SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

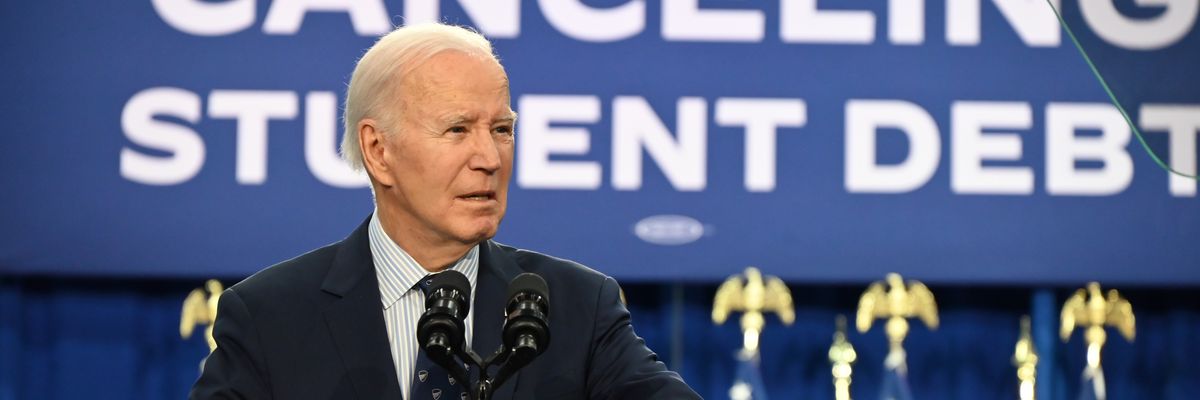

U.S. President Joe Biden delivers remarks on student debt and lowering costs for Americans at Madison College in Madison, Wisconsin on April 8, 2024.

"I reckon the U.S. Supreme Court does not like millions of people being able to afford to make payments on their student loans," said one journalist who had benefited from the SAVE program.

Millions of student loan borrowers whose monthly payments had been reduced by U.S. President Joe Biden's latest attempt to achieve debt relief were thrown into limbo Wednesday as the right-wing majority on the Supreme Court ruled in favor of a sweeping suspension of the president's policy.

After several Republican-led states filed lawsuits against the Saving on a Valuable Education (SAVE) program, the U.S. Court of Appeals for the 8th Circuit ruled last month that the program should be paused while it evaluated the merits of the case.

The Biden administration had asked the high court to clear the way for SAVE to go back into effect, allowing 8 million Americans enrolled in the program to make monthly loan payments based on their incomes.

Mike Pierce, executive director of the Student Borrower Protection Center, said the Supreme Court "bought into the 8th Circuit's legal fiction that pausing affordable payments is 'preserving the status quo,'" issuing a ruling he denounced as "bullshit."

Under SAVE, which has already cleared debts for 400,000 borrowers, the Biden administration reduced monthly payments for undergraduate loans to 5% of the borrower's discretionary income, down from 10%. Loans of $12,000 or less were to be canceled after 10 years instead of 20-25 years, as long as the borrower made required payments.

The administration argued that the program was in accordance with a 1993 law allowing the secretary of education to establish "income contingent repayment" plans based on "the appropriate portion of the annual income of the borrower."

After the lower court's earlier ruling, Education Secretary Miguel Cardona said the court had rejected "a practice of providing loan forgiveness that goes back 30 years."

Ashton Pittman, an editor for the Mississippi Free Press, said the program had reduced his monthly student loan payments so that he was "finally able to reliably make them each month."

"But I reckon the U.S. Supreme Court does not like millions of people being able to afford to make payments on their student loans," said Pittman.

The Debt Collective, a national student loan borrowers union, suggested the latest ruling—which comes over a year after the Supreme Court struck down a broader student debt relief plan from Biden—shows that the fight for debt forgiveness cannot be won through the federal court system.

The Debt Collective has joined progressive lawmakers and other groups in calling for the Department of Education to cut ties with the Missouri Higher Education Loan Authority (MOHELA), which services federal student loans and which Missouri Attorney General Andrew Bailey said would lose revenue if student debt cancellation is allowed to move forward.

"Biden is losing in court because he is not being politically or legally savvy," said the group after the 8th Circuit ruling was announced. "He should fire MOHELA and issue cancellation swiftly and automatically through an executive order and issue pause."

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

Millions of student loan borrowers whose monthly payments had been reduced by U.S. President Joe Biden's latest attempt to achieve debt relief were thrown into limbo Wednesday as the right-wing majority on the Supreme Court ruled in favor of a sweeping suspension of the president's policy.

After several Republican-led states filed lawsuits against the Saving on a Valuable Education (SAVE) program, the U.S. Court of Appeals for the 8th Circuit ruled last month that the program should be paused while it evaluated the merits of the case.

The Biden administration had asked the high court to clear the way for SAVE to go back into effect, allowing 8 million Americans enrolled in the program to make monthly loan payments based on their incomes.

Mike Pierce, executive director of the Student Borrower Protection Center, said the Supreme Court "bought into the 8th Circuit's legal fiction that pausing affordable payments is 'preserving the status quo,'" issuing a ruling he denounced as "bullshit."

Under SAVE, which has already cleared debts for 400,000 borrowers, the Biden administration reduced monthly payments for undergraduate loans to 5% of the borrower's discretionary income, down from 10%. Loans of $12,000 or less were to be canceled after 10 years instead of 20-25 years, as long as the borrower made required payments.

The administration argued that the program was in accordance with a 1993 law allowing the secretary of education to establish "income contingent repayment" plans based on "the appropriate portion of the annual income of the borrower."

After the lower court's earlier ruling, Education Secretary Miguel Cardona said the court had rejected "a practice of providing loan forgiveness that goes back 30 years."

Ashton Pittman, an editor for the Mississippi Free Press, said the program had reduced his monthly student loan payments so that he was "finally able to reliably make them each month."

"But I reckon the U.S. Supreme Court does not like millions of people being able to afford to make payments on their student loans," said Pittman.

The Debt Collective, a national student loan borrowers union, suggested the latest ruling—which comes over a year after the Supreme Court struck down a broader student debt relief plan from Biden—shows that the fight for debt forgiveness cannot be won through the federal court system.

The Debt Collective has joined progressive lawmakers and other groups in calling for the Department of Education to cut ties with the Missouri Higher Education Loan Authority (MOHELA), which services federal student loans and which Missouri Attorney General Andrew Bailey said would lose revenue if student debt cancellation is allowed to move forward.

"Biden is losing in court because he is not being politically or legally savvy," said the group after the 8th Circuit ruling was announced. "He should fire MOHELA and issue cancellation swiftly and automatically through an executive order and issue pause."

Millions of student loan borrowers whose monthly payments had been reduced by U.S. President Joe Biden's latest attempt to achieve debt relief were thrown into limbo Wednesday as the right-wing majority on the Supreme Court ruled in favor of a sweeping suspension of the president's policy.

After several Republican-led states filed lawsuits against the Saving on a Valuable Education (SAVE) program, the U.S. Court of Appeals for the 8th Circuit ruled last month that the program should be paused while it evaluated the merits of the case.

The Biden administration had asked the high court to clear the way for SAVE to go back into effect, allowing 8 million Americans enrolled in the program to make monthly loan payments based on their incomes.

Mike Pierce, executive director of the Student Borrower Protection Center, said the Supreme Court "bought into the 8th Circuit's legal fiction that pausing affordable payments is 'preserving the status quo,'" issuing a ruling he denounced as "bullshit."

Under SAVE, which has already cleared debts for 400,000 borrowers, the Biden administration reduced monthly payments for undergraduate loans to 5% of the borrower's discretionary income, down from 10%. Loans of $12,000 or less were to be canceled after 10 years instead of 20-25 years, as long as the borrower made required payments.

The administration argued that the program was in accordance with a 1993 law allowing the secretary of education to establish "income contingent repayment" plans based on "the appropriate portion of the annual income of the borrower."

After the lower court's earlier ruling, Education Secretary Miguel Cardona said the court had rejected "a practice of providing loan forgiveness that goes back 30 years."

Ashton Pittman, an editor for the Mississippi Free Press, said the program had reduced his monthly student loan payments so that he was "finally able to reliably make them each month."

"But I reckon the U.S. Supreme Court does not like millions of people being able to afford to make payments on their student loans," said Pittman.

The Debt Collective, a national student loan borrowers union, suggested the latest ruling—which comes over a year after the Supreme Court struck down a broader student debt relief plan from Biden—shows that the fight for debt forgiveness cannot be won through the federal court system.

The Debt Collective has joined progressive lawmakers and other groups in calling for the Department of Education to cut ties with the Missouri Higher Education Loan Authority (MOHELA), which services federal student loans and which Missouri Attorney General Andrew Bailey said would lose revenue if student debt cancellation is allowed to move forward.

"Biden is losing in court because he is not being politically or legally savvy," said the group after the 8th Circuit ruling was announced. "He should fire MOHELA and issue cancellation swiftly and automatically through an executive order and issue pause."