SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

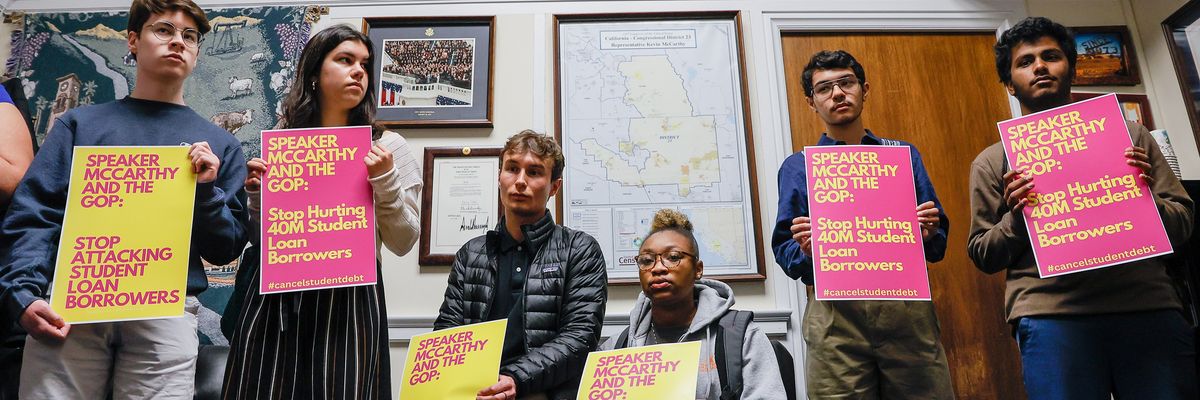

Student loan borrowers stage a sit-in on Capitol Hill at the office of U.S. Speaker of the House Kevin McCarthy (R-Calif.) on May 9, 2023 in Washington, D.C.

"What if payments begin and millions—literally millions—of people default on their debt?" the Debt Collective asked. "What if seniors get their Social Security checks garnished en masse?"

House Republicans weren't ultimately able to include a full repeal of President Joe Biden's pending student debt cancellation plan in the new debt ceiling agreement, but they did reach a deal with the Biden White House to insert a provision that campaigners say could be devastating for millions of borrowers across the country.

Tucked in the 99-page legislation that Congress could vote on this week is language prohibiting the education secretary from using "any authority to implement an extension" of the federal student loan repayment pause, which remains in place as the U.S. Supreme Court considers a pair of legal challenges to the Biden administration's debt relief plan.

If passed, the repayment pause enacted early in the Covid-19 pandemic and extended eight times—saving borrowers hundreds of billions of dollars in payments and interest—would be terminated 60 days after June 30, 2023 unless another extension is "expressly authorized" by Congress.

House Speaker Kevin McCarthy (R-Calif.)—who attended California State University, Bakersfield when tuition and fees were an inflation-adjusted $1,982—wasted little time touting the provision as he made the media rounds over the weekend, declaring in a Fox News appearance that the "pause is gone" if the debt ceiling bill passes.

Debt relief campaigners responded with alarm.

"This has huge and catastrophic financial implications for 50 million+ people," the Debt Collective, the nation's first debtors' union, wrote on Twitter.

The Biden White House had already pledged to end the student loan repayment pause 60 days after the Supreme Court decides the fate of student debt cancellation or 60 days after June 30—whichever comes first.

The debt ceiling agreement codifies that pledge into law, potentially complicating the White House's ability to authorize another pause if the Supreme Court agrees with the right-wing challengers' deeply flawed legal case and strikes down the administration's debt cancellation plan.

The Debt Collective pointed to that possibility late Monday, noting that the Biden administration "was gearing up to resume payments because they were going to simultaneously cancel lots of debt—20 million accounts zeroed out."

"Because of Covid's impact, the Biden admin said returning to repayment needed to be coupled with relief," the group wrote. "If SCOTUS rules student debt relief is legal, Biden can say he took action on student debt—the second-largest household debt in the country. The problem is, WE DON'T KNOW what SCOTUS will rule. We're still waiting. Basically this debt ceiling deal puts the cart before the horse."

"The debt-ceiling bill agreement reached by lawmakers is deeply harmful to millions of American families—the worst thing for borrowers would be a sudden and startling restart of payments."

Education Secretary Miguel Cardona insisted that, under the new agreement, the Biden administration would still retain the "ability to pause student loan payments should that be necessary in future emergencies."

But the Debt Collective warned that it could take the Biden administration weeks or months to implement another pause if it decided one was needed. The administration could also choose not to try to implement another freeze even if millions struggle to make payments.

"What if payments begin and millions—literally millions—of people default on their debt?" the Debt Collective asked. "What if seniors get their Social Security checks garnished en masse?"

\u201cThere's many more reasons to extend the pause, and absolutely no reason to let Republicans push Biden in a corner. Biden will try to tell you this is the fault of Republicans and there was nothing he could do. \n\nThat won't be true. It isn't true. The provision should go.\u201d— The Debt Collective \ud83d\udfe5 (@The Debt Collective \ud83d\udfe5) 1685396895

Due to funding shortfalls, the Education Department doesn't expect to have the capacity to begin collecting student debt payments again until October.

The financial firm Jefferies estimates that once federal student loan repayments begin, they will cost roughly 45 million borrowers a combined $18 billion per month, potentially having a significant impact on the broader U.S. economy in addition to placing major strain on individuals and families.

The average federal student loan payment in the U.S. is around $400 per month—though the Biden administration is working to finalize rules aimed at lessening that financial burden.

Natalia Abrams, president and founder of the Student Debt Crisis Center, said in a statement Monday that "it is imperative that lawmakers prioritize the wellbeing of millions of Americans by keeping payments paused until comprehensive and permanent debt cancellation is delivered."

"The debt-ceiling bill agreement reached by lawmakers is deeply harmful to millions of American families—the worst thing for borrowers would be a sudden and startling restart of payments," said Abrams. "Not only does it unnecessarily codify the end of pandemic relief measures that are still desperately needed, but it also sends a disheartening message that the ongoing efforts to assist borrowers are being rolled back before permanent relief promised by the Biden administration has been delivered."

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

House Republicans weren't ultimately able to include a full repeal of President Joe Biden's pending student debt cancellation plan in the new debt ceiling agreement, but they did reach a deal with the Biden White House to insert a provision that campaigners say could be devastating for millions of borrowers across the country.

Tucked in the 99-page legislation that Congress could vote on this week is language prohibiting the education secretary from using "any authority to implement an extension" of the federal student loan repayment pause, which remains in place as the U.S. Supreme Court considers a pair of legal challenges to the Biden administration's debt relief plan.

If passed, the repayment pause enacted early in the Covid-19 pandemic and extended eight times—saving borrowers hundreds of billions of dollars in payments and interest—would be terminated 60 days after June 30, 2023 unless another extension is "expressly authorized" by Congress.

House Speaker Kevin McCarthy (R-Calif.)—who attended California State University, Bakersfield when tuition and fees were an inflation-adjusted $1,982—wasted little time touting the provision as he made the media rounds over the weekend, declaring in a Fox News appearance that the "pause is gone" if the debt ceiling bill passes.

Debt relief campaigners responded with alarm.

"This has huge and catastrophic financial implications for 50 million+ people," the Debt Collective, the nation's first debtors' union, wrote on Twitter.

The Biden White House had already pledged to end the student loan repayment pause 60 days after the Supreme Court decides the fate of student debt cancellation or 60 days after June 30—whichever comes first.

The debt ceiling agreement codifies that pledge into law, potentially complicating the White House's ability to authorize another pause if the Supreme Court agrees with the right-wing challengers' deeply flawed legal case and strikes down the administration's debt cancellation plan.

The Debt Collective pointed to that possibility late Monday, noting that the Biden administration "was gearing up to resume payments because they were going to simultaneously cancel lots of debt—20 million accounts zeroed out."

"Because of Covid's impact, the Biden admin said returning to repayment needed to be coupled with relief," the group wrote. "If SCOTUS rules student debt relief is legal, Biden can say he took action on student debt—the second-largest household debt in the country. The problem is, WE DON'T KNOW what SCOTUS will rule. We're still waiting. Basically this debt ceiling deal puts the cart before the horse."

"The debt-ceiling bill agreement reached by lawmakers is deeply harmful to millions of American families—the worst thing for borrowers would be a sudden and startling restart of payments."

Education Secretary Miguel Cardona insisted that, under the new agreement, the Biden administration would still retain the "ability to pause student loan payments should that be necessary in future emergencies."

But the Debt Collective warned that it could take the Biden administration weeks or months to implement another pause if it decided one was needed. The administration could also choose not to try to implement another freeze even if millions struggle to make payments.

"What if payments begin and millions—literally millions—of people default on their debt?" the Debt Collective asked. "What if seniors get their Social Security checks garnished en masse?"

\u201cThere's many more reasons to extend the pause, and absolutely no reason to let Republicans push Biden in a corner. Biden will try to tell you this is the fault of Republicans and there was nothing he could do. \n\nThat won't be true. It isn't true. The provision should go.\u201d— The Debt Collective \ud83d\udfe5 (@The Debt Collective \ud83d\udfe5) 1685396895

Due to funding shortfalls, the Education Department doesn't expect to have the capacity to begin collecting student debt payments again until October.

The financial firm Jefferies estimates that once federal student loan repayments begin, they will cost roughly 45 million borrowers a combined $18 billion per month, potentially having a significant impact on the broader U.S. economy in addition to placing major strain on individuals and families.

The average federal student loan payment in the U.S. is around $400 per month—though the Biden administration is working to finalize rules aimed at lessening that financial burden.

Natalia Abrams, president and founder of the Student Debt Crisis Center, said in a statement Monday that "it is imperative that lawmakers prioritize the wellbeing of millions of Americans by keeping payments paused until comprehensive and permanent debt cancellation is delivered."

"The debt-ceiling bill agreement reached by lawmakers is deeply harmful to millions of American families—the worst thing for borrowers would be a sudden and startling restart of payments," said Abrams. "Not only does it unnecessarily codify the end of pandemic relief measures that are still desperately needed, but it also sends a disheartening message that the ongoing efforts to assist borrowers are being rolled back before permanent relief promised by the Biden administration has been delivered."

House Republicans weren't ultimately able to include a full repeal of President Joe Biden's pending student debt cancellation plan in the new debt ceiling agreement, but they did reach a deal with the Biden White House to insert a provision that campaigners say could be devastating for millions of borrowers across the country.

Tucked in the 99-page legislation that Congress could vote on this week is language prohibiting the education secretary from using "any authority to implement an extension" of the federal student loan repayment pause, which remains in place as the U.S. Supreme Court considers a pair of legal challenges to the Biden administration's debt relief plan.

If passed, the repayment pause enacted early in the Covid-19 pandemic and extended eight times—saving borrowers hundreds of billions of dollars in payments and interest—would be terminated 60 days after June 30, 2023 unless another extension is "expressly authorized" by Congress.

House Speaker Kevin McCarthy (R-Calif.)—who attended California State University, Bakersfield when tuition and fees were an inflation-adjusted $1,982—wasted little time touting the provision as he made the media rounds over the weekend, declaring in a Fox News appearance that the "pause is gone" if the debt ceiling bill passes.

Debt relief campaigners responded with alarm.

"This has huge and catastrophic financial implications for 50 million+ people," the Debt Collective, the nation's first debtors' union, wrote on Twitter.

The Biden White House had already pledged to end the student loan repayment pause 60 days after the Supreme Court decides the fate of student debt cancellation or 60 days after June 30—whichever comes first.

The debt ceiling agreement codifies that pledge into law, potentially complicating the White House's ability to authorize another pause if the Supreme Court agrees with the right-wing challengers' deeply flawed legal case and strikes down the administration's debt cancellation plan.

The Debt Collective pointed to that possibility late Monday, noting that the Biden administration "was gearing up to resume payments because they were going to simultaneously cancel lots of debt—20 million accounts zeroed out."

"Because of Covid's impact, the Biden admin said returning to repayment needed to be coupled with relief," the group wrote. "If SCOTUS rules student debt relief is legal, Biden can say he took action on student debt—the second-largest household debt in the country. The problem is, WE DON'T KNOW what SCOTUS will rule. We're still waiting. Basically this debt ceiling deal puts the cart before the horse."

"The debt-ceiling bill agreement reached by lawmakers is deeply harmful to millions of American families—the worst thing for borrowers would be a sudden and startling restart of payments."

Education Secretary Miguel Cardona insisted that, under the new agreement, the Biden administration would still retain the "ability to pause student loan payments should that be necessary in future emergencies."

But the Debt Collective warned that it could take the Biden administration weeks or months to implement another pause if it decided one was needed. The administration could also choose not to try to implement another freeze even if millions struggle to make payments.

"What if payments begin and millions—literally millions—of people default on their debt?" the Debt Collective asked. "What if seniors get their Social Security checks garnished en masse?"

\u201cThere's many more reasons to extend the pause, and absolutely no reason to let Republicans push Biden in a corner. Biden will try to tell you this is the fault of Republicans and there was nothing he could do. \n\nThat won't be true. It isn't true. The provision should go.\u201d— The Debt Collective \ud83d\udfe5 (@The Debt Collective \ud83d\udfe5) 1685396895

Due to funding shortfalls, the Education Department doesn't expect to have the capacity to begin collecting student debt payments again until October.

The financial firm Jefferies estimates that once federal student loan repayments begin, they will cost roughly 45 million borrowers a combined $18 billion per month, potentially having a significant impact on the broader U.S. economy in addition to placing major strain on individuals and families.

The average federal student loan payment in the U.S. is around $400 per month—though the Biden administration is working to finalize rules aimed at lessening that financial burden.

Natalia Abrams, president and founder of the Student Debt Crisis Center, said in a statement Monday that "it is imperative that lawmakers prioritize the wellbeing of millions of Americans by keeping payments paused until comprehensive and permanent debt cancellation is delivered."

"The debt-ceiling bill agreement reached by lawmakers is deeply harmful to millions of American families—the worst thing for borrowers would be a sudden and startling restart of payments," said Abrams. "Not only does it unnecessarily codify the end of pandemic relief measures that are still desperately needed, but it also sends a disheartening message that the ongoing efforts to assist borrowers are being rolled back before permanent relief promised by the Biden administration has been delivered."