Democratic Sen. Elizabeth Warren released a report Wednesday highlighting the splashy incentives—from luxury vacations to cash bonuses—that private insurance companies offer agents and brokers for enrolling seniors in potentially higher-cost Medigap plans.

Medigap is federally regulated supplemental health insurance offered by for-profit companies such as UnitedHealthcare, Humana, and Aetna.

According to Warren, the Medigap marketplace is rife with "incentive trips and other perks for brokers and agents" who—in pursuit of such rewards—could be motivated to "push seniors into the most expensive Medigap plans, regardless of whether those plans meet their needs."

The senator found that the estimated 32 private companies that entice agents with vacations and other incentives to boost Medigap sales provided the supplemental insurance to around 6.6 million people in the U.S. in 2021 and raked in nearly $16 billion in premiums from beneficiaries that year.

Warren acknowledged that her report "may underestimate the prevalence of incentives and rewards in the Medigap insurance industry" given that insurers and third-party companies are often not transparent about their incentive practices.

In a statement, Warren lamented the weak federal and state regulations that are giving insurance giants "free rein to scam millions of seniors in Medigap, offering agents lavish vacations to steer unknowing beneficiaries into more expensive plans."

"Regulators must act to make sure seniors aren't getting fleeced," said Warren, who noted that around 40% of Medigap enrollees had less than $40,000 in annual income in 2018.

The senator's report highlights several specific examples of the kinds of perks agents and brokers are being offered to peddle Medigap plans, which are often used to supplement traditional Medicare coverage.

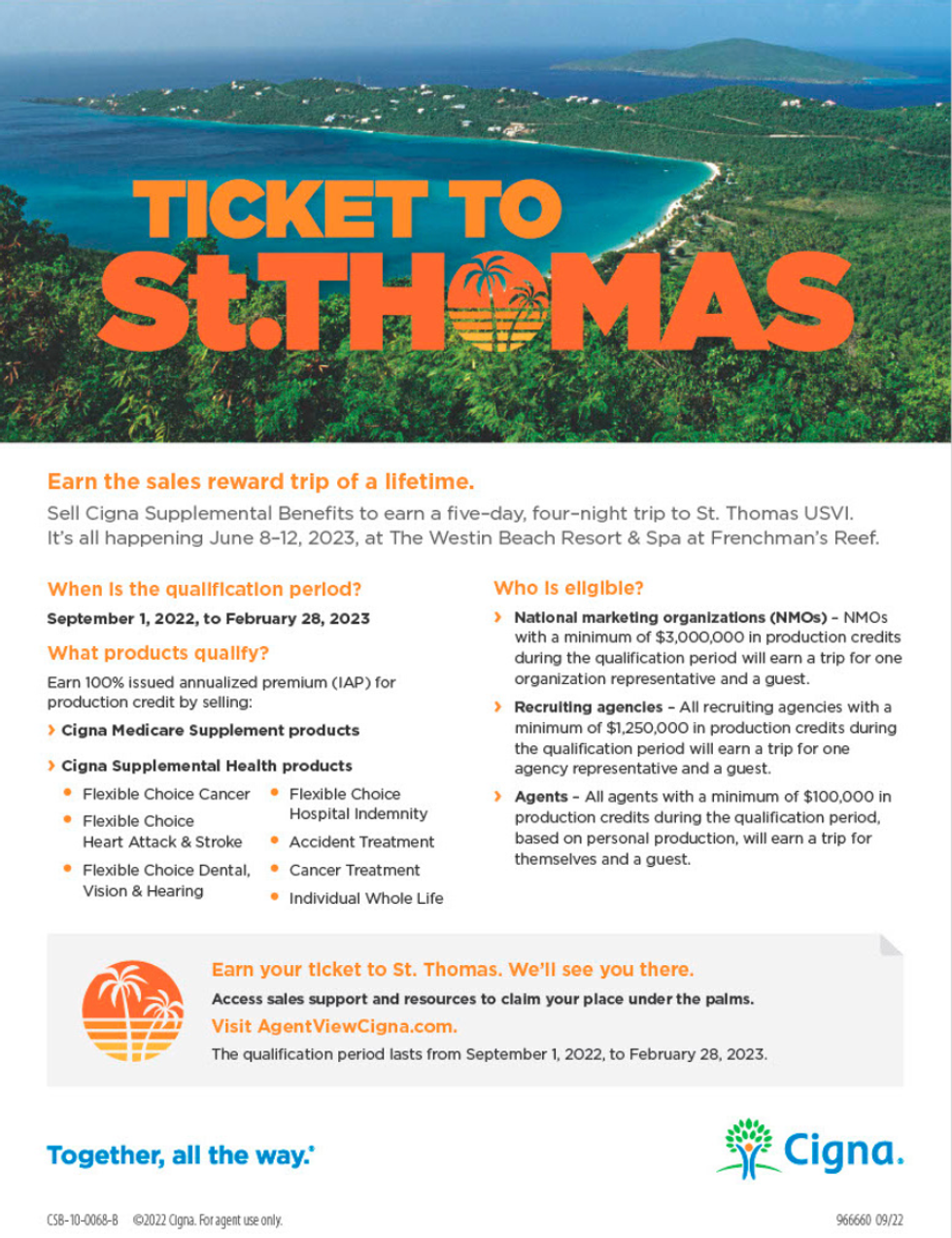

"Mutual of Omaha offered brokers and agents selling Medigap plans this year a chance to earn a 'Sunny San Diego trip' that included 'airfare, one double-occupancy standard hotel room, two hosted receptions, cash allowance, and airport transfers for two people,'" the report notes. "Cigna is currently offering brokers and agents the chance to 'earn the sales reward trip of a lifetime' to St. Thomas, U.S. Virgin Islands for sales made between September 2022 and February 2023."

Seniors receive much of their information about Medigap plans—which vary widely in price—from insurance agents motivated by undisclosed incentives, Warren's report notes, a dynamic that could be leading unsuspecting seniors to purchase higher-premium plans that they believe are best suited to their individual needs.

"Sales agents must meet certain thresholds to qualify for vacations—for example, agents must sell $250,000 worth of coverage to qualify for Mutual of Omaha's vacation rewards," the report states. "Therefore, to meet that minimum threshold, there is a clear incentive structure to sell more expensive plans. This sets up a clear conflict of interest for agents in cases where the best option for seniors might be the least expensive plan."

A separate study published last week by the Commonwealth Fund came away with similar findings. "According to brokers and agents," the study notes, "the commission structure of Medigap plans incentivizes the sale of plans charging high premiums."

Warren attached her report to a letter urging Centers for Medicare and Medicaid Services Administrator Chiquita Brooks-LaSure and the head of the National Association of Insurance Commissioners to "act as quickly as possible to end health insurers'

promises of lavish vacations and other incentives to insurance agents and brokers in exchange for selling Medigap plans to seniors."

"This practice represents an abuse of the trust that seniors place in Medicare. Medigap insurance is not federally subsidized, but the terms and conditions under which Medigap plans are offered are regulated by CMS and state insurance regulators," Warren wrote. "Nowhere does CMS indicate that agents who sell these products may receive lavish vacations and other valuable perks in exchange for these sales."

"Regulators must act to close these loopholes," she added.