Nonprofit U.S. hospitals are legally required to provide affordable medical care for low-income patients, but many are failing to do so, while taking advantage of major tax benefits and enriching executives, according to a report released Tuesday by Sen. Bernie Sanders.

"In 2020, nonprofit hospitals received $28 billion in tax breaks for the purpose of providing affordable healthcare for low-income Americans," noted Sanders (I-Vt.), a Medicare for All advocate who chairs the Senate Health, Education, Labor, and Pensions (HELP) Committee.

The report explains that "in return for the tax benefits, the federal government requires those hospitals to operate for the public benefit by providing a set of community benefits, which includes ensuring low-income individuals receive medical care for free or at significantly reduced rates—a practice known as 'charity care.'"

However, as Sanders stressed, "despite these massive tax breaks, most nonprofit hospitals are actually reducing the amount of charity care they provide to low-income families even as CEO pay is soaring."

"In recent years, nonprofit hospitals have provided less charity care even as these hospitals saw a steady increase in their revenues and operating profits."

The report—which takes aim at 16 of the largest nonprofit hospital systems in the country—found that such hospitals "spent only an estimated $16 billion on charity care in 2020, or about 57% of the value of their tax breaks in the same year," and "have made information about their charity care programs difficult to access, leaving many patients unaware that they may qualify for free or discounted care."

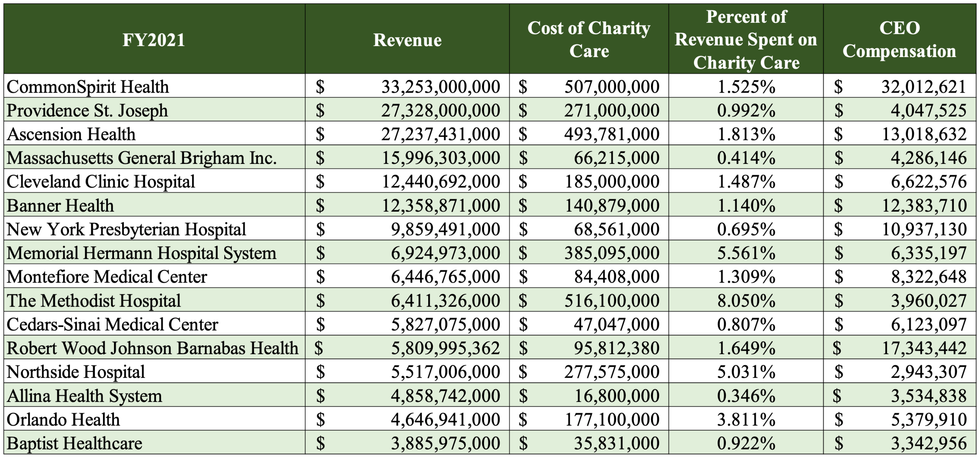

Meanwhile, "in 2021, the most recent year for which data is available for all of the 16 hospital chains, those companies' CEOs averaged more than $8 million in compensation and collectively made over $140 million," according to the publication. "CommonSpirit Health led the way, with a combined $32 million compensation package for the outgoing and incoming CEOs. In the same year, the company spent only 1.5% of its revenue on charity care."

Of the chains examined, the Methodist Hospital led the group in terms of percent of revenue spent on charity care, at 8.05%. However, the report also begins with a story from a patient at one of those hospitals:

In 2007, Carrie Barrett needed a heart catherization after experiencing chest pain and shortness of breath. She went to a Methodist Le Bonheur (Methodist) hospital in Memphis, Tennessee, and walked out with the needed procedure completed and a $12,019 bill for her medical stay. Ms. Barrett made less than $12 an hour and had no hope of paying back that bill. But the hospital not only refused to help Barrett afford her bill, it instead piled on interest and sent the bill to collections. By June 2019, Ms. Barrett owed over $33,000, nearly three times the original cost of the procedure and more than twice what she earned in a year.

Stories like Ms. Barrett's are far too common. But they are even more egregious when the hospital is a nonprofit that is required to be "organized and operated exclusively for charitable purposes."

"In recent years, nonprofit hospitals have provided less charity care even as these hospitals saw a steady increase in their revenues and operating profits," the report says. "One study found 86% of nonprofit hospitals spent less on charity care than they received in tax benefits between 2011 and 2018."

"Another recent study found that nonprofit hospitals increased their average operating profit by more than 36%, from about $43 million to almost $59 million, between 2012 and 2019," the document details. "In the same time period, the hospitals almost doubled the cash balances they held in reserve, from an average of about $133 million to more than $224 million."

As hospitals stash cash and line the pockets of executives, many patients are putting off care. The publication points out that "in 2022, about 1 in 7 Americans delayed or went without hospital services due to high costs," and that "those delays create much higher risks of more serious conditions, worse health outcomes, and higher costs for patients."

For those who initially go to the doctor, unpaid bills may prevent them from getting more care later, due to hospital policies. For example, Allina—which spent just 0.346% of its revenue on charity care—previously "blocked employees from scheduling future appointments for patients who had outstanding bills exceeding $4,500," according to the report.

"Even when patients entered into payment plans, Allina blocked them from making appointments until the entire debt was cleared. These practices result in patients being denied needed care, including children who could not receive the necessary medical forms to enroll in day care or school," the document adds. "Only after extensive reporting detailing Allina's practices did the hospital change its policies."

Current conditions are "absolutely unacceptable," declared Sanders.

"At a time when 85 million Americans are uninsured or underinsured, over 500,000 people go bankrupt because of medically related debt, and over 60,000 Americans die each year because they cannot afford to go to a doctor when they need to, nonprofit hospitals should be providing more charity care to those who desperately need it, not less," he argued. "And if they refuse to do so, they should lose their tax-exempt status."

The report calls on Congress and the Internal Revenue Service (IRS) to "hold nonprofit hospitals accountable for the benefits they reap and their moral obligation to serve as pillars of accessible healthcare in their communities," and offers some steps they both could take.

Federal lawmakers could ensure hospitals offer charity care at levels consistent with tax breaks, establish standards for financial assistance programs, and define the community engagement necessary to justify nonprofit status, the report says, while "the IRS could address the administrative gaps that allow nonprofit hospitals to benefit off of the people they are failing to help."