With a battle over congressional Republicans and former U.S. President Donald Trump's 2017 tax law brewing, a progressive think tank on Monday published an analysis that points to the surge in stock buybacks as proof that federal policymakers should raise the corporate tax rate.

When Trump—the presumptive GOP nominee to challenge President Joe Biden in November—signed the Tax Cuts and Jobs Act, slashing the corporate tax rate from 35% to 21%, he declared that "corporations are literally going wild over this, I think even beyond my expectations."

Chuck Marr, vice president for federal tax policy at the Center on Budget and Policy Priorities (CBPP) wrote in his new analysis that "other studies have shown that the corporate rate cut overwhelmingly benefits high-income people and has failed to deliver to workers the benefits its proponents promised."

He referenced research from the American Enterprise Institute, Brookings Institution, and University of North Carolina as well as the Joint Committee on Taxation and Federal Reserve Board that exposes how the law hasn't lived up to the GOP's claims.

"The fact that it also launched massive buybacks is a further reason why policymakers should revisit the rate cut next year—part of the larger course correction needed in the nation's revenue policies as major pieces of the 2017 law expire," Marr argued.

Buyback is a term for when a company purchases its own outstanding stock to reduce the number of shares on the market and increase the value of the remaining ones, a practice that further enriches shareholders.

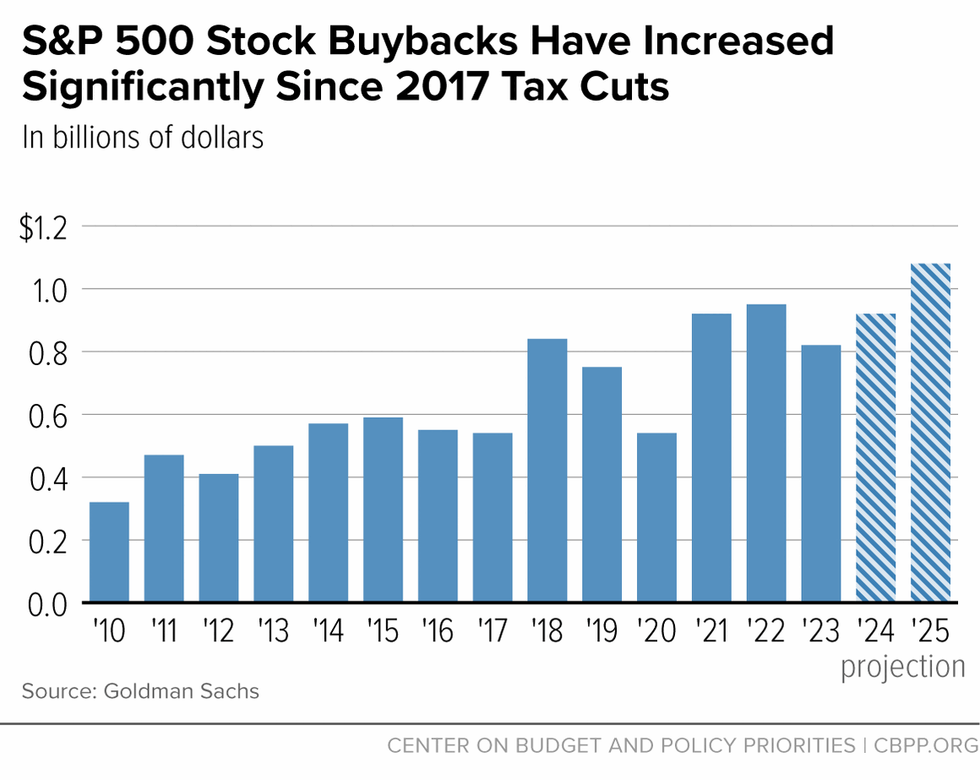

"Excluding the pandemic-induced recession in 2020, buybacks have been markedly higher every year since the 2017 law, and are projected to top $1 trillion in 2025 for the first time," Marr noted, citing Goldman Sachs.

Some companies—such as John Deere—have even laid off workers while buying back stock, as Common Dreams has reported.

"The fact that corporations have significant excess cash beyond their investment needs and are using it to further enrich already affluent shareholders suggests that partially reversing the corporate rate cut, as President Biden has proposed, poses little risk to investment or the broader economy," Marr wrote. The president's proposed rate is 28%.

"Policymakers have an opportunity to move away from corporate tax cuts that haven't delivered on their economic promises and toward a tax system that raises more revenue through progressive policies like increasing the corporate tax rate," he explained. "They can then use those revenues for investments to make the economy work better for everyone, such as an expanded child tax credit and Earned Income Tax Credit, childcare, and housing."

Marr also urged lawmakers to go even further and "raise the excise tax on stock buybacks to 4% from the current 1%."

The CBBP is far from alone in framing the looming expiration of some tax cuts as a chance to pursue more progressive policy. In fact, the center is part of a coalition led by Groundwork Collaborative that is calling on Congress to "use the expiration of these provisions as an opportunity to address long-standing problems with our tax code, not just to tinker around the edges."

Some progressives on Capitol Hill—such as Sen Elizabeth Warren (D-Mass.), who supports a wealth tax targeting the richest Americans—are also seizing the moment.

Warren said earlier this month: "It's time to stiffen our spines. President Biden is right: If the 2025 tax bill doesn't call on the wealthy and giant corporations to shoulder a bigger share of what it costs to run this country, Democrats should reject it outright. No more Trump tax breaks for billionaires."