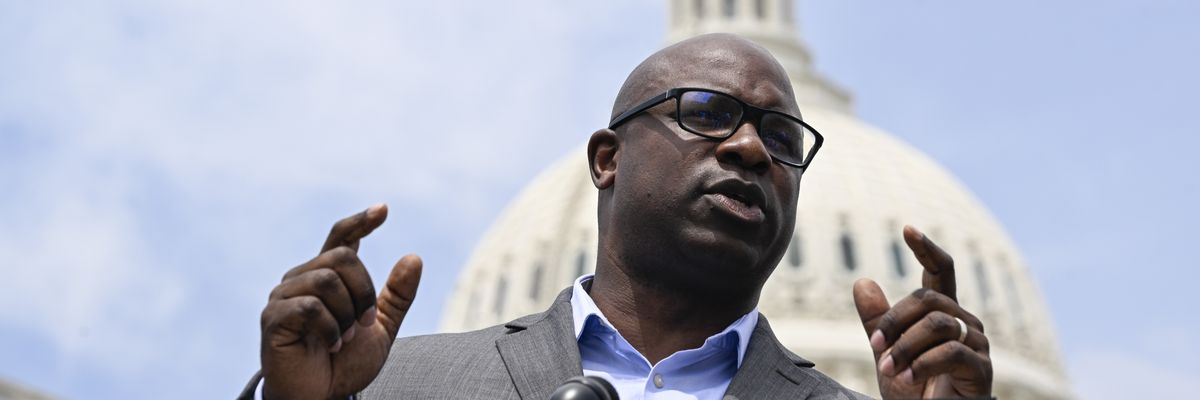

Rep. Jamaal Bowman and Sen. Bernie Sanders on Friday led a group of progressive lawmakers in announcing legislation that would penalize large corporations with a 95% windfall profits tax for using elevated inflation as a pretext to hike prices and pad their bottom lines.

The

Ending Corporate Greed Act would "establish a 95% windfall profits tax on a company's profits that are in excess of their average profit level from 2015-2019, adjusted for inflation," according to a summary of the measure.

The bill would keep intact the 21% statutory corporate tax rate for profits equal to or lower than they were prior to the coronavirus pandemic. The 95% tax on windfall profits would be limited to companies with $500 million or more in annual revenue and would be temporary, running only through 2026.

Bowman (D-N.Y.), whose primary contest against AIPAC-backed George Latimer is in on Tuesday, introduced the bill in the House on Friday alongside several original cosponsors. Sanders and Sen. Ed Markey (D-Mass.) are expected to introduce companion legislation in the Senate in the near future.

"The American people are sick and tired of being ripped off by large corporations that continue to make record-breaking profits by charging outrageously high prices for gas, rent, food, and prescription drugs,

" Sanders said in a statement.

"Enough is enough," he continued. "We cannot continue to allow large corporations to make obscene profits by price gouging Americans in virtually every sector of our economy. If corporate CEOs and their masters on Wall Street will not end their greed, we must end it for them. It is time for Congress to enact a windfall profits tax."

The bill's authors estimate that had the proposed 95% windfall tax been in place last year—when U.S. corporate profits

surged to a record high—the federal government would have raised $300 billion in additional revenue from 10 large companies alone.

"Since the pandemic, corporations have remained incredibly selfish in their business practices, squeezing their consumers who rely on them for essential goods and services, including gas, food, prescription drugs, banking, and more," Bowman said Friday. "Congress must do its part to check corporate greed before it completely robs people in America of their ability to live a life in pursuit of liberty, justice, and happiness."

Companies

haven't been shy about using elevated prices across the U.S. economy as a justification for hiking prices on their products.

As Lindsay Owens, executive director of the Groundwork Collaborative, noted in a

New York Timesop-ed in 2022: "Executives on their earnings calls crowed to investors about their blockbuster quarterly profits. One credited his company’s 'successful pricing strategies.' Another patted his team on the back for a 'marvelous job in driving price.' These executives weren't just passing along their rising costs; they were going for more. Or as one CFO put it, they were 'not leaving any pricing on the table.'"

A recent Groundwork

analysis estimated that between April and September 2023, corporate profits fueled more than half of U.S. inflation. Economists with the International Monetary Fund came to a similar conclusion last year about price increases in Europe, blaming "rising corporate profits" for "almost half the increase in Europe's inflation over the past two years."

The new bill's sponsors pointed to examples of major corporations across a range of sectors reaping massive windfall profits last year amid high inflation, including Amazon, which reported $37.6 billion in 2023 profits—a staggering 444% increase compared to the company's average profit between 2015 and 2019.

Amazon, a notorious tax avoider, would have paid an estimated $19.1 billion in windfall taxes if the Ending Corporate Greed Act was in place last year.

"Corporate greed and unconscionable price gouging have resulted in Americans paying more for basic necessities such as gas and groceries," Markey said Friday. "The Ending Corporate Greed Act penalizes large corporations raking in record profits while everyday Americans and workers pay the price."