SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

While millions of people will lose their health insurance and health coverage as a result of Republican plans to repeal the Affordable Care Act (ACA), the nation's 8 largest health insurance corporations will get a tax cut of about $72 billion over the next decade, according to new estimates from Americans for Tax Fairness. These companies will get nearly half of the $145 billion 10-year tax cut for the entire insurance industry estimated by the Joint Committee on Taxation.

"It's appalling that Republicans in Congress would yank healthcare from 20 million people and give insurance companies a $72 billion tax cut," said Frank Clemente, executive director of Americans for Tax Fairness. "Outrageous. President Trump promised not to cut Medicaid, and Republicans should keep that promise. We can't afford any health care legislation that takes coverage away from Americans so that wealthy corporations can have a tax cut."

Health Insurance Provider Fees, Top 8 Insurers, 2014-2026

Company | 2014 | 2015 | 2016 | Total 2014-2016 | Share of Industry-Wide Fee, Average 2014-2016 | Estimated Fee 2018 - 2026 |

UnitedHealth | 1,300 | 1,800 | 1,800 | 4,900 | 16.0% | 23,209 |

Anthem | 893 | 1,208 | 1,176 | 3,277 | 10.8% | 15,564 |

Humana | 562 | 867 | 916 | 2,345 | 7.6% | 11,001 |

Aetna | 605 | 856 | 837 | 2,298 | 7.5% | 10,876 |

Cigna | 240 | 310 | 310 | 860 | 2.8% | 4,094 |

Health Net* | 141 | 233 | -- | 374 | 1.9% | 2,771 |

Centene | 126 | 215 | 461 | 802 | 1.7% | 2,517 |

Molina | 89 | 157 | 217 | 463 | 1.5% | 2,133 |

Total, Top 8 | 3,957 | 5,646 | 5,717 | 15,320 | 50% | 72,165 |

Industry-wide fee | 8,000 | 11,300 | 11,300 | 30,600 | 100% | 144,727 |

Source: ATF analysis of companies' 10K filings with the Securities and Exchange Commission. Data is available here. *Health Net was acquired by Centene in 2016. Centene's fee for 2018-2016 is estimated based on the sum of Centene's and Health Net's average shares of the industry-wide fee for 2014-2015.

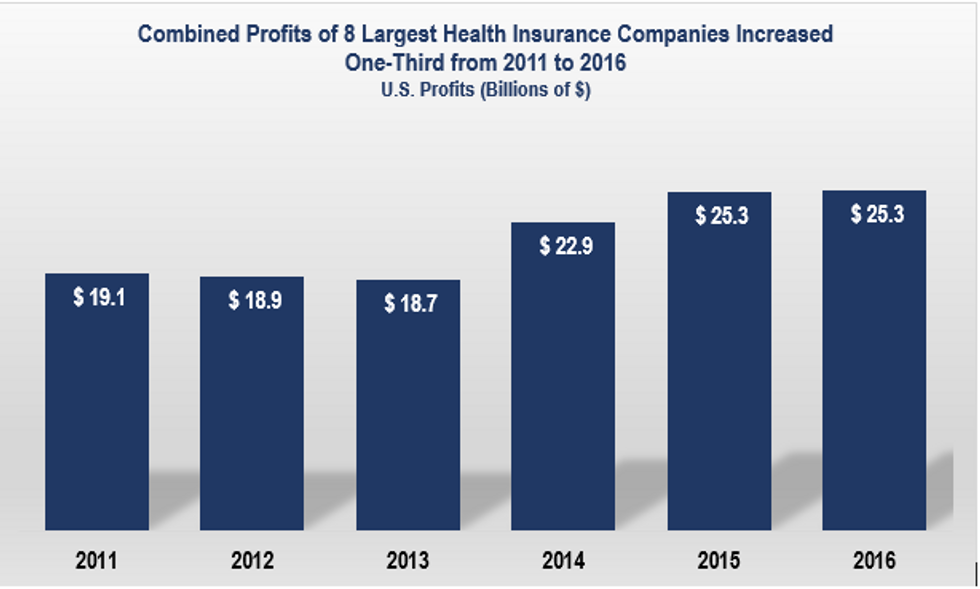

These large insurance companies have collectively increased their U.S. profits by one-third between 2011 and 2016 as the Affordable Care Act kicked into place--from $19.1 billion in 2011 to $25.3 billion-in 2016. These companies are very profitable and do not need a $72 billion tax cut.

They especially don't need a tax cut that would be paid for by steep Medicaid cuts and over 20 million Americans losing access to health coverage.

BACKGROUND

As part of the ACA, a fee was levied on health insurance providers that benefited from millions of new customers. Each company's share of the fee is based on their market share of net premiums collected from covered entities under the ACA. The fee went into effect in 2014, when the overall fee for the industry was set at $8 billion. For 2015 and 2016, the industry-wide fee was set at $11.3 billion. The 2016 Consolidated Appropriations bill suspended the fee for 2017, but under current law it will be reinstated in 2018 at $14.3 billion. Each year thereafter, the industry-wide fee will increase according to the overall rate of premium growth in the health care industry.

We estimate each company's savings from 2018 through 2026 by multiplying the company's average share of the industry-wide fee by the $145 billion that the Joint Committee on Taxation estimates the repeal of the fee will cost in revenues over the next 10 years.

ATF's estimates are available here.

Americans for Tax Fairness (ATF) is a diverse campaign of more than 420 national, state and local endorsing organizations united in support of a fair tax system that works for all Americans. It has come together based on the belief that the country needs comprehensive, progressive tax reform that results in greater revenue to meet our growing needs. This requires big corporations and the wealthy to pay their fair share in taxes, not to live by their own set of rules.

(202) 506-3264Sen. Bernie Sanders said that a Maryland resident whom the Trump administration wrongly deported "must not be allowed to rot in an El Salvadorian jail based on lies and defiance of our Constitution."

U.S. Sen. Bernie Sanders warned late Monday that President Donald Trump's open refusal to comply with court orders requiring him to bring home a Maryland resident his administration wrongly deported represents "just another step forward" in his "move toward authoritarianism."

"Just a few weeks ago, the Trump administration admitted that the deportation of Kilmar Abrego Garcia, a father of three who has been in the country more than decade, was an 'administrative error,'" Sanders (I-Vt.) said in a statement following the U.S. president's chummy meeting with far-right Salvadoran President Nayib Bukele at the White House.

"The U.S. Supreme Court—in a 9-0 decision backed by every Trump-appointed justice—ruled that the administration must bring Abrego Garcia back to the United States," Sanders continued. "Now, in open defiance of the Supreme Court and without any evidence, the White House claims that Abrego Garcia is a 'terrorist,' who was 'sent to the right place.' This is a blatant LIE."

During Monday's meeting, Bukele showed a willingness to help Trump evade domestic court mandates, echoing the U.S. administration's false narrative that Abrego Garcia is a "terrorist" and declining to release him from a notorious El Salvador mega-prison—insisting, like his American counterpart, that he lacks the power to do so.

The Trump administration proceeded to quote Bukele's claim that he cannot "smuggle a terrorist into the United States" in a court filing.

Silky Shah, executive director of Detention Watch Network, said the Trump-Bukele meeting "should alarm everyone."

"Trump is taking monumental yet calculated steps to expand the scope of who can be subjected to arrest, incarceration, and deportation, and normalize the abduction and removal of people to another country without due process," said Shah. "The Trump and Bukele partnership to outsource incarceration to El Salvador is setting a dangerous precedent of total disdain for basic human rights—not only for migrants, but for everyone in the United States, including residents and citizens, and especially Black and brown people who are disproportionately targeted by the U.S.'s unjust criminal legal system."

During Bukele's visit to the White House, livestream audio captured Trump telling El Salvador's president that "he needs to build about five more places" and that "homegrown" U.S. prisoners "are next."

Trump to Bukele: "Home-growns are next. The home-growns. You gotta build about five more places. It's not big enough." pic.twitter.com/o20thGNK9e

— Aaron Rupar (@atrupar) April 14, 2025

Working Families Party national director Maurice Mitchell said Monday that Trump's remarks were "some of the most chilling words uttered in the Oval Office."

"He's pulling straight from the authoritarian playbook—and isn't hiding it," said Mitchell. "We condemn his comments in the strongest possible terms and demand the immediate release of wrongly imprisoned Maryland resident Kilmar Abrego Garcia."

"Trump is dismantling critical environmental safeguards, putting lives at risk, and leaving working people to suffer the devastating consequences," said one campaigner.

A coalition of green groups on Monday promoted plans for nationwide "All Out on Earth Day" rallies "to confront rising authoritarianism and defend our environment, democracy, and future" against the Trump administration's gutting of government agencies and programs tasked with environmental protection and combating the climate emergency.

Organizers of the protests—which are set to take place from April 18-30—are coalescing opposition to President Donald Trump's attacks on the Environmental Protection Agency (EPA) and other agencies, which include efforts to rescind or severely curtail regulations aimed at protecting the public from pollution, oil spills, and other environmental and climate harms.

"This Earth Day, we fight for everything: for our communities, our democracy, and the future our children deserve."

The Green New Deal Network, one of the event's organizers, decried Trump's "massive rollbacks" to the EPA and noted that funds "for critical programs have been frozen and federal workers have been unjustly fired" as Elon Musk's Department of Government Efficiency, or DOGE, takes a wrecking ball to government agencies.

"This Earth Day, we fight for everything: for our communities, our democracy, and the future our children deserve," Green New Deal Network national director Kaniela Ing said in a statement.

"Trump, Musk, and their billionaire allies are waging an all-out assault on the agencies that keep our air clean, our water safe, and our families healthy," Ing continued. "They're gutting the programs and projects we fought hard to win—programs that bring down energy costs and create good-paying jobs in towns across America, especially in red states."

"So, we need to make sure the pressure continues and our protests aren't just a flash in the pan," Ing added. "When we stand together—workers, environmentalists, everyday folks—we can not only stop them, but we can build the world we deserve."

All Out on Earth Day participants include Sunrise Movement, Climate Power, Third Act, Popular Democracy, Climate Defenders, the Democratic National Committee Council on Environment and Climate, Unitarian Universalists, NAACP, Dayenu, Evergreen, United to End Polluter Handouts Coalition, Climate Hawks Vote, and the Center of Biological Diversity (CBD).

Last month, CBD sued five Cabinet-level agencies in a bid to ensure that DOGE teams tasked with finding ways to cut costs—including via workforce reductions—fully comply with federal transparency law. This, after DOGE advised the termination of thousands of probationary staffers at the EPA, Department of the Interior, and other agencies.

Although a federal judge last month ordered the Trump administration to reinstate thousands of government workers fired from half a dozen agencies based on the "lie" that their performance warranted termination, the right-wing U.S. Supreme Court subsequently sided with the White House, finding that plaintiffs in the case lacked the legal standing to sue.

Bill McKibben, co-founder of 350.org and founder of the elder-led Third Act, harkened back to the historic first Earth Day in 1970.

"Fifty-five years ago, a massive turnout on the first Earth Day forced a corrupt Republican administration to pass the Clean Air Act and the Clean Water Act, and create the EPA," he said on Monday, referring to the presidency of Richard Nixon. "Let's do it again!"

Aru Shiney-Ajay, executive director of the youth-led Sunrise Movement, highlighted the need for action now, noting that Trump "is giving oil and gas billionaires the green light to wreck our planet and put millions of lives at risk, all so they can pad their bottom line."

"Just three months into the Trump presidency, the damage has already been catastrophic," she added. "Trump is dismantling critical environmental safeguards, putting lives at risk, and leaving working people to suffer the devastating consequences. "This Earth Day, we stand united in defiance of their greed and fight for a future that prioritizes people and the planet over profits."

"No one person should have the power to impose taxes that have such vast global economic consequences," said a Liberty Justice Center lawyer, stressing that the Constitution empowers Congress to set tax rates.

Though U.S. President Donald Trump temporarily paused some of his "Liberation Day" tariffs for negotiations, a nonprofit firm and legal scholar still sued him and other officials on Monday on behalf of five import-reliant small businesses, asking the U.S. Court of International Trade to "declare the president's unprecedented power grab illegal."

Ilya Somin, a Cato Institute chair and George Mason University law professor, announced earlier this month on a legal blog hosted by the outlet Reason that he and the Liberty Justice Center—which has a record of representing libertarian positions in court battles—were "looking for appropriate plaintiffs to bring this type of case."

Monday's complaint was filed on behalf of FishUSA, Genova Pipe, MicroKits, Terry Precision Cycling, and VOS Selections. It argues that "the statute the president invokes—the International Emergency Economic Powers Act (IEEPA)—does not authorize the president to unilaterally issue across-the-board worldwide tariffs."

"And the president's justification does not meet the standards set forth in the IEEPA," the complaint continues. "His claimed emergency is a figment of his own imagination: trade deficits, which have persisted for decades without causing economic harm, are not an emergency. Nor do these trade deficits constitute an 'unusual and extraordinary threat.' The president's attempt to use IEEPA to impose sweeping tariffs also runs afoul of the major questions doctrine."

"It's devastating. The government shouldn't be able to make sweeping economic decisions like this without any checks or accountability."

Somin said in a Monday statement that "if starting the biggest trade war since the Great Depression based on a law that doesn't even mention tariffs is not an unconstitutional usurpation of legislative power, I don't know what is."

Jeffrey Schwab, senior counsel at the Liberty Justice Center, stressed that "no one person should have the power to impose taxes that have such vast global economic consequences... The Constitution gives the power to set tax rates—including tariffs—to Congress, not the president."

Just hours after Trump's taxes on imports took effect last week, he paused what he is misleadingly calling "reciprocal" tariffs—except for those on China, which now faces a minimum rate of 145%. However, his 10% baseline rate is in effect. As experts fret over a possible recession, the business leaders involved in the new legal challenge shared how they are already struggling because of the evolving policy.

"Instead of focusing on growing our business, creating more jobs in our region, and developing new products that our customers want, we are spending countless hours trying to navigate the tariff chaos that the president is causing for us and all our vendors," said FishUSA president and co-founder Dan Pastore. "It takes years working with factories to design and build our products, and we cannot just shift that business to the U.S. without starting the whole process over again."

Andrew Reese, president of Genova Pipe in Salt Lake City, Utah, explained that "we operate seven manufacturing facilities across the United States and are committed to producing high-quality products in America. With limited domestic sources, we rely on imports to meet our production needs. The newly imposed tariffs are increasing our raw material costs and hindering our ability to compete in the export market."

David Levi of MicroKits in Charlottesville, Virginia, similarly said that "we build as much as we can in the U.S. We're proud of that, but these surprise tariffs are crushing us. It's devastating. The government shouldn't be able to make sweeping economic decisions like this without any checks or accountability."

Critics of Trump's tariff policy have blasted not only how sweeping his levies have been but also the chaotic speed. Terry Precision Cycling president Nik Holm noted that "even before this year's increases, we were already paying tariffs of up to 39.5%. With the additional 145% now imposed, we can't survive long enough to shift course."

"Twenty years ago, we made all our apparel in the U.S. but gradually moved production overseas to sustain our business," the Vermonter detailed. "Bringing manufacturing back would require a long-term strategy supported by consistent government policies, investment in factories with skilled sewers, and access to raw materials that are not subject to high tariffs. Many of our products rely on raw materials that are simply not produced in the U.S."

Victor Owen Schwartz, whose New York-based VOS Selections specializes in imported alcohol, said that "as a heavily regulated business, we cannot turn on a dime... We are required to post our prices with the State Liquor Authority a full month in advance, so we're locked into pricing decisions that don't account for these sudden, unpredictable tariffs. This is devastating to our ability to operate and support the farmers and producers we work with around the world."

Trump is also facing a suit filed earlier this month in the U.S. District Court for the Northern District of Florida. That case involves Emily Ley, whose company Simplified makes home management products, including planners, and relies on imports from China.

As The New York Timesreported last week:

Her lawyers are from the New Civil Liberties Alliance, a libertarian-leaning nonprofit that counts among its financial backers Donors Trust, a group with ties to Leonard A. Leo, who is a co-chairman of the Federalist Society.

The Federalist Society is an influential legal group that advised Mr. Trump through the confirmation of justices he appointed to form the current conservative supermajority on the Supreme Court, though some in Mr. Trump's circle came to believe that its leaders were out of step with the president's political movement.

Another donor to New Civil Liberties Alliance is Charles Koch, the billionaire industrialist and Republican megadonor.

Additionally, as The Hill pointed out Monday, "four members of the Blackfeet Nation previously sued over Trump's Canada tariffs, including the Canadian aspects of his April 2 announcement."

Along with arguments over the legality of the duties, Trump's tariff announcement and pause sparked concerns about potential stock market manipulation and insider trading, triggering calls for investigation, including from members of Congress.