SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

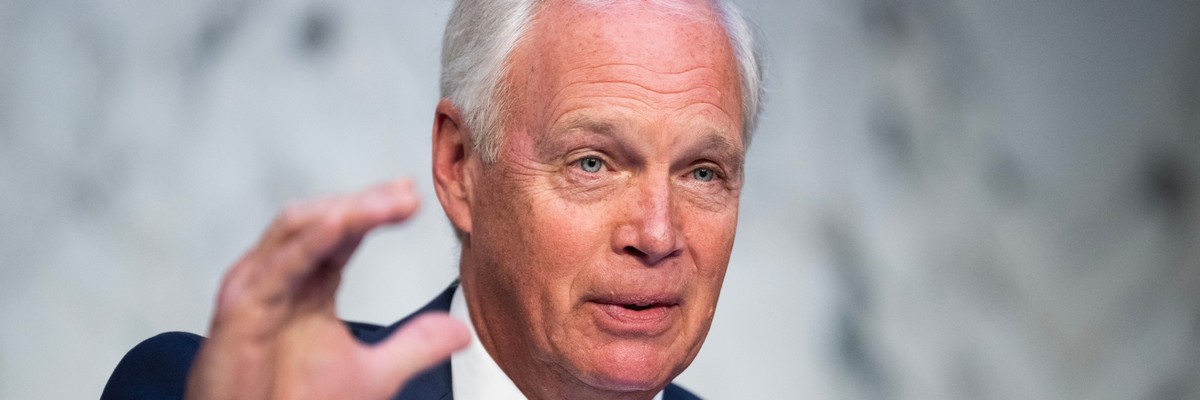

U.S. Sen Ron Johnson (R-Wis.) speaks during a Capitol Hill hearing on July 11, 2023.

The Wisconsin Republican millionaire accused working-class Americans of "getting a lot more in return" from the key social program than rich people who pay disproportionately less into its coffers.

U.S. Sen. Ron Johnson came under fire Wednesday after the multimillionaire Wisconsin Republican asserted during a Senate hearing that Social Security—an economic lifeline for tens of millions of Americans who paid into the system throughout their working lives—unfairly takes from wealthier people to support lower-income retirees.

Speaking during the Senate Budget Committee hearing—entitled Protecting Social Security for All: Making the Wealthy Pay Their Fair Share—Johnson said that his Wisconsin constituents "have a basic misconception about Social Security."

Johnson—one of the wealthiest U.S. senators, according to the watchdog OpenSecrets—derided Social Security, a key New Deal program, as a "nanny state" scheme enacted because the government doesn't trust Americans to save for retirement on their own.

"Most people think, 'Well, that's my money,' and, in fact, part of it is," the senator continued. "If you're in a low-income group, you're getting a lot more in return than you invested in... If you're in the high-income, you're not getting what you paid in."

Patient advocate and cancer survivor Peter Morley tweeted Wednesday that "Sen. Ron Johnson is a LIAR and it was clear from today's hearing that he is a defender of the rich and not for the people!"

Johnson previously called Social Security a "Ponzi scheme" in one of many attacks on the program upon which around 66 million Americans rely.

Further arguing during Wednesday's hearing that Social Security was not meant to be a "general welfare system," Johnson turned to Institute on Taxation and Economic Policy (ITEP) executive director Amy Hanauer—who testified that "our tax system raises far too little from those with the most"—to ask what he called "a very simple question."

"Out of every $1 of income that any American makes," he queried, "how much should be the maximum amount the government takes out in total?"

"I think we should think about the kind of country we want to have," Hanauer began to reply before Johnson interrupted her to demand an answer as "a percent."

"You know, we had 400 billionaires who paid less than an 8% tax rate, so more than that," she asserted. "It strikes me that in a society where the wealthiest are getting more and more of our income, they can afford to chip in more to maintain the systems that enabled them to build that wealth in the first place."

Senate Budget Committee Chair Sheldon Whitehouse (D-R.I.) followed Hanauer's response by opining that "it would make a very big difference to me in how much should be taxed on a dollar of income whether it was the first dollar of income of an individual or their billionth dollar of income."

On Tuesday, the Social Security Administration's Office of the Chief Actuary published an analysis showing how Democrats' Medicare and Social Security Fair Share Act could extend the social programs' solvency for generations by increasing taxes on incomes over $400,000.

Another bill introduced earlier this year by Sens. Bernie Sanders (I-Vt.) and Elizabeth Warren (D-Mass.) and Reps. Jan Schakowsky (D-Ill.) and Val Hoyle (D-Ore.) would boost monthly Social Security benefits by at least $200, prolonging the program's solvency for decades by lifting the cap on the maximum income subject to Social Security payroll tax.

Meanwhile, House Speaker Kevin McCarthy (R-Calif.) has announced the creation of a fiscal commission tasked with finding ways to reduce the national debt, warning last month that he was "going to make some people uncomfortable" by looking at cuts to Social Security and Medicare.

Trump and Musk are on an unconstitutional rampage, aiming for virtually every corner of the federal government. These two right-wing billionaires are targeting nurses, scientists, teachers, daycare providers, judges, veterans, air traffic controllers, and nuclear safety inspectors. No one is safe. The food stamps program, Social Security, Medicare, and Medicaid are next. It’s an unprecedented disaster and a five-alarm fire, but there will be a reckoning. The people did not vote for this. The American people do not want this dystopian hellscape that hides behind claims of “efficiency.” Still, in reality, it is all a giveaway to corporate interests and the libertarian dreams of far-right oligarchs like Musk. Common Dreams is playing a vital role by reporting day and night on this orgy of corruption and greed, as well as what everyday people can do to organize and fight back. As a people-powered nonprofit news outlet, we cover issues the corporate media never will, but we can only continue with our readers’ support. |

U.S. Sen. Ron Johnson came under fire Wednesday after the multimillionaire Wisconsin Republican asserted during a Senate hearing that Social Security—an economic lifeline for tens of millions of Americans who paid into the system throughout their working lives—unfairly takes from wealthier people to support lower-income retirees.

Speaking during the Senate Budget Committee hearing—entitled Protecting Social Security for All: Making the Wealthy Pay Their Fair Share—Johnson said that his Wisconsin constituents "have a basic misconception about Social Security."

Johnson—one of the wealthiest U.S. senators, according to the watchdog OpenSecrets—derided Social Security, a key New Deal program, as a "nanny state" scheme enacted because the government doesn't trust Americans to save for retirement on their own.

"Most people think, 'Well, that's my money,' and, in fact, part of it is," the senator continued. "If you're in a low-income group, you're getting a lot more in return than you invested in... If you're in the high-income, you're not getting what you paid in."

Patient advocate and cancer survivor Peter Morley tweeted Wednesday that "Sen. Ron Johnson is a LIAR and it was clear from today's hearing that he is a defender of the rich and not for the people!"

Johnson previously called Social Security a "Ponzi scheme" in one of many attacks on the program upon which around 66 million Americans rely.

Further arguing during Wednesday's hearing that Social Security was not meant to be a "general welfare system," Johnson turned to Institute on Taxation and Economic Policy (ITEP) executive director Amy Hanauer—who testified that "our tax system raises far too little from those with the most"—to ask what he called "a very simple question."

"Out of every $1 of income that any American makes," he queried, "how much should be the maximum amount the government takes out in total?"

"I think we should think about the kind of country we want to have," Hanauer began to reply before Johnson interrupted her to demand an answer as "a percent."

"You know, we had 400 billionaires who paid less than an 8% tax rate, so more than that," she asserted. "It strikes me that in a society where the wealthiest are getting more and more of our income, they can afford to chip in more to maintain the systems that enabled them to build that wealth in the first place."

Senate Budget Committee Chair Sheldon Whitehouse (D-R.I.) followed Hanauer's response by opining that "it would make a very big difference to me in how much should be taxed on a dollar of income whether it was the first dollar of income of an individual or their billionth dollar of income."

On Tuesday, the Social Security Administration's Office of the Chief Actuary published an analysis showing how Democrats' Medicare and Social Security Fair Share Act could extend the social programs' solvency for generations by increasing taxes on incomes over $400,000.

Another bill introduced earlier this year by Sens. Bernie Sanders (I-Vt.) and Elizabeth Warren (D-Mass.) and Reps. Jan Schakowsky (D-Ill.) and Val Hoyle (D-Ore.) would boost monthly Social Security benefits by at least $200, prolonging the program's solvency for decades by lifting the cap on the maximum income subject to Social Security payroll tax.

Meanwhile, House Speaker Kevin McCarthy (R-Calif.) has announced the creation of a fiscal commission tasked with finding ways to reduce the national debt, warning last month that he was "going to make some people uncomfortable" by looking at cuts to Social Security and Medicare.

U.S. Sen. Ron Johnson came under fire Wednesday after the multimillionaire Wisconsin Republican asserted during a Senate hearing that Social Security—an economic lifeline for tens of millions of Americans who paid into the system throughout their working lives—unfairly takes from wealthier people to support lower-income retirees.

Speaking during the Senate Budget Committee hearing—entitled Protecting Social Security for All: Making the Wealthy Pay Their Fair Share—Johnson said that his Wisconsin constituents "have a basic misconception about Social Security."

Johnson—one of the wealthiest U.S. senators, according to the watchdog OpenSecrets—derided Social Security, a key New Deal program, as a "nanny state" scheme enacted because the government doesn't trust Americans to save for retirement on their own.

"Most people think, 'Well, that's my money,' and, in fact, part of it is," the senator continued. "If you're in a low-income group, you're getting a lot more in return than you invested in... If you're in the high-income, you're not getting what you paid in."

Patient advocate and cancer survivor Peter Morley tweeted Wednesday that "Sen. Ron Johnson is a LIAR and it was clear from today's hearing that he is a defender of the rich and not for the people!"

Johnson previously called Social Security a "Ponzi scheme" in one of many attacks on the program upon which around 66 million Americans rely.

Further arguing during Wednesday's hearing that Social Security was not meant to be a "general welfare system," Johnson turned to Institute on Taxation and Economic Policy (ITEP) executive director Amy Hanauer—who testified that "our tax system raises far too little from those with the most"—to ask what he called "a very simple question."

"Out of every $1 of income that any American makes," he queried, "how much should be the maximum amount the government takes out in total?"

"I think we should think about the kind of country we want to have," Hanauer began to reply before Johnson interrupted her to demand an answer as "a percent."

"You know, we had 400 billionaires who paid less than an 8% tax rate, so more than that," she asserted. "It strikes me that in a society where the wealthiest are getting more and more of our income, they can afford to chip in more to maintain the systems that enabled them to build that wealth in the first place."

Senate Budget Committee Chair Sheldon Whitehouse (D-R.I.) followed Hanauer's response by opining that "it would make a very big difference to me in how much should be taxed on a dollar of income whether it was the first dollar of income of an individual or their billionth dollar of income."

On Tuesday, the Social Security Administration's Office of the Chief Actuary published an analysis showing how Democrats' Medicare and Social Security Fair Share Act could extend the social programs' solvency for generations by increasing taxes on incomes over $400,000.

Another bill introduced earlier this year by Sens. Bernie Sanders (I-Vt.) and Elizabeth Warren (D-Mass.) and Reps. Jan Schakowsky (D-Ill.) and Val Hoyle (D-Ore.) would boost monthly Social Security benefits by at least $200, prolonging the program's solvency for decades by lifting the cap on the maximum income subject to Social Security payroll tax.

Meanwhile, House Speaker Kevin McCarthy (R-Calif.) has announced the creation of a fiscal commission tasked with finding ways to reduce the national debt, warning last month that he was "going to make some people uncomfortable" by looking at cuts to Social Security and Medicare.

An advocate who has worked with the ICC said the order "actively undermines international justice efforts and obstructs the path to accountability for communities facing unthinkable horrors."

In a federal court in Maine on Friday, two human rights advocates argued that U.S. President Donald Trump's economic and travel sanctions against International Criminal Court Prosecutor Karim Khan violates their First Amendment rights, because of Trump's stipulation that U.S. citizens cannot provide Khan with any services or material support as long as the sanctions are in place.

The lawsuit was filed by the ACLU on behalf of Matthew Smith, co-founder of the human rights group Fortify Rights, and international lawyer Akila Radhakrishnan.

Trump targeted Khan with the sanctions over his issuing of an arrest warrant for Israeli Prime Minister Benjamin Netanyahu and former Israeli Defense Minister Yoav Gallant, whom he accused of war crimes and crimes against humanity in Gaza.

The plaintiffs argued that stopping U.S. citizens from working with Khan will bring their work investigating other atrocities to a halt.

Smith has provided the ICC with evidence of the forced deportation and genocide of the Rohingya people in Myanmar, but he said he has been "forced to stop helping the ICC investigate horrific crimes committed against the people of Myanmar, including mass murder, torture, and human trafficking."

"This executive order doesn't just disrupt our work—it actively undermines international justice efforts and obstructs the path to accountability for communities facing unthinkable horrors," Smith said in a statement.

"The Trump administration's sanctions may discourage countries, as well as individuals and corporations, from assisting the court, making it harder to bring alleged perpetrators from Israel and other countries to trial."

Charlie Hogle, staff attorney with the ACLU's National Security Project, said it was "unconstitutional" to block the plaintiffs and other humanitarian groups in the U.S. from "doing their human rights work" with the ICC.

Radhakrishnan, who focuses on gender-based violence in Afghanistan, said she was "bringing this suit to prevent my own government from punishing me for trying to hold the Taliban accountable for its systematic violence against women and girls from Afghanistan."

In March, Amnesty International warned that Trump's sanctions would "hinder justice for all victims for whom the [ICC] is a last resort," particularly those in Gaza and the occupied Palestinian territories.

The court "relies on its member states to cooperate in its investigations and prosecutions, including by arresting individuals subject to ICC arrest warrants," said Amnesty. "The Trump administration's sanctions may discourage countries, as well as individuals and corporations, from assisting the court, making it harder to bring alleged perpetrators from Israel and other countries to trial."

"Ultimately, the sanctions will harm all of the ICC's investigations, not just those opposed by the U.S. government," said the group. "They will negatively impact the interests of all victims who look to the court for justice in all the countries where it is conducting investigations, including those investigations the U.S. ostensibly supports—for example in Ukraine, Uganda, or Darfur."

"This expansion is a disastrous waste of billions of taxpayer dollars that will only line the coffers of the private prison industry," said one ACLU attorney.

The ACLU on Friday revealed new details about the Trump administration's plans to expand Immigration and Customs Enforcement detention centers in 10 states across the nation, with private prison corporations—whose share prices soared after the election of President Donald Trump—seeking to run at least a half dozen proposed ICE facilities.

The documents, obtained via a Freedom of Information Act request, "signal a massive expansion of ICE detention capacity—including at facilities notorious for misconduct and abuse—which echo reports earlier this week that the Trump administration has sought proposals for up to $45 billion to expand immigrant detention," ACLU said.

"The discovery also comes on the heels of a 'strategic sourcing vehicle' released by ICE earlier this month, which called for government contractors to submit proposals for immigration detention and related services," the group added.

The more than 250 pages of documents obtained by the ACLU "include information regarding facility capacity, history of facility use, available local transport, proximity to local hospitals, immigration courts, and transport, as well as access to local consulates and pro bono legal services."

"Specifically, the documents reveal that Geo Group, Inc. (GEO) and CoreCivic submitted proposals for a variety of facilities not currently in use by ICE," ACLU said.

These include:

GEO, CoreCivic, and Management Training Corporation (MTC) "also sought to renew contracts at current ICE detention facilities" in California, Nevada, New Mexico, Texas, and Washington, according to the files.

"The documents received provide important details regarding what we have long feared—a massive expansion of ICE detention facilities nationwide in an effort to further the Trump administration's dystopian plans to deport our immigrant neighbors and loved ones," said Eunice Cho, senior staff attorney at the ACLU's National Prison Project.

"This expansion is a disastrous waste of billions of taxpayer dollars that will only line the coffers of the private prison industry," Cho added.

Indeed, GEO shares have nearly doubled in value since Trump's election, while CoreCivic stock is up 57% over the same period.

Unlike state prisons or country and local jails, which are accountable to oversight agencies, privately operated ICE detention centers are not subject to state regulation or inspection. And although Department of Homeland Security detainees are not convicted criminals and ICE detention centers are not technically prisons, the facilities are plagued by a history of abuse, often sexual in nature, and sometimes deadly.

During Trump's first term, groups including the ACLU sounded the alarm on the record number of detainee deaths in ICE custody, and scandals—including the separation of children from their parents or guardians and forced sterilization of numerous women at an ICE facility in Georgia—sparked widespread outrage and calls for reform from immigrant rights defenders.

However, abuses continued into the administration of former President Joe Biden, including "medical neglect, preventable deaths, punitive use of solitary confinement, lack of due process, obstructed access to legal counsel, and discriminatory and racist treatment," according to a 2024 report published by the National Immigrant Justice Center. Biden also broke a campaign promise to stop holding federal prisoners and immigration detainees in private prisons.

Since Trump took office in January after being elected on a promise to carry out the largest deportation campaign in U.S. history, fresh reports of ICE detainee abuse and poor detention conditions have been reported. These include

alleged denial of medical care, insufficient access to feminine hygiene products, and rotten food at the South Louisiana ICE Processing Center in Basile, Louisiana, where Tufts University Ph.D. student and Palestine defender Rümeysa Öztürk is being held without charge.

"This flagrant conflict of interest stands to serve the interests of Elon Musk while the American people are robbed of fair access to THEIR Social Security Administration," said one former agency leader.

The Trump administration faced a fresh wave of criticism on Friday in response to reporting that the Social Security Administration is cutting its communications staff and will shift from using press releases to billionaire Elon Musk's social media platform X.

Musk, the richest person on Earth, is notably also the de facto leader of President Donald Trump's Department of Government Efficiency (DOGE), which is leading the administration's effort to gut the federal bureaucracy—though the billionaire faces a rapidly approaching 130-day limit for how long he can serve as a "special government employee" under federal law.

"Elon Musk is forcing seniors onto X to learn about and get news about Social Security," Melanie D'Arrigo, executive director of the Campaign for New York Health, which advocates for universal healthcare, wrote on the platform Friday. "The only person this benefits is Elon Musk. Welcome to the oligarchy era."

Martin O'Malley, who led the agency during the Biden administration, also

responded to the reporting on X, saying, "This flagrant conflict of interest stands to serve the interests of Elon Musk while the American people are robbed of fair access to THEIR Social Security Administration and the benefits they worked so hard to earn."

During a Thursday call with employees, SSA Midwest-West (MWW) Regional Commissioner Linda Kerr-Davis said that instead of making announcements via press releases or "Dear Colleague" letters, "the agency will be using X to communicate to the press and the public—formerly known as Twitter," according to Federal News Network. "This will become our communication mechanism."

"If you're used to getting press releases and Dear Colleague letters, you might want to subscribe to the official SSA X account, so you can stay up to date with agency news," Kerr-Davis told agency workers. "I know this probably sounds very foreign to you—it did to me as well—and not what we are used to, but we are in different times now."

Federal News Network also detailed her comments on reassigning workers to minimize the need for layoffs at the agency:

The reassignments will lead to major staffing cuts to regional offices. Kerr-Davis said the MWW regional office has about 550 employees now, but will only have about 70 employees under the new "skinny regional office" model.

"Won't losing subject-matter experts lead directly to fraud, waste, and abuse? Yes," Kerr-Davis told employees. "Things are going to break, and they're going to break fast. We know that, but hopefully we'll be able to get some support."

Kerr-Davis added that the reassignments will be a "welcome addition" for understaffed field offices. But in many cases, reassigned employees will work in less senior positions.

"I can only imagine how this shift might make them feel, after years of dedicated service in their prior roles. They are used to being experts in their field, and we're asking them to take on new responsibilities," she said. "For some, it's going back to work they used to do a long time ago, which may look very different."

Kerr-Davis' comments were also reported Friday by Wired, which noted that she did not respond to a request for comment. However, Liz Huston, a White House spokesperson, said: "This reporting is misleading. The Social Security Administration is actively communicating with beneficiaries and stakeholders."

"There has not been a reduction in workforce," Huston told Wired. "Rather, to improve the delivery of services, staff are being reassigned from regional offices to front-line help—allocating finite resources where they are most needed. President Trump will continue to always protect Social Security."

HuffPost pointed out Friday that "in recent weeks, queries to the SSA press line have produced responses from White House spokespeople instead of Social Security spokespeople."

The SSA has not published a press release on its website since March 27, but has been sharing updates on its X account, @SocialSecurity, in recent weeks—the latest post, from Wednesday, addresses the rollback of a planned identity verification policy and related phone service cuts.

American Federation of State, County, and Municipal Employees president Lee Saunders said in a Friday statement that "retirees, disabled individuals, and the millions of beneficiaries who rely on Social Security should not need an X account to receive updates on the program."

"Moving all Social Security communications to Elon Musk's personal social media platform is a blatant effort to gain more users and pad X's profits," the union leader charged. "This move should ring alarm bells everywhere. Social Security belongs to the hardworking taxpayers who have paid into the program, not an unelected billionaire like Musk."

"This administration has made their desire to gut and then privatize Social Security clear. Shuttering the program's regional offices and moving all communications to a single, unaccountable, insecure, for-profit social media company is just the next step in their scheme to enrich billionaires with our tax dollars," he added. "This is exactly why we need to keep Musk and his DOGE cronies out of the Social Security Administration, and we're not going to give up this fight."

AFSCME, the American Federation of Teachers, and the Alliance for Retired Americans are fighting DOGE's access to sensitive personal data at the SSA in federal court.