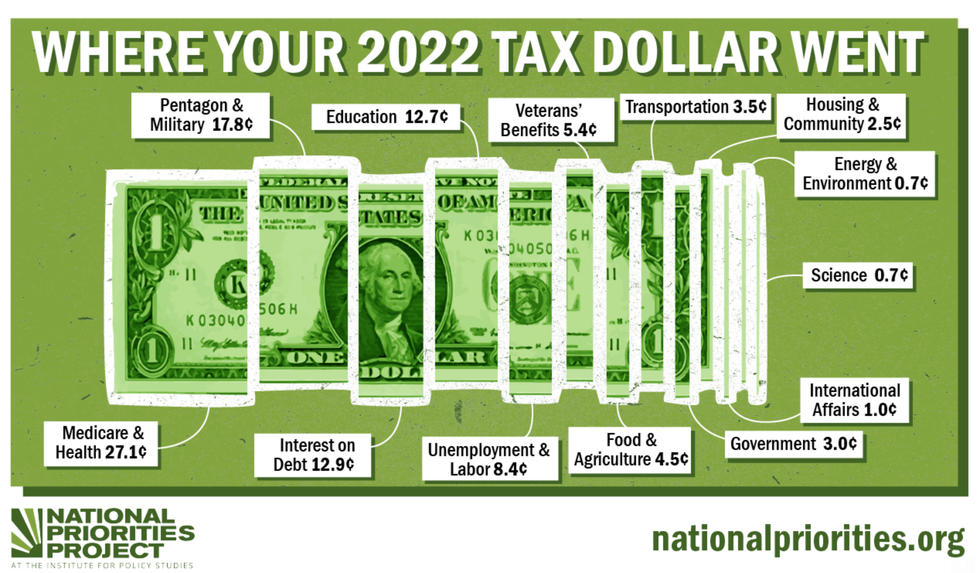

The average U.S. taxpayer in 2022 spent over four times as much on Pentagon contractors than on primary and secondary education, according to the annual Tax Day analysis published in recent days by the Institute for Policy Studies' National Priorities Project.

NPP found that, on average, American taxpayers contributed $1,087 to Pentagon contractors, compared with $270 for K-12 education. The top military contractor—Lockheed Martin—received $106 from the average taxpayer, while just $6 went to funding renewable energy.

According to the analysis, the average 2022 U.S. taxpayer:

- Paid $74 for nuclear weapons, and just $43 for the Centers for Disease Control and Prevention;

- Spent $70 on deportations and border control, versus just $19 for refugee assistance;

- Contributed $20 for federal prisons, and just $11 for anti-homelessness programs; and

- Gave $298 to the top five military contractors, and just $19 for mental health and substance abuse.

"The main message? Our government is continuing to invest too much in the military, and in militarized law enforcement, and not nearly enough on prevention, people, and our communities," NPP said.

The annual analysis shows how individual income taxes—the portion withheld from workers' paychecks—were spent in 2022. It does not include corporate or individual payroll taxes that fund Social Security and Medicare. To determine what constitutes the average tax bill, NPP divided the total amount of federal income tax collected by the number of applicable returns filed.

NPP's analysis comes just over a month after the White House released President Joe Biden's $1.6 trillion budget request for fiscal year 2024. More than half of that amount—$886 billion—would go to the military.

Responding to the $886 billion request, NPP program director Lindsay Koshgarian said last month that "this military budget represents a shameful status quo that the country can no longer afford."

"Families are struggling to afford basics like housing, food, and medicine, and our last pandemic-era protections are ending, all while Pentagon contractors pay their CEOs millions straight from the public treasury," Koshgarian noted.

"A responsible budget would restore the Pentagon's spending to previous reduced levels from just a few short years ago, and reinvest that additional money at home where we need it the most," she added.