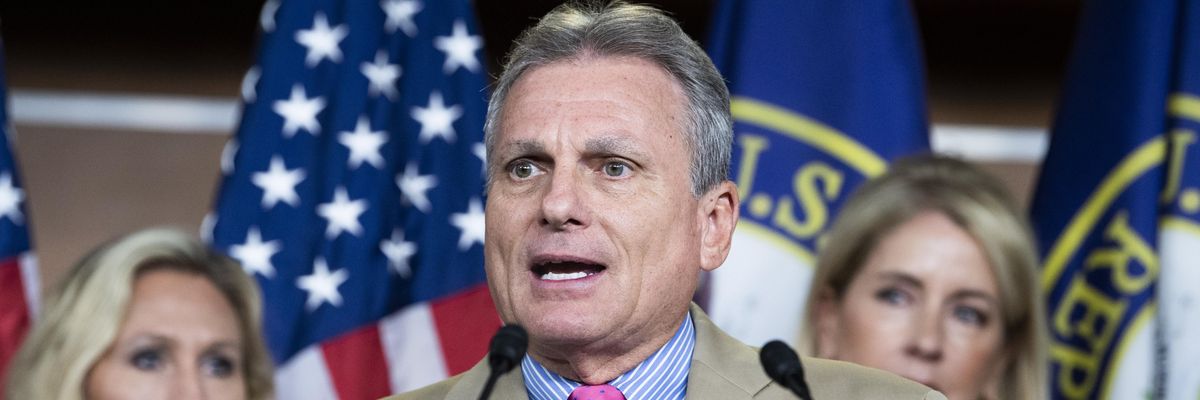

Rep. Buddy Carter (R-Ga.) speaks at a press conference on June 15, 2021.

A bill introduced by House Republicans would eliminate corporate income taxes, abolish the IRS, and impose a regressive national sales tax of 30%.

Unveiled earlier this month by Rep. Buddy Carter (R-Ga.), the Fair Tax Act is hardly a novel piece of legislation. As Steve Wamhoff of the Institute on Taxation and Economic Policy noted in a recent blog post, the bill has its origins in a proposal "initially pitched by an organization created by the Church of Scientology during its dispute with the IRS over whether it constituted a church and was thus tax-exempt."

"The Church of Scientology's only goal in the matter was to eliminate the agency causing it trouble, and lost interest once the IRS threw in the towel and allowed it to present itself as a church," Wamhoff explained. "But by then several politicians had bought into the idea and introduced it as legislation, which has been reintroduced in each Congress since as the Fair Tax."

Carter's legislation, which currently has nearly two dozen House GOP co-sponsors, would abolish the IRS—a major gift to wealthy tax cheats—and eliminate the payroll taxes that finance Medicare and Social Security. The bill would also nix the individual income tax, the corporate income tax, the estate tax, and other taxes, establishing in their place a sales tax of 30% for calendar year 2023.

"The GOP's so-called 'Fair Tax' proposal is one of the most regressive proposals in a generation, imposing a 30% federal sales tax on everything Americans buy from gas to food," said former U.S. Labor Secretary Robert Reich. "There's nothing 'fair' about it. It would punish the poor and middle class while helping the rich."

"There's nothing 'fair' about it. It would punish the poor and middle class while helping the rich."

In an attempt to offset the inherent regressivity of the sales tax, Carter's bill would send most U.S. households a monthly "prebate" to help families cover the costs of basic necessities—effectively replacing the Earned Income Tax Credit, the Child Tax Credit, and other existing tax benefits that the measure would eliminate.

But Wamhoff argued the prebates would not be "nearly enough to offset the financial hit most Americans would face from the new national sales tax."

"Back in 2004, ITEP estimated that if the Fair Tax was enacted and the national sales tax rate was set at 45%, the poorest 80% of Americans would face net tax hikes from the proposal while most of those among the richest 20% would enjoy net tax cuts," Wamhoff wrote. "ITEP plans to re-estimate the proposal because a great deal has changed since 2004."

In a detailed

video analysis of the "Fair Tax" plan, Matt Bruenig of the People's Policy Project estimated that the poorest 20% of the U.S. public would pay roughly 70% of their income in taxes as a result of the bill's levy on consumption.

This 30% National Sales Tax Plan Is a Jokeyoutu.be

Democratic lawmakers and President Joe Biden have wasted no time seizing on the tax proposal as further evidence of the Republican Party's commitment to delivering huge windfalls to the rich.

"The GOP wants to scrap the income tax and replace it with a 30% sales tax," tweeted Rep. Pramila Jayapal (D-Wash.), the chair of the Congressional Progressive Caucus. "In WA State, where we have no income tax and rely on sales and excise taxes, the poorest families spend 17% of their income on taxes. The wealthiest spend 3%. This effort is a tax cut for the rich, period."

Sen. Jeff Merkley (D-Ore.) quipped on Wednesday that "it really must be Opposite Day if Republicans are claiming that a national 30% sales tax is 'fair.'"

"In what world is it fair to slam working families with huge tax increases, while giving tax breaks to the mega-rich?" Merkley asked.

On Thursday afternoon, Biden is expected to attack the GOP tax proposal as well as the Republican push to cut Social Security and Medicare in a speech at a steamfitters union hall in Springfield, Virginia.

"The president will outline the biggest threat to our economic progress: House Republicans' MAGA economic plan," an unnamed White House official toldReuters ahead of the address.

"When MAGA extremists openly threaten to push the economy off the cliff unless they can further enrich billionaires and big corporations at the expense of everyone else, believe them."

With Democrats in control of the Senate and the White House, the Fair Tax Act has no chance of becoming law, and Rep. Kevin McCarthy (R-Calif.) only agreed to allow hearings on the legislation as part of the speakership deal he struck with far-right GOP holdouts.

But progressives argued the proposal offers a telling glimpse into the Republican Party's extreme economic priorities at a time of skyrocketing inequality, large-scale corporate tax avoidance, and economic hardship for poor and middle-class households.

"MAGA extremists are testing the waters to see how far they can go in their backwards economic agenda written by and for wealthy special interests—starting with a staggering 30% tax hike on the middle class with a national sales tax that would immediately make necessities unaffordable while letting greedy corporations off scot-free from any tax responsibility," Liz Zelnick, director of the Economic Security and Corporate Power program at Accountable.US, said in a statement Thursday.

“That's only the beginning," Zelnick continued. “A growing chorus in the Republican House caucus is scheming to sabotage the economy and the U.S. government's full faith and credit unless they get deep cuts to Social Security and Medicare benefits that keep millions of Americans out of poverty and in better health."

"When MAGA extremists openly threaten to push the economy off the cliff unless they can further enrich billionaires and big corporations at the expense of everyone else," she added, "believe them."

Trump and Musk are on an unconstitutional rampage, aiming for virtually every corner of the federal government. These two right-wing billionaires are targeting nurses, scientists, teachers, daycare providers, judges, veterans, air traffic controllers, and nuclear safety inspectors. No one is safe. The food stamps program, Social Security, Medicare, and Medicaid are next. It’s an unprecedented disaster and a five-alarm fire, but there will be a reckoning. The people did not vote for this. The American people do not want this dystopian hellscape that hides behind claims of “efficiency.” Still, in reality, it is all a giveaway to corporate interests and the libertarian dreams of far-right oligarchs like Musk. Common Dreams is playing a vital role by reporting day and night on this orgy of corruption and greed, as well as what everyday people can do to organize and fight back. As a people-powered nonprofit news outlet, we cover issues the corporate media never will, but we can only continue with our readers’ support. |

Unveiled earlier this month by Rep. Buddy Carter (R-Ga.), the Fair Tax Act is hardly a novel piece of legislation. As Steve Wamhoff of the Institute on Taxation and Economic Policy noted in a recent blog post, the bill has its origins in a proposal "initially pitched by an organization created by the Church of Scientology during its dispute with the IRS over whether it constituted a church and was thus tax-exempt."

"The Church of Scientology's only goal in the matter was to eliminate the agency causing it trouble, and lost interest once the IRS threw in the towel and allowed it to present itself as a church," Wamhoff explained. "But by then several politicians had bought into the idea and introduced it as legislation, which has been reintroduced in each Congress since as the Fair Tax."

Carter's legislation, which currently has nearly two dozen House GOP co-sponsors, would abolish the IRS—a major gift to wealthy tax cheats—and eliminate the payroll taxes that finance Medicare and Social Security. The bill would also nix the individual income tax, the corporate income tax, the estate tax, and other taxes, establishing in their place a sales tax of 30% for calendar year 2023.

"The GOP's so-called 'Fair Tax' proposal is one of the most regressive proposals in a generation, imposing a 30% federal sales tax on everything Americans buy from gas to food," said former U.S. Labor Secretary Robert Reich. "There's nothing 'fair' about it. It would punish the poor and middle class while helping the rich."

"There's nothing 'fair' about it. It would punish the poor and middle class while helping the rich."

In an attempt to offset the inherent regressivity of the sales tax, Carter's bill would send most U.S. households a monthly "prebate" to help families cover the costs of basic necessities—effectively replacing the Earned Income Tax Credit, the Child Tax Credit, and other existing tax benefits that the measure would eliminate.

But Wamhoff argued the prebates would not be "nearly enough to offset the financial hit most Americans would face from the new national sales tax."

"Back in 2004, ITEP estimated that if the Fair Tax was enacted and the national sales tax rate was set at 45%, the poorest 80% of Americans would face net tax hikes from the proposal while most of those among the richest 20% would enjoy net tax cuts," Wamhoff wrote. "ITEP plans to re-estimate the proposal because a great deal has changed since 2004."

In a detailed

video analysis of the "Fair Tax" plan, Matt Bruenig of the People's Policy Project estimated that the poorest 20% of the U.S. public would pay roughly 70% of their income in taxes as a result of the bill's levy on consumption.

This 30% National Sales Tax Plan Is a Jokeyoutu.be

Democratic lawmakers and President Joe Biden have wasted no time seizing on the tax proposal as further evidence of the Republican Party's commitment to delivering huge windfalls to the rich.

"The GOP wants to scrap the income tax and replace it with a 30% sales tax," tweeted Rep. Pramila Jayapal (D-Wash.), the chair of the Congressional Progressive Caucus. "In WA State, where we have no income tax and rely on sales and excise taxes, the poorest families spend 17% of their income on taxes. The wealthiest spend 3%. This effort is a tax cut for the rich, period."

Sen. Jeff Merkley (D-Ore.) quipped on Wednesday that "it really must be Opposite Day if Republicans are claiming that a national 30% sales tax is 'fair.'"

"In what world is it fair to slam working families with huge tax increases, while giving tax breaks to the mega-rich?" Merkley asked.

On Thursday afternoon, Biden is expected to attack the GOP tax proposal as well as the Republican push to cut Social Security and Medicare in a speech at a steamfitters union hall in Springfield, Virginia.

"The president will outline the biggest threat to our economic progress: House Republicans' MAGA economic plan," an unnamed White House official toldReuters ahead of the address.

"When MAGA extremists openly threaten to push the economy off the cliff unless they can further enrich billionaires and big corporations at the expense of everyone else, believe them."

With Democrats in control of the Senate and the White House, the Fair Tax Act has no chance of becoming law, and Rep. Kevin McCarthy (R-Calif.) only agreed to allow hearings on the legislation as part of the speakership deal he struck with far-right GOP holdouts.

But progressives argued the proposal offers a telling glimpse into the Republican Party's extreme economic priorities at a time of skyrocketing inequality, large-scale corporate tax avoidance, and economic hardship for poor and middle-class households.

"MAGA extremists are testing the waters to see how far they can go in their backwards economic agenda written by and for wealthy special interests—starting with a staggering 30% tax hike on the middle class with a national sales tax that would immediately make necessities unaffordable while letting greedy corporations off scot-free from any tax responsibility," Liz Zelnick, director of the Economic Security and Corporate Power program at Accountable.US, said in a statement Thursday.

“That's only the beginning," Zelnick continued. “A growing chorus in the Republican House caucus is scheming to sabotage the economy and the U.S. government's full faith and credit unless they get deep cuts to Social Security and Medicare benefits that keep millions of Americans out of poverty and in better health."

"When MAGA extremists openly threaten to push the economy off the cliff unless they can further enrich billionaires and big corporations at the expense of everyone else," she added, "believe them."

Unveiled earlier this month by Rep. Buddy Carter (R-Ga.), the Fair Tax Act is hardly a novel piece of legislation. As Steve Wamhoff of the Institute on Taxation and Economic Policy noted in a recent blog post, the bill has its origins in a proposal "initially pitched by an organization created by the Church of Scientology during its dispute with the IRS over whether it constituted a church and was thus tax-exempt."

"The Church of Scientology's only goal in the matter was to eliminate the agency causing it trouble, and lost interest once the IRS threw in the towel and allowed it to present itself as a church," Wamhoff explained. "But by then several politicians had bought into the idea and introduced it as legislation, which has been reintroduced in each Congress since as the Fair Tax."

Carter's legislation, which currently has nearly two dozen House GOP co-sponsors, would abolish the IRS—a major gift to wealthy tax cheats—and eliminate the payroll taxes that finance Medicare and Social Security. The bill would also nix the individual income tax, the corporate income tax, the estate tax, and other taxes, establishing in their place a sales tax of 30% for calendar year 2023.

"The GOP's so-called 'Fair Tax' proposal is one of the most regressive proposals in a generation, imposing a 30% federal sales tax on everything Americans buy from gas to food," said former U.S. Labor Secretary Robert Reich. "There's nothing 'fair' about it. It would punish the poor and middle class while helping the rich."

"There's nothing 'fair' about it. It would punish the poor and middle class while helping the rich."

In an attempt to offset the inherent regressivity of the sales tax, Carter's bill would send most U.S. households a monthly "prebate" to help families cover the costs of basic necessities—effectively replacing the Earned Income Tax Credit, the Child Tax Credit, and other existing tax benefits that the measure would eliminate.

But Wamhoff argued the prebates would not be "nearly enough to offset the financial hit most Americans would face from the new national sales tax."

"Back in 2004, ITEP estimated that if the Fair Tax was enacted and the national sales tax rate was set at 45%, the poorest 80% of Americans would face net tax hikes from the proposal while most of those among the richest 20% would enjoy net tax cuts," Wamhoff wrote. "ITEP plans to re-estimate the proposal because a great deal has changed since 2004."

In a detailed

video analysis of the "Fair Tax" plan, Matt Bruenig of the People's Policy Project estimated that the poorest 20% of the U.S. public would pay roughly 70% of their income in taxes as a result of the bill's levy on consumption.

This 30% National Sales Tax Plan Is a Jokeyoutu.be

Democratic lawmakers and President Joe Biden have wasted no time seizing on the tax proposal as further evidence of the Republican Party's commitment to delivering huge windfalls to the rich.

"The GOP wants to scrap the income tax and replace it with a 30% sales tax," tweeted Rep. Pramila Jayapal (D-Wash.), the chair of the Congressional Progressive Caucus. "In WA State, where we have no income tax and rely on sales and excise taxes, the poorest families spend 17% of their income on taxes. The wealthiest spend 3%. This effort is a tax cut for the rich, period."

Sen. Jeff Merkley (D-Ore.) quipped on Wednesday that "it really must be Opposite Day if Republicans are claiming that a national 30% sales tax is 'fair.'"

"In what world is it fair to slam working families with huge tax increases, while giving tax breaks to the mega-rich?" Merkley asked.

On Thursday afternoon, Biden is expected to attack the GOP tax proposal as well as the Republican push to cut Social Security and Medicare in a speech at a steamfitters union hall in Springfield, Virginia.

"The president will outline the biggest threat to our economic progress: House Republicans' MAGA economic plan," an unnamed White House official toldReuters ahead of the address.

"When MAGA extremists openly threaten to push the economy off the cliff unless they can further enrich billionaires and big corporations at the expense of everyone else, believe them."

With Democrats in control of the Senate and the White House, the Fair Tax Act has no chance of becoming law, and Rep. Kevin McCarthy (R-Calif.) only agreed to allow hearings on the legislation as part of the speakership deal he struck with far-right GOP holdouts.

But progressives argued the proposal offers a telling glimpse into the Republican Party's extreme economic priorities at a time of skyrocketing inequality, large-scale corporate tax avoidance, and economic hardship for poor and middle-class households.

"MAGA extremists are testing the waters to see how far they can go in their backwards economic agenda written by and for wealthy special interests—starting with a staggering 30% tax hike on the middle class with a national sales tax that would immediately make necessities unaffordable while letting greedy corporations off scot-free from any tax responsibility," Liz Zelnick, director of the Economic Security and Corporate Power program at Accountable.US, said in a statement Thursday.

“That's only the beginning," Zelnick continued. “A growing chorus in the Republican House caucus is scheming to sabotage the economy and the U.S. government's full faith and credit unless they get deep cuts to Social Security and Medicare benefits that keep millions of Americans out of poverty and in better health."

"When MAGA extremists openly threaten to push the economy off the cliff unless they can further enrich billionaires and big corporations at the expense of everyone else," she added, "believe them."