Republican presidential nominee Donald Trump's proposal to further reduce the U.S. corporate tax rate from 21% to 15% would make the bottom half of the nation's income distribution poorer while boosting the fortunes of those at the very top, according to an analysis published Thursday by economists at American University.

The analysis, released just over a month before the high-stakes November 5 election, projects the hypothetical macroeconomic and distributional impacts of corporate tax rate plans put forth by Trump and Vice President Kamala Harris, the Democratic nominee. Harris has called for increasing the corporate tax rate to 28%.

If implemented, the economists found, Trump's plan would "modestly reduce" the nation's gross domestic product (GDP), decrease government revenue, and "significantly increase inequality," given that wealthier households "are the primary owners of corporate stocks" that would benefit from the former president's tax cuts.

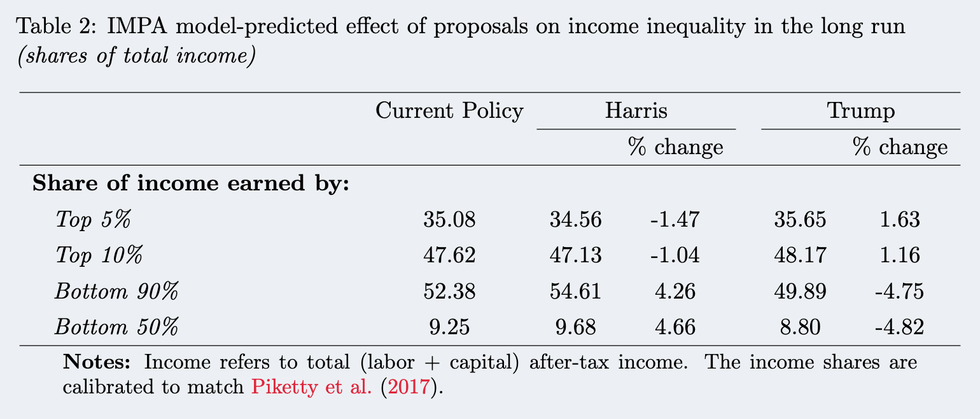

The "share of national income going to the top 5% would increase by around 1.6%, while the share of the bottom 50% would fall by roughly 4.8%," the analysis estimates.

Harris' plan, by contrast, would "mildly" raise U.S. GDP, increase federal revenue, and "decrease inequality, reducing the share of income earned by the top 5% of the distribution by about 1% and increasing the share of income earned by the bottom 50% of the distribution by about 4.7%, compared to current policy."

The analysis came a day after the Congressional Budget Office released a report showing that the richest 1% saw their share of the nation's wealth grow to 27% between 1989 and 2022 while families in the bottom half of the distribution held just 6% of the country's wealth in both 1989 and 2022—a wealth gap that further slashing corporate taxes would exacerbate.

Trump's call to reduce the corporate tax rate to 15% was the "centerpiece" of an address he delivered last month at the Economic Club of New York, as Bloombergreported at the time.

When Trump took office in 2017, the statutory corporate tax rate was 35%. Later that year, Trump and congressional Republicans rammed through an unpopular tax-cut package that slashed the corporate rate to 21% and led to a surge in tax avoidance. The law has been hugely regressive, delivering major benefits to the rich and very little to the working class.

Cutting the corporate tax rate to 15% would hand roughly $50 billion in annual tax cuts to the 100 largest and most profitable U.S. companies, according to a recent analysis by the Center for American Progress Action Fund.