SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

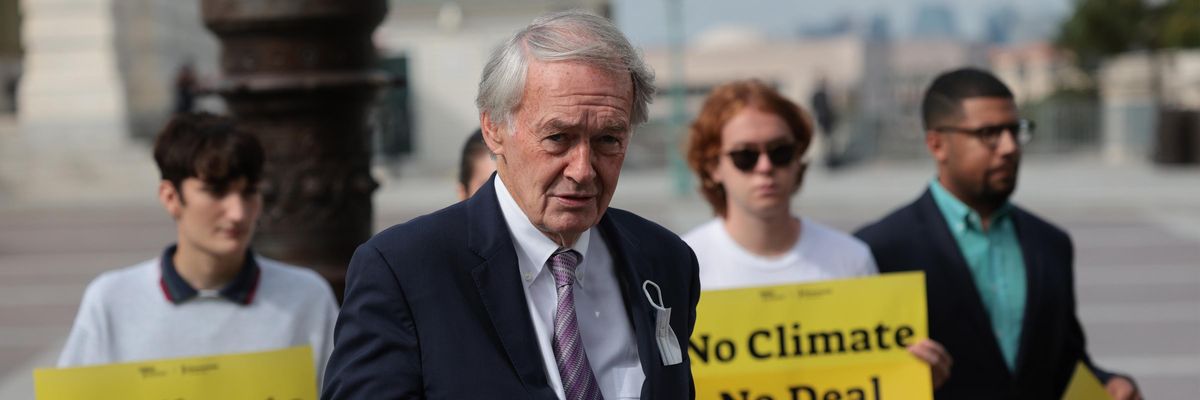

Sen. Ed Markey (D-Mass.) speaks at a press conference about climate provisions in the Build Back Better bill outside the U.S. Capitol October 7, 2021.

"The SEC's decision to bow to industry pressure against comprehensive climate disclosure requirements is a disservice to both the planet and investors," said one expert.

The U.S. Securities and Exchange Commission released a climate disclosure rule on Wednesday that will require public companies to report their greenhouse gas emissions and climate risks, but the new rule does not include requirements for companies to report emissions related to their supply chains.

The SEC seemingly bent to big business interests after many major companies pressured the commission to omit the supply chain aspect of the rule.

"Under the original proposal, large companies would have been required to disclose not just planet-warming emissions from their own operations, but also emissions produced along what's known as a company's 'value chain'—a term that encompasses everything from the parts or services bought from other suppliers, to the way that people who use the products ultimately dispose of them. Pollution created all along this value chain could add up," The New York Timesreports.

The new rule only requires that companies report their direct greenhouse gas emissions and the risks they're exposed to from climate-related natural disasters and extreme heat.

Climate risks are financial risks. This @SECGov decision will let big corporations off the hook by not requiring disclosure of emissions throughout their supply chains. That means big promises with little accountability to deliver emissions reductions. Unacceptable. https://t.co/HjO4d1XyZu

— Ed Markey (@SenMarkey) March 6, 2024

Charles Slidders, a senior attorney at the Center for International Environmental Law, criticized the weakened rule in a statement.

"The SEC's decision to bow to industry pressure against comprehensive climate disclosure requirements is a disservice to both the planet and investors," Slidders said. "In an era of urgent need for more sustainable practices, greater transparency, and reliable information on corporate climate impacts and risks, the lack of ambition reflected in this rule represents a step backward that could ultimately undermine efforts to mitigate climate change and protect investors' interests."

David Arkush, director of Public Citizen's climate program, said in a statement that the SEC had "caved to special interests and was cowed by litigation risk." Sen. Sheldon Whitehouse (D-R.I.) said it was "unfortunate" that the SEC had watered down the rule.

"Climate-related risks are financial risks, and investors have a right to know the full scope of a public company's emissions profile. This SEC decision will let big corporations off the hook in the United States, allowing them to avoid disclosure of emissions from throughout their supply chains," said Sen. Ed Markey (D-Mass.).

While the SEC may be refusing to require that companies disclose how their supply chains affect the climate, the state of California doesn't have any problem doing that. The state passed a bill in September that requires large companies to disclose this information.

Trump and Musk are on an unconstitutional rampage, aiming for virtually every corner of the federal government. These two right-wing billionaires are targeting nurses, scientists, teachers, daycare providers, judges, veterans, air traffic controllers, and nuclear safety inspectors. No one is safe. The food stamps program, Social Security, Medicare, and Medicaid are next. It’s an unprecedented disaster and a five-alarm fire, but there will be a reckoning. The people did not vote for this. The American people do not want this dystopian hellscape that hides behind claims of “efficiency.” Still, in reality, it is all a giveaway to corporate interests and the libertarian dreams of far-right oligarchs like Musk. Common Dreams is playing a vital role by reporting day and night on this orgy of corruption and greed, as well as what everyday people can do to organize and fight back. As a people-powered nonprofit news outlet, we cover issues the corporate media never will, but we can only continue with our readers’ support. |

The U.S. Securities and Exchange Commission released a climate disclosure rule on Wednesday that will require public companies to report their greenhouse gas emissions and climate risks, but the new rule does not include requirements for companies to report emissions related to their supply chains.

The SEC seemingly bent to big business interests after many major companies pressured the commission to omit the supply chain aspect of the rule.

"Under the original proposal, large companies would have been required to disclose not just planet-warming emissions from their own operations, but also emissions produced along what's known as a company's 'value chain'—a term that encompasses everything from the parts or services bought from other suppliers, to the way that people who use the products ultimately dispose of them. Pollution created all along this value chain could add up," The New York Timesreports.

The new rule only requires that companies report their direct greenhouse gas emissions and the risks they're exposed to from climate-related natural disasters and extreme heat.

Climate risks are financial risks. This @SECGov decision will let big corporations off the hook by not requiring disclosure of emissions throughout their supply chains. That means big promises with little accountability to deliver emissions reductions. Unacceptable. https://t.co/HjO4d1XyZu

— Ed Markey (@SenMarkey) March 6, 2024

Charles Slidders, a senior attorney at the Center for International Environmental Law, criticized the weakened rule in a statement.

"The SEC's decision to bow to industry pressure against comprehensive climate disclosure requirements is a disservice to both the planet and investors," Slidders said. "In an era of urgent need for more sustainable practices, greater transparency, and reliable information on corporate climate impacts and risks, the lack of ambition reflected in this rule represents a step backward that could ultimately undermine efforts to mitigate climate change and protect investors' interests."

David Arkush, director of Public Citizen's climate program, said in a statement that the SEC had "caved to special interests and was cowed by litigation risk." Sen. Sheldon Whitehouse (D-R.I.) said it was "unfortunate" that the SEC had watered down the rule.

"Climate-related risks are financial risks, and investors have a right to know the full scope of a public company's emissions profile. This SEC decision will let big corporations off the hook in the United States, allowing them to avoid disclosure of emissions from throughout their supply chains," said Sen. Ed Markey (D-Mass.).

While the SEC may be refusing to require that companies disclose how their supply chains affect the climate, the state of California doesn't have any problem doing that. The state passed a bill in September that requires large companies to disclose this information.

The U.S. Securities and Exchange Commission released a climate disclosure rule on Wednesday that will require public companies to report their greenhouse gas emissions and climate risks, but the new rule does not include requirements for companies to report emissions related to their supply chains.

The SEC seemingly bent to big business interests after many major companies pressured the commission to omit the supply chain aspect of the rule.

"Under the original proposal, large companies would have been required to disclose not just planet-warming emissions from their own operations, but also emissions produced along what's known as a company's 'value chain'—a term that encompasses everything from the parts or services bought from other suppliers, to the way that people who use the products ultimately dispose of them. Pollution created all along this value chain could add up," The New York Timesreports.

The new rule only requires that companies report their direct greenhouse gas emissions and the risks they're exposed to from climate-related natural disasters and extreme heat.

Climate risks are financial risks. This @SECGov decision will let big corporations off the hook by not requiring disclosure of emissions throughout their supply chains. That means big promises with little accountability to deliver emissions reductions. Unacceptable. https://t.co/HjO4d1XyZu

— Ed Markey (@SenMarkey) March 6, 2024

Charles Slidders, a senior attorney at the Center for International Environmental Law, criticized the weakened rule in a statement.

"The SEC's decision to bow to industry pressure against comprehensive climate disclosure requirements is a disservice to both the planet and investors," Slidders said. "In an era of urgent need for more sustainable practices, greater transparency, and reliable information on corporate climate impacts and risks, the lack of ambition reflected in this rule represents a step backward that could ultimately undermine efforts to mitigate climate change and protect investors' interests."

David Arkush, director of Public Citizen's climate program, said in a statement that the SEC had "caved to special interests and was cowed by litigation risk." Sen. Sheldon Whitehouse (D-R.I.) said it was "unfortunate" that the SEC had watered down the rule.

"Climate-related risks are financial risks, and investors have a right to know the full scope of a public company's emissions profile. This SEC decision will let big corporations off the hook in the United States, allowing them to avoid disclosure of emissions from throughout their supply chains," said Sen. Ed Markey (D-Mass.).

While the SEC may be refusing to require that companies disclose how their supply chains affect the climate, the state of California doesn't have any problem doing that. The state passed a bill in September that requires large companies to disclose this information.