March, 10 2021, 11:00pm EDT

A Year Into Crisis, Billionaires Could Pay for 2/3 of Biden's COVID Relief Bill With Their Pandemic Profits

As presidential address marks grim coronavirus anniversary, America’s wealthiest 657 stand $1.3 trillion richer than they were last March.

WASHINGTON

One year, 530,000 deaths, 29 million cases, and 78 million lost jobs into the COVID-19 crisis, America's billionaires have made so much money they could fund two-thirds of President Biden's American Rescue Plan (ARP) just with their pandemic profits. As the President plans to address the nation tonight on the first anniversary of the pandemic, many suffering Americans would be shocked to learn what a different year it's been for the richest of the rich.

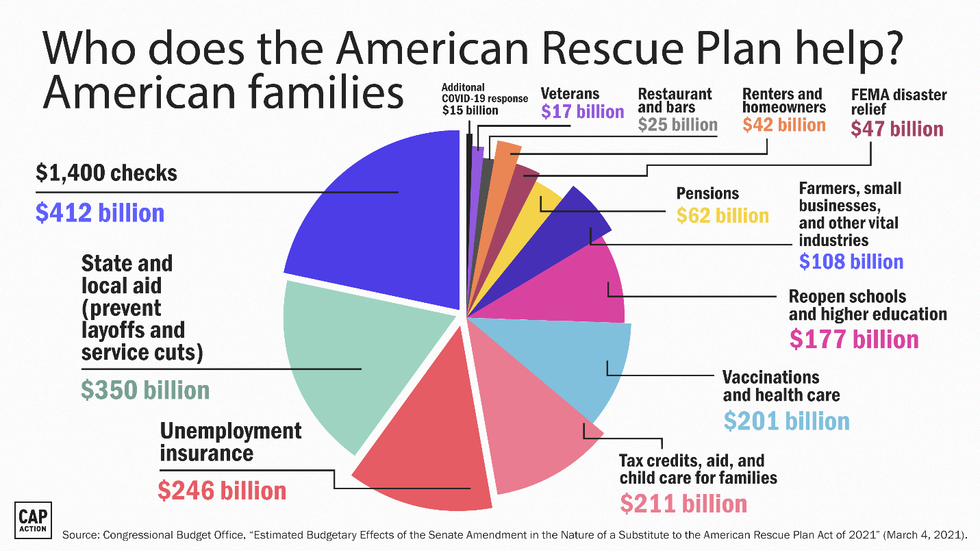

Using the jump in their wealth since last March, three men alone--Jeff Bezos, Elon Musk and Mark Zuckerberg--could foot the nearly $250 billion cost for supplemental unemployment benefits contained in the ARP that will pay millions of jobless Americans $300 a week for the next six months. [Below see a chart of ARP's components and a table of the top 15 billionaires.]

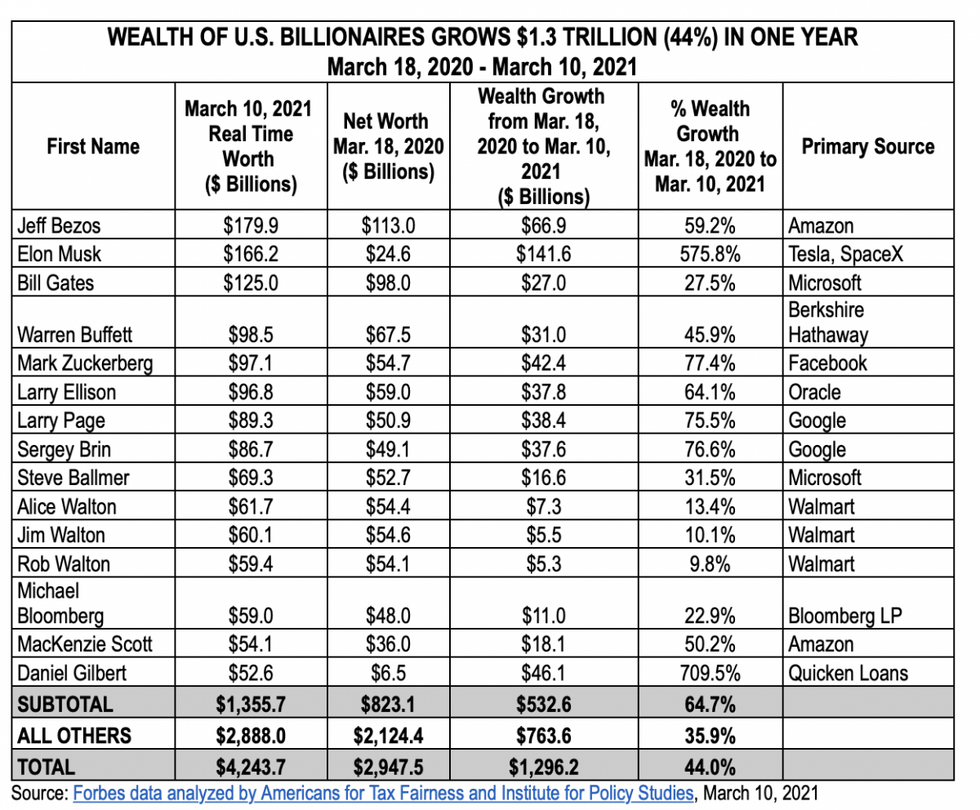

The collective net worth of the nation's 657 billionaires stood at $4.2 trillion as of Wednesday morning, March 10, 2021--up $1.3 trillion, or 44%, since the pandemic recession began about a year ago-- based on Forbes data compiled in this report by the Institute for Policy Studies (IPS) and Americans for Tax Fairness (ATF). The combined fortune of the nation's billionaires was just under $3 trillion on March 18, 2020, the rough start of the pandemic crisis.

This billionaire wealth growth represents two-thirds of the $1.9 trillion cost of Biden's pandemic rescue plan, which has been attacked by the GOP as too expensive. No Republican voted for the measure as it made its way through Congress.

There have been 43 newly minted billionaires since the beginning of the pandemic, when there were 614. As billionaire wealth soared over 78 million lost work between March 21, 2020, and Feb. 6, 2021, and 18 million were collecting unemployment on Feb. 13, 2021.

"These obscene gains of wealth during a pandemic prove that our economy is clearly designed for billionaires to profit, while millions suffer," said Chuck Collins, director of the Program on Inequality at IPS, and author of the forthcoming book, "The Wealth Hoarders: How Billionaires Pay Millions to Hide Trillions." "The relief package will ease some of the suffering, but it is temporary. We also need to permanently address the underlying economic conditions that the pandemic exposed."

"It's been a full year now of illness, unemployment, and insecurity for tens of millions of Americans--but 12 months of incredible wealth growth for the nation's billionaires," said Frank Clemente, executive director of ATF. "President Biden and Democrats in Congress came to the rescue with a major plan that benefits working families. Now they need to turn their attention to a bold long-term jobs and investment plan that also reforms the tax code so the wealthy and corporations start paying their fair share and everyone can benefit."

There are other startling matchups of the pandemic wealth growth of individual U.S. billionaires and components of Biden's bill meant to help millions of Americans cast into crisis by the virus.

- Musk, founder of Tesla Motors and Space-X, saw his wealth skyrocket $142 billion since March, or 567%--enough to solo fund the bill's support for farmers, small businesses, and other industries ($108 billion) and for bars and restaurants ($25 billion). [See chart] He would still be $9 billion richer than he was when the COVID shutdowns began last year.

- Bezos, founder of Amazon, had wealth growth of $67 billion, or 59%, the last 12 months--which could fund the assistance the ARP provides to renters and homeowners ($42 billion) and to veterans ($17 billion). [See chart] He would still pocket an $8 billion pandemic profit.

The ARP contains many forms of pandemic relief, including $1,400 payments for 60% of Americans. The $1.3 trillion wealth gain by U.S. billionaires since March 2020 could pay for a stimulus check of more than $3,900 for every one of the roughly 331 million people in the United States. A family of four would receive over $15,600. Republicans in Congress resisted sending families stimulus checks most of last year, claiming we could not afford them.

Under current tax law, none of the billionaires' $4.2 trillion in wealth will be taxed during their lifetimes, unless the underlying assets are sold at a gain. Thanks to a weakened estate tax and aggressive estate-tax dodging by the rich, much of the money will also escape taxation when passed onto the next generation.

Sen. Elizabeth Warren and colleagues in the House have introduced the "Ultra-Millionaire Tax Act" to reap some revenue from huge fortunes that otherwise sit untaxed year after year. The tax rate would just be two cents on the dollar (2%) for people with wealth between $50 million and $1 billion and just three cents on the dollar (a total of 3%) for wealth above $1 billion. According to an ATF and IPS analysis of Forbes data, America's billionaires alone would owe $114 billion for last year if Warren's wealth tax had been in place and $1.4 trillion over 10 years. The law would raise a total of about $3 trillion over 10 years.

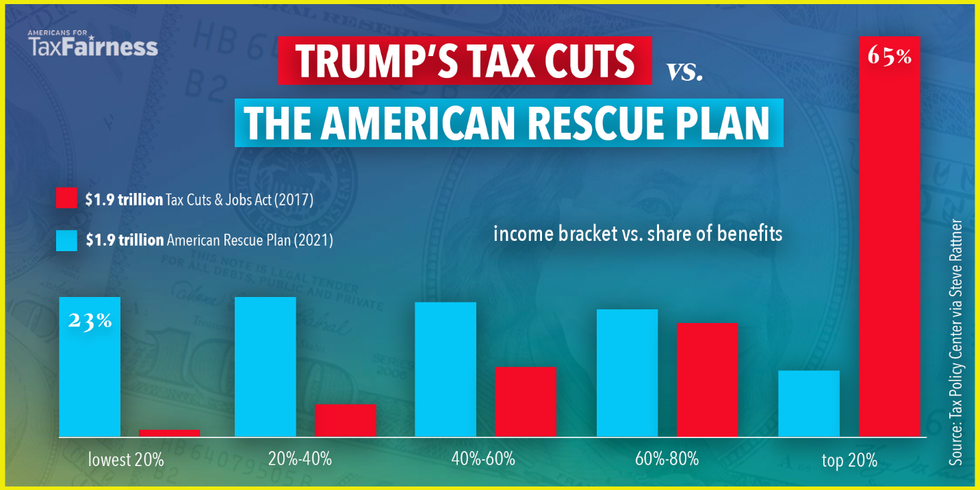

Taxing some of the towering wealth of billionaires would be the diametric opposite of the last overhaul of the U.S. tax code, 2017's Trump-GOP tax cuts. Those tax cuts, which coincidentally cost the same estimated $1.9 trillion over 10 years as Biden's ARP, mostly benefitted the wealthy and corporations--very much including billionaires and the businesses they control. According to the Tax Policy Center, 65% of the TCJA's benefits will go to the highest-income 20% of American households. By contrast, about 90% of the ARP's benefits will go to the bottom 80% of households, with nearly a quarter (23%) going to the lowest-income fifth.

March 18 is used as the unofficial beginning of the crisis because by then most federal and state economic restrictions responding to the virus were in place. March 18 was also the date that Forbes picked to measure billionaire wealth for the 2020 edition of its annual billionaires report, which provided a baseline that ATF and IPS compare periodically with real-time data from the Forbes website. PolitiFact has favorably reviewed this methodology.

Institute for Policy Studies turns Ideas into Action for Peace, Justice and the Environment. We strengthen social movements with independent research, visionary thinking, and links to the grassroots, scholars and elected officials. I.F. Stone once called IPS "the think tank for the rest of us." Since 1963, we have empowered people to build healthy and democratic societies in communities, the US, and the world. Click here to learn more, or read the latest below.

LATEST NEWS

'This Guy Is a Leech on the Public': AOC Rips Musk Over Attack on Social Security

"No matter how many billions he gets in tax cuts and government contracts, it will never be enough for him," said Rep. Alexandria Ocasio-Cortez. "Now he's going after the elderly, the disabled, and orphaned children."

Mar 03, 2025

Progressive lawmakers and advocates hit back on Sunday after Elon Musk parroted the long-debunked right-wing claim that Social Security is a Ponzi Scheme, the unelected billionaire's latest false attack on the nation's most effective anti-poverty program.

Musk made the comments during an appearance on the "Joe Rogan Experience" podcast over the weekend, and the episode has already racked up nearly 8 million views as of this writing.

"Social Security is the biggest Ponzi scheme of all time," Musk said. "If you look at the future obligations of Social Security, it far exceeds the tax revenue."

The advocacy group Social Security Works noted in response that Social Security—which is 90% funded for the next quarter-century—"hasn't missed a payment in 89 years" and accused Musk of "defaming" the program as part of an effort to "cut benefits and otherwise destroy Social Security."

BREAKING: Elon Musk called Social Security "the biggest Ponzi scheme of all time" in an interview with Joe Rogan. pic.twitter.com/gCrDPLM15u

— More Perfect Union (@MorePerfectUS) March 1, 2025

Musk's comments came as the Trump administration, with the assistance of the billionaire Tesla CEO's lieutenants, is working to gut the already-understaffed Social Security Administration, an effort that could result in benefit delays and disruptions.

"This guy is a leech on the public," Rep. Alexandria Ocasio-Cortez (D-N.Y.) wrote on social media after a clip of Musk's remarks on Rogan's podcast circulated. "No matter how many billions he gets in tax cuts and government contracts, it will never be enough for him."

"Now he's going after the elderly, the disabled, and orphaned children so he can pocket it in tax cuts for himself," Ocasio-Cortez added. "It's disgusting."

Rep. Greg Casar (D-Texas), chair of the Congressional Progressive Caucus, wrote that "a guy who makes $8 million a day off the government thinks seniors getting $65 a day they worked their whole lives to earn is a 'Ponzi scheme.'"

"Protect Social Security," Casar wrote. "Fire Elon Musk."

Sen. Bernie Sanders (I-Vt.) also weighed in on Musk's comments during an appearance on MSNBC's "Meet the Press" Sunday morning, calling the billionaire's attack on Social Security "totally outrageous."

"That's a hell of a Ponzi scheme when for the last 80 years, Social Security has paid out every nickel owed to every eligible American. Quite a Ponzi scheme," said Sanders, who called on lawmakers to support his proposal to expand Social Security benefits by lifting the cap on income subject to payroll taxes.

"You lift that cap, we can extend the solvency of Social Security for 75 years," the Vermont senator said. "And you can raise benefits."

Last week, as Common Dreamsreported, Sanders attempted to pass his Social Security expansion bill through the Senate via unanimous consent, but Sen. Mike Crapo (R-Idaho) objected, blocking the legislation.

Keep ReadingShow Less

'War-Crime Starvation Strategy': Israel Blocks All Humanitarian Aid into Gaza

“There will be famine and chaos”

Mar 02, 2025

Israel has reneged on the existing ceasefire agreement they had agreed to with Hamas. The first phase of the ceasefire expired Saturday and Israel announced on Sunday it is halting all humanitarian aid and fuel deliveries to Gaza and closing the border between Israel and Gaza. Israeli Prime Minister Benjamin Netanyahu said on Sunday that he made the decision "in full coordination with President Trump and his people."

In a statement Hamas called the suspension of aid a “war crime” and a violation of the ceasefire agreement. It said Netanyahu’s “decision to suspend humanitarian aid is cheap blackmail, a war crime and a blatant coup against the [ceasefire] agreement”.

Stephen Zunes, the director of Middle Eastern studies at the University of San Francisco, says the US’s apparent proposal favoring Israel follows a well-established pattern seen since the beginning of the war.

“This is typical,” he told Al Jazeera. “Hamas and Israel will agree to something. Then Israel will try to revise it in its favor. Then the US will put forward a new proposal that is in Israel’s favor and then the US will blame Hamas for not accepting that proposal.”

Israel’s decision to block all aid going into the Gaza Strip is a war crime under international law, a human rights expert says.

Kenneth Roth – former head of Human Rights Watch who is now a visiting professor at Princeton University – said Israel as an occupying power has an “absolute duty” to facilitate humanitarian aid under the Geneva Conventions.

“Israel’s latest threat to cut off all aid is a resumption of the war-crime starvation strategy” that led to the arrest warrant for Prime Minister Benjamin Netanyahu by the International Criminal Court, he said.

Doctors Without Borders said Israel's decision is “outrageous and will have devastating consequences”, said the group’s emergency coordinator Caroline Seguin.

“Humanitarian aid should never be used as a tool of war,” added the charity, known by its French acronym MSF, in a statement. “Regardless of negotiations between warring parties, people in Gaza still need an immediate and massive scale-up of humanitarian supplies.”

Jeremy Corbyn, who once led the UK Labour Party, said that Israel’s blocking of humanitarian aid was a “resumption of genocide”, before adding that the current British government – led by Labour – was “complicit."

AP reports:

Fayza Nassar, a woman living in the heavily destroyed urban Jabaliya refugee camp, said the closure would exacerbate already dire living conditions.

“There will be famine and chaos,” she said. “Closing the crossings is a heinous crime.”

Israel’s offensive has killed at least 48,388 Palestinians, according to Gaza’s Health Ministry. It says more than half of those killed were women and children.

Keep ReadingShow Less

Vermonters Protest JD Vance: 'Go Ski in Russia'

'J.D.Vance came to Vermont for a get-away. Locals had other ideas'

Mar 01, 2025

Over a thousand Vermonters lined both sides of Route 100 in Waitsfield, Vermont, Saturday morning protesting Vice President JD Vance, who was visiting nearby Sugarbush Resort this weekend with his family.

Vance's ski vacation comes right after Friday's disastrous meeting where US President Donald Trump and Vance ambushed Ukrainian President Volodymyr Zelensky in the Oval Office.

Protesters shouted obscenities and waved signs as the Vance motorcade rolled past. "Vance is a traitor. Go Ski in Russia," one sign read.

Keep ReadingShow Less

Most Popular