Most Americans contribute to Social Security year-round, but U.S. millionaires will stop paying into the critical program on March 2—just over two months into 2024.

That's because Social Security's payroll tax doesn't apply to earned income above a certain level. For 2024, the cut-off is $168,600, and capital gains—such as stock appreciation—are not subject to the payroll levy at all. Elon Musk, the CEO of Tesla and the world's richest man, pays nothing into Social Security because he doesn't take a salary.

Emma Curchin, domestic outreach and research assistant at the Center for Economic and Policy Research (CEPR), noted Thursday that with the $168,600 payroll tax cap in place, a millionaire's effective Social Security tax rate "is less than 1%."

"This is compared to the 6.2% that any worker making less than $168,600 pays," Curchin wrote. "The burden of paying for Social Security rests on working class people in this country."

CEPR on Thursday released a calculator that allows users to see when people with certain annual incomes stop contributing to Social Security, which keeps more people out of poverty in the U.S. than any other program.

The calculator shows that a CEO with a $20 million annual salary stopped paying into Social Security just three days into 2024—and contributed just as much to the program for the year as someone who makes $168,600.

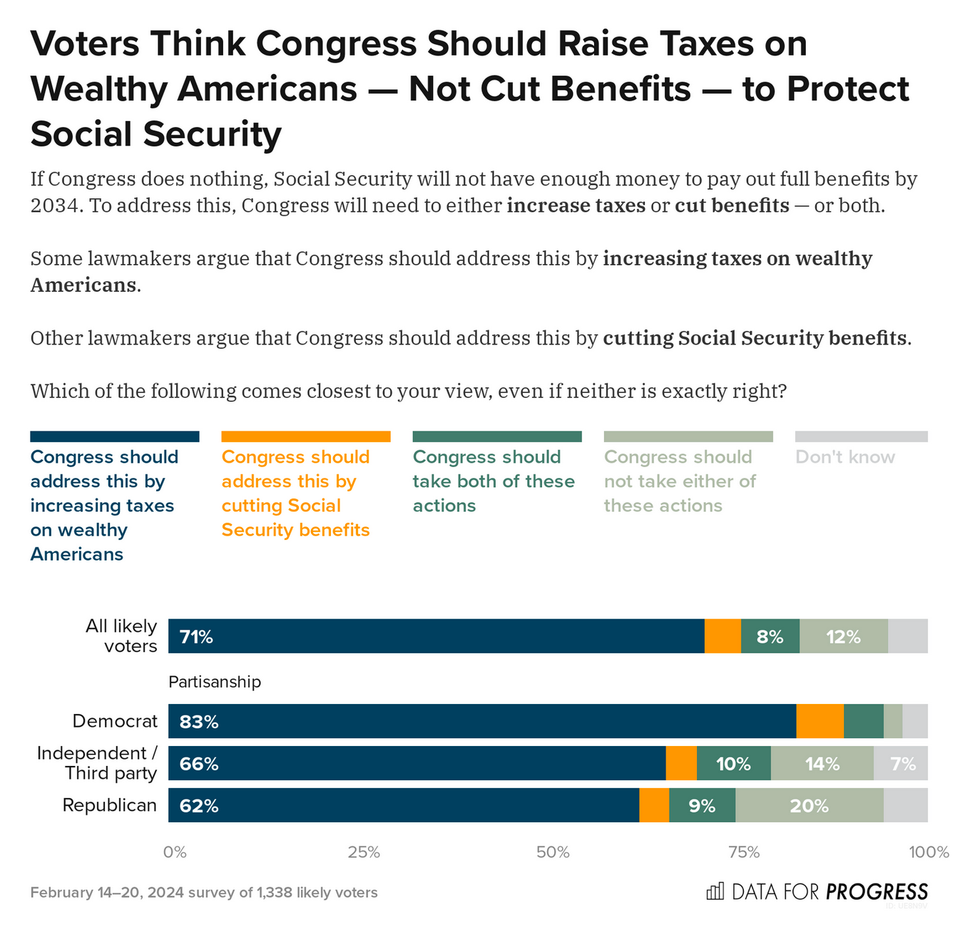

The tool was released as a new survey by Data for Progress showed that 71% of likely U.S. voters want Congress to guarantee Social Security's solvency "by increasing taxes on wealthy Americans" rather than by cutting benefits.

Progressive lawmakers have long supported lifting the Social Security payroll tax cap to force rich Americans to contribute more to the program.

Rep. John Larson's (D-Conn.) Social Security 2100 Act, for example, would expand the program's benefits by applying the payroll tax to annual earnings above $400,000.

"Ninety-four percent of Americans contribute to Social Security all year long, but the wealthy stop paying after their first $168,600 in wage income, and they don't pay in at all on their unearned investment income," Larson and Social Security Works president Nancy Altman wrote in an op-ed for Data for Progress on Thursday.

"The best part about the Social Security 2100 Act? There's no need for a closed-door commission to pass it into law, because it's what the American people want to do," they added.