Then-President Donald Trump shook hands with then-IRS Commissioner Charles Rettig on October 2, 2018 in Washington, D.C.

Under Trump, IRS Targeted Low-Income Families at Higher Rate Than Millionaires for First Time

"House Republicans want to return to the lawless days of rampant tax evasion by the nation's wealthiest."

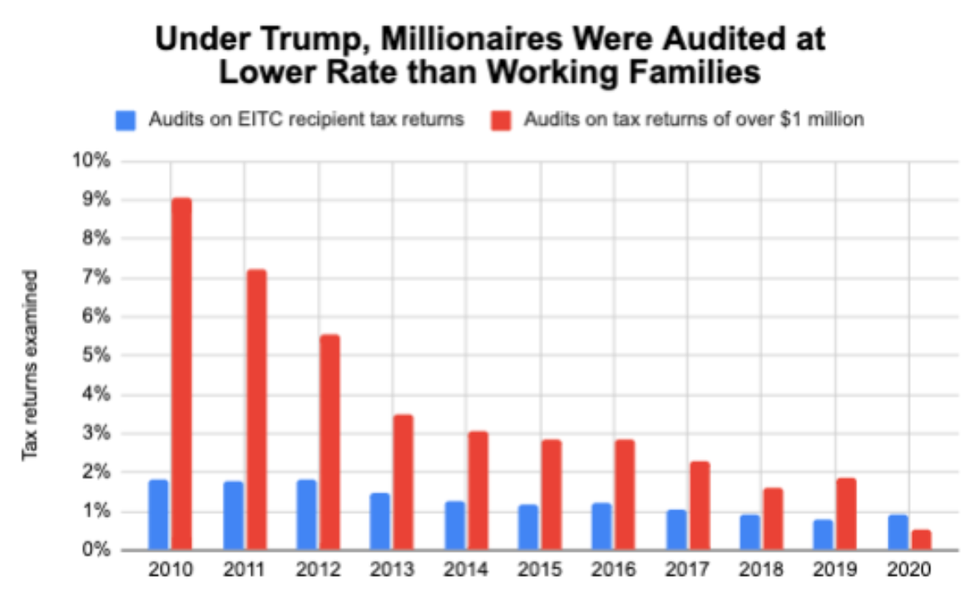

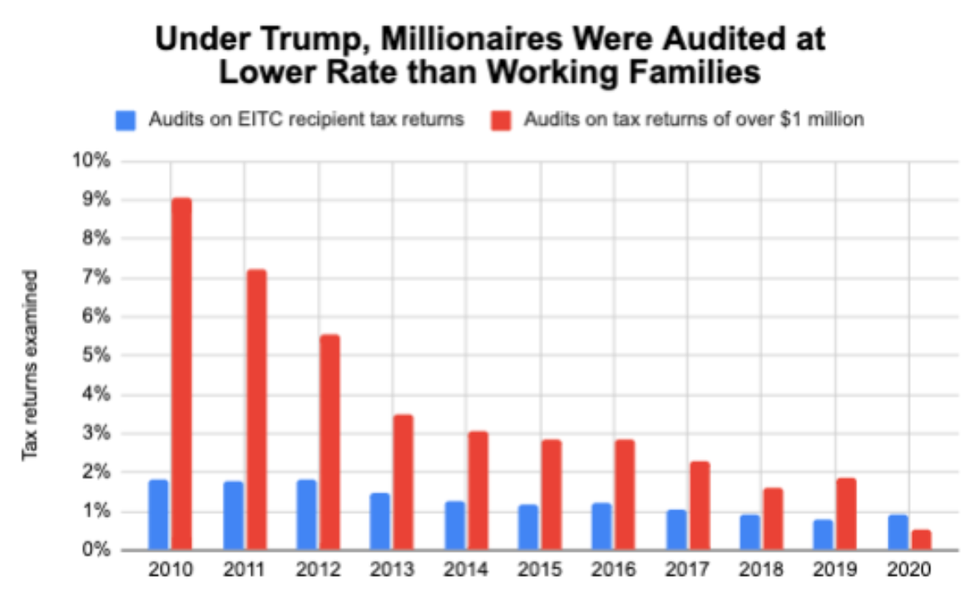

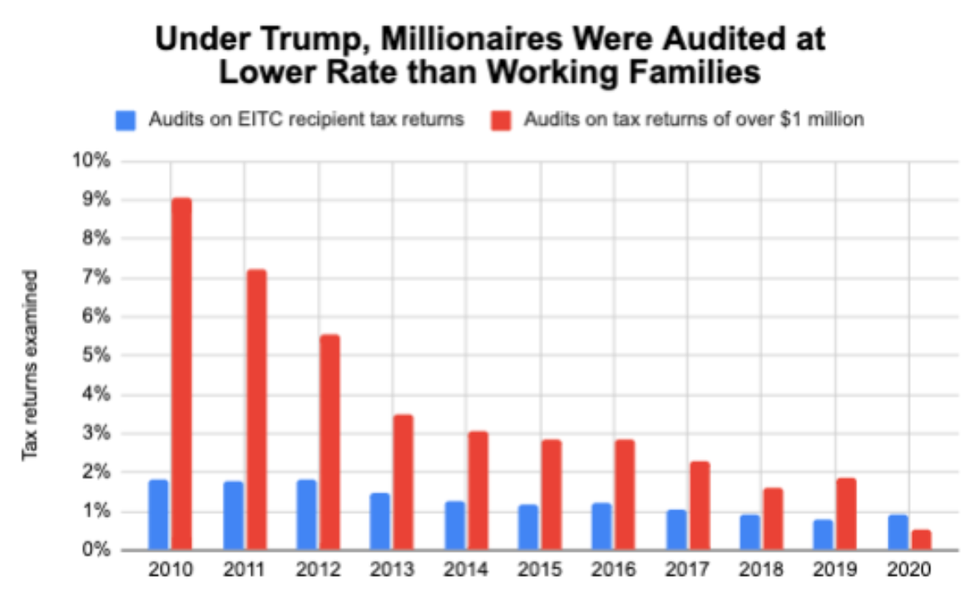

During the final year of Donald Trump's presidency, the Internal Revenue Service audited low-income families at a higher rate than millionaires for the first time, according to an Americans for Tax Fairness analysis released as congressional Republicans work to further hamper the agency's ability to crack down on rich tax cheats.

Years of Republican-imposed budget cuts have left the IRS badly understaffed and without sufficient resources to aggressively pursue wealthy tax evaders, whose returns tend to be more complex.

As a result, ATF noted in its analysis, "audits of millionaires have dropped 92% over the last decade." Audits of Earned Income Tax Credit (EITC) recipients have also fallen over the past 10 years, but not nearly as dramatically.

Inadequate scrutiny of the rich has allowed more than a million wealthy Americans to evade close to $66 billion in federal taxes in recent years, according to IRS data.

In an effort to reverse the damage done by chronic underfunding, Democratic lawmakers and President Joe Biden approved an $80 billion budget increase for the IRS over the next decade, money that has already helped the agency increase its full-time staff, improve customer service, and collect tens of millions of dollars in delinquent taxes from rich Americans.

But that hasn't stopped Republicans from attempting to roll back the agency's recent budget increase and drumming up hysteria about armed IRS agents targeting ordinary Americans.

Across their appropriations bills, House Republicans have proposed $67 billion in IRS cuts, which would add to the deficit by undermining the agency's ability to pursue wealthy tax dodgers. The House and Senate must pass appropriations bills to fund the government and avert a shutdown next month.

"Extreme MAGA Republicans are demanding that their rich donors get a green light to evade taxes as the price of keeping our government open," said David Kass, ATF's executive director. "Just as restored IRS funding contained in the Inflation Reduction Act that President Biden and congressional Democrats enacted last year is beginning to bear fruit in the form of tougher tax enforcement on wealthy and corporate tax cheats, House Republicans want to return to the lawless days of rampant tax evasion by the nation's wealthiest."

ATF's analysis, released last week, shows that U.S. millionaires are now audited less than 1% of the time despite receiving a sixth of the nation's total household income.

"Mega-corporations have also benefited dramatically in the past decade from an underfunded IRS," the group observed. "Over the past decade, audits of corporations with over $1 billion of income have dropped 87%, to an historic low. Audits of corporations with over $100 million of income have dropped by 91%."

An Urgent Message From Our Co-Founder

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

During the final year of Donald Trump's presidency, the Internal Revenue Service audited low-income families at a higher rate than millionaires for the first time, according to an Americans for Tax Fairness analysis released as congressional Republicans work to further hamper the agency's ability to crack down on rich tax cheats.

Years of Republican-imposed budget cuts have left the IRS badly understaffed and without sufficient resources to aggressively pursue wealthy tax evaders, whose returns tend to be more complex.

As a result, ATF noted in its analysis, "audits of millionaires have dropped 92% over the last decade." Audits of Earned Income Tax Credit (EITC) recipients have also fallen over the past 10 years, but not nearly as dramatically.

Inadequate scrutiny of the rich has allowed more than a million wealthy Americans to evade close to $66 billion in federal taxes in recent years, according to IRS data.

In an effort to reverse the damage done by chronic underfunding, Democratic lawmakers and President Joe Biden approved an $80 billion budget increase for the IRS over the next decade, money that has already helped the agency increase its full-time staff, improve customer service, and collect tens of millions of dollars in delinquent taxes from rich Americans.

But that hasn't stopped Republicans from attempting to roll back the agency's recent budget increase and drumming up hysteria about armed IRS agents targeting ordinary Americans.

Across their appropriations bills, House Republicans have proposed $67 billion in IRS cuts, which would add to the deficit by undermining the agency's ability to pursue wealthy tax dodgers. The House and Senate must pass appropriations bills to fund the government and avert a shutdown next month.

"Extreme MAGA Republicans are demanding that their rich donors get a green light to evade taxes as the price of keeping our government open," said David Kass, ATF's executive director. "Just as restored IRS funding contained in the Inflation Reduction Act that President Biden and congressional Democrats enacted last year is beginning to bear fruit in the form of tougher tax enforcement on wealthy and corporate tax cheats, House Republicans want to return to the lawless days of rampant tax evasion by the nation's wealthiest."

ATF's analysis, released last week, shows that U.S. millionaires are now audited less than 1% of the time despite receiving a sixth of the nation's total household income.

"Mega-corporations have also benefited dramatically in the past decade from an underfunded IRS," the group observed. "Over the past decade, audits of corporations with over $1 billion of income have dropped 87%, to an historic low. Audits of corporations with over $100 million of income have dropped by 91%."

- Trump Fraud Case Finding Suggests 'Major Tax Evasion': Watchdog ›

- Democrats' IRS Crackdown on Millionaires Draws in $1 Billion | Common Dreams ›

- Trump Pick to Lead IRS Signals 'Open Season for Tax Cheats' | Common Dreams ›

- Opinion | The DOGE Attack on the IRS Is an Attack on Economic Justice and Equality | Common Dreams ›

During the final year of Donald Trump's presidency, the Internal Revenue Service audited low-income families at a higher rate than millionaires for the first time, according to an Americans for Tax Fairness analysis released as congressional Republicans work to further hamper the agency's ability to crack down on rich tax cheats.

Years of Republican-imposed budget cuts have left the IRS badly understaffed and without sufficient resources to aggressively pursue wealthy tax evaders, whose returns tend to be more complex.

As a result, ATF noted in its analysis, "audits of millionaires have dropped 92% over the last decade." Audits of Earned Income Tax Credit (EITC) recipients have also fallen over the past 10 years, but not nearly as dramatically.

Inadequate scrutiny of the rich has allowed more than a million wealthy Americans to evade close to $66 billion in federal taxes in recent years, according to IRS data.

In an effort to reverse the damage done by chronic underfunding, Democratic lawmakers and President Joe Biden approved an $80 billion budget increase for the IRS over the next decade, money that has already helped the agency increase its full-time staff, improve customer service, and collect tens of millions of dollars in delinquent taxes from rich Americans.

But that hasn't stopped Republicans from attempting to roll back the agency's recent budget increase and drumming up hysteria about armed IRS agents targeting ordinary Americans.

Across their appropriations bills, House Republicans have proposed $67 billion in IRS cuts, which would add to the deficit by undermining the agency's ability to pursue wealthy tax dodgers. The House and Senate must pass appropriations bills to fund the government and avert a shutdown next month.

"Extreme MAGA Republicans are demanding that their rich donors get a green light to evade taxes as the price of keeping our government open," said David Kass, ATF's executive director. "Just as restored IRS funding contained in the Inflation Reduction Act that President Biden and congressional Democrats enacted last year is beginning to bear fruit in the form of tougher tax enforcement on wealthy and corporate tax cheats, House Republicans want to return to the lawless days of rampant tax evasion by the nation's wealthiest."

ATF's analysis, released last week, shows that U.S. millionaires are now audited less than 1% of the time despite receiving a sixth of the nation's total household income.

"Mega-corporations have also benefited dramatically in the past decade from an underfunded IRS," the group observed. "Over the past decade, audits of corporations with over $1 billion of income have dropped 87%, to an historic low. Audits of corporations with over $100 million of income have dropped by 91%."

- Trump Fraud Case Finding Suggests 'Major Tax Evasion': Watchdog ›

- Democrats' IRS Crackdown on Millionaires Draws in $1 Billion | Common Dreams ›

- Trump Pick to Lead IRS Signals 'Open Season for Tax Cheats' | Common Dreams ›

- Opinion | The DOGE Attack on the IRS Is an Attack on Economic Justice and Equality | Common Dreams ›