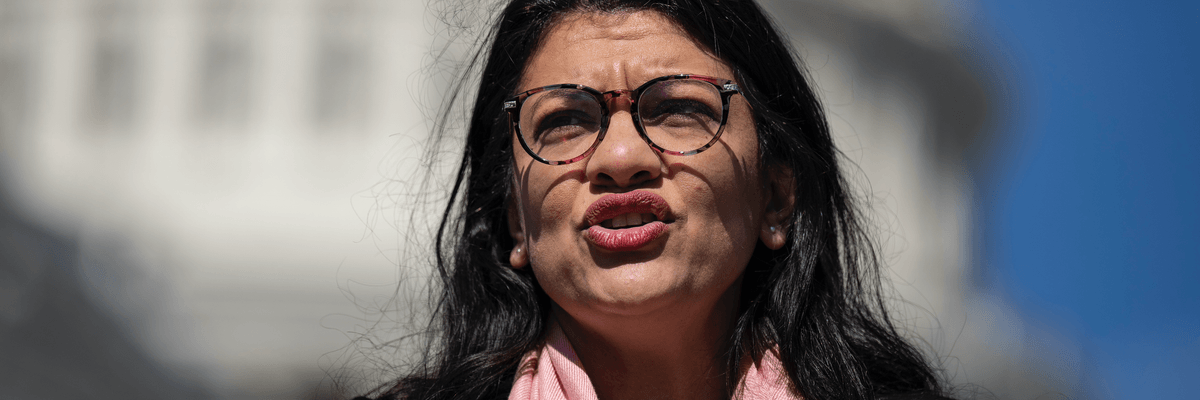

Asserting that "undergoing a medically necessary procedure should never haunt someone financially," Democratic Michigan Congresswoman Rashida Tlaib on Wednesday reintroduced legislation to ban the collection of medical debt for two years and prohibit such indebtedness from appearing on patients' credit reports.

First introduced in 2021, Tlaib's Consumer Protection for Medical Debt Collections Act would safeguard people who, "at no fault of their own, got sick and could not afford medical care due to our broken healthcare system," the congresswoman's office explained.

The bill passed the House of Representatives last year and was included in the Comprehensive Debt Collection Improvement Act, but the Senate declined to take up the measure.

"Nearly 1 in 5 adults have one or more medical debt collections listed on their credit report. That means 1 in 5 Americans may be denied housing, transportation, or other necessities because of a sudden health crisis or visit to the emergency room," Tlaib said in a statement. "That hits particularly hard in communities like mine, where residents already face challenges with access to credit. This bill will help increase opportunities for residents and is a major step in fixing our broken credit system."

According to the Kaiser Family Foundation, U.S. adults owe at least $195 billion in collective medical debt. The U.S. Consumer Financial Protection Bureau (CFPB) estimates around $88 billion worth of that debt is reflected in Americans' credit reports.

"While medical debt has long played an outsized role on credit reports, concerns about medical debt collections and reporting are particularly elevated due to the Covid-19 pandemic," the CFPB reported last March. "Frontline workers may be particularly likely to have pandemic-related medical debt since they have more exposure to the virus but are less likely to have health insurance than the general population."

Researchers have linked roughly two-thirds of all U.S. bankruptcies to medical issues. The recent proliferation of medical credit cards has further fueled the crisis.

In February, the CFPB reported that 8.2 million fewer Americans were struggling with medical debt during the first quarter of 2022 compared with the same period in 2020. The Biden administration attributed the improvement to the rising number of people covered under the Affordable Care Act, as well as CFPB pressure on credit bureaus, the three largest of which—TransUnion, Equifax, and Experian—began removing cleared medical debts from consumers' credit reports last July.

"Treating medical debt the same as other debt is not right and leads to irreparable harm to residents who simply just needed health and medical care," said Tlaib. "Medical debt is a leading cause of personal bankruptcy in our country and the pandemic has only made the medical debt crisis worse."

"No one chooses to get sick," she added. "This is commonsense legislation and we must get it signed into law."